Digital-first banking has taken off in popularity, especially during the pandemic, but as an increased number of people turn to these fintech solutions, there is a rising concern about security and fraud prevention. Alloy is the first end-to-end identity core platform that helps companies make better identity verification and risk decisions using a single API. The moment a customer onboards, Alloy’s API is at work ensuring that customers are onboarded safely and securely and that they are who they say are, ensuring that financial institutions are compliant with all regulations. Alloy’s platform reduces fraud and burdens on back-office operations by automating risk management, decision making, and centralizing access to data sources.

AlleyWatch caught up with Cofounder and CRO Laura Spiekerman to learn more the inspiration for Alloy, the company’s experience working with its partners during the pandemic to power their digital transformations, and the company’s recent funding round

Who were your investors and how much did you raise?

Canapi Ventures led the $40M Series B with participation from Felicis Ventures and Avid Ventures, as well as existing investors Bessemer Venture Partners, Primary Venture Partners, and Eniac Ventures. Canapi Ventures partner Walker Forehand also joined the company’s Board of Directors.

Tell us about the product or service that Alloy offers.

Tell us about the product or service that Alloy offers.

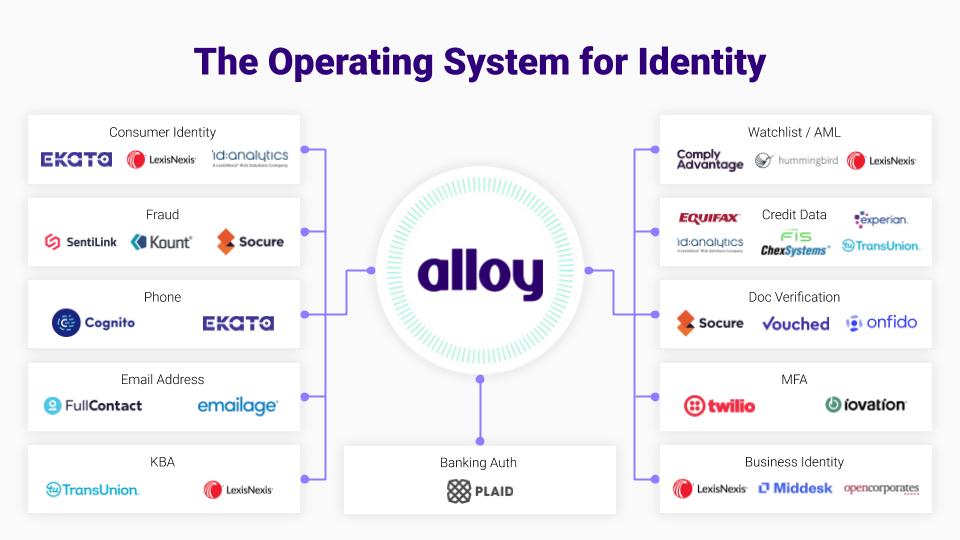

Alloy is an identity operating system that helps companies make better identity verification and risk decisions using a single API. From initial customer onboarding to ongoing transactions and events, Alloy enables you to make real-time decisions by leveraging multiple external and internal data sources, all while making your rules and configurations completely flexible and transparent.

Alloy makes it easy for financial services companies to quickly and safely onboard more customers, automating the vast majority of decisions, mitigating fraud and high-cost financial risk, and reducing burden on the back office and manual review queues.

What inspired the start of Alloy?

I was working with Tommy Nicholas, Charles Hearn, and Scott Clark at a payments startup and we were running into the same problem over and over. While trying to allow people to move money around, we often struggled with the fraud and ID verification stack. This is bad for both fintech companies and customers. We wanted to find a way to make sure users moving money are who they say they are, while also meeting regulatory requirements.

How is Alloy different?

Alloy is the first end-to-end identity core platform with access to a depth of data sources and products.

Generally speaking, the “build vs. buy” decision is our biggest competition in the market. However, the maintenance involved in even a well-built platform is significant: finding, testing, integrating, and standardizing new data sources, changing rules, and all the exhaustive compliance and audit work required. There’s also a limited ability to learn from others, benchmark across the industry, and benefit from larger-scaled models. Identity is not (and should not be) a strategic competency. Companies have systematically limited resources, which makes focusing on building a great product difficult. In-house builds rely on hard-coded data ingestion and decision logic that is hard to understand or change. They also lack the back-office automation/workflow efficiencies like auditable decision trail, reporting, and analytics.

What market does Alloy target and how big is it?

Our clients are digitally focused financial institutions and fintech companies, including neobanks, platform banks, rapidly scaling fintech companies, and more. Some of our clients include Radius Bank, Aspiration, Brex, and many more.

What’s your business model?

Our technology is an API and SaaS platform. We sell access to this platform on a subscription and variable fee basis, so we are aligned with our clients’ success as they onboard more and more users safely and seamlessly.

How has COVID-19 impacted the business?

We did take time to reevaluate things when the pandemic first hit. However, after some scenario planning in March, we were confident we had enough runway to weather the storm.

April and May ended up being strong months as consumers and small businesses were forced to migrate to digital channels and by early summer, the decision was made to raise another round.

Even prior to COVID-19, banks have been undergoing digital transformation, increasing the need for services that can help with identity and risk decisions. The growth has been compounded by the focus on digital account opening during the pandemic.

What was the funding process like?

We wanted to take advantage of the moment and the increased need for fast, reliable ways to digitally manage risk. Because of travel limitations, we wanted to move quickly, and we established a shortlist of six firms we knew shared our vision. The process lasted about two weeks.

What are the biggest challenges that you faced while raising capital?

Raising capital over Zoom is always a bit of a challenge, and bringing on partners who will be a part of your team for 5-10 years is no small decision!

What factors about your business led your investors to write the check?

Quote from Walker Forehand, partner at lead investor Canapi Ventures:

“Like all of our venture investments, it’s about the team, product and market. Tommy, Laura, and Charles are A+ operators and have created a platform that serves a clear need to help banks and fintechs manage risks as they expand their online activity. Several of Canapi’s bank limited partners, including one of the 20 largest banks in the US, are current Alloy customers and self-professed “raving fans” – the customer testimonials we heard during diligence were off the charts positive. And the market for onboarding, KYC, and fraud solutions is only exploding as digital channels have experienced decades worth of growth since March.”

What are the milestones you plan to achieve in the next six months?

Looking ahead, the focus for Alloy will be to go deeper, not wider. Essentially, the goal is to aid financial firms with any questions it may have about a client’s identity. We’ll continue to invest in our onboarding decisioning system, enhancing the product’s features and functionality, while rolling out newer products to help our clients offer secure, seamless transactions to their users.

Looking ahead, the focus for Alloy will be to go deeper, not wider. Essentially, the goal is to aid financial firms with any questions it may have about a client’s identity.

We’ll continue to invest in our onboarding decisioning system, enhancing the product’s features and functionality, while rolling out newer products to help our clients offer secure, seamless transactions to their users.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Just stay alive. There are so many near-death moments for many successful startups (even though they may not talk about them!) where the only way to get over the hump was just to stay afloat.

Where do you see the company going now over the near term?

First and foremost, we plan to scale up our sales and marketing teams to accommodate new demand. As part of our continued focus on serving our customers, we’ll bring new products to market-related to transaction and credit decisioning as well as document verification.