The vast majority of individuals make their livings from wages, salaries, or other forms of labor compensation. However, this is changing as our outlook on work and how income is earned continues to evolve. For the most affluent, a large portion of their total income is derived from capital investments; there are countless services available that are catered to manage the sophisticated finances for this group. Harness Wealth is an accessible digital wealth management solution for the needs of people that have sizable equity-based holdings but aren’t necessarily affluent yet. The digital platform is a hub that focuses on financial, tax, and estate planning that connects founders, employees, and investors with vetted professionals and advisory firms. The target audience has tremendous demands on their time and optimizing their financial health often isn’t top of mind. Yet, decisions made now can have an outsized impact in the future for wealth creation. Founded in 2018, Harness Wealth now has over 1000 advisers to make wealth management accessible to this increasing portion of the population with investable assets that are seeking hybrid solutions.

AlleyWatch caught up with CEO and Founder David Snider to learn more about the inspiration for the business, the company’s strategic plans, latest round of funding, which brings the total funding raised to $19M, and much, much more.

Who were your investors and how much did you raise?

$15M Series A. Lead Investor is Jackson Square Ventures. Additional investors: Bain Capital, GingerBread Capital, FJ Labs, i2BF, Torch Capital, Activant, NFP Ventures, First Minute Capital, Liquid2 Ventures, Alleycorp, Marc Benioff (CEO/founder of Salesforce), Paul Edgerley (former MP at Bain Capital), and Ori Allon (Founder of Compass).

Tell us about the product or service that Harness Wealth offers.

Harness Wealth is the next-generation wealth management solution created for builders – individuals founding, scaling, and investing in businesses. It is a holistic wealth platform that seeks to make bespoke financial and tax advice accessible, intuitive, and valuable through a combination of innovative technology and exceptional advisory firms.

What inspired the start of Harness Wealth?

I started Harness Wealth with Catherine Prentke English. We both had our own experiences in managing the complexities of equity and cross-border work. We found that existing tax and financial guidance was siloed and often people had to choose between digital DIY and working with advisers in a purely analog way. Harness Wealth was created to provide personalized, expert advice that is tech-enabled.

How is Harness Wealth different?

We have three key areas of differentiation:

- Our offering is both personalized and holistic. We offer advisors across the three most impactful areas – financial, tax, and estate planning. Additionally, our solution is personalized such that it can meet the diverse needs of all employees, whether they need advice in a single vertical or across multiple verticals.

- Our advisory firms are best-in-class. All of the firms on our platform are fiduciaries, which means that they are legally obligated to act in the best interests of their clients. We take our firms through a rigorous evaluation process of over 120 qualifications across both the firm and the advisors individually. We now have over 1,000 advisors on our platform across the U.S., with a diverse set of skills to meet the needs of a variety of individuals.

- Our process is seamless. We provide clients with a combination of digital tools to surface the actions they need to take, and an easy, online platform to find and evaluate advisory firms that can help.

What market does Harness Wealth target and how big is it?

What market does Harness Wealth target and how big is it?

Harness Wealth is starting with a solution to meet the needs of high complexity equity holders – tech founders, employees, and investors.

This market spends tens of billions on advisory services and is growing quickly (with 7M more individuals in the U.S. receiving some form of equity-based compensation in the last 5 years).

What’s your business model?

We are financially aligned with the interests of our clients and advisers. We offer clients services at a variety of price points and capture a portion of the fees paid. We only do well if our clients find long-term success with the advisers on our platform. Clients are not charged anything additional by Harness Wealth or the firms to use our platform.

How has COVID-19 impacted the business??

We were lucky in that we didn’t see a substantial impact on our business from COVID. Our solution is digital and all the advisors on our platform have integrated digital experiences, so clients were able to pretty seamlessly connect with advisors. It did, however, reduce any in-person advisor meetings.

Additionally, the tax deadline extension this year, particularly combined with movement in the cryptocurrency and stock markets, created additional tax planning and filing complexities for our clients that increased demand for well-vetted, expert tax services.

Many of our clients and partners are small businesses owners, and they struggled both economically and logistically throughout the year. We feel lucky to have been able to help where we could and learn about the degrees to which our business could flex in changing or unforeseen circumstances.

What was the funding process like?

Between my role at Compass and Harness Wealth, I have raised several rounds of capital and the shift to exclusively digital conversations was definitely a change. While nice to be able to do everything from home, the format meant that I was often starting the day very early and ending it late to accommodate time zones. Personally, I also found pitching into a laptop more exhausting than building in-person connections.

What are the biggest challenges that you faced while raising capital?

We are seeking to tackle a large market with a multi-faceted strategy of combining digital insights & enablement with human advisers. It is a more complex story to tell though I think for those that have spent time in the space it’s one that resonated.

What factors about your business led your investors to write the check?

Our focus on the demographic of people with equity-based compensation and solving their initial needs through tax expertise to build a broader relationship resonated. Tax services are a must-have for this demographic and the status quo leaves a lot to be improved upon.

What are the milestones you plan to achieve in the next six months?

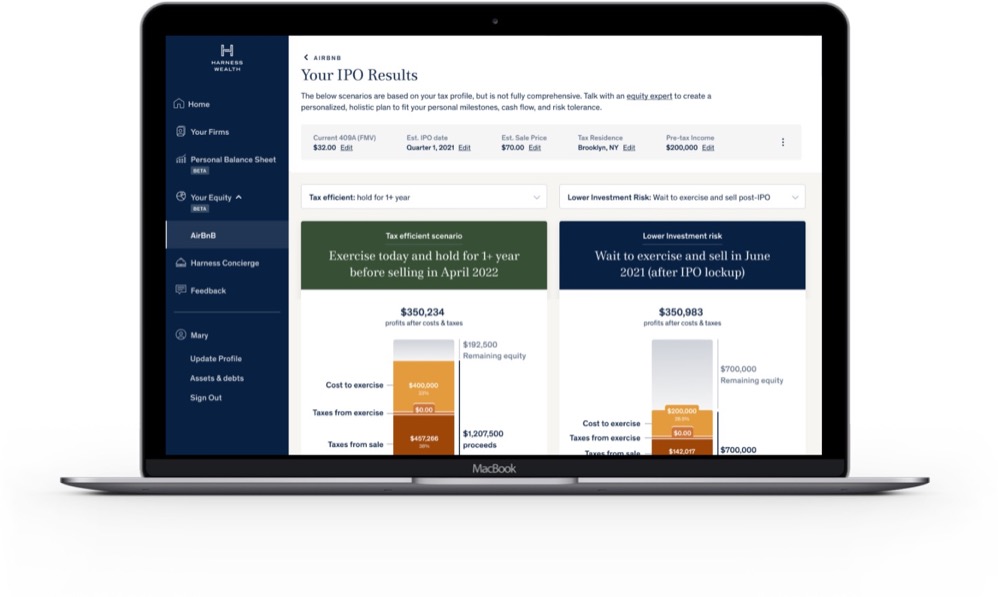

We plan on releasing a comprehensive set of digital financial tools to give equity builders the tools to manage key financial decisions. In particular, we will enable equity holders to visualize their full balance sheet and analyze potential liquidity decisions and their tax implications.

We’re also continuously bringing on more specialized advisers, particularly tax pros while launching innovative new tax services to provide our clients with better outcomes.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

When I was first exploring the New York tech scene in 2011 there was a reluctance to consider a hire from traditional professional services – consulting, banking, corporate general management. That mentality has shifted although there still is a massive amount of highly talented people who are looking to transition into the startup world and being open to raw talent even if from non-startup backgrounds can be a real advantage.

Where do you see the company going now over the near term?

We are in the early innings of our journey toward building the gateway to next-generation wealth and tax services. We are excited about the rapid expansion of our capabilities and resources to effectively serve a growing base of clients and help them reach their best financial outcomes.

What’s your favorite outdoor dining restaurant in NYC

In NYC, outdoor dining can be as much about the street life as the restaurant itself. I am a big fan of Sant Ambroeus West Village, where the outdoor tables have always had a great perch.