We’d all like to be able to look into a crystal ball and tell the future. With the use of AI and machine intelligence, we are now able to more accurately produce trend forecasts that accurately mimic reality. NWO.ai takes this one step further. The platform combs through unstructured data to track 20M+ signals, adds a time dimension, eliminates noise, and prioritizes sources to identify microtrends and global cultural shifts. For example, the platform has recently considered and tracked possible geopolitical events and themes like will COVID-19 lead to war, will Bitcoin continue to rise, and the impact of the pandemic on Big Tobacco. The platform is already being used by several Fortune 500 companies across various industries to navigate these uncertain times.

AlleyWatch caught up with Cofounders Sourav Goswami and Pulkit Jaiswal to learn more about the company’s recent launch out of stealth, future plans, and recent round of funding.

Who were your investors and how much did you raise?

We raised $3.5M in a seed round co-led by Hyperplane, Wavemaker, and Colle Capital with participation from Adit Ventures and SuperAngel.

Tell us about the product or service that NWO.ai offers.

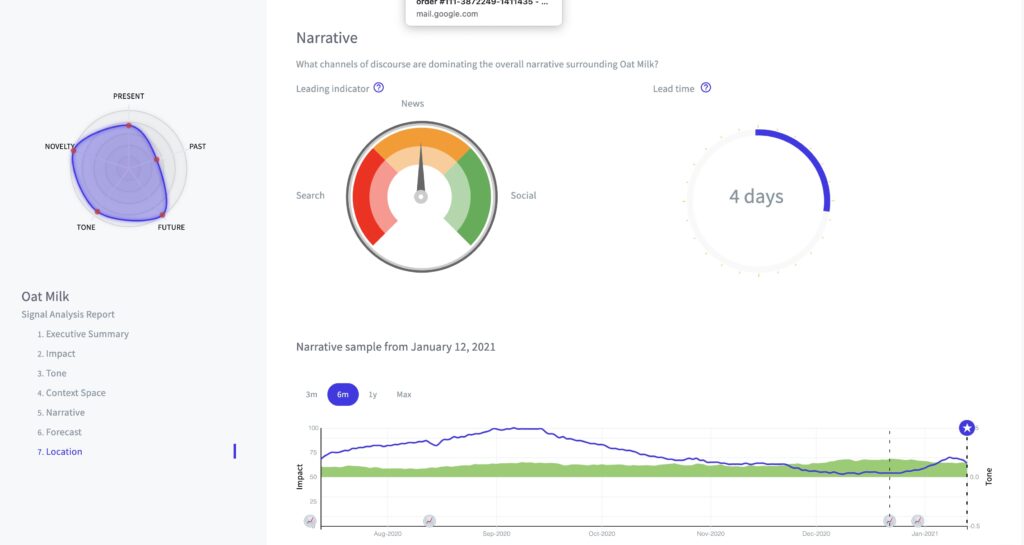

We’ve built the largest AI-enabled civilian database capturing the voice of the consumer. Using proprietary analysis of unstructured external data, we’re “genetically sequencing” the lifecycle of trends as they’re created and evolve.

What inspired the start of NWO.ai?

We started NWO originally to use disparate data sources to try to uncover geopolitical trends. As we curated and processed more data and began to incorporate proprietary methods of “time-shifting” data sources, we began to realize we were able to anticipate consumer and cultural shifts.

How is NWO.ai different?

Our platform goes beyond providing just descriptive statistics on the number of mentions of a keyword on a variety of data sources, but instead incorporates a time dimension and source prioritization component to determine not only the past performance of trends but also help predict future potential.

We have developed a novel cross-correlation, time-shifting algorithm that automatically weighs a number of data sources across various input streams and figures out the leading and lagging indicators, time-shifts the lagging ones – and generates a composite “signal.”

What market does NWO.ai target and how big is it?

We are targeting the Total artificial intelligence market as a whole which is worth ~$40B according to Grand View Research, and expected to eclipse $700B by 2027. As a starting point, our first sights are set on the artificial intelligence application for supply chain and marketing use cases which is estimated at ~$8B, per Meticulous Research, and expected to cross $60B by 2027. Both these market estimates are growing fast as the focus on AI-powered decision making has become a key priority for businesses across almost all industries.

What’s your business model?

NWO.ai is a SaaS business that offers a paid monthly access to its web-interface platform. Clients pay a per-user monthly fee which is packaged into annual contracts.

How has COVID-19 impacted the business?

In today’s fast-paced business environment, everything is evolving in a chain reaction of events. COVID-19 has radically accelerated a number of existing trends. There is no way to actively measure and anticipate cultural shifts.

Using the latest in machine learning and by tracking digital conversations on the internet, we enable monitoring key microtrends and issues that define our culture today.

In today’s fast-paced business environment, everything is evolving in a chain reaction of events. COVID-19 has radically accelerated a number of existing trends. There is no way to actively measure and anticipate cultural shifts.

Using the latest in machine learning and by tracking digital conversations on the internet, we enable monitoring key microtrends and issues that define our culture today.

What was the funding process like?

Fundraising in the midst of a pandemic was definitely unique and nuanced. There were ironically more meetings, albeit via Zoom; and, since everyone was working from home effectively stretching available work hours, the product level diligence was very thorough with several follow-up Zooms. The reference checks and background checks took on additional importance, but it was also a great opportunity to assess how nimble and proactive our investors could be in a difficult environment. We are extremely proud and excited by the partners we made in this funding round.

What are the biggest challenges that you faced while raising capital?

Time. The pandemic stretched the process beyond what we had expected, and so we were in a race against the clock to ensure we concluded fundraising before we needed to make major capital commitments to business requirements.

What factors about your business led your investors to write the check?

I believe investors back entrepreneurs first, and the company thereafter. We were able to demonstrate our commitment and conviction to the investors over a period of 3 months. Moreover, we were able to engage in a partnership with SAP.io right before our funding, which I would imagine provided a great deal of comfort around our go-to-market strategy. Our biggest focus is to launch several POCs with the aim at converting them into annual contracts. We are targeting to showcase the value of our products within the larger consumer sector in businesses spanning from beauty brands to automotive manufacturers to insurance companies.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Proof of concept with a beta customer who can provide feedback and credibility is of paramount importance. Until then, believe in your product and your team, and keep pushing ahead. Most importantly, when you do raise capital, make sure it is with great collaborators and partners.

Proof of concept with a beta customer who can provide feedback and credibility is of paramount importance. Until then, believe in your product and your team, and keep pushing ahead. Most importantly, when you do raise capital, make sure it is with great collaborators and partners.

Where do you see the company going now over the near term?

We are currently expanding our development team to increase the velocity of our product iteration process. We plan to continuously track and analyze our clients’ usage of the platform to define our short-term product roadmap, while also building toward our longer-term goals and company vision.