The popularity of socially responsible investments continues to grow. Between 2018 and 2020, sustainably invested assets under management grew to $17.1T, up 42%. This accounts for nearly 1/3 of US assets under professional management. Ethic is an asset management platform that lets advisors build socially conscious investment portfolios. The platform lets these wealth advisors purchase indexes and efficiently tailor them by opting out of individual investments that may not be suited to the client’s preferences based on 19 societal issues like women’s rights and racial justice. The number of assets on Ethic has grown 10x since 2019 and the company now is helping wealth managers manage $760M in assets.

AlleyWatch caught up with CEO and Cofounder Doug Scott to learn more about the red-hot environmental, social, and governance (ESG) market, the company’s future plans, and latest round of funding, which brings the total funding raised to $48.8M.

Who were your investors and how much did you raise?

We raised $29M in Series B funding from leading venture investors focused on a mix of institutional finance, fintech and impact investing. The round was led by Oak HC/FT, with participation from existing investors including Fidelity Investments, Nyca Partners, Sound Ventures, ThirdStream Partners, Urban Innovation Fund, and Kapor Capital.

Tell us about the product or service that Ethic offers.

Ethic is a tech-driven asset management platform that builds personalized, sustainable investment portfolios. We work with wealth advisors, enabling them to customize a given index in line with a client’s investment, values, and tax management preferences—all while seeking to minimize tracking error against the underlying benchmark.

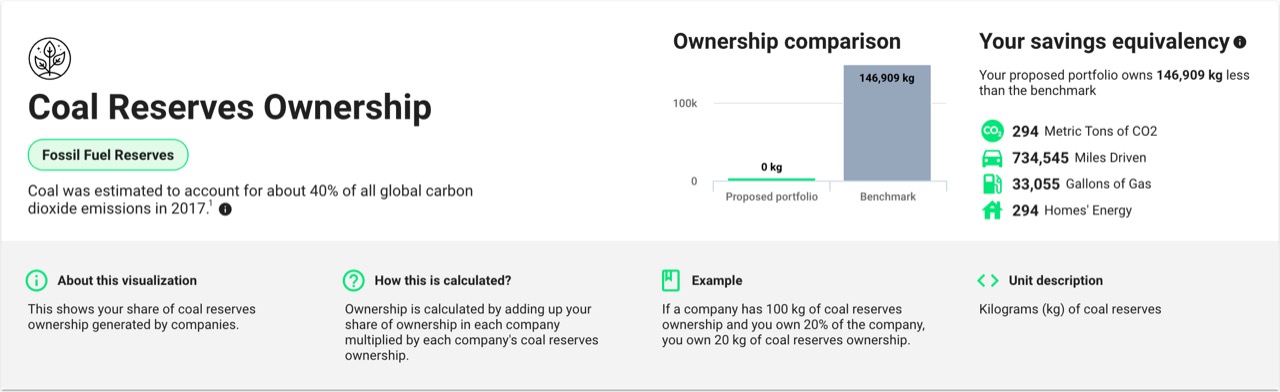

Our vast array of educational tools, as well as our impact reporting feature, provides advisors and their clients with greater insight as to how their portfolios are affecting the issues they care about most. Climate change, women’s rights, and racial justice are currently popular focus areas; however, we cover 19 separate but closely interlinked environmental, social, and governance issues.

What inspired the start of Ethic?

Our founding team is connected by a common desire to channel our skills, which span institutional finance and technology, to maximize their positive impact in the world. The inspiration for Ethic came through the realization that our experiences from leading financial institutions, including Deutsche Bank and JPMorgan, could be used to help address the defining issues of our time.

We employ a lot of design thinking in our platform, and from the get-go have been focused on building a solution that people actually want to use. Working in larger financial institutions, we were often struck by how far removed the product/ development team were from the very people that were actually using their technology. At Ethic, our client relationship and product teams work closely in tandem— in fact, members of our product team regularly join client calls. This means they are highly attuned to the needs of our client base, which in turn translates to exceptional user experience.

We also have a lot of fun working together, and see ourselves as one big family with a shared commitment to tackling some of the world’s most pressing issues: from climate change to racial injustice, and beyond. We were recently recognized by InvestmentNews for our commitment to diversity and inclusion, and were named by American Banker/ Financial Planning as a Best Place to Work in Fintech.

What market does Ethic target and how big is it?

We partner with financial intermediaries, which include wealth managers, family offices, private banks, and independent financial advisors, as well as advisor networks/ turnkey asset management platforms (TAMPs). The market for financial advice has been growing in recent years, and that trend is only set to accelerate as the so-called “Great Wealth Transfer” gets underway. Estimates vary, but some projections suggest that as much as $70 trillion could be passed down from Baby Boomers to their beneficiaries in the coming two to three decades.

For advisors, however, this means increased competition at a time when they’re already up against significant fee compression and industry disruption. In order to adapt and differentiate, advisors are well served by augmenting their human offering with digital solutions that meet the growing demand for personalization and values-aligned investing. That’s where Ethic is able to help—and we continue to receive great feedback from our advisor clients that indicates our offering has really enabled them to connect with clients in a more meaningful way.

What’s your business model?

As a tech-driven asset manager, we charge our clients a fee to manage their assets.

How has COVID-19 impacted your business?

The COVID-19 pandemic, and related crises, has actually heightened investor and advisor awareness for how their portfolios affect various sustainability issues—e.g., deforestation, racial justice, and health and wellness. To that end, we’ve experienced tremendous demand for our sustainable investing solutions, which saw us increase the number of assets on our platform by over 10x since its prior round of funding in 2019.

What was the funding process like?

Our belief is that a successful funding process is centered on finding backers that (i) share our vision of a personalized future for asset and wealth management, and (ii) support our mission to accelerate the transition to sustainable investing. Through the funding process, we were extremely impressed with Oak HC/FT, a $3.3B women-founded venture fund with a focus on investing in the future of financial services. In particular, Oak HC/FT Partner Dan Petrozzo, former head of investment management technology at Goldman Sachs, demonstrated a deep understanding of our market, positioning, and solution. We are delighted to be welcoming Oak HC/FT into the Ethic family.

In addition to our lead, we were also in the fortunate position to have a very supportive existing investor base, many of whom upped their investment in Ethic.

What are the biggest challenges that you faced while raising capital?

The primary challenge entrepreneurs typically face when raising capital is to find the right balance between focusing attention on scaling a fast-growing business, and dedicating time to securing the right capital from the right sources to continue to support this growth. The key to successfully navigating this is to assemble the right team and foster a culture of empowerment. We’re so proud of our team and the broader culture, and we were able to very successfully navigate this balance.

What factors about your business led your investors to write the check?

In part, they were encouraged by our meteoric growth—we’ve grown assets on our platform tenfold since our Series A raise in 2019. They also recognize that the technology we’ve built enables true personalization at scale.

What are the milestones you plan to achieve in the next six months?

We have some really exciting partnerships in the pipeline that we look forward to sharing in due course. We are also planning to expand our team, adding more top-tier technology, investment, and client relationship talent that will support the company’s already rapid growth.

On the platform side, we will continue to add more features that help investors to understand and define their values, gain transparency into their current portfolio, and engage with the real-world impact their investments are having.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

One of our company principles is to actively seek opportunities to add value to those around you. We adopted this principle since the inception of the company, and has been key to helping us build a strong community of supporters.

Where do you see the company going now over the near term?

We continue to be focused on delivering our advisor clients a best-in-class experience, both on-platform and off-platform. Ultimately, we feel that we are uniquely positioned to help power the transition to investment personalization across all intermediaries.

What’s your favorite outdoor dining restaurant in NYC

As an Aussie, I’m a big fan of Two Hands in Tribeca. If you’re around the neighborhood, you will likely see me there regularly drinking a flat white coffee.