.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.a href=”https://www.alleywatch.com/profile//” target=”_blank”>.tyle=”text-align: center;”>

Armed with some data from our friends at CrunchBase, I broke down the largest US startup funding rounds from March 2020. I have included some additional information such as industry, company description, round type, founders, and total equity funding raised to further the analysis.

CLICK HERE TO SEE THE TOP US STARTUP FUNDINGS OF MARCH 2020

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

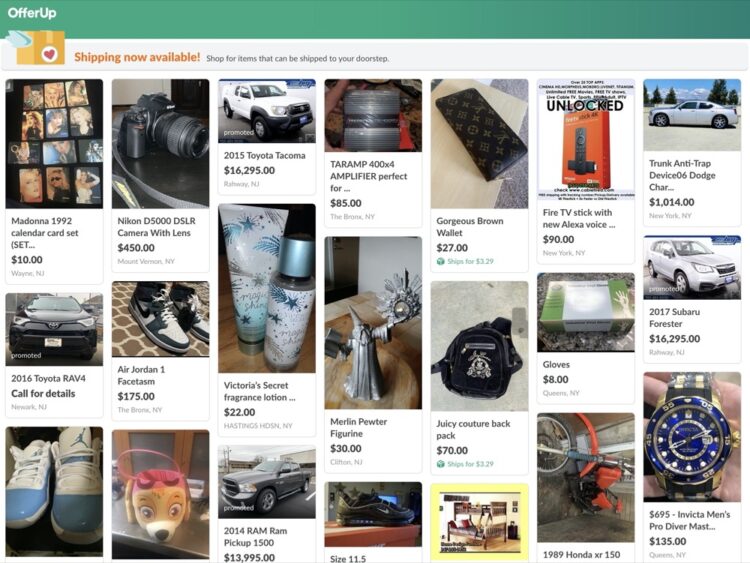

10. OfferUp $120.0M

Round: Venture

Description: OfferUp provides an online and mobile C2C marketplace app for people to buy and sell electronics, furniture, and cars.

Investors in the round: Andreessen Horowitz, OLX Group, Warburg Pincus

Industry: Apps, Classifieds, E-Commerce, E-Commerce Platforms, Mobile, Mobile Payments

Founders: Arean van Veelen, Nick Huzar

Founding year: 2011

Location: Bellevue-based OfferUp provides an online and mobile C2C marketplace app for people to buy and sell electronics, furniture, and cars. Founded by Arean van Veelen and Nick Huzar in 2011, OfferUp has now raised a total of $381.0M in total equity funding and is backed by investors that include Warburg Pincus, Andreessen Horowitz, T. Rowe Price, Coatue Management, and GGV Capital.

Total equity funding raised: $381.0M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

9. Alignment Healthcare $135.0M

Round: Series C

Description: Alignment Healthcare is dedicated to transforming the complex and confusing process of medical treatment.

Investors in the round: Durable Capital Partners, Fidelity Management and Research Company, T. Rowe Price

Industry: Health Care, Hospital, Medical

Founders: John Kao

Founding year: 2013

Location: Orange-based Alignment Healthcare is dedicated to transforming the complex and confusing process of medical treatment. Founded by John Kao in 2013, Alignment Healthcare has now raised a total of $375.0M in total equity funding and is backed by investors that include General Atlantic, Warburg Pincus, T. Rowe Price, Durable Capital Partners, and Fidelity Management and Research Company.

Total equity funding raised: $375.0M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

8. Element Science $145.6M

Round: Series C

Description: Element Science is a medical device and digital health start-up that develops lifesaving wearable solutions .

Investors in the round: Cormorant Asset Management, Deerfield, GV, Invus, Qiming Venture Partners USA, Third Rock Ventures

Industry: Health Care, Medical, Medical Device

Founders: Uday Kumar

Founding year: 2011

Location: San Francisco-based Element Science is a medical device and digital health start-up that develops lifesaving wearable solutions . Founded by Uday Kumar in 2011, Element Science has now raised a total of $183.1M in total equity funding and is backed by investors that include Cormorant Asset Management, Third Rock Ventures, Invus, Deerfield, and GV.

Total equity funding raised: $183.1M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

7. iCapital Network $146.0M

Round: Venture

Description: iCapital Network connects advisors and their high net worth investors to leading alternative investment managers.

Investors in the round: Affiliated Managers Group, BlackRock, Blackstone Group, BNY Mellon, Credit Suisse, Goldman Sachs, Hamilton Lane, JP Morgan Chase, Morgan Stanley Investment Management, Ping An Global Voyager Fund, The Carlyle Group, UBS, WestCap

Industry: Asset Management, Banking, Financial Services, FinTech, Software

Founders: Dan Vene, John Robertshaw, Nick Veronis, Phil Pool

Founding year: 2013

Location: New York-based iCapital Network connects advisors and their high net worth investors to leading alternative investment managers. Founded by Dan Vene, John Robertshaw, Nick Veronis, and Phil Pool in 2013, iCapital Network has now raised a total of $182.9M in total equity funding and is backed by investors that include Credit Suisse, BlackRock, Goldman Sachs, JP Morgan Chase, and UBS.

Total equity funding raised: $182.9M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

6. HashiCorp $175.0M

Round: Series E

Description: HashiCorp is a remote-first company that solves development, security, and operations challenges in infrastructure.

Investors in the round: Franklin Templeton Investments, Geodesic Capital, GGV Capital, IVP (Institutional Venture Partners), Mayfield Fund, Redpoint, T. Rowe Price, True Ventures

Industry: Cloud Infrastructure, Cyber Security, Information Technology, Infrastructure, Private Cloud, Productivity Tools, Software

Founders: Armon Dadgar, Mitchell Hashimoto

Founding year: 2012

Location: San Francisco-based HashiCorp is a remote-first company that solves development, security, and operations challenges in infrastructure. Founded by Armon Dadgar and Mitchell Hashimoto in 2012, HashiCorp has now raised a total of $349.2M in total equity funding and is backed by investors that include T. Rowe Price, Franklin Templeton Investments, True Ventures, Mayfield Fund, and Redpoint.

Total equity funding raised: $349.2M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

5. Via $200.0M

Round: Series E

Description: Via develops and provides on-demand public mobility solutions.

Investors in the round: 83North, Broadscale, Counterpart Advisors, Ervington Investments, EXOR N.V., Hearst Ventures, Macquarie Capital, Mori Trust, Pitango Venture Capital, Planven Investments, RiverPark Ventures, Shell Ventures

Industry: Automotive, Mobile Apps, Real Time, Ride Sharing, Transportation, Travel

Founders: Daniel Ramot, Oren Shoval

Founding year: 2012

Location: New York-based Via develops and provides on-demand public mobility solutions. Founded by Daniel Ramot and Oren Shoval in 2012, Via has now raised a total of $587.1M in total equity funding and is backed by investors that include Shell Ventures, Pitango Venture Capital, Millhouse LLC, 83North, and Hearst Ventures.

Total equity funding raised: $587.1M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

5. Scopely $200.0M

Round: Series D

Description: Scopely is an interactive entertainment and mobile games company.

Investors in the round: Advance, Canada Pension Plan Investment Board, Greycroft, NewView Capital, Revolution, Sands Capital Ventures, TCG

Industry: Developer Platform, Digital Entertainment, Mobile, Mobile Apps, Online Games, Video Games

Founders: Ankur Bulsara, Eric Futoran, Eytan Elbaz, Walter Driver

Founding year: 2011

Location: Culver City-based Scopely is an interactive entertainment and mobile games company. Founded by Ankur Bulsara, Eric Futoran, Eytan Elbaz, and Walter Driver in 2011, Scopely has now raised a total of $658.5M in total equity funding and is backed by investors that include Techstars, BlackRock, Science, Techstars Ventures, and Lerer Hippeau.

Total equity funding raised: $658.5M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

4. StackPath $216.0M

Round: Series B

Description: StackPath is an SaaS company developing technology to enable a safer Internet from cyber security threats.

Investors in the round: Cox Communications, Juniper Networks

Industry: Cyber Security, Enterprise Software, Information Technology, Internet, Network Security, SaaS, Software

Founders: Jason Gulledge, Lance Crosby, Ryan Carter

Founding year: 2015

Location: Dallas-based StackPath is an SaaS company developing technology to enable a safer Internet from cyber security threats. Founded by Jason Gulledge, Lance Crosby, and Ryan Carter in 2015, StackPath has now raised a total of $396.0M in total equity funding and is backed by investors that include Juniper Networks, Cox Communications, and ABRY Partners.

Total equity funding raised: $396.0M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

3. Bakkt $300.0M

Round: Series B

Description: Bakkt is a financial services company that focuses on digital currency that specializes in concurrency, rewards, and loyalty points.

Investors in the round: CityBlock Capital, CMT Digital Ventures LLC, Goldfinch Partners, IntercontinentalExchange, M12, Pantera Capital, PayU, SGH CAPITAL, The Boston Consulting Group

Industry: Cryptocurrency, Digital Marketing, Loyalty Programs, Payments, Software

Founders: Adam White, Kelly L. Loeffler, Mike Blandina

Founding year: 2018

Location: Atlanta-based Bakkt is a financial services company that focuses on digital currency that specializes in concurrency, rewards, and loyalty points. Founded by Adam White, Kelly L. Loeffler, and Mike Blandina in 2018, Bakkt has now raised a total of $482.5M in total equity funding and is backed by investors that include PayU, Pantera Capital, M12, Galaxy Digital LP, and Horizons Ventures.

Total equity funding raised: $482.5M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

2. Impossible Foods $500.0M

Round: Series F

Description: Impossible Foods is a company developing plant-based substitutes for meat, dairy, and fish products.

Investors in the round:

Industry: Cooking, Food and Beverage, Food Processing, Nutrition, Organic Food

Founders: Monte Casino, Patrick Brown

Founding year: 2011

Location: Redwood City-based Impossible Foods is a company developing plant-based substitutes for meat, dairy, and fish products. Founded by Monte Casino and Patrick Brown in 2011, Impossible Foods has now raised a total of $982.0M in total equity funding and is backed by investors that include Mirae Asset Global Investments, Bill Gates, Microsoft, UBS, and Khosla Ventures.

Total equity funding raised: $982.0M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.

1. Waymo $2.3B

Round: Venture

Description: Waymo improves transportation by developing self-driving technology developed in Google’s labs.

Investors in the round: Alphabet, Andreessen Horowitz, AutoNation, Canada Pension Plan Investment Board, Magna International, Mubadala Capital | Ventures US, Silver Lake Partners

Industry: Automotive, Autonomous Vehicles, Robotics, Sensor, Transportation

Founders: Anthony Levandowski

Founding year: 2009

Location: Mountain View

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC, LA, London, Paris, Boston), TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including having prominent brand placement in a high-visibility piece like this, which will be read by the vast majority of key influencers in the business community and beyond. Find out more here.