According to a recent AARP study, $28.3B is lost to elder fraud scams annually and the FBI reports that there were just shy of 100,000 adults that were considered older victims of fraud in 2021. Thieves target this segment not only because of the vast assets that they have accumulated but also because many of these older adults leave themselves vulnerable for various reasons. Carefull is a tech solution provider that works with financial institutions to protect the financial health of older adults. The technology actively monitors all customer accounts, tracking over 50 behavior and financial red flags often associated with fraud, to ensure that there is no financial exploitation taking place, whether by a stranger or even a family member; this is critical given that 72% of fraud is committed by someone known to the victim. Carefull also includes $1M in identity theft insurance, a password vault, and a contact system that provides controlled access to family caregivers and trustees. For financial institutions who purchase access to the service and provide to their clients for free, the platform provides the opportunity to foster relationships with the next generation of family members as assets are transferred from aging parents to their adult children; this transition is estimated to be quite sizable – $84T.

AlleyWatch caught up with Carefull Cofounders and Co-CEOs Todd Rovak and Max Goldman to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding raised to $19.7M, and much, much more…

Who were your investors and how much did you raise?

Carefull has just closed its Series A round with $16.5M in funding. The round was led by Fin Capital and joined by Bessemer Venture Partners, TTV Capital, Commerce Ventures, Montage Ventures, and Alloy Labs.

Tell us about the product or service that Carefull offers.

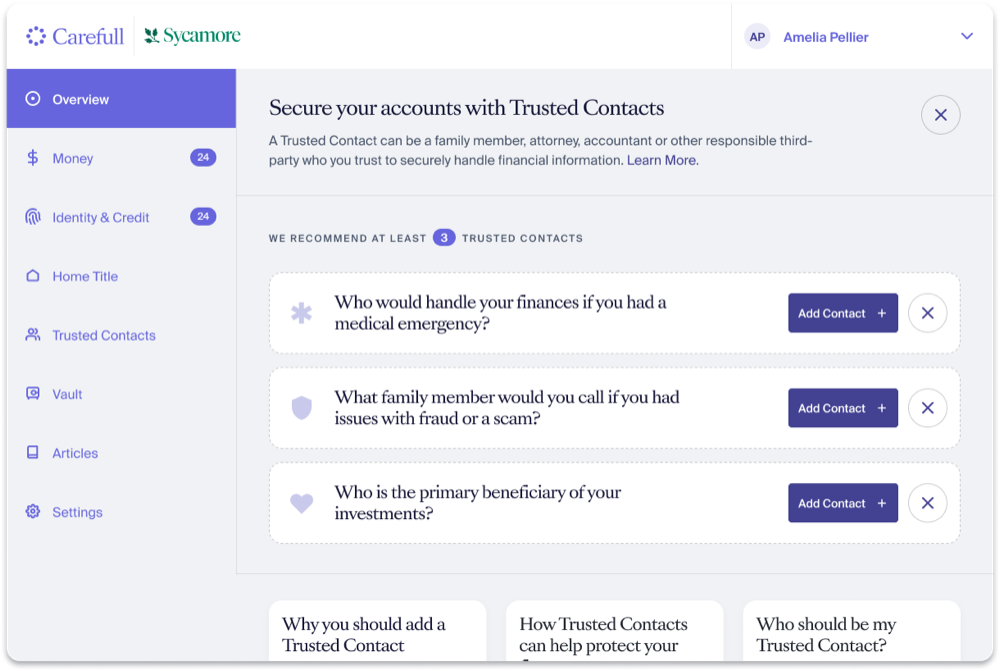

Carefull is the financial ecosystem’s first Protect-Retain-Transfer (PRT) provider: a tech solution that enables banks, financial advisors, and insurers to protect older adults – their most valuable and vulnerable customers – from outside threats and even their own money mistakes, while the institution retains their assets and deposits for longer and builds relationships with next-generation family members ahead of wealth transfer. Carefull actively scans all customer account types for over 50 financial and behavioral issues unique to aging, catching unusual activity, suspicious patterns, and even bigger problems like financial exploitation by a loved one or signs of cognitive decline. The platform also integrates identity, credit and home title monitoring; $1M in identity theft insurance; a password and document vault; and a smarter Trusted Contacts system for banks to gain “share of family” in addition to share of wallet.

Carefull is provided by a financial institution to its customers, either directly to older adults or to the next generation of “financial caregiver” customers who are tasked with managing finances for their aging parents. Currently, 45 million Americans are involved in coordinating an elderly relative’s finances, and seniors lose $37B annually in fraud and money mistakes. Financial institutions are actively seeking out ways to cultivate relationships with their next generation of customers, and helping caregivers to manage their loved one’s accounts provides value for all parties involved.

What inspired the start of Carefull?

We have been friends for over 15 years, had independently sold our last companies, and wanted to collaborate on our next venture. After creating a number of products – from HR software to vending – we wanted to do something that could help with a complex problem faced by just about every family on the planet.

We recognized that, today, the bulk of financial innovation and investment is directed to solve the patterns and problems of Millennials and Gen Z. Aging is typically considered to be a healthcare or housing issue, yet it is rife with underserved financial needs: from the $37B annual elder fraud and financial exploitation to the 45 million desperate adult “financial caregivers” who have been pulled into helping with their aging parents’ finances. With the FBI estimating an 80% rise in elder fraud from 2021-2022, $84T of wealth transfer already underway, and 9 out of 10 people forgoing their parents’ financial institution, there were simply too many pain points and ecosystem inefficiencies to ignore. Banks and wealth managers needed technology to better protect and connect with their older families.

How is Carefull different?

There hasn’t yet been a breakthrough solution for supporting aging adult finances, yet with $84T of wealth transfer now moving between generations, it is a massive market with systemic implications for the largest banks, wealth managers, and insurers. To date, financial technologies directed at older adults have been either repositioned commodities like credit-monitoring, or specific point solutions. Carefull’s platform approach supports customers aged 55+ and their caregivers through the decades-long transition from full financial independence to needing assistance with their finances to next-generation wealth transfer.

Carefull’s value proposition for enterprise partners like banks, wealth platforms, and insurers is twofold:

- Deposit Retention: Carefull’s PRT (Protect-Retain-Transfer) platform locks down low-cost deposits; one bank saw a 10x reduction in the customer attrition rate in Carefull users vs. the general customer population.

- Protection/Elder Fraud: Rather than treating elder fraud as a set of disconnected incidents, Carefull finally provides the C-suite with a SaaS solution across the organization, both for customer education and self-prevention as well as early issue identification and resolution. The result is reduced fraud write-downs, reduced resolution expense, and fewer lost customers.

What market does Carefull target and how big is it?

Currently, 45 million Americans are involved in coordinating an elderly relative’s finances, and seniors lose $37B annually in fraud and money mistakes. There is 84 trillion of wealth transfer already in motion, and 5000 banks and credit unions with a disproportionate amount of older adults who are at risk of losing these assets, since 9 out of 10 younger adults don’t use their parents’ financial institution.

What’s your business model?

Carefull is a B2B2C product. We sell to banks, wealth advisors, and insurers, who in turn give their clients a free Carefull membership. Over the past year, we have rapidly expanded our footprint to include more than 35 financial institutions and advisor groups. The Cooperative Bank in Roslindale, Massachusetts recently won a 2023 Community Commitment Award from the American Bankers Association for its use of Carefull to protect older Americans from fraud and unusual account activity. As of Q3 2023, Carefull has been shown to reduce customer account churn and attrition by as much as 10x in partner banks, and has generated as many as 60 new leads per wealth advisor.

Carefull is a B2B2C product. We sell to banks, wealth advisors, and insurers, who in turn give their clients a free Carefull membership. As of Q3 2023, Carefull has been shown to reduce customer account churn and attrition by as much as 10x in partner banks, and has generated as many as 60 new leads per wealth advisor.

How are you preparing for a potential economic slowdown?

We plan to use the capital to scale onboarding and support for new partners, enhance R&D efforts aimed at protecting older adults, and build capacity to meet new state regulations that require more protections for aging Americans.

What was the funding process like?

We were lucky to have a great set of engaged insiders coming along for the next step, plus we found a great fit with fintech-specific experts like Fin Capital, TTV Capital, and Commerce Ventures. It’s not an easy market, but engaging primarily with those investors who know and understand our channel made for a relatively smooth process.

What are the biggest challenges that you faced while raising capital?

Lots of great generalist investors had interest, but we had to be somewhat disciplined around engaging those who knew what we were building and how to get it to market. So much of fundraising is about managing your time, and trying to limit the distraction so you can stay focused on customers.

Lots of great generalist investors had interest, but we had to be somewhat disciplined around engaging those who knew what we were building and how to get it to market. So much of fundraising is about managing your time, and trying to limit the distraction so you can stay focused on customers.

What factors about your business led your investors to write the check?

There were a number of factors that gave our investors confidence in where Carefull is headed: the overall market opportunity, our ability to attract and retain financial institutions and wealth advisors as partners, and the core IP underlying a differentiated product offering. There’s a lot we can build on top of this.

What are the milestones you plan to achieve in the next six months?

As Carefull grows, we anticipate that we will double our headcount to reach ~50 employees in twelve months. The next six to twelve months are about focus and scale; we will continue to forge new partnerships with banks, wealth advisors, and insurers, and enhance the Carefull IP through R&D efforts.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Run lean until you have fit. It’s ok to be bad at some things (in our case, GTM) until you’re sure you have something that customers love. Being good at everything too early is expensive, and it’s a fast way to run out of cash.

Where do you see the company going now over the near term?

We’re focused on growth and scale over the next year, and have plans to increase our headcount, add new partners, and enhance our product through research and development.