Primary care is the foundation of the healthcare system accounting for 50% of outpatient visits. Yet, spending on primary care only accounts for 5-7% of total medical spending in the US. With such demand and tight margins, primary care physicians are asked to do more with less time as declining primary care capacity is leading to 85 deaths per day. Pearl Health is a platform designed for primary care providers that uses data science to optimize a physician’s time to ensure they are taking care of the patients that need it the most at the right time. The platform offers visualizations to give providers a holistic view of their patients as well as each patient’s history. By taking a proactive approach to patient management, providers are able to provide better care at a lower cost while ensuring they are building sustainable practices. It’s been predicted that the US is expected to have a significant shortage of primary care providers by 2032 and healthcare technologies like Pearl Health combined with Medicare reform will be the determinants of attracting new providers and retaining existing ones to avoid the healthcare system from hitting a breaking point.

AlleyWatch caught up with Pearl Health Cofounder and CEO Michael Kopko to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total equity funding raised to $75.5M, and much, much more…

Who were your investors and how much did you raise?

Pearl Health has raised $75M in an oversubscribed Series B funding round, led by Andreessen Horowitz’s Growth Fund and Viking Global Investors, with participation by AlleyCorp, SV Angel’s Growth Fund, and other leading investors. The round is comprised of $55M in equity capital and an anticipated $20M in a line of credit, and brings Pearl’s total funding to date to more than $100M.

Tell us about the product or service that Pearl Health offers.

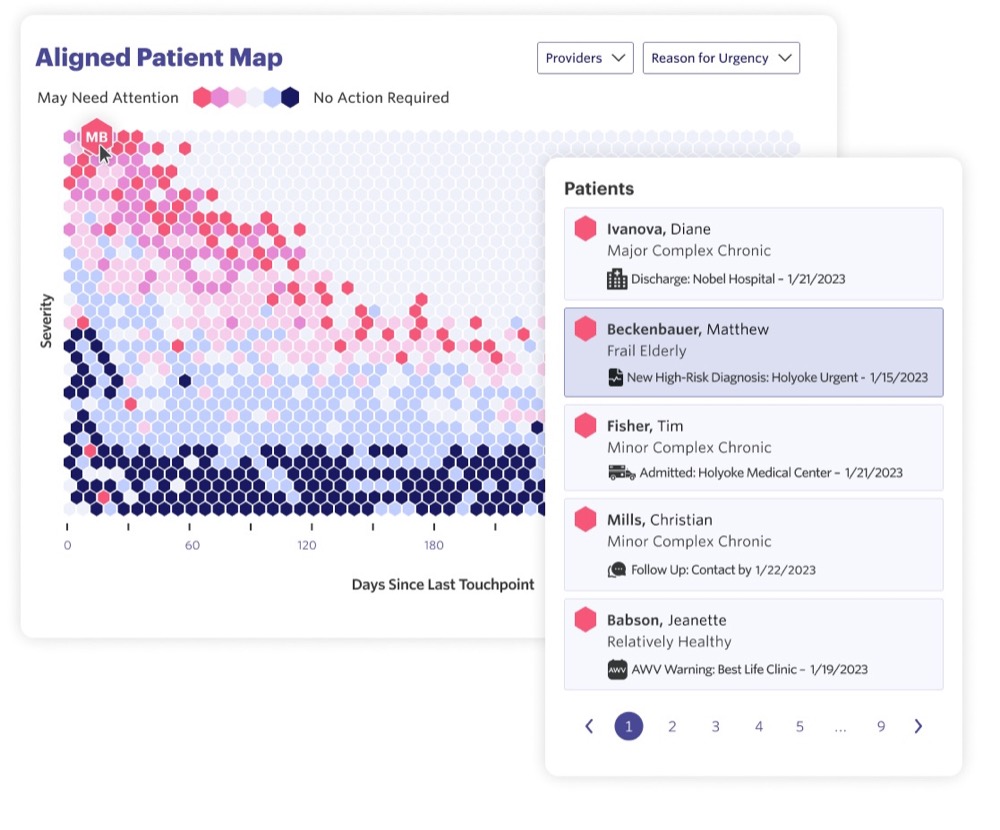

Pearl Health uses data science and workflow optimization technology to help primary care providers focus their attention on the patients who are most likely to need it, enabling physicians and clinical staff to provide proactive, personalized treatments and invest in preventative care.

What inspired the start of Pearl Health?

We have always seen primary care as an under-appreciated and under-equipped asset in great healthcare delivery. As our population demographics shift toward more Medicare enrollment and rising medical costs, our founders and early team knew we were at an inflection point of healthcare sustainability and access. The opportunity to bring a renaissance to primary care and through true technology enablement and contribute to more affordable Medicare and better health outcomes for our seniors has been meaningful work from day one.

We have always seen primary care as an under-appreciated and under-equipped asset in great healthcare delivery. As our population demographics shift toward more Medicare enrollment and rising medical costs, our founders and early team knew we were at an inflection point of healthcare sustainability and access. The opportunity to bring a renaissance to primary care and through true technology enablement and contribute to more affordable Medicare and better health outcomes for our seniors has been meaningful work from day one.

How is Pearl Health different?

Pearl is helping providers transform the way they provide care for their patients. We enable a transition from a reactive, volume-oriented care model, where providers are focused on who is in their waiting room and seeing how many visits they can squeeze into a day, to a model where they can take a step back and strategically allocate their time to the patients who need it most — often, these are the patients who haven’t set up an appointment and aren’t in the waiting room.

We think of this as a shift toward proactive panel management, and our job is to make that transition as easy as possible, distilling data from across the healthcare system to what is most important for providers to effectively manage healthcare risk and care delivery across their patient panels.

Our approach differs from other value-based care and physician enablement companies in some critical ways.

- Many companies are purportedly in value-based care but still predominantly focus on enabling providers within the fee-for-service payment system, which aligns revenue for the practice with the volume of services provided. We believe that the deeply entrenched fee-for-service model inherently misaligns incentives, which has profound consequences on both health outcomes and cost of care in our healthcare system. Pearl enables providers to transition away from fee-for-service and align incentives with keeping patients healthy.

- Our partnership model is not fee-based. Rather, it is based on shared risk and outcomes: we succeed when providers succeed, and providers succeed when they are providing more proactive, holistic patient care.

- In contrast to the flurry of acquisitions of physician practices by health systems, PE groups, and other physician enablement companies, at Pearl Health, we aren’t seeking to have greater control over practices. Instead, we give them greater access to economics that are more in line with the value they create for the healthcare industry and enable them to take advantage of that opportunity.

- The enablement we provide is not simply sending them more staffing resources. We take a technology-first approach, enabling them with data and insights that help them to truly transform the way they provide care.

What market does Pearl Health target and how big is it?

Pearl enables primary care providers across the US to serve elderly patients in a better way. We started in traditional Medicare, which currently serves approximately 30 million Americans. The Centers for Medicare and Medicaid Services has set a goal that 100% of people with traditional Medicare will be part of an accountable care relationship, invested in value-based care programs like what Pearl enables, by 2030.

While we started with traditional Medicare, we will increasingly be working to expand partnerships with forward-thinking Medicare Advantage plans, so our provider partners can treat all seniors in a proactive, data-driven way. And be rewarded for it.

According to US Census Bureau data and projections, people age 65 and older represented 16% of the population in the year 2019 but are expected to grow to be 21.6% of the population by 2040; the 85 and older population is expected to more than double from 6.6 million in 2019 to 14.4 million in 2040. This demographic shift makes the impact that Pearl could potentially make on our healthcare system greater and greater in the decades ahead.

What’s your business model?

Our business model will naturally become increasingly diversified as we continue to evolve our product offerings and expand into new lines of business, with the ultimate goal of converting the entire patient panel of our primary care partners to value.

How are you preparing for a potential economic slowdown?

We serve primary care organizations that provide care for patients with Medicare. The US population is aging and the Medicare trust fund is on the verge of financial insolvency, which means that an already overstretched system is reaching a financial breaking point. Pearl is at the forefront of creating a system to alleviate that strain and we believe these demographics and market pressures will supersede a potential economic slowdown in other sectors.

With that context in mind, we would be remiss not to acknowledge the effects that market volatility can have on all businesses. We have always had a focus on capital efficiency at Pearl, and we believe our responsible financial stewardship has been one of the factors that has contributed to both our success in securing funding from such esteemed investors and our execution as a rapidly scaling business. Having a consistent ethos of efficient capital management positions us to both operate more nimbly and be better prepared for difficult economic conditions when they arise.

With that context in mind, we would be remiss not to acknowledge the effects that market volatility can have on all businesses. We have always had a focus on capital efficiency at Pearl, and we believe our responsible financial stewardship has been one of the factors that has contributed to both our success in securing funding from such esteemed investors and our execution as a rapidly scaling business. Having a consistent ethos of efficient capital management positions us to both operate more nimbly and be better prepared for difficult economic conditions when they arise.

Part of efficient capital management is responsibly scaling as a company. While we’re currently hiring across functions — including engineering, product, sales, marketing, customer success, and finance — we believe that operating in a lean way gives us greater agility as a business. At Pearl, we believe that our team — and above all, our culture — will be the ultimate reason for our success or failure. As we enter the next phase of growth, we’re very mindful of building the right team and culture to meet the moment.

What was the funding process like?

While it was of course important to raise sufficient capital to empower us to achieve our next set of milestones — it was equally critical to have investors who were aligned with our vision for the company, whose judgment we valued, and whom we believed would be the best advisors and partners to us over the long term.

Ultimately, this was a mutually evaluative process through which we had many conversations with current and potential investors, educating them on our mission, strategy, team, and our thesis on the space as a whole. Now that we’re on the other side of this process, we feel confident that our investors are the best partners for Pearl as we enter the next phase of our growth.

What are the biggest challenges that you faced while raising capital?

Our Series B raise coincided with some of the most difficult market conditions in years for accessing venture capital. We were fortunate to have a business model that was isolated from many of the macro trends occurring presently. At the same time, we recognize that the managerial best practices around lean, deliberate growth were critical in establishing our investors’ trust in our leadership. We feel extremely fortunate to have had such a successful raise and are humbled by the caliber of our investors.

What factors about your business led your investors to write the check?

Here are some quotes from our investors that provide insight into what excites them about Pearl Health and our technology:

“Pearl Health arms providers with data insights and superpowers to help them manage the health of an entire patient panel,” said Vineeta Agarwala, Andreessen Horowitz General Partner, Bio + Health, and Board Director for Pearl Health. “We believe this technology should enable providers across the country to be at the forefront of our healthcare industry’s transformation towards value, achieving improved outcomes and lower total cost of care.”

“Pearl Health has done a great job of developing software to help providers achieve their goals around value-based care,” said Scott Kupor, Managing Partner at Andreessen Horowitz, who recently joined Pearl Health’s Board of Directors. “This new round of funding will help them significantly expand their market presence and bring their solution to a much wider audience.”

“Patients deserve medicine aligned with their true needs,” said Pearl Cofounder and Executive Chairman Jeffrey De Flavio, MD. “Pearl’s physicians have the tools to deliver more effective and compassionate care.”

“We are proud to support companies like Pearl Health that have the potential to drive positive change and disruption in their industries,” said AlleyCorp Founder and CEO Kevin Ryan. “We are excited to see the impact that Pearl Health will have on patient outcomes and are proud to be a part of their growth since day one.”

What are the milestones you plan to achieve in the next six months?

Over the past year, more than 800 primary care providers across the country partnered with Pearl to align payments with patient health and leverage emerging data and technology to achieve better outcomes more efficiently. Over the next six months, we’ll continue to expand our network of enabled providers who can cooperate in risk-based arrangements.

Over the past year, more than 800 primary care providers across the country partnered with Pearl to align payments with patient health and leverage emerging data and technology to achieve better outcomes more efficiently. Over the next six months, we’ll continue to expand our network of enabled providers who can cooperate in risk-based arrangements.

We’ll also continue to make long-term investments in our technology and services, including improvements to the algorithm that surfaces insights within the Pearl Platform, new sources of data to continue to provide a more nuanced understanding of individual patient care journeys, and pilot partnerships that will help facilitate more holistic care coordination.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

We feel blessed and humbled to be in the position we are given the tough broader climate we are all building in. We share insights in the hope they help fellow entrepreneurs but not in any way to suggest we know better than others or are better than them.

- Having a clear thesis and value add that is increasingly measurable on a shorter time cycle is critical in this new macro environment.

- Operating with a lean methodology that ensures core milestones are achieved and key metrics around LTV/CAC and future profitability align with investor expectations is critical.

- De-emphasizing large raises and huge valuations and focusing on core proof points and excellent execution are critical.

- Enjoying important work with colleagues that you value and bringing optimism grounded in reality is more critical than ever.

For entrepreneurs just starting, I encourage you to enjoy the experience and be ready to put in the hard work. Entrepreneurship can be found in many places, so don’t create a false idol of what successful entrepreneurship looks like. It’s rarely what you read in the news, and it’s never the same thing twice.

What’s your favorite restaurant in the city?

Bellini (Italian) or Rosa Mexicano (huge fan of Mexican food!).