Effectively management cash flow is at the heart of every business. Ensuring that your outstanding invoices are paid in a timely manner can be the difference between making and missing payroll. You may have a CRM to manage your sales and even an ERP to help with the records but these systems are fragmented and siloed. Enter YayPay, the end-to-end SaaS platform focused on the management of accounts receivable. Yaypay’s solution centralizes receivable collections by integrating communication outreach, reporting, payments, and forecasting.

AlleyWatch sat down with Cofounder and CEO Anthony Venus to learn more about the company’s offering, future plans, and its newly closed round of funding, which bringsYayPay’s total funding to date to $13.8M over three funding rounds since its founding in 2015.

Who were your investors and how much did you raise?

We raised $8.4M in Series A funding, led by Information Venture Partners with follow-on investment from existing shareholders including Birchmere, QED, Fifth Third Capital, the direct equity investment subsidiary of Fifth Third Bancorp, Gaingels, and 500 Fintech Fund. We also have a new supporting institutional investor, Runway Venture Partners, who joined the round.

Tell us about the product or service that YayPay offers.

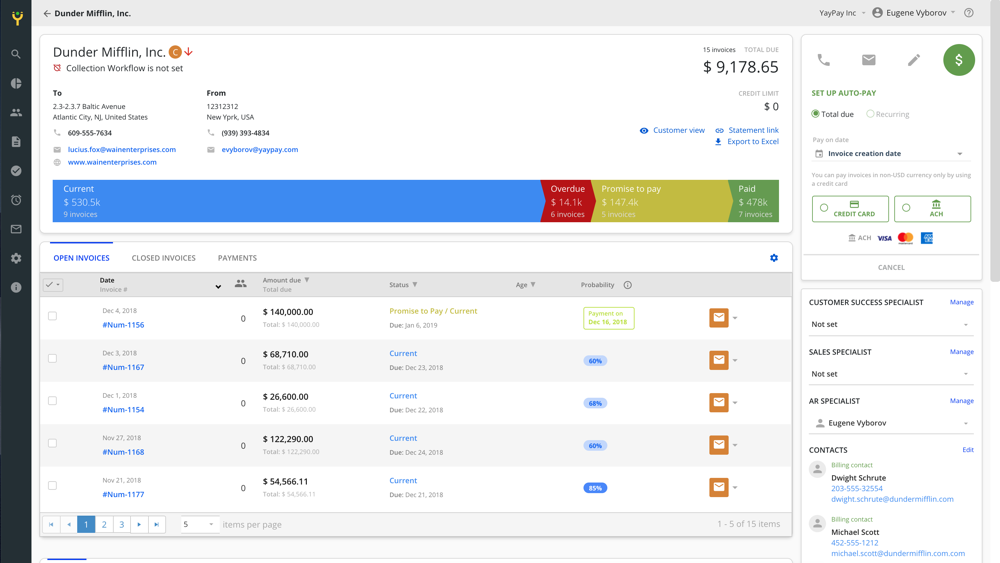

YayPay is a SaaS-based accounts receivable (AR) management platform that makes collecting fast, easy, and highly predictable. The YayPay platform provides AR teams with:

- Real-time AR analytics reporting and forecasting

- Dynamic AR aging reporting

- An AR customer relationship management (CRM) system

- Ability to send customizable, automated, collection emails

- An online payment portal

What inspired you to start YayPay?

What inspired you to start YayPay?

I cofounded YayPay with Eugene Vyborov, our CTO. At our previous businesses, our sales and marketing teams had all the great CRM and automation systems. While the back office finance team had an ERP system that was good for record keeping, they also used a CRM that was not integrated with financial data. Most of all, they used lots of spreadsheets. None of these systems were integrated with each others, and watching them do their highly manual work every day gave us the inspiration for YayPay. These AR teams (we call them Revenue Heroes) are the reason why the YayPay team exists. We think that there is a better way to stay on top of collections than simply using spreadsheets and disconnected CRM and ERP systems.

How is YayPay different?

Imagine having a list of 100 customers in an excel spreadsheet that you were tasked to follow up with over the course of the month. You have to email and call each account until you get a response. You have to log all your activities and notes in the spreadsheet and send every email manually. Some of these activities are logged on your ERP, others on your CRM, and maybe even billing systems. None of these systems talk to each other, but you can do it because you only have 100 customers.

Now imagine your business growing to the point where you are looking at 10,000 invoices a month. Can your effort scale without integration and streamlining? Can you still manage those customer relationships? That’s how YayPay is different. It fundamentally makes these tedious and manual tasks a thing of the past for the modern AR team.

Why do organizations need a standalone receivables management platform? Can many of these functions be done through a sales CRM or accounting software that a company is already using?

You need a standalone AR management platform because when all of the systems you use talk to each other, share the same real-time data and also helps you add meaning to what you’re looking at, the amount of time this saves is immense. With YayPay, and AR team members never have to scroll through an aging report to figure out who to follow up with or send a manual collection email again.

Any company that is sending over 500 to 100,000 invoices/month and has collections and AR team of 2 to 50 people should highly consider investing in an AR management platform. While today’s accounting systems, ERPs, CRMs have come a long way from the green-screens of the 80s/90s, these systems are still, and will be for a long time, core accounting platforms that handle the general ledger.

What market does YayPay target and how big is it?

We target mid-market enterprises, from $50 million to $5 billion in size. It’s a $10 billion software and payments market.

What’s your business model?

We sell annual upfront software license fees with pricing based on the volume of invoices processed. We also make money on payment transactions through the platform.

What was the funding process like?

I knew many of the investors in our space quite well already, and I officially started the fundraising process in late September, doing about 15 meetings. In reality, the process probably started about 12-18 months beforehand, when I met Rob Antoniades from Information Venture Partners. We kept in touch and developed a good relationship. I knew Rob and his team had a lot to offer as they knew our space very well, having invested in success stories like Adaptive Insights, recently sold to Workday for $1.55B.

What are the biggest challenges that you faced while raising capital?

It’s always tough managing the business while raising capital. It’s like you have two jobs at the same time. The waistline suffers and you sleep less.

I was very involved in sales at the same time as raising capital this time around, and having a strong team behind me made all the difference. I’m grateful that we have experienced managers like Nicole Dwyer in Product Development, Tom Bartolucci in Engineering, Tim Teeter in Business Development, and a great cofounder CTO in Eugene Vyborov. We also had a bunch of rising stars who really stepped up and made the company happen, like Mitch DeForest in Sales, Jazzy Zhu in Marketing, Namgyal Schaaf in Customer Success, and many more. Without them, this would not have been possible, as team efforts like these are only impactful when you know the team has everyone’s back. Also, I have a really patient Director of Finance in Matt Horn, who managed the data room and built financial model…. after model…. after model…

What factors about your business led your investors to write the check?

Our investors backed an experienced team that not only knows the space that we are in, it also helps that we’ve built a great product with less than 5% churn (120% net negative churn). At the same time, after having sluggish sales earlier in the year under a different team, we put together a new team of committed millennials to work on sales. From that point in September onward, we had a series of record months in sales. It all happened at the right time and not too soon. Our investors saw that we had turned the corner and had achieved explosive sales growth — all the right ingredients to get the round done.

Our investors backed an experienced team that not only knows the space that we are in, it also helps that we’ve built a great product with less than 5% churn (120% net negative churn). At the same time, after having sluggish sales earlier in the year under a different team, we put together a new team of committed millennials to work on sales. From that point in September onward, we had a series of record months in sales. It all happened at the right time and not too soon. Our investors saw that we had turned the corner and had achieved explosive sales growth — all the right ingredients to get the round done.

What are the milestones you plan to achieve in the next six months?

Our OKRs over the next 6 months focus on the following

- Sales bookings growth

- Focus on unit economics

- Deliver outstanding customer experience to ensure our customer’s success

- Deliver a predictive, leading, and secure product that helps our customers achieve their objectives and key results

- Happy and high performing team

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Manage the burn rate, focus on sales, and hustle! There is an investor out there for every decent business.

Where do you see the company going now over the near term?

Our goal is to dominate the mid-market for AR automation software. We will be launching more software modules in Q1 and Q2, and will continue to move deeper into the mid-market.

Using software powered by machine learning algorithms that analyze transactional and behavioral patterns, we are helping finance and AR teams to hit their monthly credit and collections goals while driving costs lower. We are developing predictive credit models and building a credit-to-cash workflow specifically designed for the modern AR team.

What’s your favorite restaurant in the city?

I like Aria on Perry Street. It’s always lively and tasty!