Armed with some data from our friends at CrunchBase, I broke down the largest US startup funding rounds from June 2021. I have included some additional information such as industry, company description, round type, founders, and total equity funding raised to further the analysis.

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

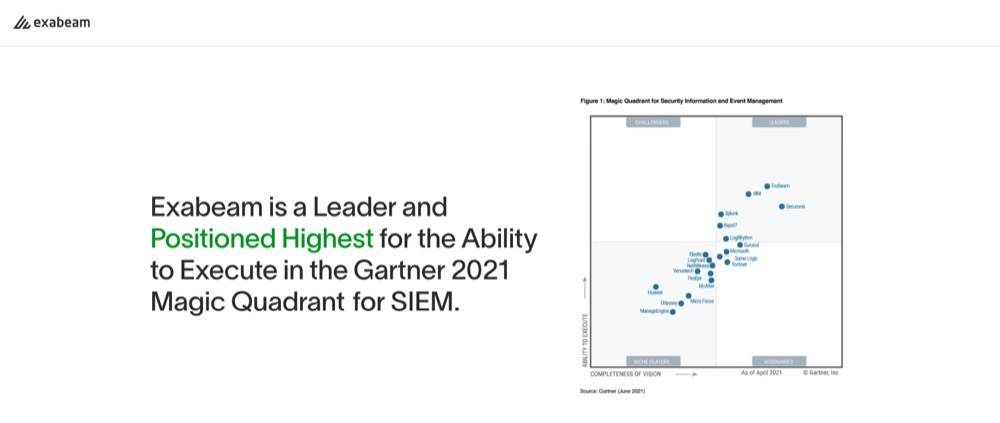

13. Exabeam $200.0M

Round: Series F

Description: Foster City-based Exabeam is a cybersecurity company that provides a cloud platform designed to simplify security operations. Founded by Domingo Mihovilovic, Nir Polak, and Sylvain Gil in 2013, Exabeam has now raised a total of $390.0M in total equity funding and is backed by investors that include Acrew Capital, Lightspeed Venture Partners, Norwest Venture Partners, and Owl Rock Capital.

Investors in the round: Acrew Capital, Lightspeed Venture Partners, Norwest Venture Partners, Owl Rock Capital

Industry: Analytics, Big Data, Cloud Security, Cyber Security

Founders: Domingo Mihovilovic, Nir Polak, Sylvain Gil

Founding year: 2013

Total equity funding raised: $390.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

13. Figma $200.0M

Round: Series E

Description: San Francisco-based Figma is a design platform for teams who build products together. Founded by Dylan Field and Evan Wallace in 2012, Figma has now raised a total of $332.9M in total equity funding and is backed by investors that include Andreessen Horowitz, Base Partners, Counterpoint Global, Durable Capital Partners, Greylock, Index Ventures, Kleiner Perkins, Lachy Groom, and Sequoia Capital.

Investors in the round: Andreessen Horowitz, Base Partners, Counterpoint Global, Durable Capital Partners, Greylock, Index Ventures, Kleiner Perkins, Lachy Groom, Sequoia Capital

Industry: Developer Tools, Graphic Design, Software, UX Design, Web Design

Founders: Dylan Field, Evan Wallace

Founding year: 2012

Total equity funding raised: $332.9M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

13. Guideline $200.0M

Round: Series E

Description: San Mateo-based Guideline is a retirement plan platform that offers the all-inclusive 401(k) and full-stack solution for growing businesses. Founded by Jeremy Caballero, Kevin Busque, and Mike Nelson in 2015, Guideline has now raised a total of $339.0M in total equity funding and is backed by investors that include Felicis Ventures, General Atlantic, Generation Investment Management, Greyhound Capital, Propel Venture Partners, and Xfund.

Investors in the round: Felicis Ventures, General Atlantic, Generation Investment Management, Greyhound Capital, Propel Venture Partners, Xfund

Industry: Finance, FinTech, Insurance, Retirement, Small and Medium Businesses

Founders: Jeremy Caballero, Kevin Busque, Mike Nelson

Founding year: 2015

Total equity funding raised: $339.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

13. Iterable $200.0M

Round: Series E

Description: San Francisco-based Iterable provides a marketing automation platform designed to optimize and measure every customer interaction. Founded by Andrew Boni and Justin Zhu in 2013, Iterable has now raised a total of $342.2M in total equity funding and is backed by investors that include 645 Ventures, Adams Street Partners, Blue Cloud Ventures, Capital One Ventures, CRV, DTCP, Glynn Capital Management, Silver Lake, and Viking Global Investors.

Investors in the round: 645 Ventures, Adams Street Partners, Blue Cloud Ventures, Capital One Ventures, CRV, DTCP, Glynn Capital Management, Silver Lake, Viking Global Investors

Industry: CRM, Email Marketing, Enterprise Software, Marketing Automation

Founders: Andrew Boni, Justin Zhu

Founding year: 2013

Total equity funding raised: $342.2M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

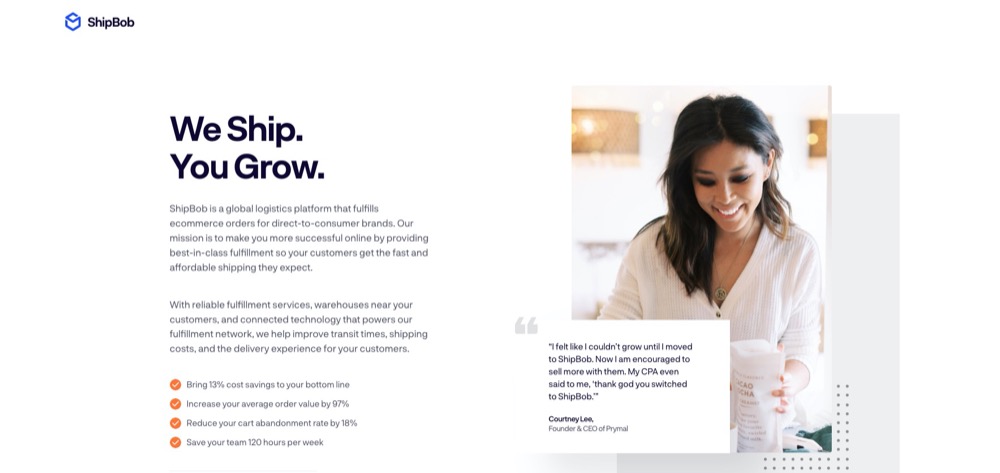

13. ShipBob $200.0M

Round: Series E

Description: Chicago-based ShipBob is a global logistics company that offers an e-commerce fulfillment order platform for direct-to-consumer brands. Founded by Dhruv Saxena, Divey Gulati, George Wojciechowski, and Jivko Bojinov in 2014, ShipBob has now raised a total of $330.5M in total equity funding and is backed by investors that include Bain Capital Ventures, Hyde Park Angels, Hyde Park Venture Partners, Menlo Ventures, Silicon Valley Bank, and SoftBank.

Investors in the round: Bain Capital Ventures, Hyde Park Angels, Hyde Park Venture Partners, Menlo Ventures, Silicon Valley Bank, SoftBank

Industry: E-Commerce, Logistics, Mobile, SaaS, Shipping

Founders: Dhruv Saxena, Divey Gulati, George Wojciechowski, Jivko Bojinov

Founding year: 2014

Total equity funding raised: $330.5M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

13. Moveworks $200.0M

Round: Series C

Description: Mountain View-based Moveworks offers an AI platform that revolutionizes how companies support their employees. Founded by Bhavin Shah, Jiang Chen, Vaibhav Nivargi, and Varun Singh in 2016, Moveworks has now raised a total of $305.0M in total equity funding and is backed by investors that include Alkeon Capital, Bain Capital, ICONIQ Capital, Kleiner Perkins, Lightspeed Venture Partners, Sapphire Ventures, and Tiger Global Management.

Investors in the round: Alkeon Capital, Bain Capital, ICONIQ Capital, Kleiner Perkins, Lightspeed Venture Partners, Sapphire Ventures, Tiger Global Management

Industry: Artificial Intelligence, Cloud Computing, Information Technology, Technical Support

Founders: Bhavin Shah, Jiang Chen, Vaibhav Nivargi, Varun Singh

Founding year: 2016

Total equity funding raised: $305.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

13. Outreach $200.0M

Round: Series G

Description: Seattle-based Outreach is a sales engagement platform that uses AI for predictive analytics as it relates to sales. Founded by Andrew Kinzer, Gordon Hempton, Manny Medina, and Wes Hather in 2014, Outreach has now raised a total of $489.0M in total equity funding and is backed by investors that include DFJ Growth, Lone Pine Capital, Mayfield Fund, PremjiInvest, Salesforce Ventures, Sands Capital Management, Sequoia Capital Global Equities, Steadfast Financial, Tiger Global Management, Trinity Ventures, and Vista Equity Partners.

Investors in the round: DFJ Growth, Lone Pine Capital, Mayfield Fund, PremjiInvest, Salesforce Ventures, Sands Capital Management, Sequoia Capital Global Equities, Steadfast Financial, Tiger Global Management, Trinity Ventures, Vista Equity Partners

Industry: Analytics, Artificial Intelligence, CRM, Enterprise Software, SaaS, Sales, Software

Founders: Andrew Kinzer, Gordon Hempton, Manny Medina, Wes Hather

Founding year: 2014

Total equity funding raised: $489.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

13. ServiceTitan $200.0M

Round: Series G

Description: Glendale-based ServiceTitan is a service management software that helps home services businesses generate more leads and close more sales. Founded by Ara Mahdessian and Vahe Kuzoyan in 2012, ServiceTitan has now raised a total of $1.1B in total equity funding and is backed by investors that include Battery Ventures, Bessemer Venture Partners, Dragoneer Investment Group, ICONIQ Capital, Index Ventures, Sequoia Capital Global Equities, T. Rowe Price, Thoma Bravo, and Tiger Global Management.

Investors in the round: Battery Ventures, Bessemer Venture Partners, Dragoneer Investment Group, ICONIQ Capital, Index Ventures, Sequoia Capital Global Equities, T. Rowe Price, Thoma Bravo, Tiger Global Management

Industry: CRM, Home Services, Information Technology, SaaS

Founders: Ara Mahdessian, Vahe Kuzoyan

Founding year: 2012

Total equity funding raised: $1.1B

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

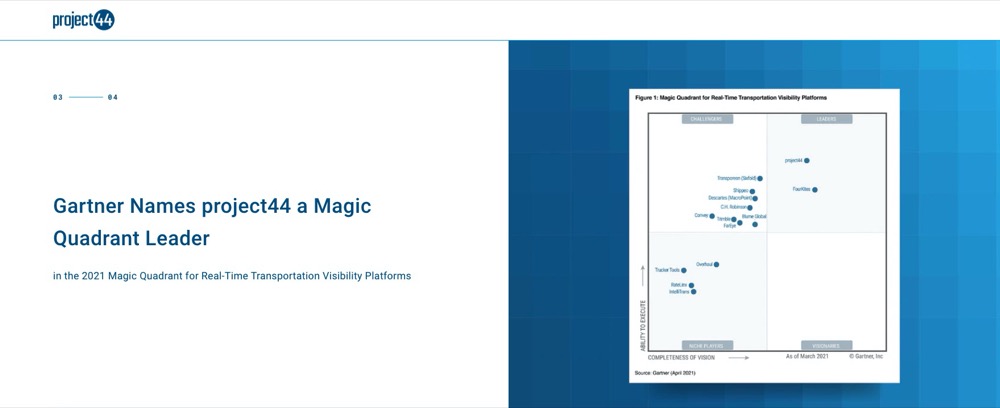

12. project44 $202.0M

Round: Series E

Description: Chicago-based project44 is a provider of an advanced supply chain visibility platform for shippers and third-party logistics firms. Founded by Jett McCandless and Wally Ibrahim in 2014, project44 has now raised a total of $397.5M in total equity funding and is backed by investors that include Emergence, Girteka Logistics, Goldman Sachs Asset Management, and Lineage Logistics.

Investors in the round: Emergence, Girteka Logistics, Goldman Sachs Asset Management, Lineage Logistics

Industry: Developer APIs, Enterprise Software, Freight Service, SaaS, Transportation

Founders: Jett McCandless, Wally Ibrahim

Founding year: 2014

Total equity funding raised: $397.5M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

11. Eightfold $220.0M

Round: Series E

Description: Santa Clara-based Eightfold is a developer of a talent intelligence platform used to help companies find, recruit, and retain workers. Founded by Ashutosh Garg and Varun Kacholia in 2016, Eightfold has now raised a total of $396.8M in total equity funding and is backed by investors that include Capital One Ventures, Foundation Capital, General Catalyst, Institutional Venture Partners, Lightspeed Venture Partners, and SoftBank Vision Fund.

Investors in the round: Capital One Ventures, Foundation Capital, General Catalyst, Institutional Venture Partners, Lightspeed Venture Partners, SoftBank Vision Fund

Industry: Artificial Intelligence, Business Intelligence, Human Resources, Information Technology, Recruiting, SaaS

Founders: Ashutosh Garg, Varun Kacholia

Founding year: 2016

Total equity funding raised: $396.8M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

10. Illumio $225.0M

Round: Series F

Description: Sunnyvale-based Illumio is a provider of a SaaS platform offering automated enforcement against cyberattacks. Founded by Andrew Rubin and PJ Kirner in 2013, Illumio has now raised a total of $557.5M in total equity funding and is backed by investors that include Franklin Templeton Investments, Hamilton Lane, Owl Rock Capital, and Thoma Bravo.

Investors in the round: Franklin Templeton Investments, Hamilton Lane, Owl Rock Capital, Thoma Bravo

Industry: Cloud Security, Cyber Security, Data Center, SaaS, Security

Founders: Andrew Rubin, PJ Kirner

Founding year: 2013

Total equity funding raised: $557.5M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

9. 4G Clinical $230.0M

Round: Venture

Description: Wellesley-based 4G Clinical provides software and services for clinical drug trials specifically in randomization and trial supply management (RTSM). Founded by David Kelleher and Ed Tourtellotte in 2015, 4G Clinical has now raised a total of $252.1M in total equity funding and is backed by investors that include Goldman Sachs Asset Management.

Investors in the round: Goldman Sachs Asset Management

Industry: Health Care, Management Information Systems, Pharmaceutical

Founders: David Kelleher, Ed Tourtellotte

Founding year: 2015

Total equity funding raised: $252.1M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

8. DataRobot $250.0M

Round: Series G

Description: Boston-based DataRobot brings AI technology and ROI enablement services to global enterprises. Founded by Jeremy Achin and Thomas DeGodoy in 2012, DataRobot has now raised a total of $1.0B in total equity funding and is backed by investors that include Altimeter Capital and Tiger Global Management.

Investors in the round: Altimeter Capital, Tiger Global Management

Industry: Artificial Intelligence, Enterprise Software, Machine Learning, SaaS

Founders: Jeremy Achin, Thomas DeGodoy

Founding year: 2012

Total equity funding raised: $1.0B

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

8. Gong $250.0M

Round: Series E

Description: San Francisco-based Gong.io is a revenue intelligence platform that delivers insights at scale. Founded by Amit Bendov and Eilon Reshef in 2015, Gong has now raised a total of $583.0M in total equity funding and is backed by investors that include Coatue, Franklin Templeton Investments, Salesforce Ventures, Sequoia Capital, Thrive Capital, and Tiger Global Management.

Investors in the round: Coatue, Franklin Templeton Investments, Salesforce Ventures, Sequoia Capital, Thrive Capital, Tiger Global Management

Industry: Artificial Intelligence, CRM, Information Technology, Machine Learning, Sales, Software

Founders: Amit Bendov, Eilon Reshef

Founding year: 2015

Total equity funding raised: $583.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

8. Zipline $250.0M

Round: Series E

Description: Half Moon Bay-based Zipline designs, manufactures, and operates drones to deliver vital medical products to everyone, no matter where they live. Founded by Keenan Wyrobek, Keller Rinaudo, and Will Hetzler in 2014, Zipline has now raised a total of $483.0M in total equity funding and is backed by investors that include Baillie Gifford, Emerging Capital Partners (ECP), Fidelity, Intercorp, Katalyst.Ventures, Reinvent Capital, and Temasek Holdings.

Investors in the round: Baillie Gifford, Emerging Capital Partners (ECP), Fidelity, Intercorp, Katalyst.Ventures, Reinvent Capital, Temasek Holdings

Industry: Delivery, Drones, Logistics, Robotics, Supply Chain Management

Founders: Keenan Wyrobek, Keller Rinaudo, Will Hetzler

Founding year: 2014

Total equity funding raised: $483.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

7. Faire $260.0M

Round: Series F

Description: San Francisco-based Faire is a company that helps retailers find and buy wholesale merchandise for their stores. Founded by Daniele Perito, Jeffrey Kolovson, Marcelo Cortes, and Max Rhodes in 2017, Faire has now raised a total of $696.0M in total equity funding and is backed by investors that include Baillie Gifford, D1 Capital Partners, Dragoneer Investment Group, DST Global, Forerunner Ventures, Founders Fund, Khosla Ventures, Lightspeed Venture Partners, Sequoia Capital, Wellington Management, and Y Combinator.

Investors in the round: Baillie Gifford, D1 Capital Partners, Dragoneer Investment Group, DST Global, Forerunner Ventures, Founders Fund, Khosla Ventures, Lightspeed Venture Partners, Sequoia Capital, Wellington Management, Y Combinator

Industry: E-Commerce, Marketplace, Retail, Retail Technology, Supply Chain Management, Wholesale

Founders: Daniele Perito, Jeffrey Kolovson, Marcelo Cortes, Max Rhodes

Founding year: 2017

Total equity funding raised: $696.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

6. Thumbtack $275.0M

Round: Series I

Description: San Francisco-based Thumbtack is a technology company that builds a modern home management platform. Founded by Jeremy Tunnell, Jonathan Swanson, Marco Zappacosta, and Sander Daniels in 2008, Thumbtack has now raised a total of $698.2M in total equity funding and is backed by investors that include Baillie Gifford, Blackstone Alternative Asset Management, CapitalG, Founders Circle Capital, G Squared, Qatar Investment Authority, Sequoia Capital, and Tiger Global Management.

Investors in the round: Baillie Gifford, Blackstone Alternative Asset Management, CapitalG, Founders Circle Capital, G Squared, Qatar Investment Authority, Sequoia Capital, Tiger Global Management

Industry: Internet, Professional Services, Service Industry

Founders: Jeremy Tunnell, Jonathan Swanson, Marco Zappacosta, Sander Daniels

Founding year: 2008

Total equity funding raised: $698.2M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

5. Age of Learning $300.0M

Round: Series C

Description: Glendale-based Age of Learning provides a comprehensive and engaging online curriculum for pre-k, kindergarten, elementary, and middle school programs. Founded by Doug Dohring in 2007, Age of Learning has now raised a total of $450.0M in total equity funding and is backed by investors that include Madrone Capital Partners, Qatar Investment Authority, and TPG.

Investors in the round: Madrone Capital Partners, Qatar Investment Authority, TPG

Industry: E-Learning, EdTech, Education

Founders: Doug Dohring

Founding year: 2007

Total equity funding raised: $450.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

4. Neo4j $325.0M

Round: Series F

Description: San Mateo-based Neo4j is a graph database platform that provides data analytics and connections services through a cloud service. Founded by Emil Eifrem, Johan Svensson, and Peter Neubauer in 2007, Neo4j has now raised a total of $515.1M in total equity funding and is backed by investors that include Creandum, DTCP, Eurazeo, Greenbridge Partners, GV, Lightrock, and One Peak Partners.

Investors in the round: Creandum, DTCP, Eurazeo, Greenbridge Partners, GV, Lightrock, One Peak Partners

Industry: Analytics, Business Information Systems, Data Visualization, Database

Founders: Emil Eifrem, Johan Svensson, Peter Neubauer

Founding year: 2007

Total equity funding raised: $515.1M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

3. Anduril Industries $450.0M

Round: Series D

Description: Irvine-based Anduril Industries is a defense product company that builds technology for military agencies and border surveillance. Founded by Brian Schimpf, Joseph Chen, Matt Grimm, Palmer Luckey, and Trae Stephens in 2017, Anduril Industries has now raised a total of $691.0M in total equity funding and is backed by investors that include 8VC, Andreessen Horowitz, Contrary, D1 Capital Partners, Elad Gil, Founders Fund, General Catalyst, Jackson Moses, Jovono, Lux Capital, and Valor Equity Partners.

Investors in the round: 8VC, Andreessen Horowitz, Contrary, D1 Capital Partners, Elad Gil, Founders Fund, General Catalyst, Jackson Moses, Jovono, Lux Capital, Valor Equity Partners

Industry: Aerospace, Artificial Intelligence, Augmented Reality, Government, National Security, Virtual Reality

Founders: Brian Schimpf, Joseph Chen, Matt Grimm, Palmer Luckey, Trae Stephens

Founding year: 2017

Total equity funding raised: $691.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

2. Transmit Security $543.0M

Round: Series A

Description: Boston-based Transmit Security offers risk management and passwordless identity solutions for customers and workforce. Founded by Mickey Boodaei and Rakesh K. Loonkar in 2014, Transmit Security has now raised a total of $583.0M in total equity funding and is backed by investors that include Artisanal Ventures, Cyberstarts, General Atlantic, Geodesic Capital, Insight Partners, SYN Ventures, and Vintage Investment Partners.

Investors in the round: Artisanal Ventures, Cyberstarts, General Atlantic, Geodesic Capital, Insight Partners, SYN Ventures, Vintage Investment Partners

Industry: Cyber Security, Fraud Detection, Identity Management, Information Technology, Security

Founders: Mickey Boodaei, Rakesh K. Loonkar

Founding year: 2014

Total equity funding raised: $583.0M

You can’t always count on inbound deal flow. The best deal-making firms have a systematic process for building a pre-deal pipeline that is bursting with potential. Register for SourceScrub‘s webinar on 7/13 to learn:

What it takes to systematically build a deal pipeline full of potential

How to measure and optimize outbound performance

Keys to high-impact outreach that gets attention.

REGISTER NOW

1. Relativity Space $650.0M

Round: Series E

Description: Long Beach-based Relativity Space is an aerospace company that designs, develops, and builds 3D printed rockets. Founded by Jordan Noone and Tim Ellis in 2015, Relativity Space has now raised a total of $1.3B in total equity funding and is backed by investors that include Baillie Gifford, BlackRock, Brad Buss, Centricus, Coatue, Fidelity Management and Research Company, Jared Leto, K5 Global, Mark Cuban, Soroban Capital, Spencer Rascoff, Tiger Global Management, Tribe Capital, and XN.

Investors in the round: Baillie Gifford, BlackRock, Brad Buss, Centricus, Coatue, Fidelity Management and Research Company, Jared Leto, K5 Global, Mark Cuban, Soroban Capital, Spencer Rascoff, Tiger Global Management, Tribe Capital, XN

Industry: 3D Technology, Aerospace, Artificial Intelligence, Manufacturing, Supply Chain Management

Founders: Jordan Noone, Tim Ellis

Founding year: 2015

Total equity funding raised: $1.3B