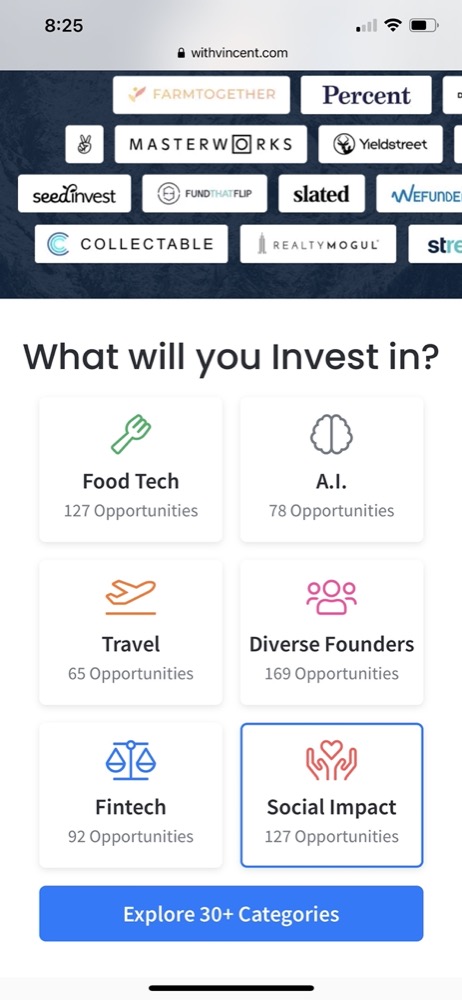

The alternative investment market is estimated to be north of $13 trillion in assets. Despite COVID and economic uncertainty, the alternative investment industry has displayed significant signs of growth, becoming more mainstream as access to opportunities is becoming democratized and as investors seek higher returns in a low-interest-rate environment. One of the biggest challenges has been finding the right deals and opportunities efficiently. Vincent has built a comprehensive search engine for alternative asset investment opportunities, allowing investors to build tailored searches based on their preferences and portfolio requirements. Opportunities can be filtered by asset class, investment minimums, liquidity, and potential returns across real estate, private equity, art, collectibles, and venture.

AlleyWatch caught up with the founding team at Vincent (Slava Rubin, Eric Cantor, Ross Cohen, Evan Cohen) to learn more about how Vincent plans to transform the discovery of alternative investments, the company’s origin, future plans, and latest round of funding.

Who were your investors and how much did you raise?

We raised a $6M funding round led by Jason Calacanis of LAUNCH along with Joe Lonsdale of 8VC. Joining the round were a number of founders and key executives from the online investing ecosystem, including Republic, NBA Topshot/Dapper Labs, AngelList, Grayscale, Collectable and Slated, as well as investing trailblazers Barry Silbert (DCG), Sahil Lavingia, and Meltem Demirors. Previous investors participating included humbition, Uncommon Denominator, ERA, and The Fund.

Tell us about the product or service that Vincent offers.

Vincent unifies the fragmented world of online investing into an easy-to-use search engine, helping everyday investors find unique investment opportunities to expand their portfolios outside traditional stocks or bonds. Today on Vincent, investors can explore more than $3.5 billion worth of investible opportunities across popular asset categories like digital assets, art, and private credit, originated by more than 75 integrated investment partners.

What inspired the start of Vincent?

The founders of Vincent each navigated the opaque world of alternatives in their own way, and have always been asked by friends and family, “what should I invest in?” We started the company to be able to answer that question in a more systematic way for the emerging generation of investors.

While launching more than 150 online crowdfunding raises, Evan and Slava realized the value of a search and aggregation layer to bring the emerging set of investment opportunities to interested investors. Vincent was conceived with the knowledge that investors want to see a broad set of options rather than a narrow set, and that an engine to facilitate discovery could help all of the vertical-specific platforms find the right investors. They were joined by serial founder and alts enthusiast Eric Cantor and technology lead Ross Cohen, former head of engineering at Mirror, which sold to Lululemon for $500 million, and the journey began.

How is Vincent different?

With the JOBS Act, mobility, and the search for yield, we’ve seen exponential growth in the variety and dollar volume of alternative investments being offered to individual investors. But there was no on-ramp for those investors to discover, diligence, and invest in those opportunities across an entire portfolio. That’s what Vincent is here for. The platform now services more than one million investment searches from more than 100,000 individual investors. Vincent’s investment database, which includes opportunities from popular investment platforms like Fundrise, Yieldstreet, Collectable, Republic, and Masterworks, has quickly become a hub for individual investors looking to ‘get smart’ in alternative finance. Using proprietary data, Vincent regularly publishes market reports highlighting trends and analysis around investor activity and sentiment across the ecosystem.

What market does Vincent target and how big is it?

The alternative investment market is set to grow from $13 to $24+ trillion in the coming decade. There are an estimated 15 million accredited investors in the United States, and another 15+ million sophisticated investors on their way to being accredited who have an interest in alternatives.

The trend has not gone unnoticed, as venture capitalists have poured hundreds of millions of dollars into the growing alternative investment ecosystem. The platforms on Vincent benefit from the 2012 JOBS act rules, which opened the door for general solicitation and crowdfunding online. Last November, the SEC announced expansions to those rules, which will lead to further growth and increase the availability of online alternative investment opportunities.

How has COVID-19 impacted the business??

Market conditions and limited social opportunities brought online investing to the forefront during the craziness of these last 14 months. We see increasing interest among individual investors and our partner platforms enjoying record months as more people find that having part of their allocation in longer-term and high-return investments to be compelling, and the burgeoning supply and new regulations give them more choices than ever. This trend is continuing even as the pandemic begins to fade.

Market conditions and limited social opportunities brought online investing to the forefront during the craziness of these last 14 months. We see increasing interest among individual investors and our partner platforms enjoying record months as more people find that having part of their allocation in longer-term and high-return investments to be compelling, and the burgeoning supply and new regulations give them more choices than ever. This trend is continuing even as the pandemic begins to fade.

What was the funding process like?

Fast and furious. Raising via Zoom is totally different as you have to get into detail in relatively short periods of time without a lot of nonverbal communication. That said, you can also check in with more potential investors and think about who might be the best fit. We were grateful that Jason had the conviction to lead after hearing our vision, and that a number of other investors whose opinions we respect validated our efforts by getting on board.

What are the biggest challenges that you faced while raising capital?

Keeping one eye on the business and another one on the pitch deck is always challenging. And doing it without meeting with anyone in person was a new wrinkle we had to adjust to.

What factors about your business led your investors to write the check?

Jason, Joe, and Barry just got it. And fast. They see where the investment world is heading and they understand the impact and reach fintech can have when applied to providing more universal access to opportunities previously reserved for the few. Jason says it best himself — “With interest in alternative assets booming over the past couple of years, Vincent is well-positioned to be the best source of deals across a range of asset classes. From cars to crypto, startups to art, and real estate to trading cards, Vincent is the perfect onramp for investors looking to expand their portfolios into alternatives.”

What are the milestones you plan to achieve in the next six months?

We’re going to accelerate growth and double-down on our search experience by building a suite of powerful tools helping investors evaluate investment deals with richer sets of data. Vincent aims to become the largest independent database of alternative assets for everyday investors by doubling its investment inventory. We’ve shown millions of opportunities to our investor audience, but we’re really just getting started in terms of helping them build awesome portfolios.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Think big. Don’t be afraid to lead with your big vision for your company, and put on the table a real assessment of the resources it takes to get there.

Where do you see the company going now over the near term?

Over the past few months, we saw individual investors increasingly looking into alts, which was accompanied by growth in demand on our platform and rapid expansion in our space. Moving forward, we want to triple down on meeting those investors where they are, and delight them by making the alts experience faster, easier, more transparent, and more personalized.

What’s your favorite outdoor dining restaurant in NYC

Hudson Clearwater.