Employee benefits or non-wage compensation is growing in importance and the pandemic has further solidified this trend as employees are re-evaluating their relationship with work. For example, there’s been a pronounced increase in interest in financial health, mental wellbeing, caretaking, and wellness options. Technology has enabled benefits selection and redemption to be a family-wide affair where partners can be included in the decision-making process. Benepass is an employee benefits management platform and card that can manage all benefits, meeting the needs of both employers and employees. The platform allows employers to easily integrate all their pre-tax benefits given to employees along with perks into a unified mobile app and card that gives employees the flexibility to easily access and utilize their benefits. Without Benepass, HR teams were forced to provide a disparate experience to employees, encompassing several benefit providers without a unifying resource or any personalization options. The company’s benefit card is usable everywhere VISA is accepted. In an era where the competition for talent has become relentless, Benepass is ensuring that company’s have benefits management solidified for their workforce.

AlleyWatch caught up with Benepass CEO Jaclyn Chen to learn about how she successfully navigated the fundraising process while serving on a grand jury, the company’s strategic plans, latest round of funding, which brings the total funding raised to $14.65M, and much, much more…

Who were your investors and how much did you raise?

$12M Series A led by Threshold Ventures.

Tell us about the product or service that Benepass offers.

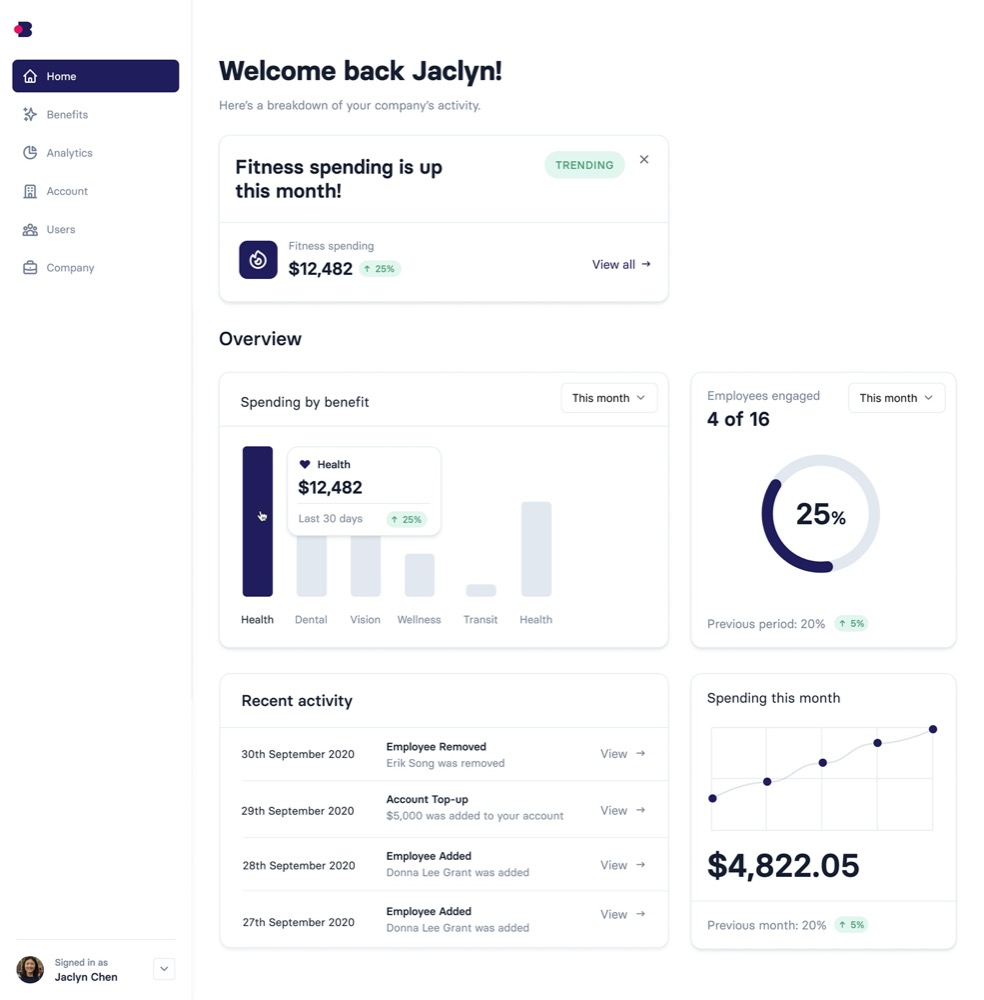

Benepass helps companies take care of their people. With a single card + mobile app, Benepass consolidates multiple benefits into a single platform, making benefits flexible, intuitive, and easy to use. With Benepass, companies can scale efficiently and say “yes” to a diverse set of employee preferences.

We currently support pre-tax benefits (e.g. HSA, FSA, Dependent Care, Commuter) and a variety of perks & stipends (e.g. physical and mental wellness, remote work, professional development, lunch).

What inspired the start of Benepass?

My cofounders and I previously worked at big corporate companies that have great benefits. But most corporate employees have a rather impersonal intranet page of a bunch of logos & discounts. If one specific perk isn’t useful to you, then you’re out of luck, which isn’t a great experience for employees.

For me personally, I remember when I experienced a family member suddenly passing away. It was a difficult time, and it impacted my well-being. The free lunches, Uber credits, gym memberships were great perks, but suddenly those seemed less important. I would have really appreciated help paying for last-minute airline tickets or grief counseling. But how could a company predict that? While I certainly hope that no one else has that same experience, it would have been incredible to get personalized support at that moment.

We’re building the employee benefits experience that we wish we would have. The experience should be delightful, personal, and meaningful. When we talk to HR/People Ops teams, that’s their goal too. With their existing set of tools, that’s been nearly impossible to date without taking on a significant admin load. And that’s where Benepass comes in.

Our mission is to help HR/People teams reimagine benefits for their teams and to give them the tools to make that easy.

The financial infrastructure underpinning our platform allows us to personalize the benefits stack for HR/People teams in a way they’ve never been able to before. We can take a specific theme such as mental health or financial health – and mold a package that fits their team. We can handle a lot of complex eligibility rules for both employees and their benefits.

In addition, our cards work everywhere VISA is accepted, which is a game-changer for companies growing internationally because they deliver an equitable experience.

We sweat the details in areas that have historically created significant admin load, such as automating directory sync, imputed income reporting, nondiscrimination testing… all the things behind the scenes that are essential for any enterprise.

What market does Benepass target and how big is it?

We serve mid-market and enterprise companies. Companies we partner with typically have several hundred to several thousand employees, spread through multiple locations domestically and internationally with remote teams, and are fast-growing.

What’s your business model?

Companies pay a monthly fee per enrolled employee. We also make interchange revenue for every dollar transacted on Benepass cards.

What are your post-COVID office plans??

We are committed to a fully distributed team. Our team is currently spread throughout the U.S., Brazil, Chile, and Canada.

What was the funding process like?

Fortunately, it came together rather quickly, and the investors I reached out to were all very respectful of our time together. Coincidentally I was called for grand jury duty in New York City, and I served 4 weeks while fundraising. I would talk to investors during lunch break and after hours. Talk about context switching! I gained a ton of appreciation for human ingenuity in crafting our legal system. But also, it was emotional for me to see firsthand the terrible things humans do to one another and the inequity in the system.

Fundraising is a tool to help us scale the business – it’s not a milestone in it of itself. I tried to maintain that mindset and return to the business as quickly as possible. I have a personal relationship with Mo – we’re business school classmates – so we had implicit trust right away. I knew it was the right fit early on.

I don’t want to glorify the process though – I was a complete stress case throughout. I don’t think I slept for 4 weeks.

What are the biggest challenges that you faced while raising capital?

Managing stress levels. I’m a first-time founder, and fundraising feels incredibly high stakes. I had a ton of questions about how to navigate it – when to say what, how to negotiate, what was expected of me in terms of prep, when I could push back. Fortunately, I was able to rely on a few other founders who had recently raised rounds, and they helped coach me through the process, which was invaluable. I am looking forward to passing that wisdom onto other founders in my network.

What factors about your business led your investors to write the check?

The “why now” for our business is compelling. COVID has sped up decades of hybrid work, which multiplies the challenges companies already face in trying to serve the many different personal needs of their growing workforce. To scale their benefits programs yet maintain the personalization that stands out in a tight talent market – it requires a platform like Benepass.

In addition, we were able to partner with fast-growing, enterprise clients, like Jamf, Bright Health, Wix, and Mural within the first year and a half of starting our business and quickly prove not only our value to them but also our enterprise readiness. We’re already serving employees in over 30 countries.

What are the milestones you plan to achieve in the next six months?

We’re rapidly growing and looking forward to serving more employees with Benepass. That means up leveling every function within the company. It’s an exciting time to build and scale the company.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Regardless of capital, early-stage companies must prioritize well. Raising money means you get to tackle more things on your list and to experiment in your approach with a greater safety net. If you don’t have that safety net, then you tackle the highest priority item only. In the early days, it is all about delivering ROI to your customer, which is basically proving why you should exist as a product or service. Now that we have a good sense of that, it’s about scaling that initial fit into a company. Everything else is a lower priority, so you don’t spend resources or capital there.

Where do you see the company going now over the near term?

We’re expanding our capabilities and adding features to help employees and HR admins. This includes additional admin capabilities, integrations, and internationalization, and growing the team.

What’s your favorite outdoor dining restaurant in NYC

I live close to La Pecora Bianca in NoMad, and it’s basically taken over Broadway on that block. I love their pasta.