Theodore Roosevelt said, “In any moment of decision, the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing.”

Venture investment volume, deal flow, and valuations are down sharply this year. For the first time in a generation of startups, founders of perfectly good companies must decide whether to keep going, look for an M&A deal, or simply cut their losses.

If you are a founder facing such uncertainty, I feel for you. It is the most difficult and emotionally charged decision that many of you will ever have to make. But when faced with such a decision, you cannot freeze and “wait for something to happen.” Trust me, it won’t. You must be the architect of your own destiny and decide exactly where you want to go. And you must take fast, decisive action to get there. I cannot stress this enough. The greatest weapon in your arsenal in a situation like this is motion.

But where do you even start? Here is how I am advising my portfolio companies:

1. Take a hard look at yourself in the mirror.

If you have not done so already, you should sit down with your co-founders and advisors today, and take stock of your organization’s position, prospects, and challenges. It is not always easy to see the answers from the inside, so having advisors who will tell you the ugly truth is crucial. I urge you not only to be open to criticism, but to actively solicit it.

Are you on track to meet your milestones? Does your target market know you exist? Does it desperately need what you are offering? Will your current investors support you through your next round of funding? Will you be left with enough of a stake to motivate you for the future? Or would M&A be your best move at this time? If so, how do you even go about that?

2. Raise less money than you planned to.

If you do need to raise money now, you should consider raising a smaller amount than you might otherwise have been inclined to. Median Q2 2023 valuations for tech startups fell sharply across the board from Q2 2022, down 29% (Series A), 30% (Series B), 48% (Series C), and 60% (Series D). Amidst this tidal wave of down rounds, the market consensus is that “flat is the new up.”

With funding in scarce supply, it is tempting for founders to take whatever valuation they need to in order to keep the lights on. Some existing investors may even encourage that, seeing dilution as a favorable alternative to going out of business. The problem is—if your ownership stake becomes significantly devalued, it might be hard for you to maintain the motivation you need to go the distance. It’s a deal with the devil.

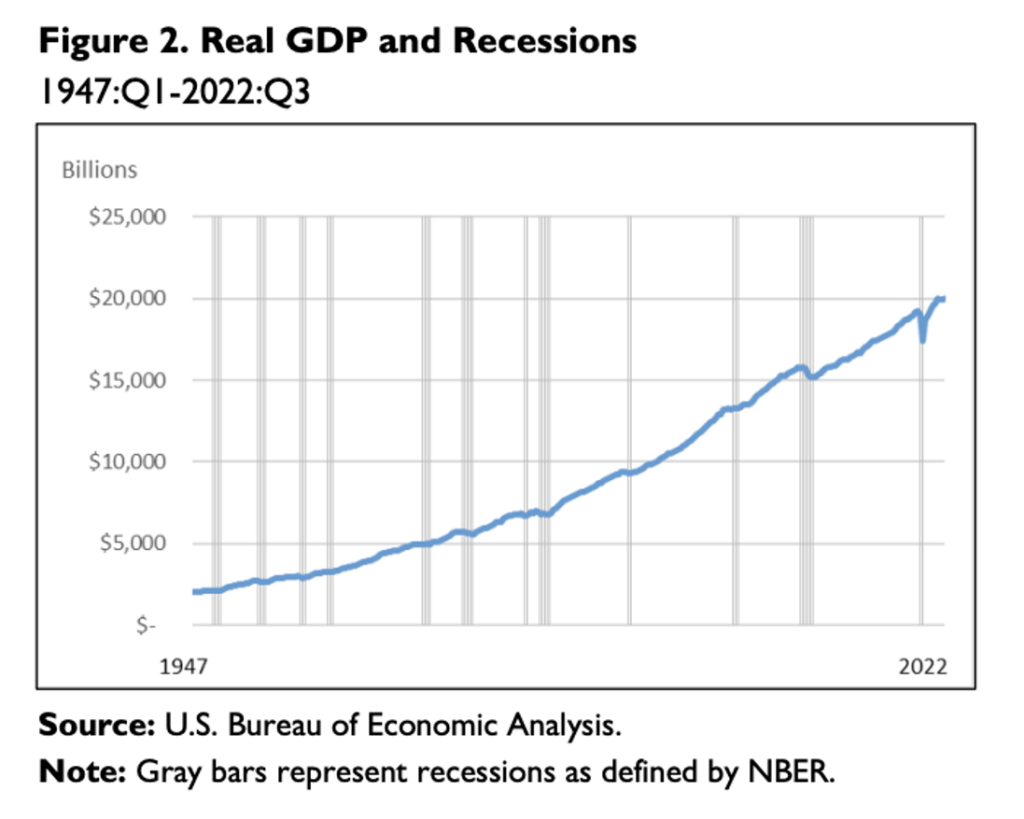

Instead, I am encouraging some of my portfolio companies to ask for the minimum funding that they need to move the ball down the field. From 1945 through 2019, the average length of a recession was 11 months. Although the US economy hasn’t entered a recession and history is no guarantee of the future, I believe that this cycle will last 12-18 months. Plan for that period of time, and no more.

3. Slow down your burn rate.

Even if you have successfully raised money recently, you probably need to slow your spend. This is a very case-specific decision, of course. Some of my portfolio companies have stripped down to a skeleton crew, or even just the founders. Others have instituted a temporary hiring freeze. Still others, flush with cash and experiencing strong revenue growth, have increased their spending to take advantage of momentum in their markets (and the troubles of their competitors).

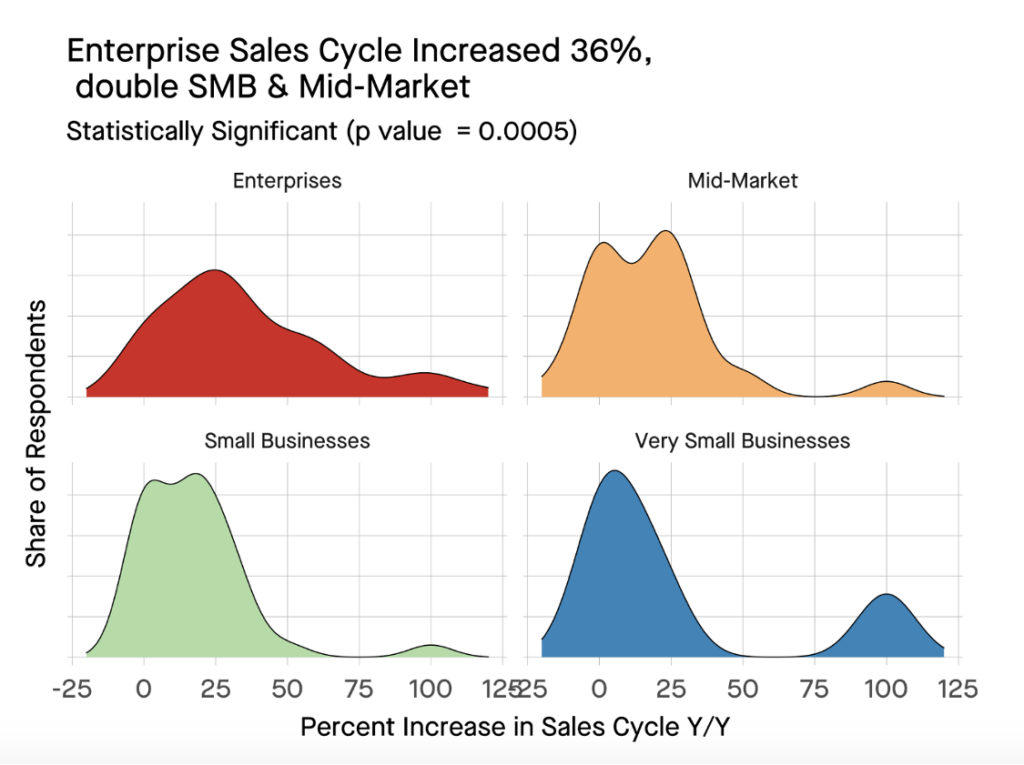

By and large, however, thrift is your friend today. The average lead time for technology sales increased by 24% from 2022 to 2023. Sales cycles for big-ticket enterprise deals increased by as much as 50%. You can’t use last year’s cash flow metrics to calculate your runway anymore. For most early-stage startups—even those who have hit all their milestones—it’s a good idea to safeguard your valuation in the next round by making your cash last. Time is quite literally money on this one.

4. Take decisive action—no matter your destination.

Have you really achieved product-market fit? Have you hit your product development, sales, and revenue milestones? Are your key players performing? Where are the weak links in your organization?

If you are running out of cash, it probably isn’t practical to completely revamp your product. But you could alter your go-to-market strategy, retire failing products or features, change senior team roles (even the CEO), cut founder salaries, or start to wind down the company.

At the end of the day, it is your company, it is your destiny to design, and you must decide what action to take. Whether that turns out to be staying the course or looking for an off ramp, you have plenty of work to do. The sooner you take stock and take action, the better your chances are of getting to where you are going.

Remember, just as Teddy Roosevelt said, “the worst thing you can do… is nothing.”