Distributed ledger technologies like Blockchain are considered to be inherently secure. Yet, vulnerabilities in infrastructure can lead to manipulation and attacks. CertiK offers end-to-end security solutions for blockchain, providing exhaustive security audits and smart contract monitoring. The company’s Skynet platform provides real-time insights into the security of DeFi applications. Founded in 2017, CertiK serves over 1000 clients, has secured digital assets valued at $70B+, and is already profitable.

AlleyWatch caught up with Cofounder Ronghui Gu to learn more about the state of blockchain security, the role CertiK is playing in bringing DeFi to the forefront of commercial transactions, the company’s strategic plans, latest round of funding, which brings the total funding raised to $72M, and much, much more.

Who were your investors and how much did you raise?

This was a Series B funding round with a B+ extension. Combined, the two rounds bring our 2021 fundraising efforts to $61M. This Series B follows last year’s Series A round, which raised $11M. CertiK has expanded operations rapidly over the last 18 months, and we now provide our leading blockchain security services to over 1,000 clients, securing more than $90B of digital asset value.

Our list of backers includes Tiger Global, Coatue Management, Coinbase Ventures, Binance, Lightspeed Venture Partners, IDG Capital, Shunwei Capital, Hillhouse Capital, and more.

Tell us about the product or service that CertiK offers.

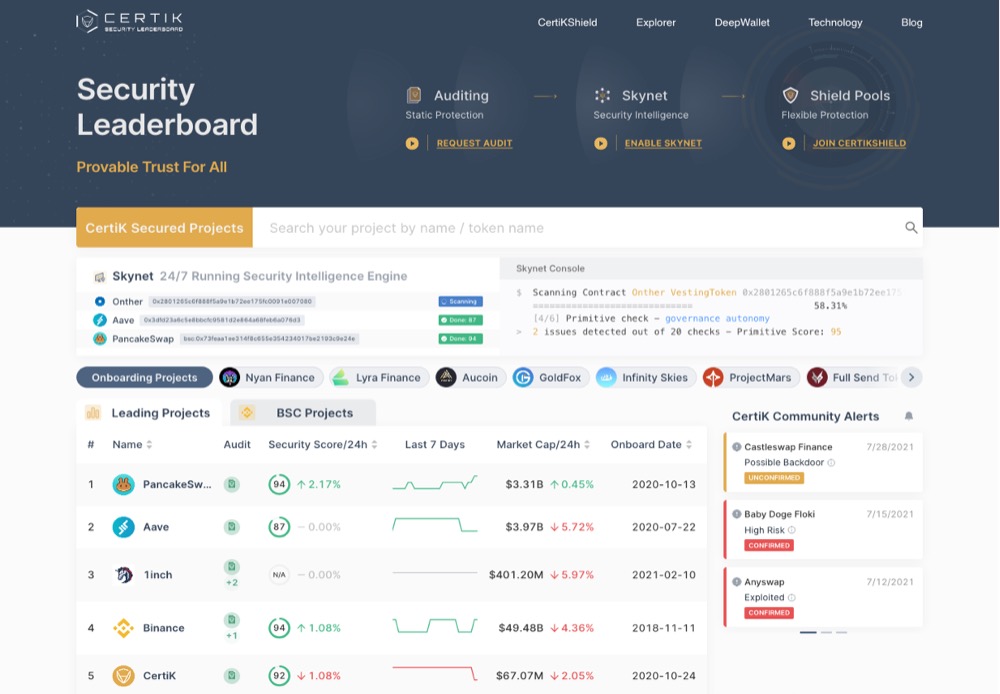

CertiK is perhaps best known for our security auditing, which is indeed where we made a name for ourselves. We’re coming up on one million lines of code secured, which will be a big milestone, representing both our reach into securing the blockchain space, as well as the growing expectations for projects to undergo third-party auditing. In addition to manual and automated code review, we offer a comprehensive suite of end-to-end security solutions. From providing code auditing by our team of security experts to deploying real-time smart contract monitoring and alerts with Skynet Premium, we secure every stage of a blockchain project’s lifecycle.

What inspired the start of CertiK?

What inspired the start of CertiK?

CertiK was co-founded by Professor Zhong Shao, the department chair of Computer Science at Yale University, as well as myself, a professor of Computer Science at Columbia University. Our research stems across provably secure software systems, where mathematical proofs are utilized to ensure the correctness of systems. As blockchain technology emerged, hackers began preying on the open-sourced projects, causing substantial disruption to the pace of innovation. As a result, we created CertiK, which aims to bring the latest innovations of academia into enterprise, creating technologies that effectively defend against malicious vulnerabilities.

How is CertiK different?

That’s a good question. CertiK is not the only blockchain auditing firm out there, but what sets us apart is our suite of end-to-end security solutions. The code audit is not the end of the security process; it’s just the beginning.

Smart contracts’ risks and vulnerabilities are constantly evolving, which means that ongoing real-time monitoring is essential. We recently launched Skynet Premium, which utilizes machine learning to continuously adapt to and protect against new threats once a smart contract has been deployed into the wild.

While many auditing firms work behind the scenes with clients, we offer a range of services for individual investors. Our Security Leaderboard is a free tool that collects and presents a wealth of data in an easily digestible form. Users can dive into the security of a project before committing any funds, which helps them make better-informed decisions. Doing your own research is a fundamental tenet of the DeFi space, but the sheer amount of data available can be overwhelming. The Security Leaderboard makes it easy to DYOR.

While CertiK started off as an auditor, we’ve expanded into new fields to meet the demand for comprehensive smart contract security solutions.

What market does CertiK target and how big is it?

CertiK fulfills the important and rapidly-growing demand for blockchain security services. This is already a multi-billion dollar market and we foresee continued growth as the industry matures.

Security is critical to the continued and future success of decentralized finance (DeFi). Exploits dampen users’ enthusiasm for trying out new products and platforms, and without these users, the industry is at risk of stagnation. Luckily, it seems that there is more of an appetite than ever, but we can always do better.

DeFi currently represents just under 5% of the total value invested in cryptocurrencies. We think that the utility it provides will bring this figure up drastically over the coming years. It’s such a new and innovative industry that there are bound to be some growing pains, but by setting a high standard for security we can ensure that DeFi develops to meet the needs of the hundreds of millions of people to whom it offers a new era of financial inclusion.

What’s your business model?

We work with our clients to assist them in their bespoke security needs, starting with a code audit. To ensure the highest level of cyber defense, we offer subscriptions for our Skynet Premium product, which acts in a similar manner as an antivirus for the blockchain; our systems monitor the smart contracts and blockchains and provide alerts when suspicious activity or inconsistencies occur. For any custom security requests, we evaluate the project to determine how we can work together to assist.

How has COVID-19 impacted the business?

Our global HQ is located in the heart of NYC, where the early US epicenter occurred, so we quickly had to shift our gears to getting accustomed to a remote working life. Luckily, our team has always been very diverse, made up of the strongest security talent across the globe. This enabled us to quickly leverage our existing remote infrastructure, and funny enough, the lack of commuting times into the office was able to be channeled more productively. We saw our overall productivity and metrics rise to new highs.

What was the funding process like?

We had successfully closed our Series A during the peak of the pandemic, so we expected any funding process to go more smoothly than that one went. We were right, and a large part was because our numbers spoke for themselves. For our Series B, we brainstormed about which investors we’d be targeting, based on their strategic advantages, and we were able to bring onboard our top choices.

What are the biggest challenges that you faced while raising capital?

While raising capital, the biggest challenge was trying to fit in our strategic investors into our oversubscribed round. We had initially targeted a small raise, but with our numbers and growth rate, we attracted heavy interest. Ironically, the hardest part is saying no.

What factors about your business led your investors to write the check?

The graph of our month-over-month revenue numbers had truly illustrated the term of exponential growth. Whereas we would mention to our investors that they should be prepared for our growth to slow down, we kept setting all-time high revenue numbers on a monthly basis. It also helped that we’ve been profitable since 2020, and our profit margins kept increasing.

The graph of our month-over-month revenue numbers had truly illustrated the term of exponential growth. Whereas we would mention to our investors that they should be prepared for our growth to slow down, we kept setting all-time high revenue numbers on a monthly basis. It also helped that we’ve been profitable since 2020, and our profit margins kept increasing.

What are the milestones you plan to achieve in the next six months?

There’s a lot that we’re looking to do during these next six months – launch new products, onboard major clients, develop strategic partnerships, etc. With the current trajectory, it seems like we’re surpassing our revenue goals over six months sooner than we initially expect, so we’ll see what we can do to keep our pace accelerating. A huge priority for us is to hire the right people to make this happen.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Keep fighting for product-market fit. It’s not something that just happens overnight, and if you’re still looking for it, you’re probably lagging on the product side, rather than the market side. Therefore, it’s likely less of a matter of sinking in more money on marketing expenses, and more of a matter of decomposing your product into the problems that it is trying to solve.

Where do you see the company going now over the near term?

We’re going to keep redefining what it means to be the market leader, especially as our blockchain market continually evolves. The funds will help us move with speed and focus into the areas that we believe can be advanced, from the comprehensiveness of the security infrastructure to better tooling to support blockchain users. We expect our headcount to triple in the upcoming year, and we plan to permanently integrate the flexibility of a remote-friendly culture into our values.

What’s your favorite outdoor dining restaurant in NYC

There’s a restaurant in the UES called Vietnaam that’s not necessarily an outdoor dining restaurant, but because it’s only a short walk away from Central Park, it’s the perfect place to go to grab sandwiches for an outdoor picnic.