Armed with some data from our friends at CrunchBase, I broke down the largest US startup funding rounds from September 2023. I have included some additional information such as industry, company description, round type, founders, and total equity funding raised to further the analysis.

2478 Everyday Investors Shared $1,123,615 Net Profit on a Monet

Now you might be thinking: “what the heck are you talking about?” But keep reading, because this investment platform’s users are already smiling all the way to the bank. Thanks to Masterworks, the award-winning platform for investing in blue-chip art.

Every single one of Masterworks’ 15 sales has returned a profit to investors, for a 100% positive net return track record. With 3 recent sales, Masterworks investors realized net annualized returns of 17.6%, 21.5% and 35%.

How does it work? Simple, Masterworks does all of the heavy lifting like finding the painting, buying it, storing it, and eventually selling it. It files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but AlleyWatch readers can skip the waitlist to join with this exclusive link.

LEARN MORE

See important disclosures at masterworks.com/cd

13. Pryon $100.0M

Round: Series B

Description: Raleigh-based Pryon is an AI company that focuses on enterprise knowledge management. Founded by Igor Jablokov in 2017, Pryon has now raised a total of $156.1M in total equity funding and is backed by Gaingels, Silicon Valley Bank, Plug and Play Ventures, Breyer Capital, and Revolution’s Rise of the Rest Seed Fund.

Investors in the round: Aperture Venture Capital, BootstrapLabs, Breyer Capital, Duke Capital Partners, Good Growth Capital, Omnimed Capital, Revolution’s Rise of the Rest Seed Fund, US Innovative Technology Fund

Industry: Artificial Intelligence, Computer Vision, Knowledge Management, Machine Learning, Natural Language Processing, Predictive Analytics, SaaS

Founders: Igor Jablokov

Founding year: 2017

Total equity funding raised: $156.1M

13. Openly $100.0M

Round: Series D

Description: Boston-based Openly offers home insurance, life insurance, and auto insurance services. Founded by Matt Wielbut and Ty Harris in 2017, Openly has now raised a total of $237.9M in total equity funding and is backed by Techstars, Trinity Capital, Gradient Ventures, Obvious Ventures, and PJC.

Investors in the round: Advance Venture Partners, Clocktower Technology Ventures, Eden Global Partners, Gradient Ventures, Trinity Capital

Industry: Auto Insurance, Commercial Insurance, Insurance, Life Insurance, Property Insurance

Founders: Matt Wielbut, Ty Harris

Founding year: 2017

Total equity funding raised: $237.9M

13. Writer $100.0M

Round: Series B

Description: San Francisco-based Writer is a full-stack generative AI platform that helps businesses use large language models to generate written content. Founded by May Habib and Waseem AlShikh in 2020, Writer has now raised a total of $126.0M in total equity funding and is backed by Accenture, Insight Partners, Gradient Ventures, WndrCo, and Vanguard.

Investors in the round: Accenture, Aspect Ventures, Balderton Capital, Gradient Ventures, ICONIQ Growth, Insight Partners, Vanguard, WndrCo

Industry: Content, Natural Language Processing, Productivity Tools, Software, Virtual Assistant

Founders: May Habib, Waseem AlShikh

Founding year: 2020

Total equity funding raised: $126.0M

12. d-Matrix $110.0M

Round: Series B

Description: Santa Clara-based D-Matrix is a computing platform that targets artificial intelligence inferencing workloads in the datacenter. Founded by Sid Sheth and Sudeep Bhoja in 2019, d-Matrix has now raised a total of $154.0M in total equity funding and is backed by Mirae Asset, Temasek Holdings, SK Hynix, Palo Alto Networks, and M12 – Microsoft’s Venture Fund.

Investors in the round: Archerman Capital, Cortes capital, Entrada Ventures, Ericsson Ventures, Industry Ventures, Lam Capital, M12 – Microsoft’s Venture Fund, Marlan Holding, Mirae Asset, Nautilus Venture Partners, Palo Alto Networks, Playground Global, Samsung Ventures, Temasek Holdings, TGC Square

Industry: Artificial Intelligence, Cloud Infrastructure, Data Center

Founders: Sid Sheth, Sudeep Bhoja

Founding year: 2019

Total equity funding raised: $154.0M

2478 Everyday Investors Shared $1,123,615 Net Profit on a Monet

Now you might be thinking: “what the heck are you talking about?” But keep reading, because this investment platform’s users are already smiling all the way to the bank. Thanks to Masterworks, the award-winning platform for investing in blue-chip art.

Every single one of Masterworks’ 15 sales has returned a profit to investors, for a 100% positive net return track record. With 3 recent sales, Masterworks investors realized net annualized returns of 17.6%, 21.5% and 35%.

How does it work? Simple, Masterworks does all of the heavy lifting like finding the painting, buying it, storing it, and eventually selling it. It files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but AlleyWatch readers can skip the waitlist to join with this exclusive link.

LEARN MORE

See important disclosures at masterworks.com/cd

11. Alto Pharmacy $120.0M

Round: Series F

Description: San Francisco-based Alto is a digital pharmacy that makes the prescription experience easier. Founded by Jamie Karraker, Mattieu Gamache-Asselin, and Vlad Blumen in 2015, Alto Pharmacy has now raised a total of $643.6M in total equity funding and is backed by Soma Capital, Y Combinator, FJ Labs, Hack VC, and Sand Hill Angels.

Investors in the round: FJ Labs

Industry: Consumer, Health Care, Medical, Pharmaceutical, Software

Founders: Jamie Karraker, Mattieu Gamache-Asselin, Vlad Blumen

Founding year: 2015

Total equity funding raised: $643.6M

10. Boston Metal $122.0M

Round: Series C

Description: Woburn-based Boston Metal is a metallurgy company developing technology to reduce the carbon footprint of steel production. Founded by Antoine Allanore, Donald Sadoway, and Jim Yurko in 2012, Boston Metal has now raised a total of $332.0M in total equity funding and is backed by Vale, National Science Foundation, ArcelorMittal, Breakthrough Energy Ventures, and Baillie Gifford.

Investors in the round: Aramco Ventures, Baillie Gifford, BHP Ventures, Breakthrough Energy Ventures, Goehring & Rozencwajg Associates, M&G Investments, Microsoft Climate Innovation Fund, Prelude Ventures

Industry: Building Material, CleanTech, Manufacturing, Mechanical Engineering

Founders: Antoine Allanore, Donald Sadoway, Jim Yurko

Founding year: 2012

Total equity funding raised: $332.0M

9. Enfabrica $125.0M

Round: Series B

Description: Mountain View-based Enfabrica develops hardware, software, and system technologies to resolve blockages in computing workloads. Founded by Rochan Sankar and Shrijeet Mukherjee in 2019, Enfabrica has now raised a total of $125.0M in total equity funding and is backed by NVIDIA, Sutter Hill Ventures, Alumni Ventures, IAG Capital Partners, and Valor Equity Partners.

Investors in the round: Alumni Ventures, Atreides Management, IAG Capital Partners, Infinitum Partners, Liberty Global Ventures, NVIDIA, Sutter Hill Ventures, Valor Equity Partners

Industry: Artificial Intelligence, Information Technology, Software

Founders: Rochan Sankar, Shrijeet Mukherjee

Founding year: 2019

Total equity funding raised: $125.0M

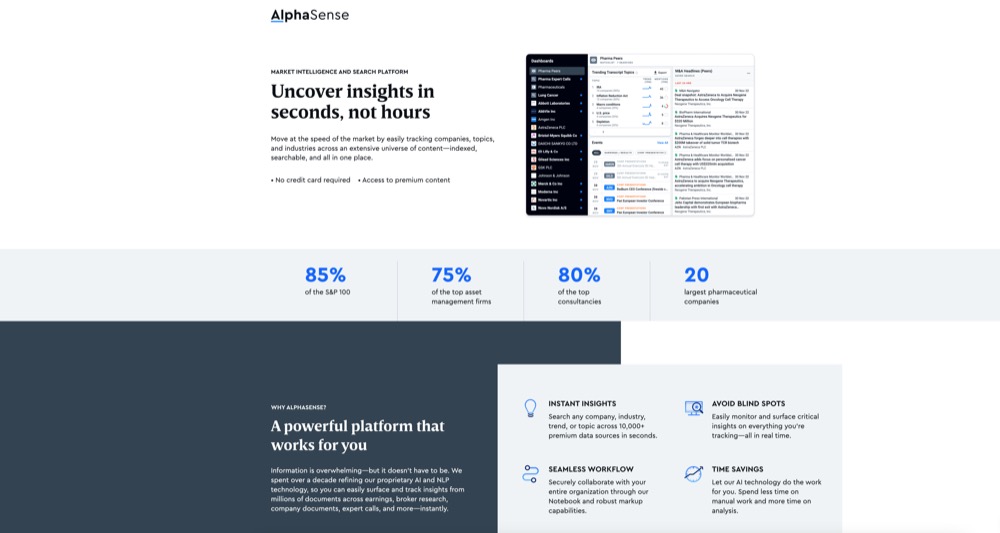

8. AlphaSense $150.0M

Round: Series E

Description: New York-based AlphaSense is a intelligence platform that uses artificial intelligence allowing professionals to make critical decisions. Founded by Jack Kokko in 2008, AlphaSense has now raised a total of $740.0M in total equity funding and is backed by Citi, BlackRock, Morgan Stanley, Bank of America, and Goldman Sachs Asset Management.

Investors in the round: BAM Elevate, Bond, CapitalG, Goldman Sachs Asset Management, Viking Global Investors

Industry: Analytics, Artificial Intelligence, Machine Learning, SaaS, Search Engine

Founders: Jack Kokko

Founding year: 2008

Total equity funding raised: $740.0M

2478 Everyday Investors Shared $1,123,615 Net Profit on a Monet

Now you might be thinking: “what the heck are you talking about?” But keep reading, because this investment platform’s users are already smiling all the way to the bank. Thanks to Masterworks, the award-winning platform for investing in blue-chip art.

Every single one of Masterworks’ 15 sales has returned a profit to investors, for a 100% positive net return track record. With 3 recent sales, Masterworks investors realized net annualized returns of 17.6%, 21.5% and 35%.

How does it work? Simple, Masterworks does all of the heavy lifting like finding the painting, buying it, storing it, and eventually selling it. It files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but AlleyWatch readers can skip the waitlist to join with this exclusive link.

LEARN MORE

See important disclosures at masterworks.com/cd

8. Shield AI $150.0M

Round: Venture

Description: San Diego-based Shield AI is an artificial intelligence company that aims to protect service members and civilians with intelligent systems. Founded by Andrew Reiter, Brandon Tseng, and Ryan Tseng in 2015, Shield AI has now raised a total of $628.1M in total equity funding and is backed by Andreessen Horowitz, Point72 Ventures, Chaos Ventures, Breyer Capital, and Founder Collective.

Investors in the round: Sahin Boydas

Industry: Artificial Intelligence, Autonomous Vehicles, Drones, Machine Learning, National Security

Founders: Andrew Reiter, Brandon Tseng, Ryan Tseng

Founding year: 2015

Total equity funding raised: $628.1M

7. Lyten $200.0M

Round: Series B

Description: San Jose-based Lyten is an advanced materials company that develops, sources, and manufactures low-carbon footprint products. Founded by Daniel Cook, Lars Herlitz, Scott Mobley, and William Wraith III in 2015, Lyten has now raised a total of $360.0M in total equity funding and is backed by Honeywell, FedEx, Amazon Web Services, Prime Movers Lab, and Triatomic Capital.

Investors in the round: FedEx, Honeywell, Prime Movers Lab, Stellantis Ventures, Triatomic Capital, Walbridge

Industry: Advanced Materials, Industrial, Manufacturing

Founders: Daniel Cook, Lars Herlitz, Scott Mobley, William Wraith III

Founding year: 2015

Total equity funding raised: $360.0M

7. Imbue $200.0M

Round: Series B

Description: San Francisco-based Imbue is an independent research lab that trains foundational models to develop AI agents. Founded by Josh Albrecht and Kanjun Qiu in 2021, Imbue has now raised a total of $220.0M in total equity funding and is backed by NVIDIA, Y Combinator, Astera Institute, Simon Last, and Kyle Vogt.

Investors in the round: Astera Institute, Kyle Vogt, NVIDIA, Simon Last

Industry: Artificial Intelligence, Machine Learning, Robotics

Founders: Josh Albrecht, Kanjun Qiu

Founding year: 2021

Total equity funding raised: $220.0M

6. Indigo $250.0M

Round: Venture

Description: Boston-based Indigo is an agricultural technology company that focuses on improving sustainability and profitability in farming practices. Founded by David Berry, Geoffrey von Maltzahn, Ignacio Martinez, and Noubar Afeyan in 2014, Indigo has now raised a total of $1.4B in total equity funding and is backed by Flagship Pioneering, Baillie Gifford, FedEx, Alaska Permanent Fund, and G Squared.

Investors in the round: Flagship Pioneering, Lingotto, State of Michigan Retirement System

Industry: Agriculture, AgTech, Farming, GreenTech

Founders: David Berry, Geoffrey von Maltzahn, Ignacio Martinez, Noubar Afeyan

Founding year: 2014

Total equity funding raised: $1.4B

5. Mapbox $280.0M

Round: Series E

Description: Washington-based Mapbox develops a location data platform for mobile and web applications. Founded by Bonnie Bogle, Eric Gundersen, Will White, and Young Hahn in 2010, Mapbox has now raised a total of $613.6M in total equity funding and is backed by SoftBank, Thrive Capital, Foundry Group, PremjiInvest, and DFJ Growth.

Investors in the round: SoftBank

Industry: Business Intelligence, Fleet Management, Logistics, Mapping Services, SaaS

Founders: Bonnie Bogle, Eric Gundersen, Will White, Young Hahn

Founding year: 2010

Total equity funding raised: $613.6M

2478 Everyday Investors Shared $1,123,615 Net Profit on a Monet

Now you might be thinking: “what the heck are you talking about?” But keep reading, because this investment platform’s users are already smiling all the way to the bank. Thanks to Masterworks, the award-winning platform for investing in blue-chip art.

Every single one of Masterworks’ 15 sales has returned a profit to investors, for a 100% positive net return track record. With 3 recent sales, Masterworks investors realized net annualized returns of 17.6%, 21.5% and 35%.

How does it work? Simple, Masterworks does all of the heavy lifting like finding the painting, buying it, storing it, and eventually selling it. It files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but AlleyWatch readers can skip the waitlist to join with this exclusive link.

LEARN MORE

See important disclosures at masterworks.com/cd

4. Sierra Space $290.0M

Round: Series B

Description: Louisville-based Sierra Space is a commercial space company that specializes in the development of advanced space technologies and solutions. Founded by Eren Ozmen and Faith Ozmen in 2021, Sierra Space has now raised a total of $1.7B in total equity funding and is backed by General Atlantic, Coatue, Moore Strategic Ventures, MUFG Bank, and BlackRock Private Equity Partners.

Investors in the round: Coatue, Fenix Group, General Atlantic, Kanematsu Corporation, Moore Strategic Ventures, MUFG Bank, Sierra, Tokio Marine Nichido

Industry: Advanced Materials, Aerospace, Industrial Manufacturing, Space Travel, Transportation

Founders: Eren Ozmen, Faith Ozmen

Founding year: 2021

Total equity funding raised: $1.7B

3. Ascend Elements $460.0M

Round: Series D

Description: Westborough-based Ascend Elements manufactures sustainable battery materials using elements from discarded lithium-ion batteries. Founded by Diran Apelian, Eric Gratz, and Yan Wang in 2015, Ascend Elements has now raised a total of $882.0M in total equity funding and is backed by Mirae Asset, MassChallenge, Temasek Holdings, Alumni Ventures, and National Science Foundation.

Investors in the round: Agave Partners Capital, Alumni Ventures, At One Ventures, BHP Ventures, CMA CGM Ventures, Decarbonization Partners, Fifth Wall, Hitachi Ventures, Mirae Asset, Qatar Investment Authority, Resource Alliance Partners, Temasek Holdings, Tenaska

Industry: Advanced Materials, Battery, Energy Storage, Manufacturing, Sustainability

Founders: Diran Apelian, Eric Gratz, Yan Wang

Founding year: 2015

Total equity funding raised: $882.0M

2. Databricks $500.0M

Round: Series I

Description: San Francisco-based Databricks is an AI cloud data platform that interacts with corporate information stored in the public cloud. Founded by Ali Ghodsi, Andy Konwinski, Arsalan Tavakoli-Shiraji, Ion Stoica, Matei Zaharia, Patrick Wendell, and Reynold Xin in 2013, Databricks has now raised a total of $4.0B in total equity funding and is backed by Ghisallo, NVIDIA, Gaingels, BlackRock, and GIC.

Investors in the round: Andreessen Horowitz, Baillie Gifford, Capital One Ventures, ClearBridge Investments, Counterpoint Global, Eastlink Capital, Fidelity Management and Research Company, Franklin Templeton Investments, Ghisallo, GIC, NVIDIA, Octahedron Capital, Ontario Teachers’ Pension Plan, T. Rowe Price, Tiger Global Management

Industry: Analytics, Artificial Intelligence, Information Technology, InsurTech, Machine Learning

Founders: Ali Ghodsi, Andy Konwinski, Arsalan Tavakoli-Shiraji, Ion Stoica, Matei Zaharia, Patrick Wendell, Reynold Xin

Founding year: 2013

Total equity funding raised: $4.0B

1. Stack AV $1.0B

Round: Venture

Description: Pittsburgh-based Stack AV operates in the transportation industry that develops advanced autonomous systems. Founded by Bryan Salesky, Pete Rander, and Brett Browning in 2023, Stack AV has now raised a total of $1.0B in total equity funding and is backed by SoftBank.

Investors in the round: SoftBank

Industry: Automotive, Autonomous Vehicles, Transportation

Founders: Bryan Salesky, Pete Rander, Brett Browning

Founding year: 2023

Total equity funding raised: $1.0B

2478 Everyday Investors Shared $1,123,615 Net Profit on a Monet

Now you might be thinking: “what the heck are you talking about?” But keep reading, because this investment platform’s users are already smiling all the way to the bank. Thanks to Masterworks, the award-winning platform for investing in blue-chip art.

Every single one of Masterworks’ 15 sales has returned a profit to investors, for a 100% positive net return track record. With 3 recent sales, Masterworks investors realized net annualized returns of 17.6%, 21.5% and 35%.

How does it work? Simple, Masterworks does all of the heavy lifting like finding the painting, buying it, storing it, and eventually selling it. It files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but AlleyWatch readers can skip the waitlist to join with this exclusive link.