Armed with some data from our friends at CrunchBase, I broke down the largest NYC Startup funding rounds in New York for June 2021. I have included some additional information such as industry, description, round type, total equity funding raised to further the analysis for the state of venture capital in NYC

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

9. Orum.io $56.0M

Round: Series B

Description: Orum builds infrastructure for a frictionless financial system that enables real-time money movement with proprietary intelligence. Founded by Stephany Kirkpatrick in 2019, Orum.io has now raised a total of $82.2M in total equity funding and is backed by investors that include Bain Capital Ventures, BoxGroup, Accel, SVB Capital, and Primary Venture Partners.

Investors in the round: Accel, Acrew Capital, Bain Capital Ventures, BoxGroup, Canapi Ventures, Clocktower Technology Ventures, Homebrew, Inspired Capital Partners, Primary Venture Partners

Industry: Financial Services, FinTech, Machine Learning

Founders: Stephany Kirkpatrick

Founding year: 2019

Total equity funding raised: $82.2M

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

8. Spruce Holdings $60.0M

Round: Series C

Description: Spruce Holdings aims to improve title insurance assessment and issuance to reduce the time needed to close a real estate deal. Founded by Andrew Weisgall and Patrick Burns in 2016, Spruce Holdings has now raised a total of $110.1M in total equity funding and is backed by investors that include Bessemer Venture Partners, Collaborative Fund, Scale Venture Partners, MetaProp, and Zigg Capital.

Investors in the round: Bessemer Venture Partners, Scale Venture Partners, Zigg Capital

Industry: Financial Services, Insurance, InsurTech, Property Insurance, Real Estate

Founders: Andrew Weisgall, Patrick Burns

Founding year: 2016

Total equity funding raised: $110.1M

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

7. Kindbody $62.0M

Round: Series C

Description: Kindbody is a health and technology company providing fertility, gynecology, and family-building care. Founded by Gina Bartasi and Joanne Schneider in 2018, Kindbody has now raised a total of $125.3M in total equity funding and is backed by investors that include Alumni Ventures Group, GV, RRE Ventures, Perceptive Advisors, and NFP.

Investors in the round: Bramalea Partners, Claritas Health Ventures, Eldridge, GV, Monashee Investment Management, Perceptive Advisors, Rock Springs Capital, RRE Ventures, What If Ventures

Industry: Fertility, Health Care, Medical, Wellness, Women’s

Founders: Gina Bartasi, Joanne Schneider

Founding year: 2018

Total equity funding raised: $125.3M

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

6. Gloat $68.0M

Round: Series C

Description: Gloat is an internal talent marketplace that allows people to be matched to internal career opportunities. Founded by Amichai Schreiber, Ben Reuveni, Danny Shtainberg, and Roy Reuveni in 2015, Gloat has now raised a total of $102.6M in total equity funding and is backed by investors that include Intel Capital, Accel, Eight Roads Ventures, Magma Venture Partners, and PICO Venture Partners.

Investors in the round: Accel, Eight Roads Ventures, Intel Capital, Magma Venture Partners, PICO Venture Partners

Industry: Career Planning, Human Resources, Marketplace, Social Media, Software

Founders: Amichai Schreiber, Ben Reuveni, Danny Shtainberg, Roy Reuveni

Founding year: 2015

Total equity funding raised: $102.6M

AlleyWatch’s exclusive coverage of this round: Gloat Raises $57M for its Talent Marketplace Platform That Allows Companies to Tap into Their Talent Pools More Effectively

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

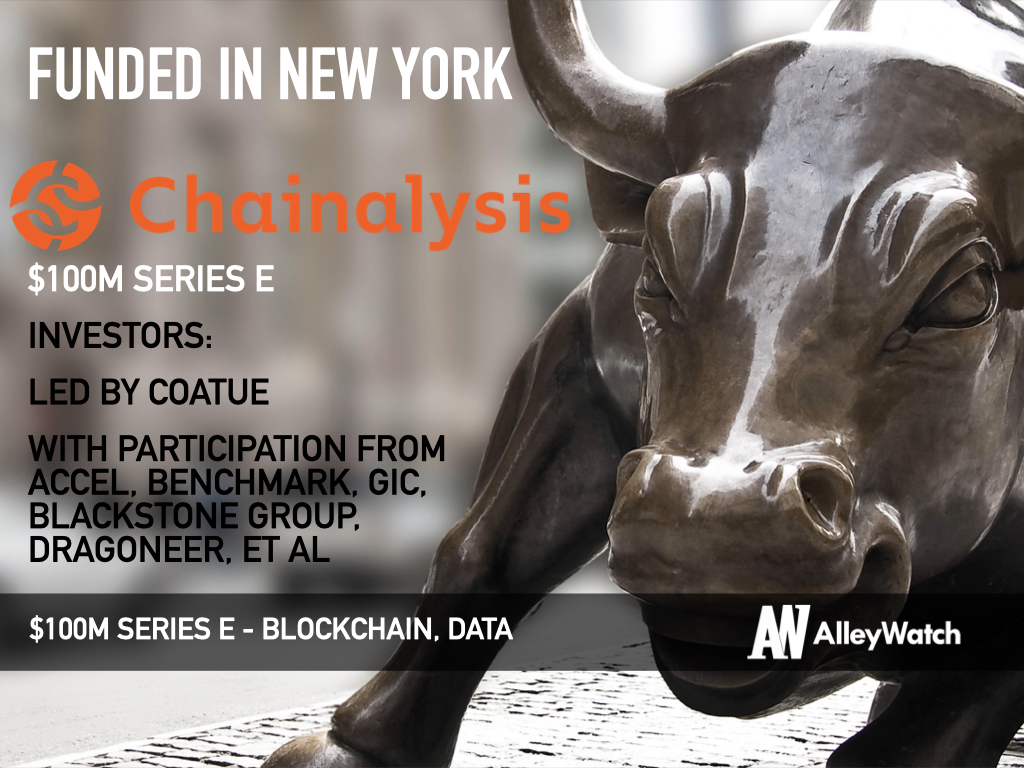

5. Chainalysis $100.0M

Round: Series E

Description: Chainalysis provides blockchain data and analysis to governments, banks, and businesses worldwide. Founded by Jan Moller, Jonathan Levin, and Michael Gronager in 2014, Chainalysis has now raised a total of $366.6M in total equity funding and is backed by investors that include FundersClub, Techstars, Ribbit Capital, Digital Currency Group, and GIC.

Investors in the round: 9Yards Capital, Accel, Addition, Altimeter, Benchmark, Blackstone Group, Coatue, Dragoneer Investment Group, Durable Capital Partners, GIC, Pictet Private Equity Investors S.A., Sequoia Heritage, SVB Capital

Industry: Blockchain, Cryptocurrency, FinTech, Software

Founders: Jan Moller, Jonathan Levin, Michael Gronager

Founding year: 2014

Total equity funding raised: $366.6M

AlleyWatch’s exclusive coverage of this round: Chainalysis Raises $100M for its Blockchain Data Platform That Brings Industry-Leading Transparency to Cryptocurrencies

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

5. JW Player $100.0M

Round: Series E

Description: JW Player is a video streaming and analytics platform that offers an HTML5 video player for web content, publishing, and running video ads. Founded by Adam Fawer, Brian Rifkin, Dave Otten, and Jeroen Wijering in 2004, JW Player has now raised a total of $145.7M in total equity funding and is backed by investors that include Greenspring Associates, Greycroft, LLR Partners, Headline, and Cue Ball.

Investors in the round: LLR Partners

Industry: Advertising, Publishing, Software, Video, Video Streaming

Founders: Adam Fawer, Brian Rifkin, Dave Otten, Jeroen Wijering

Founding year: 2004

Total equity funding raised: $145.7M

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

5. Yieldstreet $100.0M

Round: Series C

Description: Yieldstreet is a management platform that provides institutional investors with access to income-generating investment products. Founded by Dennis Shields, Michael Weisz, and Milind Mehere in 2015, Yieldstreet has now raised a total of $178.5M in total equity funding and is backed by investors that include FJ Labs, Gaingels, Greenspring Associates, Edison Partners, and Greycroft.

Investors in the round: Edison Partners, Expansion Capital, Gaingels, Greenspring Associates, Greycroft, Kingfisher Investment Advisors, Raine Ventures, Soros Fund Management, Tarsadia Investments, Top Tier Capital Partners

Industry: Finance, Financial Services, FinTech, Wealth Management

Founders: Dennis Shields, Michael Weisz, Milind Mehere

Founding year: 2015

Total equity funding raised: $178.5M

AlleyWatch’s exclusive coverage of this round: Yieldstreet Raises Another $100M for its Platform that Democratizes Access to Alternative Investments

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

4. SmartAsset $110.0M

Round: Series D

Description: SmartAsset is the web’s go-to resource for financial advice connecting consumers with financial advisors. Founded by Michael Carvin and Philip Camilleri in 2012, SmartAsset has now raised a total of $160.5M in total equity funding and is backed by investors that include FJ Labs, SV Angel, Citi Ventures, Y Combinator, and Javelin Venture Partners.

Investors in the round: Citi Ventures, CMFG Ventures, Contour Venture Partners, Javelin Venture Partners, New York Life Ventures, North Bridge Venture Partners & Growth Equity, TTV Capital

Industry: Analytics, Finance, Financial Services, FinTech, Personal Finance, Wealth Management

Founders: Michael Carvin, Philip Camilleri

Founding year: 2012

Total equity funding raised: $160.5M

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

3. Claroty $140.0M

Round: Series D

Description: Claroty is a cybersecurity company that protects industrial control networks from cyber-attacks. Founded by Amir Zilberstein, Benny Porat, and Galina Antova in 2015, Claroty has now raised a total of $240.0M in total equity funding and is backed by investors that include Siemens, Schneider Electric, Temasek Holdings, Team8, and Bessemer Venture Partners.

Investors in the round: 40 North Ventures, Bessemer Venture Partners, ISQ Global Infrastructure Fund, LG Capital, Rockwell Automation, Schneider Electric, Siemens, Team8

Industry: Cyber Security, Industrial, Network Security, Security

Founders: Amir Zilberstein, Benny Porat, Galina Antova

Founding year: 2015

Total equity funding raised: $240.0M

AlleyWatch’s exclusive coverage of this round: Claroty Raises $140M for its Industrial Cybersecurity Platform that Protects our Most Critical Infrastructure

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

3. Thirty Madison $140.0M

Round: Series C

Description: Thirty Madison offers direct-to-consumer healthcare and wellness products for people living with chronic conditions. Founded by Demetri Karagas and Steven Gutentag in 2017, Thirty Madison has now raised a total of $209.8M in total equity funding and is backed by investors that include Alumni Ventures Group, First Round Capital, Gaingels, Polaris Partners, and Northzone.

Investors in the round: Bracket Capital, Greycroft, HealthQuest Capital, Johnson & Johnson Innovation – JJDC, Mousse Partners, Northzone, Polaris Partners

Industry: Health Care, Personal Health, Pharmaceutical, Wellness

Founders: Demetri Karagas, Steven Gutentag

Founding year: 2017

Total equity funding raised: $209.8M

AlleyWatch’s exclusive coverage of this round: Thirty Madison Raises $140M to Make the Treatment of Chronic Conditions Accessible

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

2. LetsGetChecked $150.0M

Round: Series D

Description: LetsGetChecked is an at-home health testing platform that connects customers to regulated laboratory testing. Founded by Peter Foley in 2015, LetsGetChecked has now raised a total of $263.0M in total equity funding and is backed by investors that include Casdin Capital, Qiming Venture Partners, Optum Ventures, Deerfield, and HLM Venture Partners.

Investors in the round: Casdin Capital, Common Fund, HLM Venture Partners, Illumina Ventures, Optum Ventures, Qiming Venture Partners USA, Symphony Ventures, Transformation Capital

Industry: Health Care, Health Diagnostics, Medical, mHealth

Founders: Peter Foley

Founding year: 2015

Total equity funding raised: $263.0M

AlleyWatch’s exclusive coverage of this round: LetsGetChecked Raises Another $150M to Expand its Virtual Healthcare Services

Startups and small businesses are collectively wasting $130B each year due to poor visibility into vendor spend. Glean unlocks the powerful information detailed in vendor invoices to surface non-intuitive spend insights so finance teams are empowered to create a culture of spend accountability within their organizations.

REQUEST A 60-DAY FREE TRIAL TODAY

1. Verbit $157.0M

Round: Series D

Description: Verbit uses smart AI technology to disrupt captioning and transcription with speed and automation. Founded by Eric Shellef, Kobi Ben Tzvi, and Tom Livne in 2017, Verbit has now raised a total of $282.0M in total equity funding and is backed by investors that include HV Capital, Sapphire Ventures, Vertex Ventures, Third Point Ventures, and Stripes.

Investors in the round: Big Tech 50, ClalTech, HV Capital, Lion Investment Partners, More Capital, Omer Cygler, Oryzn Capital, Sapphire Ventures, Stripes, Third Point Ventures, Vertex Growth Fund, Vertex Ventures, Viola Ventures

Industry: Artificial Intelligence, Machine Learning, Natural Language Processing, SEO

Founders: Eric Shellef, Kobi Ben Tzvi, Tom Livne

Founding year: 2017

Total equity funding raised: $282.0M

AlleyWatch’s exclusive coverage of this round: Verbit Raises $157M for its Transcription and Captioning Platform Powered by AI