Customer verification protocols like Know Your Customer (KYC) were introduced to establish a system of trust and verification to minimize the chance of fraud, protecting both customers and, at the time, largely financial institutions. As more and more transactions move online and also outside of the scope of traditional financial services, identity verification takes on an even more important role. Footprint is a frictionless identity verification platform that automates the customer onboarding process for companies by satisfying KYC and other requirements through a customizable engine. The company develops personal identifying information (PII) vaults that allow companies to securely collect a user’s required data to confirm their identities, creating a portable and authenticated persona that can be used across the digital landscape, similar to the Apple Pay experience where consumers do not have to constantly type in the same details across different merchants, leading to a better customer experience. On the backend, Footprint continuously monitors and confirms the behavioral and location attributes associated with a user, minimizing the chance of fraudulent activity. The experience is completely customizable for companies using the platform as they can define the data and documents required for their customers using a sophisticated rules engine. All this can be integrated into their digital offerings with only a few lines of code.

AlleyWatch caught up with Footprint Founder and CEO Eli Wachs to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding raised to $20M, and much, much more…

Who were your investors and how much did you raise?

QED led our $13M Series A. The round included participation from existing investors Index Ventures, Lerer Hippeau, Operator Partners, BoxGroup, Palm Tree Capital, and Definition. New investors Neo and Animal Capital also participated.

Tell us about the product or service that Footprint offers.

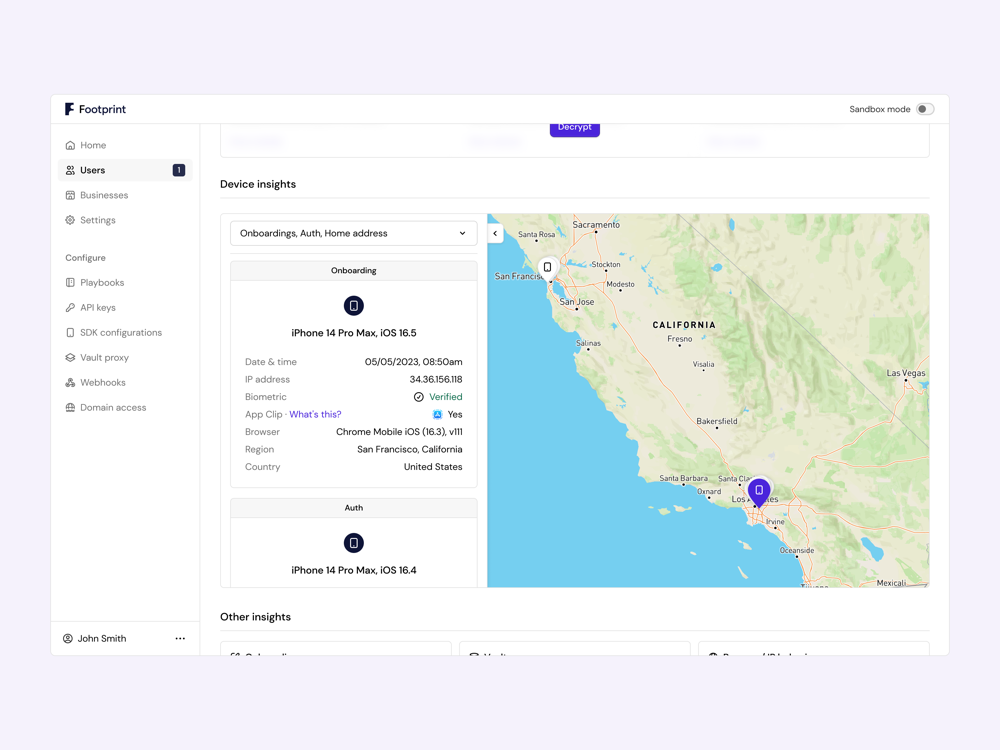

Footprint automates consumer onboarding for companies. We provide embedded UX components that companies are able to use to collect, verify, and securely store information their users must enter to create accounts. This means we can identity people when they create accounts (KYC + Fraud detection) and as they sign back into accounts.

Over time, Footprint makes identity portable. We move the world from a state of default-bad (everyone must go through medium KYC) to default-good (actors we know quickly go through KYC; others face more scrutiny). Fraud is a 3% tax on the internet. Identity theft takes billions of dollars from people each year. Our mission is to bring both of these numbers to zero.

What inspired the start of Footprint?

I was at Stanford when data privacy became a hot-button issue. GDPR + CCPA I thought were well-intentioned, but I saw a world where data would be locked away in siloes. To me, data could be used for great good (ie. Google + Apple could likely be best predictors of early signs of Parkinson’s and Dementia). I wanted to build a company to put people in control of their data.

I was at Stanford when data privacy became a hot-button issue. GDPR + CCPA I thought were well-intentioned, but I saw a world where data would be locked away in siloes. To me, data could be used for great good (ie. Google + Apple could likely be best predictors of early signs of Parkinson’s and Dementia). I wanted to build a company to put people in control of their data.

After I graduated, I worked at a VC fund, General Atlantic, where I was able to lead a lot of our work across Identity, Privacy, and Security. It shocked me that: these were disparate tools and that each company re-built the same flow. By that, I mean each company had to build an identity verification flow and then a schema to securely store that information. At the same time, consumers had to re-do these flows at each company despite having already completed them. This leads to fraud and friction. By building an Apple Pay for Identity, we could solve all of these issues.

How is Footprint different?

For one, we are not just a KYC or IDV company. We are an onboarding company and an identity lifecycle company. There are a lot of point solutions that serve as mere checkboxes: backend APIs that can verify data entered with a database, encryption-at-rest companies which can help with SOC2, and robust auth companies that still support passwords. Footprint is a prescriptive compound platform. We live on the front end, meaning that we do not just verify the information someone entered, but the behavioral and location attributes behind it. All data is automatically vaulted, and we then use novel biometrics to bind that PII to the device. This means Footprint ties the initial account creation to continuous sign-in, preventing ATOs + phishing.

I think Footprint is the only company in our space with a logical end-game. Others’ business model is misaligned in my opinion with our customers. The more fraud there is, the more modules they can sell. By contrast, our ideal default world is one where we’ve verified each consumer and can help them navigate their identity journeys. This is “logical” to me because there is an infinite amount of fraudsters, so we have no way of ever catching them all. Our model is superior because we then productize the identities (instead of the fear of more fraud) in an internet with savings for all.

What market does Footprint target and how big is it?

At this point, most companies with a digital presence that interact with consumers are potential customers. Historically, KYC was limited to banks (stemming from the Patriot Act). But now, even marketplaces are doing some version of KYC (think Airbnb or Uber to build trust).

What’s your business model?

We charge per/onboard (a combination of our KYC/KYB and our fraud tools), and then recurring charge for our security and authentication products.

How are you preparing for a potential economic slowdown?

We operate in a large market–I believe that great products and companies will always be able to grow. Valuations may change, but top-performing companies will still be rewarded. We’re a lean team. This causes ruthless prioritization, and intellectual honesty toward the challenges we are well-equipped to solve.

Perhaps the area an economic slowdown makes us think through most is the customers we serve. We love working with enterprise and startups the same, but we have recently been spending more GTM time on the enterprise segment.

What was the funding process like?

From my time back in VC, I am a big believer in building genuine relationships with investors. By the time we raised, there were about 15 funds we felt we had a genuine relationship with. I think this helped in that they knew our vision and the story behind it.

Obviously, 2024 is not 2022. VCs (understandably) want to see real numbers and traction. They don’t want to be rushed. And there is a lot out of your control. As soon as we seemed to reach alignment with QED, the round became a no-brainer for us. They’re incredibly sharp on the problem space and we thought had the perfect background experience to be the right partner to us as we enter our next stage of company growth.

What are the biggest challenges that you faced while raising capital?

Fundraising, like company building in general, is an emotional roller coaster. You have a great pitch and think you’re the next Stripe, and then get an unexpected pass note on a Friday afternoon and spend your weekend worried about your longevity. To me, the biggest challenge there is balancing the mental aspect of it–trying to stay grounded and not get too high or too low.

What factors about your business led your investors to write the check?

I think a combination of our customer feedback today and vision for tomorrow. We’re lucky to work with a diverse and incredible set of customers. They’re the best testament to the differentiation of the product, and their articulation of the tangible ROI they got in using Footprint showed how our platform was so valuable. It is one thing to hypothetically speak of the power of dynamic onboarding, but another to hear companies say we increased conversion by 50% or were the most significant fraud improvement they had made all year.

The other I’d imagine is our vision. Solving identity on the internet sets us up to enter multiple arenas. We take none of this lightly, and feel lucky every day for the opportunity to build this company.

What are the milestones you plan to achieve in the next six months?

We expect to see our first major enterprise deployments go live. We also expect a record number of “one-click” KYCs this summer.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Don’t get bogged down by the unimportant matters. Focus on the two-three most salient things each week that can help you reach your next big milestone. Be stubborn on vision but flexible on how to get there. And above all–if you don’t believe in yourself, no one else will.

Where do you see the company going now over the near term?

We continue to see great traction with banks, real estate + auto companies, and investment platforms. Our goal is to continue to delight those customers which in turn will allow us to pursue our vision of building an identity layer to the internet which protects people.

What’s your favorite summer destination in and around the city?

In the city: West Side Highway

Around the city: Visiting my Grandparents in Long Island