As a financial analyst it is impossible to follow every breaking news story as it happens, and you often have to trust that mainstream sources are doing a good enough job. But if you are not able to settle for ‘good enough’, and want curated breaking news that is comprehensive and accurate, you need Accern. Monitoring over 300 websites, Accern brings you up to date news on U.S public companies faster than anyone else. With the largest public financial news coverage and the largest selection of financial news analytics, Accern is successfully disrupting Fintech.

AlleyWatch spoke with cofounder and CEO Kumesh Aroomoogan about the startup and their process of raising a new round of funding.

Who were your investors and how much did you raise?

We raised $1.25M in Seed funding from Rostra Capital and VYL LLC, but we had a host of participating firms and investors including: Gurtin Ventures, 26 Ventures, Belmont Capital, Affinity Investment Group, IBM, Harvard Management Company, Shenkman Capital, and Asher Fried.

Tell us about your product or service.

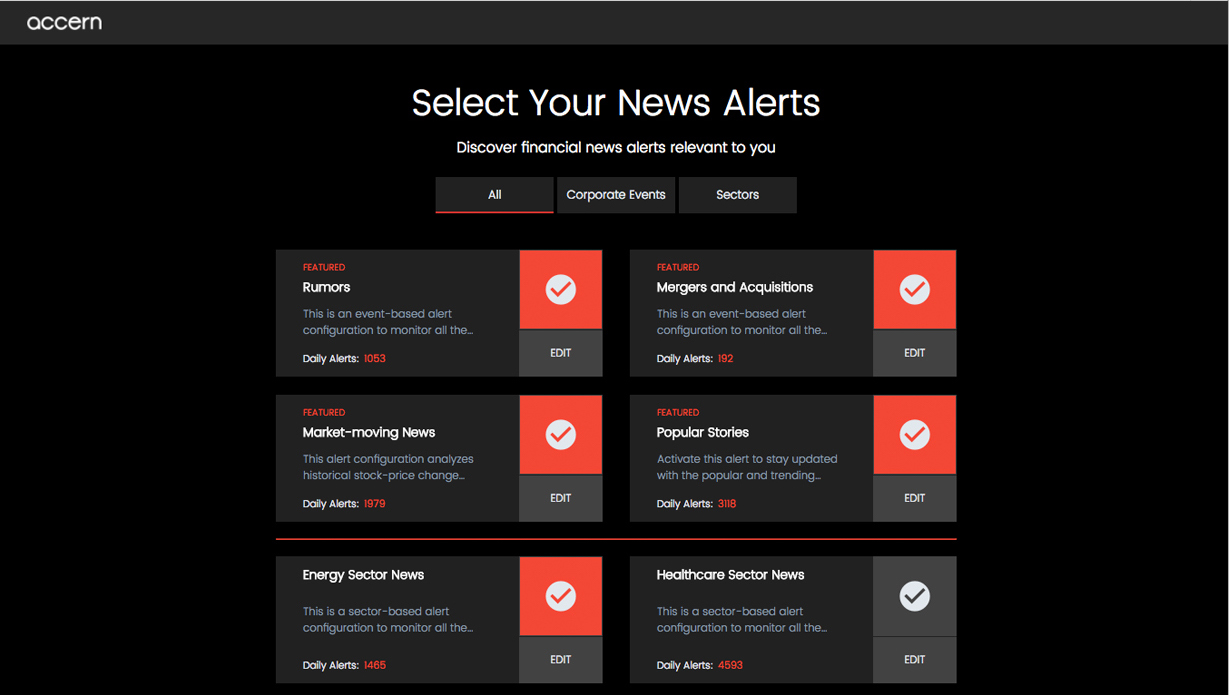

Our product currently monitors over 300 million websites (all public news, blogs, social media websites such as Twitter) and it curates the news for the most relevant stories. Right now we’re working with many multibillion dollar hedge funds and banks to consolidate all their existing news subscriptions feeds into a centralized news platform (the Accern platform) and then we curate the news using our artificial intelligence technologies to help them find the most relevant stories on stocks they are tracking.

What inspired you to start the company?

I used to be an equity researcher at Citi and I used to monitor multiple news feeds (Bloomberg, Thomson Reuters, Dow Jones, etc.) on multiple screens to find actionable information on a stock. Sometimes major news happens and you don’t realize it in time because there is no signal that says “Hey pay attention to this news”. So the idea sparked from this. It would have been good if I could consolidate all the news I am looking at on multiple screen into a single platform and then set critical alerts so it automatically alerts me of major news events right away. Also at that time my cofounder Anshul was doing something similar with news but dealing with the United Nations.

How is it different?

You can think of our technology as 80 percent out-of-the-box and the rest of the 20 percent is customized based on customers’ requirements. By applying this 20 percent customization strategy, we automatically create a customer that will stick with us for a while and will be happy to sign multi-year agreements because of the value we created for them. They simply will not get the same value from other competitors that sell out-of-the-box news solutions.

Additionally, we have the largest public financial news coverage (300 million websites), we have the largest selection of financial news analytics (12+ news metrics), we have the fastest on-premise deployment to process internal documents (4-6 weeks), the have the fastest news processing time (40 ms per article) and the highest customer lifetime value compare to competitors (custom solutions).

Our automated sales method keeps us lean and outperforms competitors’ sales forces.

What market you are targeting and how big is it?

We are currently targeting the financial service industry specially the banks. The financial industry alone is $50B+ when it comes to solutions like ours.

What’s your business model?

Accern offers out of the box and custom services. Standard packages are $500mo/per while the custom solutions vary in pricing based on company news-related needs.

How has the pace of news changed in the last 5 years?

It has been increasing year to year tremendously and many of our customers are complaining that they are getting overwhelmed with news. We are here to help them through this by building artificial intelligence curation technology to help them pinpoint what actually matters.

What was the funding process like?

It was very quick. We had a lot of traction and plus we bootstrapped to a good amount of revenues so many investors were very interested. We got over subscribed within 3 weeks of starting the fundraising process.

What are the biggest challenges that you faced while raising capital?

Once you have good amount of traction, raising capital should not be challenging. However, the biggest challenging is finding the right investors to go with because they will stick with you for the long term.

What factors about your business led your investors to write the check?

Our pipeline of deals with banks and fortune 500 companies. Also a big part was our existing team and current clients that we have bootstrapped and built up.

What are the milestones you plan to achieve in the next six months?

In terms of product, we would like to expand the asset classes we are tracking news on to 12,000+ global equities, commodities, forex, macro, and 1 million+ private companies. In addition, we would like to expand our data coverage to some premium news feeds and other social media feeds.

What advice can you offer companies in New York that do not have a fresh

injection of capital in the bank?

Bootstrap and build up a solid pipeline list. If customers say we are willing to pay for your product but you don’t have the resources to handle those customers – then it’s the right time to raise.

Where do you see the company going now over the near term?

Within 3 years, we are hoping to be set for either an IPO or an acquisition. During those 3 years, we will consider expanding our news analytics from English-only to most of the popular languages (Russian, Spanish, Chinese, etc.). We’ll also be on the lookout to acquire data startups that could help save us time, decrease the risk of dependency, and help us stay competitive. In addition, we will experiment in multiple verticals that could benefit from our technology aside from financial services, such as public relations, news media, and government intelligence. Simply put, we plan on being a one-stop solution for all enterprise news analytics needs.

Where is your favorite bar in the city for an after work drink?

Great question. Monarch Rooftop or Le Bain.