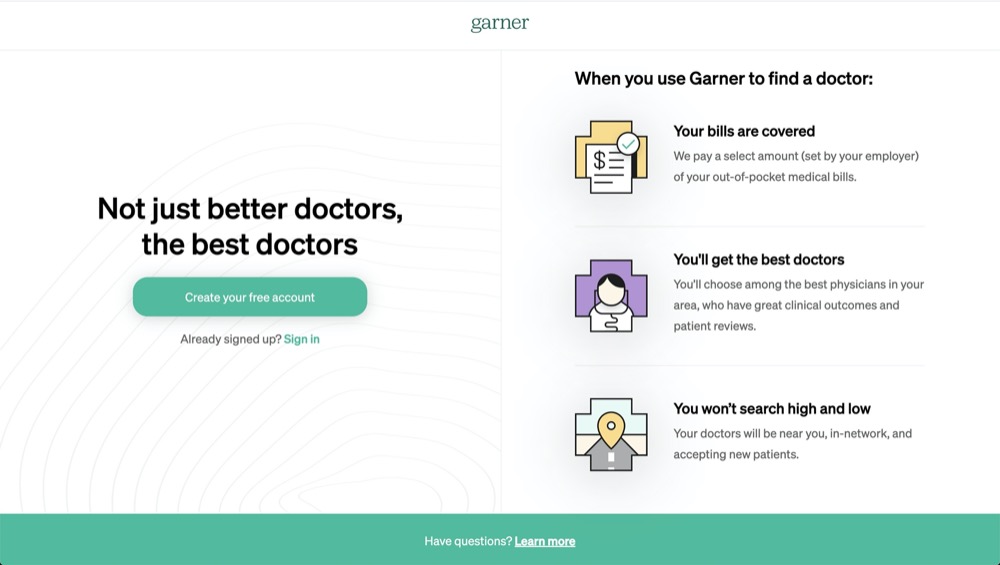

There’s been a growing movement towards outcome-based healthcare payments as we look to value-based care and providing the best care possible. This starts with selecting quality providers. Garner Health is a technology-driven platform that analyzes aggregate medical data to isolate the highest-performing physicians by specialty, procedure, and geography. Employees of companies that are partnered with Garner Health are able to access this curated selection, filtered for availability and network considerations for upcoming medical visits. The platform also features a concierge service available through phone, chat, or email to provide additional guidance on provider selection, if necessary. If the employee opts to use one of the recommended providers, then the employer covers all or a portion of any out-of-pocket expenses. The incentivization for employees, in the short term, to visit quality providers results in lower employer costs in the long-term, amounting to savings Garnder has estimated to be at least 10%. Garner does not maintain any commercial relationship with healthcare providers and its determinations are completely on the basis of past treatment data, eliminating any bias or undue influence in the recommendations.

AlleyWatch caught up with Founder and CEO Nick Reber (prev. Oscar Health and Bridgewater) to learn more about this innovative model to address rising healthcare costs, the company’s future plans, and latest round of funding, which brings the total funding raised to $17M.

Who were your investors and how much did you raise?

$12.5M Series A round led by Founders Fund, with support from Maverick Ventures and Thrive Capital.

Tell us about the product or service that Garner Health offers.

Tell us about the product or service that Garner Health offers.

Garner analyzes large amounts of medical insurance claims data to identify the highest-quality doctors in a user’s city or neighborhood. It then partners with local employers to guide their employees to the best doctors. The employer offers an incentive – if employees use Garner to choose their next doctor, then the employer will pay for the employees’ out-of-pocket costs. Since high-performing doctors keep patients healthy, these doctors are often lower-cost in the long run. By guiding employees to these high-quality doctors, Garner creates net cost-savings for employers and results in better and more affordable care for employees.

What inspired the start of Garner Health?

Garner Health was created based on my personal experience with the healthcare system. When I was experiencing back pain, I consulted a doctor that recommended a procedure, which then snowballed into multiple unnecessary operations. It was only after immense research that I saw the massive discrepancies in care (and ultimately their recoveries!) among patients with the same exact symptoms, but different doctors. I knew there had to be a better way to find effective care, which inspired me to found Garner.

How is Garner Health different?

Right now, there is no other company doing what Garner is doing. There are certainly other health tech platforms trying to tackle specific areas of health insurance or healthcare, but no other one specifically integrated as an employee benefit and resource. Garner is also unique in that it has no financial relationship with healthcare providers. Doctors cannot pay Garner to receive higher placement in Garner’s rankings, so the options that patients see are unbiased and transparent. All healthcare provider recommendations are based on cost and quality analytics derived from hard data.

What market does Garner Health target and how big is it?

Rising healthcare costs are an increasing issue for American industry. Businesses in the U.S. pay almost three times more than employers in similar countries do for healthcare benefits.

What’s your business model?

Garner believes that, for too long, individual doctor performance has been overlooked in the healthcare system. Americans shouldn’t have to pay hundreds of dollars in deductible costs for care that is profitable for hospitals to give, but that creates worse health outcomes for patients. Garner’s technology-enabled platform works to address this problem, paving the way for better healthcare experiences for employers and employees. The results? The employee saves money and receives the best treatment, and the employer avoids paying for ineffective care.

How has COVID-19 impacted the business?

As you can imagine, healthcare utilization was generally down in 2020 as many folks decided to forgo or defer care due to COVID-19. However, for those that still needed to seek care, finding the best and most efficient doctors were more important than ever. Since Garner is a specific solution that works directly with employers and employees to help them find the best care, not having the typical face-to-face interaction with clients was challenging but Garner embraced the virtual customer experience and continued to deliver a much-needed resource for its members.

What was the funding process like? What are the biggest challenges that you faced while raising capital?

The funding process for Garner’s Series A was entirely virtual. One positive of virtual fundraising was the ability to simply have more meetings—no travel time needed! The Series A process felt very different from Garner’s Seed round, during which Garner was able to meet each of their investors in person, at their offices or over coffee, with more time and space to get to know each other in-person.

The funding process for Garner’s Series A was entirely virtual. One positive of virtual fundraising was the ability to simply have more meetings—no travel time needed! The Series A process felt very different from Garner’s Seed round, during which Garner was able to meet each of their investors in person, at their offices or over coffee, with more time and space to get to know each other in-person.

What factors about your business led your investors to write the check?

One factor that really sets Garner apart to investors is its overall business model. What Garner is doing isn’t health insurance, so they have the flexibility to create incentives for individuals to choose the highest-quality doctors. Therefore, Garner can layer on top of a proper insurance plan, serving as both an employee benefit and essential health resource.

What are the milestones you plan to achieve in the next six months? Where do you see the company going now over the near term?

Garner is actively hiring and will be focused on bringing on the best people for roles across product, engineering, customer experience, and more. The company hopes to bring on an additional 8-10 team members by the end of 2021.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Don’t forget to check-in with old friends and acquaintances you might have missed since COVID has started. Catch up and where possible find a way to add value to them. A lot of our best advisors and investors came from friends I reached out to in the past year.

What’s your favorite outdoor dining restaurant in NYC?

Emmett’s Pizza in Soho.