Armed with some data from our friends at CrunchBase, I broke down the largest NYC Startup funding rounds in New York for May 2021. I have included some additional information such as industry, description, round type, total equity funding raised to further the analysis for the state of venture capital in NYC. Only equity rounds were considered.

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

13. Ever/Body $38.0M

Round: Series B

Description: Ever/Body is a cosmetic dermatology provider of personalized and tech-enabled services. Founded by Karen Castelletti and Kate Twist in 2018, Ever/Body is backed by investors that include ACME Capital, Addition, Declaration Partners, Fifth Wall, Gaingels, MetaProp, Redesign Health, and Tiger Global Management.

Investors in the round: ACME Capital, Addition, Declaration Partners, Fifth Wall, Gaingels, MetaProp, Redesign Health, Tiger Global Management

Industry: Beauty, Cosmetics, Health Care

Founders: Karen Castelletti, Kate Twist

Founding year: 2018

Total equity funding raised: $55.0M

AlleyWatch’s exclusive coverage of this round: Ever/Body Raises $38M as the Interest in Cosmetic Dermatology Surges

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

12. Talos Trading $40.0M

Round: Series A

Description: Talos is a technology provider of digital asset trading. Founded by Anton Katz and Ethan Feldman in 2018, Talos Trading is backed by investors that include Andreessen Horowitz, Autonomous Partners, Castle Island Ventures, Elefund, Fidelity Investments, Galaxy Digital, Illuminate Financial, Initialized Capital, Notation Capital, PayPal Ventures, and Steadfast Capital.

Investors in the round: Andreessen Horowitz, Autonomous Partners, Castle Island Ventures, Elefund, Fidelity Investments, Galaxy Digital, Illuminate Financial, Initialized Capital, Notation Capital, PayPal Ventures, Steadfast Capital

Industry:

Founders: Anton Katz, Ethan Feldman

Founding year: 2018

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

12. Timescale $40.0M

Round: Series B

Description: TimescaleDB is an open-source time-series database optimized for fast ingest and complex queries. Founded by Ajay Kulkarni and Michael Freedman in 2015, Timescale is backed by investors that include Amplo, Chris Paul, Fidelity Management and Research Company, Gaingels, General Catalyst, GGV Capital, Groupe Artemis, GV, Jose Andres, Justin Timberlake, Lewis Hamilton, Natalie Portman, and Temasek Holdings.

Investors in the round: Amplo, Chris Paul, Fidelity Management and Research Company, Gaingels, General Catalyst, GGV Capital, Groupe Artemis, GV, Jose Andres, Justin Timberlake, Lewis Hamilton, Natalie Portman, Temasek Holdings

Industry: Computer, Database, Information Services, Software

Founders: Ajay Kulkarni, Michael Freedman

Founding year: 2015

Total equity funding raised: $71.1M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

11. Lithic $43.0M

Round: Series B

Description: Lithic is a virtual card platform that provides secure payments for businesses and consumers. Founded by Boling Jiang, David Nichols, and Jason Kruse in 2014, Lithic is backed by investors that include Bessemer Venture Partners, Index Ventures, Rainfall Ventures, Teamworthy Ventures, Tusk Venture Partners, and Walkabout Ventures.

Investors in the round: Bessemer Venture Partners, Index Ventures, Rainfall Ventures, Teamworthy Ventures, Tusk Venture Partners, Walkabout Ventures

Industry: FinTech, Payments, Privacy, Security, Software

Founders: Boling Jiang, David Nichols, Jason Kruse

Founding year: 2014

Total equity funding raised: $55.4M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

10. Lili $55.0M

Round: Series B

Description: Lili is an all-in-one mobile banking service designed for freelance workers. Founded by Lilac Bar David and Liran Zelkha in 2018, Lili is backed by investors that include AltaIR Capital, Foundation Capital, Google for Startups, Group 11, Target Global, and Zeev Ventures.

Investors in the round: AltaIR Capital, Foundation Capital, Google for Startups, Group 11, Target Global, Zeev Ventures

Industry: Apps, Banking, Financial Services, FinTech, Software

Founders: Lilac Bar David, Liran Zelkha

Founding year: 2018

Total equity funding raised: $80.0M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

9. Vise $65.0M

Round: Series C

Description: Vise is an AI-driven portfolio management platform for financial advisors. Founded by Runik Mehrotra and Samir Vasavada in 2016, Vise is backed by investors that include Ribbit Capital and Sequoia Capital.

Investors in the round: Ribbit Capital, Sequoia Capital

Industry: Artificial Intelligence, Financial Services, FinTech

Founders: Runik Mehrotra, Samir Vasavada

Founding year: 2016

Total equity funding raised: $128.0M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

8. HiberCell $67.4M

Round: Series B

Description: HiberCell is a biotechnology company developing treatments to prevent cancer relapse and metastasis. Founded by Alan Rigby and Ari Nowacek in 2019, HiberCell is backed by investors that include ARCH Venture Partners, Bristol-Myers Squibb, Huizenga Capital Management, Magnetic Ventures, Monashee Investment Management, and Trinitas Capital.

Investors in the round: ARCH Venture Partners, Bristol-Myers Squibb, Huizenga Capital Management, Magnetic Ventures, Monashee Investment Management, Trinitas Capital

Industry: Biotechnology, Health Care, Health Diagnostics, Medical

Founders: Alan Rigby, Ari Nowacek

Founding year: 2019

Total equity funding raised: $128.2M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

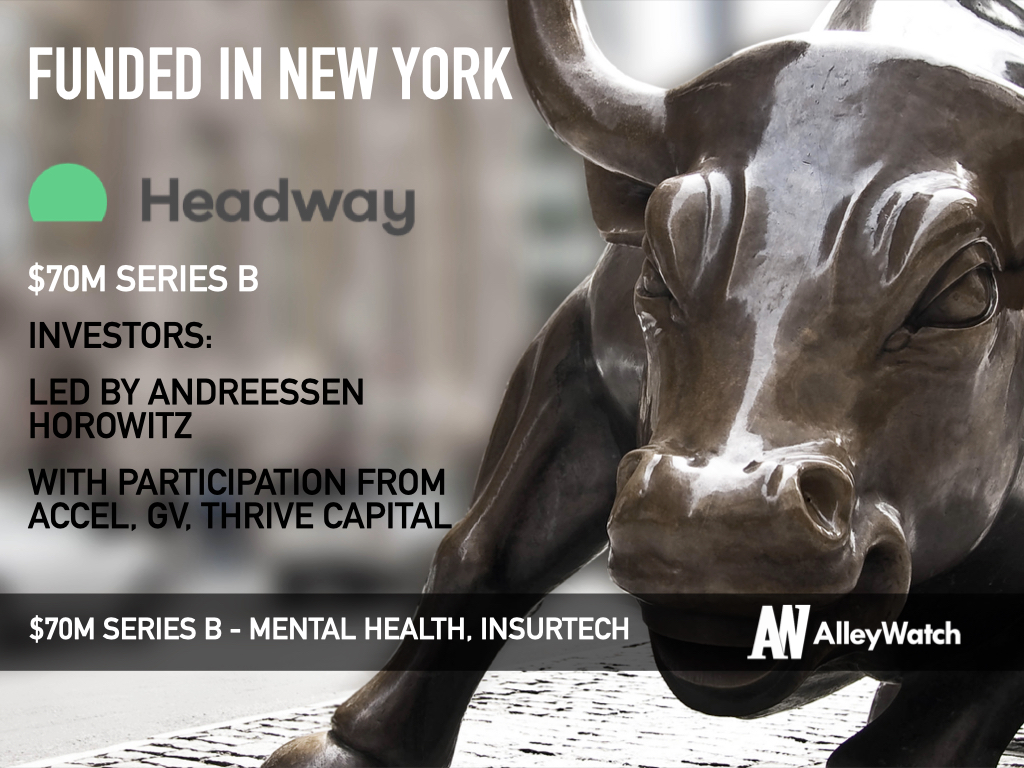

7. Headway $70.0M

Round: Series B

Description: Headway is a mental healthcare system provider that helps patients connect with therapists and submit insurance claims online. Founded by Andrew Adams, Daniel Ross, Jake Sussman, and Kevin Chan in 2019, Headway is backed by investors that include Accel, Andreessen Horowitz, GV, and Thrive Capital.

Investors in the round: Accel, Andreessen Horowitz, GV, Thrive Capital

Industry: Health Care, Information Technology, Insurance, Therapeutics

Founders: Andrew Adams, Daniel Ross, Jake Sussman, Kevin Chan

Founding year: 2019

Total equity funding raised: $100.5M

AlleyWatch’s exclusive coverage of this round: Headway Raises $70M to Make Mental Healthcare Accessible With its National Network of Therapists

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

6. VAST Data $83.0M

Round: Series D

Description: VAST Data is a software company bringing an end to complex storage tiering and unlocking the ability to use flash across the enterprise. Founded by Jeff Denworth, Renen Hallak, and Shachar Fienblit in 2016, VAST Data is backed by investors that include 83North, Common Fund, Dell Technologies Capital, Goldman Sachs, Greenfield Partners, Mellanox Capital, Next47, Norwest Venture Partners, NVIDIA, The Syndicate Group, and Tiger Global Management.

Investors in the round: 83North, Common Fund, Dell Technologies Capital, Goldman Sachs, Greenfield Partners, Mellanox Capital, Next47, Norwest Venture Partners, NVIDIA, The Syndicate Group, Tiger Global Management

Industry: Computer, Data Storage, Software

Founders: Jeff Denworth, Renen Hallak, Shachar Fienblit

Founding year: 2016

Total equity funding raised: $263.0M

AlleyWatch’s exclusive coverage of this round: VAST Data Raises $83M, Tripling its Valuation in the Last Year

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

5. Goldbelly $100.0M

Round: Series C

Description: Goldbelly is an online delivery platform for specialty food makers and artisans. Founded by Joe Ariel, Joel Gillman, Trevor Stow, and Vanessa Torrivilla in 2012, Goldbelly is backed by investors that include Intel Capital and Spectrum Equity.

Investors in the round: Intel Capital, Spectrum Equity

Industry: Delivery Service, E-Commerce, Food and Beverage, Online Portals

Founders: Joe Ariel, Joel Gillman, Trevor Stow, Vanessa Torrivilla

Founding year: 2012

Total equity funding raised: $133.1M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

5. Material Bank $100.0M

Round: Series C

Description: Material Bank is the world’s largest architectural and design-focused material resource library. Founded by Adam Sandow in 2018, Material Bank is backed by investors that include Annox Capital, Bain Capital Ventures, Bond, Durable Capital Partners, General Catalyst, IPD Capital, Lead Edge Capital, and Raine Ventures.

Investors in the round: Annox Capital, Bain Capital Ventures, Bond, Durable Capital Partners, General Catalyst, IPD Capital, Lead Edge Capital, Raine Ventures

Industry: Architecture, Industrial Design, Interior Design, Logistics

Founders: Adam Sandow

Founding year: 2018

Total equity funding raised: $148.2M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

4. Aetion $110.0M

Round: Series C

Description: Aetion provides real-world evidence (RWE) and outcomes-based analytics solutions to life science companies and payers. Founded by Allon Rauer, Jeremy Rassen, and Sebastian Schneeweiss in 2013, Aetion is backed by investors that include B Capital Group, Flare Capital Partners, Foresite Capital, New Enterprise Associates, and Warburg Pincus.

Investors in the round: B Capital Group, Flare Capital Partners, Foresite Capital, New Enterprise Associates, Warburg Pincus

Industry: Analytics, Artificial Intelligence, Biotechnology, Health Care, Life Science, Pharmaceutical, Software

Founders: Allon Rauer, Jeremy Rassen, Sebastian Schneeweiss

Founding year: 2013

Total equity funding raised: $203.6M

AlleyWatch’s exclusive coverage of this round: Aetion Raises Another $112M to Empower the Healthcare Industry with Data to Make Informed Decisions and Reduce the Time to Market

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

3. ASAPP $120.0M

Round: Series C

Description: ASAPP develops an AI-powered customer service tool designed to automate workflows in call centers. Founded by Gustavo Sapoznik and Marcus Westin in 2014, ASAPP is backed by investors that include 40 North Ventures, Dragoneer Investment Group, Emergence, Euclidean Capital, Fidelity Management and Research Company, HOF Capital, John Chambers, John Doerr, March Capital, and Telstra Ventures.

Investors in the round: 40 North Ventures, Dragoneer Investment Group, Emergence, Euclidean Capital, Fidelity Management and Research Company, HOF Capital, John Chambers, John Doerr, March Capital, Telstra Ventures

Industry: Artificial Intelligence, Customer Service, Enterprise Software, Sales Automation

Founders: Gustavo Sapoznik, Marcus Westin

Founding year: 2014

Total equity funding raised: $380.0M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

2. Bowery Farming $300.0M

Round: Series C

Description: Bowery Farming uses vision systems, automation technology, and machine learning to monitor plants and their growth. Founded by Brian Falther, David Golden, and Irving Fain in 2014, Bowery Farming is backed by investors that include Amplo, Chris Paul, Fidelity Management and Research Company, Gaingels, General Catalyst, GGV Capital, Groupe Artemis, GV, Jose Andres, Justin Timberlake, Lewis Hamilton, Natalie Portman, and Temasek Holdings.

Investors in the round: Amplo, Chris Paul, Fidelity Management and Research Company, Gaingels, General Catalyst, GGV Capital, Groupe Artemis, GV, Jose Andres, Justin Timberlake, Lewis Hamilton, Natalie Portman, Temasek Holdings

Industry: Agriculture, Farming, Food and Beverage, Machine Learning, Organic Food

Founders: Brian Falther, David Golden, Irving Fain

Founding year: 2014

Total equity funding raised: $467.5M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

2. Forter $300.0M

Round: Series F

Description: Forter offers a fraud solution that helps retailers grow sales, lower costs, and improve customer experience via its Decision as Service. Founded by Alon Shemesh, Liron Damri, and Michael Reitblat in 2013, Forter is backed by investors that include Adage Capital Management, Bessemer Venture Partners, March Capital, NewView Capital, Salesforce Ventures, Scale Venture Partners, Sequoia Capital Israel, Third Point Ventures, and Tiger Global Management.

Investors in the round: Adage Capital Management, Bessemer Venture Partners, March Capital, NewView Capital, Salesforce Ventures, Scale Venture Partners, Sequoia Capital Israel, Third Point Ventures, Tiger Global Management

Industry: E-Commerce, FinTech, Fraud Detection, SaaS

Founders: Alon Shemesh, Liron Damri, Michael Reitblat

Founding year: 2013

Total equity funding raised: $525.0M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.

1. Noom $540.0M

Round: Series F

Description: Noom is a psychology-based digital health platform used to provide intelligent nutrition and exercise coaching. Founded by Artem Petakov and Saeju Jeong in 2008, Noom is backed by investors that include Novo Holdings, Oak HC/FT, RRE Ventures, Samsung Ventures, Sequoia Capital, Silver Lake, and Temasek Holdings.

Investors in the round: Novo Holdings, Oak HC/FT, RRE Ventures, Samsung Ventures, Sequoia Capital, Silver Lake, Temasek Holdings

Industry: Fitness, Health Care, Mobile, Nutrition, Wellness

Founders: Artem Petakov, Saeju Jeong

Founding year: 2008

Total equity funding raised: $657.3M

The Australian Trade and Investment Commission, in partnership with NUMA New York, invites you to Demo Day to meet the 10 most innovative US-bound Australian startups in FinTech, RegTech, InsurTech, and Big Data! Sign up before 6/17 for an exclusive invitation to Demo Day here.