Bancor hit the market with a splash in June, 2017, when it raised a (then) record $150 million in an ICO.

At it’s core, Bancor is a set of formulas that solves the liquidity problems faced by most tokens. Bancor works by creating a token that is connected to shared liquidity pools on the blockchain. The way the math works, the formulas are essentially hard coded two way price elasticity of demand functions. If it sounds complex, it is because it is complex, but so are many algorithms.

There’s been a lot written about Bancor, most of which has been negative. The most notable negative story was Emin Gün Sirer’s “Bancor is Flawed”, which was a 29 point takedown of Bancor. While Bancor Product Architect Eyal Hertzog penned a well written response to each of the Emin’s 29 points, I found it odd that not one of Emin’s 29 points directly addressed the set of formulas that power Bancor, which is really the only thing that matters (IMHO).

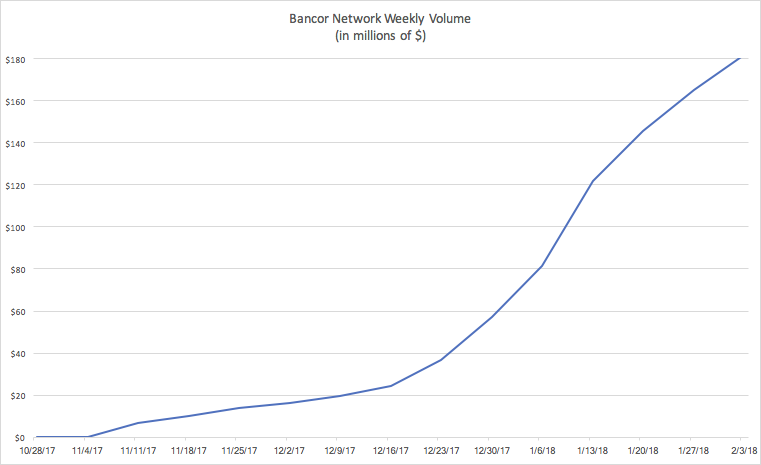

Now it appears that the tide of public sentiment for Bancor is turning, as the market focus shifts from hypotheticals, to what is actually happening. Last week, Coindesk featured the article “Bancor Bounce Back?” which highlighted that Bancor’s volume rose from “…$3 million per week in November to $37 million per week in January”.

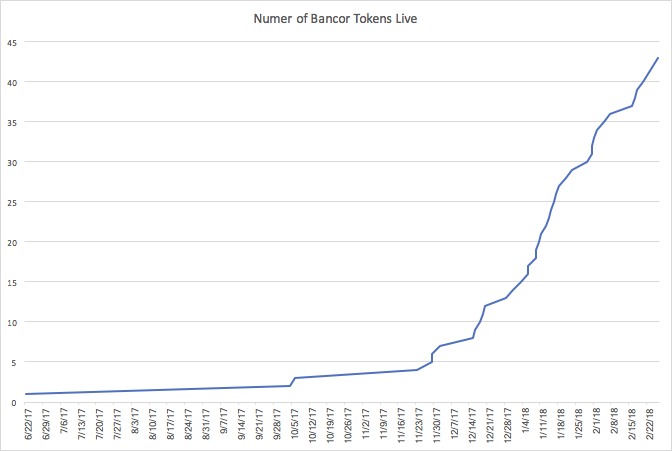

Below I look at some additional data which speaks to the rate at which the Bancor platform is scaling.

- There are now 43 tokens traded on the Bancor platform, up from 3 at the end of October and :

This includes a Top 10 coins ETH (which is the most active token on the platform) and EOS, as well as Top 20 coin OMG.

2. Weekly trading on the Bancor platform has been rising week-after-week, more than tripling since the beginning of the new year:

3. Per CoinMarketCap, over the last 24 hours (as of the writing of this post), Bancor is one of the leading liquidity providers for multiple coins including Storm:

Kin:

and TaaS (Token-as-a-Service):

So the bottom line is, Bancor’s liquidity solution appears to be working, and as a result, the number of tokens on the network is growing and the volume is growing. This is good news for Bancor and good news for the entire crypto ecosystem, which needs liquidity to thrive.