Over the last few years, our team has been taking a close look at other ecosystems as we contemplate our expansion beyond our New York roots. Presently, we provide hyper-local tech coverage for London, Los Angeles, Paris, and Boston, in addition to New York through AlleyWatch.

As a part of our research, we are chronicling some of our experiences as we have been fortunate to visit several growing ecosystems. Today we recap our recent visit to the island nation of Bermuda.

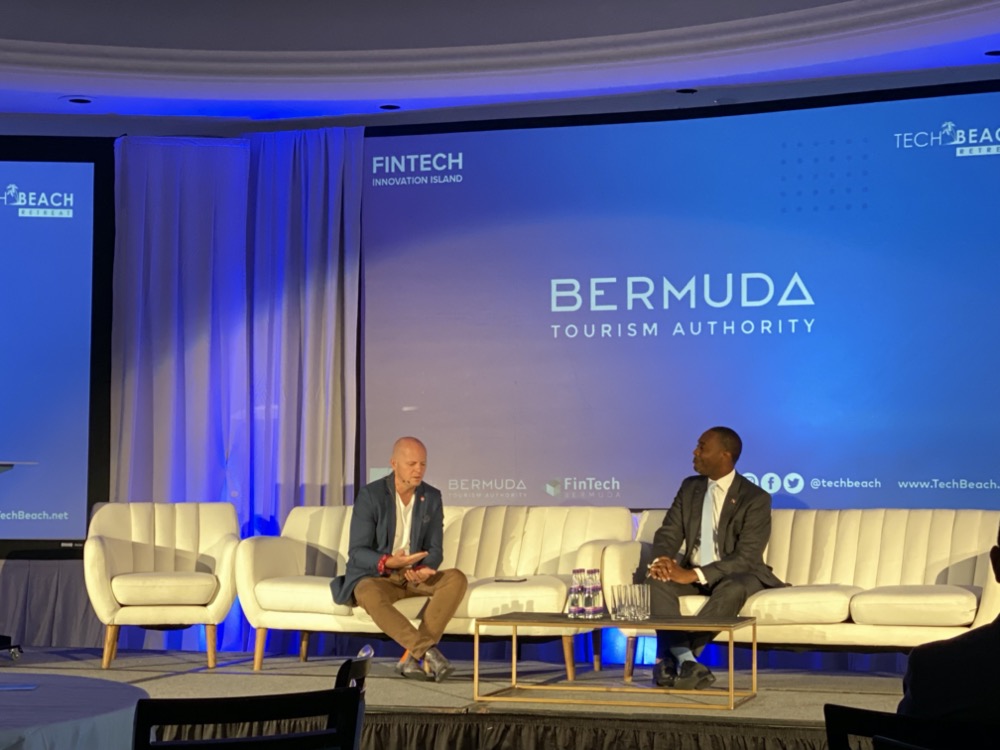

Fresh off a 90-minute direct flight from JFK, I landed in Hamilton, Bermuda for the Tech Beach Retreat Bermuda hosted at the Hamilton Princess, which sits on the picturesque waterfront of Hamilton Harbor. I had the pleasure of speaking at the two-day conference, which this year was focused on Fintech. From beginning to end, I was immersed in the Bermudian business scene, interacting with leaders both from the local ecosystem and abroad. The central focus on the conference, which anchored Bermuda Tech Week, was how Bermuda can emerge as a Fintech innovation center and model for the Caribbean region as the country moves into an era beyond its traditional reinsurance roots. This a national strategic imperative and that was readily apparent from the localized programming. Before we look at the future, it’s important to look back at Bermuda’s rise in the (re)insurance space.

The first insurance company was formed in Bermuda in 1947, shortly after World War II ended. The 1960s and 1970s led to the formation of many insurance companies on the 20-square mile island and the natural disasters of the 1990s and 2000s brought in an influx of capital to the reinsurance business. The growth of the insurance industry has been supported by intellectual capital as Bermuda has the highest per capita concentration of actuaries, accountants, and underwriters amongst its population that’s just over 65,000. The speed, convenience and efficiency of the insurance industry in Bermuda has led to its meteoric growth and one of the catalysts for this growth is the Bermuda Monetary Authority (BMA).

This body is responsible for the regulation of the financial services industry in the island nation and any company that wants to conduct business in Bermuda. The regulatory framework that BMA has developed is known as the global gold standard when it comes to compliance, risk, and security for insurance assets (if it passes scrutiny in Bermuda, it’s ready to be global) but it’s also flexible in its ability to closely work with companies to ensure compliance from application to certification. This one-to-one serviced-based interaction with a regulatory authority wouldn’t be possible in a larger country without bureaucratic complications; costing time and efficiency. The authority has a proven track record of solving sophisticated regulatory issues for the largest insurance companies in the world. And closer to home, for startups, the BMA has developed separate programs to foster innovation within the insurtech field in Bermuda – both Regulatory Sandboxes and Innovation Hubs. These programs are designed to allow companies to test new technologies or business models with a limited number of clients in a controlled environment within Bermuda for a limited period of time and then scale these solutions to the rest of the world.

These innovation programs where companies are able to work closely in conjunction with the regulators have set the foundation for the development of a robust Fintech ecosystem. Over the course of two short days, I was able to personally interact with the several ministers and the Premier himself, David Burt, who is only 40 years old. Most of the members of the government that I encountered are relatively young, forward-thinking, and educated in the US. They understand and have a vision for the role that technology will play in Bermuda’s development well beyond their administrations. During Bermuda Tech Week, the government announced plans for two initiatives that have not been done elsewhere – payment for government services in a 1:1 USD-pegged stable coin on the Blockchain and also a Blockchain-based national ID system. In fact, Bermuda was the first nation to provide any sort of governance for initial coin offerings and digital asset regulations.

With a history of understanding risk, the country is well poised to understand the risks that innovation will bring and is focused on housing that innovation within its shores. For its own internal innovation needs, the country has embraced the reliance framework where speed is key and leverages the private sector with partnerships. The private sector is allowed to use Bermuda as a real-life regulated testing ground in a close contained environment with the help and clout of the relevant stakeholders and regulatory bodies. This paradigm breeds innovation and world-class talent that hopes to one day drive progress and innovation for the entire Caribbean and globally. If you’re building in the Fintech space, it’s worth keeping an eye on the progress that Bermuda makes as being the next destination for your startup to operate in as finance as we know it is being reimagined.

A special thanks to Kirk-Anthony Hamilton and Kyle Maloney, (Founders of Tech Beach Retreat), and to the entire Tech Beach Retreat team for the hospitality during my trip. In a short time, these two energetic entrepreneurs have produced several word-class events that are showcasing innovation and opportunity in the Caribbean.