Armed with some data from our friends at CrunchBase, we broke down the largest NYC Startup funding rounds in New York for Q2 2020. I have included some additional information such as industry, description, round type, total equity funding raised to further the analysis for the state of venture capital in NYC.

CLICK HERE TO SEE THE LARGEST NYC STARTUP FUNDING ROUNDS OF Q2 2020

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

16. Squire $27.0M

Round: Series B

Description: Squire is a barbershop management and point of sale system software that connects people with barbers nationwide. Founded by Dave Salvant, Songe LaRon, and Yas Tabasam in 2015, Squire has now raised a total of $27.0M in total equity funding and is backed by investors that include Y Combinator, AltaIR Capital, CRV, Trinity Ventures, and Tiger Global Management.

Investors in the round: 645 Ventures, CRV, CV Catalyst Fund, San Francisco 49ers, Tiger Global Management, Trinity Ventures, Y Combinator

Month of funding: June

Industry: Mobile Apps, Online Portals, Point of Sale, Small and Medium Businesses

Founders: Dave Salvant, Songe LaRon, Yas Tabasam

Founding year: 2015

Total equity funding raised: $40.1M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

15. Spruce Holdings $29.0M

Round: Series B

Description: Spruce Holdings aims to improve title insurance assessment and issuance to reduce the time needed to close a real estate deal. Founded by Andrew Weisgall and Patrick Burns in 2016, Spruce Holdings has now raised a total of $29.0M in total equity funding and is backed by investors that include Bessemer Venture Partners, Omidyar Network, Scale Venture Partners, Third Prime, and MetaProp NYC.

Investors in the round: Bessemer Venture Partners, Scale Venture Partners, Zigg Capital

Month of funding: May

Industry: Financial Services, Insurance, InsurTech, Property Insurance, Real Estate

Founders: Andrew Weisgall, Patrick Burns

Founding year: 2016

Total equity funding raised: $50.1M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

14. Beyond Identity $30.0M

Round: Series A

Description: Beyond Identity provides passwordless identity management solutions. Founded by James Clark and Thomas Jermoluk in 2019, Beyond Identity has now raised a total of $30.0M in total equity funding and is backed by investors that include New Enterprise Associates (NEA) and Koch Disruptive Technologies.

Investors in the round: Koch Disruptive Technologies, New Enterprise Associates (NEA)

Month of funding: April

Industry: Computer, Cyber Security, Identity Management, Network Security, Security, Software

Founders: James Clark, Thomas Jermoluk

Founding year: 2019

Total equity funding raised: $30.0M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

13. Semperis $40.0M

Round: Series B

Description: Semperis develops enterprise identity protection and cyber resilience for cross-cloud and hybrid environments. Founded by Guy Teverovsky, Matan Liberman, and Mickey Bresman in 2013, Semperis has now raised a total of $40.0M in total equity funding and is backed by investors that include Insight Partners, Mindset Ventures, Microsoft Accelerator, Maverick Ventures Israel, and Silvertech Ventures.

Investors in the round: Insight Partners, Silvertech Ventures

Month of funding: May

Industry: Cyber Security, Identity Management, Information Technology

Founders: Guy Teverovsky, Matan Liberman, Mickey Bresman

Founding year: 2013

Total equity funding raised: $40.0M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

13. Attentive $40.0M

Round: Series C

Description: Attentive is a personalized mobile messaging platform for innovative brands and organizations. Founded by Andrew Jones, Brian Long, and Ethan Lo in 2016, Attentive has now raised a total of $40.0M in total equity funding and is backed by investors that include Bain Capital Ventures, Coatue Management, Sequoia Capital, NextView Ventures, and Eniac Ventures.

Investors in the round: Coatue Management, Global Equities, Sequoia Capital

Month of funding: April

Industry: Advertising, Marketing, Marketing Automation, Messaging, Mobile, Personalization, SaaS, Software

Founders: Andrew Jones, Brian Long, Ethan Lo

Founding year: 2016

Total equity funding raised: $163.0M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

12. Slice $43.0M

Round: Series C

Description: Slice transforms independent pizzerias with the tech, data, marketing, and shared services needed to serve today’s digital-minded customers. Founded by Ilir Sela in 2009, Slice has now raised a total of $43.0M in total equity funding and is backed by investors that include GGV Capital, Kohlberg Kravis Roberts, Primary Venture Partners, RiverPark Ventures, and Wiley Cerilli.

Investors in the round: GGV Capital, Kohlberg Kravis Roberts

Month of funding: May

Industry: E-Commerce, Food and Beverage, Food Delivery, Restaurants

Founders: Ilir Sela

Founding year: 2009

Total equity funding raised: $82.0M

AlleyWatch’s exclusive coverage of this funding round: Slice’s Series C round

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

11. MakeSpace $45.0M

Round: Series E

Description: MakeSpace is an on-demand storage company that makes it easy to order, store, and retrieve physical belongings. Founded by Adam LeVasseur, Rahul Gandhi, and Sam Rosen in 2013, MakeSpace has now raised a total of $45.0M in total equity funding and is backed by investors that include Iron Mountain, Founders Fund, Slow Ventures, Primary Venture Partners, and Upfront Ventures.

Investors in the round: 8VC, CX Collective, Iron Mountain, Maywic Select Investments, Provenio Capital, Ten Eighty Capital, Upfront Ventures

Month of funding: May

Industry: E-Commerce, Internet, Self-Storage

Founders: Adam LeVasseur, Rahul Gandhi, Sam Rosen

Founding year: 2013

Total equity funding raised: $132.6M

AlleyWatch’s exclusive coverage of this funding round: MakeSpace’s Series E round

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

10. SevenRooms $50.0M

Round: Series B

Description: SevenRooms is an operations, marketing, and guest engagement platform for restaurants, nightclubs, hotels, and entertainment venues. Founded by Allison Page, Joel Montaniel, and Kinesh Patel in 2011, SevenRooms has now raised a total of $50.0M in total equity funding and is backed by investors that include Amazon Alexa Fund, Comcast Ventures, Providence Strategic Growth, and Chasella.

Investors in the round: Providence Strategic Growth

Month of funding: June

Industry: Hospitality, Hotel, Reservations, Restaurants, SaaS

Founders: Allison Page, Joel Montaniel, Kinesh Patel

Founding year: 2011

Total equity funding raised: $67.2M

AlleyWatch’s exclusive coverage of this funding round: SevenRooms’s Series B round

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

10. DigitalOcean $50.0M

Round: Series C

Description: DigitalOcean provides a cloud platform to deploy, manage, and scale applications of any size. Founded by Alec Hartman, Ben Uretsky, Jeff Carr, Mitch Wainer, and Moisey Uretsky in 2012, DigitalOcean has now raised a total of $50.0M in total equity funding and is backed by investors that include Techstars, Andreessen Horowitz, Right Side Capital Management, EquityZen, and Opus Bank.

Investors in the round: Access Industries, Andreessen Horowitz

Month of funding: May

Industry: Cloud Computing, SaaS, Software, Virtualization, Web Hosting

Founders: Alec Hartman, Ben Uretsky, Jeff Carr, Mitch Wainer, Moisey Uretsky

Founding year: 2012

Total equity funding raised: $173.4M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

10. Bluecore $50.0M

Round: Series D

Description: Bluecore is building the future of ecommerce marketing through data and automation. Founded by Fayez Mohamood, Mahmoud Arram, and Max Bennett in 2013, Bluecore has now raised a total of $50.0M in total equity funding and is backed by investors that include Techstars, FirstMark, Felicis Ventures, Right Side Capital Management, and Norwest Venture Partners.

Investors in the round: FirstMark, Georgian Partners, Norwest Venture Partners

Month of funding: May

Industry: Advertising, Brand Marketing, E-Commerce, Email Marketing, Marketing Automation, SaaS, Software

Founders: Fayez Mohamood, Mahmoud Arram, Max Bennett

Founding year: 2013

Total equity funding raised: $113.2M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

9. Hyperscience $60.0M

Round: Series C

Description: Hyperscience is the world’s first Software-Defined, Input-to-Output Automation Platform. Founded by Krasimir Marinov, Peter Brodsky, and Vladimir Tzankov in 2014, Hyperscience has now raised a total of $60.0M in total equity funding and is backed by investors that include Bessemer Venture Partners, Battery Ventures, FirstMark, Felicis Ventures, and SV Angel.

Investors in the round: Battery Ventures, Bessemer Venture Partners, Felicis Ventures, FirstMark, Gaingels, Penna & Company, Stripes, Third Kind Venture Capital, Tiger Global Management

Month of funding: June

Industry: Business Information Systems, Business Intelligence, Cloud Data Services, Data Center Automation, Enterprise Applications, Enterprise Software, Image Recognition, Information Technology, Natural Language Processing, SaaS

Founders: Krasimir Marinov, Peter Brodsky, Vladimir Tzankov

Founding year: 2014

Total equity funding raised: $108.9M

AlleyWatch’s exclusive coverage of this funding round: Hyperscience’s Series C round

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

8. ByHeart $70.0M

Round: Series A

Description: ByHeart is an infant nutrition company that translates nutrition science and breastmilk research into evolved foods and formulas. Founded by Mia Funt and Ron Belldegru in 2016, ByHeart has now raised a total of $70.0M in total equity funding and is backed by investors that include Polaris Partners, Red Sea Ventures, Sean Parker, D1 Capital Partners, and OCV.

Investors in the round: Bellco Capital, D1 Capital Partners, OCV, Polaris Partners, Red Sea Ventures, Sean Parker, Two River

Month of funding: April

Industry: Health Care, Nutrition, Wellness

Founders: Mia Funt, Ron Belldegru

Founding year: 2016

Total equity funding raised: $70.0M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

7. LetsGetChecked $71.0M

Round: Series C

Description: LetsGetChecked is an at-home health testing platform that connects customers to regulated laboratory testing. Founded by Peter Foley in 2014, LetsGetChecked has now raised a total of $71.0M in total equity funding and is backed by investors that include Qiming Venture Partners, Optum Ventures, Transformation Capital, Deerfield, and Illumina Ventures.

Investors in the round: Angeles Investment Advisors, LLC, Common Fund, Deerfield, HLM Venture Partners, Illumina Ventures, Optum Ventures, Qiming Venture Partners USA, Transformation Capital

Month of funding: May

Industry: Health Care, Health Diagnostics, Medical

Founders: Peter Foley

Founding year: 2014

Total equity funding raised: $113.0M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

6. BetterCloud $75.0M

Round: Series F

Description: BetterCloud is the first SaaS Operations Management platform, empowering IT to define, remediate, and enforce policies for SaaS applications Founded by David Politis in 2011, BetterCloud has now raised a total of $75.0M in total equity funding and is backed by investors that include Bain Capital Ventures, Dropbox, Accel, Warburg Pincus, and e.ventures.

Investors in the round: Accel, Bain Capital Ventures, e.ventures, Flybridge, Greycroft, New Amsterdam Growth Capital, Warburg Pincus

Month of funding: May

Industry: Apps, Cloud Security, Enterprise Software, SaaS, Software

Founders: David Politis

Founding year: 2011

Total equity funding raised: $186.9M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

5. Cedar $77.0M

Round: Series C

Description: Cedar is a patient payment and engagement platform for hospitals, health systems, and medical groups that elevates the patient experience. Founded by Arel Lidow and Florian Otto in 2016, Cedar has now raised a total of $77.0M in total equity funding and is backed by investors that include Kaiser Permanente, Andreessen Horowitz, JP Morgan Chase, SV Angel, and Founders Fund.

Investors in the round: Andreessen Horowitz, Founders Fund, Jeffrey L. Vacirca, Jerod Mayo, Kaiser Permanente, Kinnevik AB, Lakestar, Thrive Capital

Month of funding: June

Industry: Billing, FinTech, Health Care, Medical, Payments

Founders: Arel Lidow, Florian Otto

Founding year: 2016

Total equity funding raised: $126.0M

AlleyWatch’s exclusive coverage of this funding round: Cedar’s Series C round

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

4. Cockroach Labs $86.6M

Round: Series D

Description: Cockroach Labs is the company behind CockroachDB, an open source, distributed SQL database. Founded by Benjamin Darnell, Peter Mattis, and Spencer Kimball in 2015, Cockroach Labs has now raised a total of $86.6M in total equity funding and is backed by investors that include FirstMark, Sequoia Capital, Index Ventures, GV, and Tiger Global Management.

Investors in the round: Altimeter Capital, Benchmark, Bond, FirstMark, GV, Index Ventures, Redpoint, Sequoia Capital, Tiger Capital

Month of funding: May

Industry: Database, Enterprise Software, Open Source, Software

Founders: Benjamin Darnell, Peter Mattis, Spencer Kimball

Founding year: 2015

Total equity funding raised: $195.1M

AlleyWatch’s exclusive coverage of this funding round: Cockroach Labs’s Series D round

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

3. VAST Data $100.0M

Round: Series C

Description: VAST Data is a storage company bringing an end to complex storage tiering and HDD usage in the enterprise. Founded by Jeff Denworth, Renen Hallak, and Shachar Fienblit in 2016, VAST Data has now raised a total of $100.0M in total equity funding and is backed by investors that include Goldman Sachs, Dell Technologies Capital, Norwest Venture Partners, 83North, and Next47.

Investors in the round: 83North, Common Fund, Dell Technologies Capital, Goldman Sachs, Greenfield Partners, Mellanox Capital, Next47, Norwest Venture Partners

Month of funding: April

Industry: Computer, Data Storage, Software

Founders: Jeff Denworth, Renen Hallak, Shachar Fienblit

Founding year: 2016

Total equity funding raised: $180.0M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

3. Payfone $100.0M

Round: Series H

Description: Payfone is a customer identity platform that provides mobile and digital identity authentication solutions for businesses. Founded by Mike Brody and Rodger Desai in 2008, Payfone has now raised a total of $100.0M in total equity funding and is backed by investors that include TransUnion, RRE Ventures, Verizon Ventures, MassMutual Ventures, and Wellington Management.

Investors in the round: Andrew Prozes, Apax Digital, MassMutual Ventures, Ralph de la Vega, Sandbox Insurtech Ventures, Synchrony Ventures, The Blue Venture Fund, Wellington Management

Month of funding: June

Industry: Cyber Security, Identity Management, Information Technology, Mobile, Software

Founders: Mike Brody, Rodger Desai

Founding year: 2008

Total equity funding raised: $212.1M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

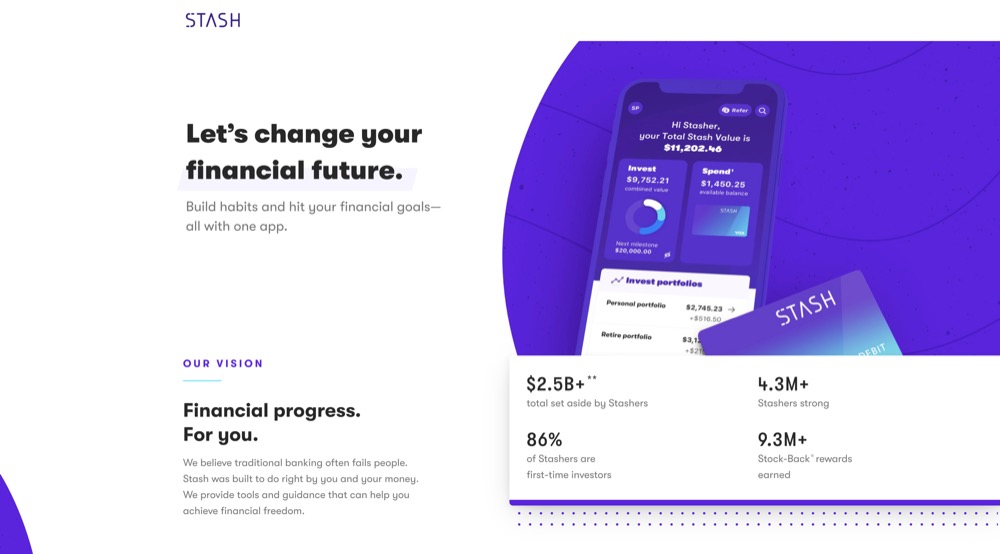

2. Stash $112.0M

Round: Series F

Description: Stash is pioneering the future of personal finance with the first financial subscription that helps people create better lives. From budgeting to saving for retirement, Stash unites banking, investing, and advice all in one app. Founded by Brandon Krieg, David Ronick, and Ed Robison in 2015, Stash has now raised a total of $112.0M in total equity funding and is backed by investors that include Coatue Management, Union Square Ventures, T. Rowe Price, Founders Fund, and Entree Capital.

Investors in the round: Breyer Capital, Entrée Capital, Goodwater Capital, Greenspring Associates, LendingTree, T. Rowe Price, Union Square Ventures

Month of funding: April

Industry: Finance, Financial Services, FinTech, Personal Finance

Founders: Brandon Krieg, David Ronick, Ed Robison

Founding year: 2015

Total equity funding raised: $301.3M

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.

1. Oscar Health $225.0M

Round: Venture

Description: Oscar is a technology-focused health insurance company that employs technology, design, and data to humanize health care. Founded by Joshua Kushner, Kevin Nazemi, and Mario Schlosser in 2012, Oscar Health has now raised a total of $225.0M in total equity funding and is backed by investors that include Khosla Ventures, Goldman Sachs, General Catalyst, Verily, and Coatue Management.

Investors in the round: Alphabet, Baillie Gifford, Coatue Management, General Catalyst, Khosla Ventures, Lakestar, Thrive Capital

Month of funding: June

Industry: Health Care, Health Insurance, Information Technology, Insurance, InsurTech

Founders: Joshua Kushner, Kevin Nazemi, Mario Schlosser

Founding year: 2012

Total equity funding raised: $1.5B

Mastercard has been transforming how people pay and get paid for more than 50 years. Guided by a commitment to innovation, Mastercard helps businesses grow, improves the consumer payments experience, and advances a more inclusive financial system around the globe. Fostering a culture of innovation is critical to success and Mastercard attracts talented people with curious minds and big ideas across eight global tech hubs, including in the heart of NYC. Mastercard is also committed to working with developers and entrepreneurs, enabling advances in the payments ecosystem of the future. Learn more about innovation and life at Mastercard here.