FundingPost has been connecting entrepreneurs with angel investors and venture capital funds worldwide for 15 years. They showcase entrepreneur company profiles to a pool of over 8,000 accredited angel investors, venture capitalists, family offices, and corporate venture funds representing over $107.69 billion through successful events in 23 cities. Founders Joe Rubin and Howie Schwartz are also active angels and investors. Last week, they hosted the 4th Annual Food Investing Conference in New York City.

The packed event featured three informative panels and a breakfast workshop.

- Early-stage food and food-tech investing: How to meet investors, pitch them, and what it really takes to get them to write you a check

- Growing your food or food-tech business: Protecting and selling your product, and positioning it for a capital raise

- Using crowdfunding to raise capital for your food company

While food may be the new thing for entrepreneurs and investors, the food industry is extremely complex, diverse, and high risk. It is an ongoing challenge to find an inclusive way to cover all aspects of food production and sale. Food entrepreneurs need to employ a sustainable set of strategies and tactics to succeed in raising capital.

It is becoming common to pursue both traditional and non-traditional sources of capital. Savvy entrepreneurs are gravitating towards hybrid models that are a combination of any of the following eight capital sources:

- Bootstrapping

- Friends and family

- Crowdfunding

- Accelerators

- Angel investors

- Venture capitalists

- Family offices

- Corporate investors

All investors care about the success of your company. As an entrepreneur, it is important to have a clear picture of what you need and align the capital sources accordingly. Raising capital is about developing relationships and nurturing partnerships, not just seeking investors. The common entry point into each capital source remains the same; the dreaded “pitch.”

The quest for the perfect pitch brought many brave entrepreneurs to the forefront of a panel of four seasoned investors at the breakfast workshop. In an engaging live session, entrepreneurs presented their pitches while the panel deconstructed and advised on formulating a clean and concise pitch.

In our digital age of increasingly short attention spans, the focus of the pitch is to quickly convey the critical information that investors need to hear to make an educated decision on funding your company at its current stage.

“Investors are pinched between two kinds of fear: fear of investing in startups that fizzle, and fear of missing out on startups that take off” – Paul Graham, Founder, Y Combinator

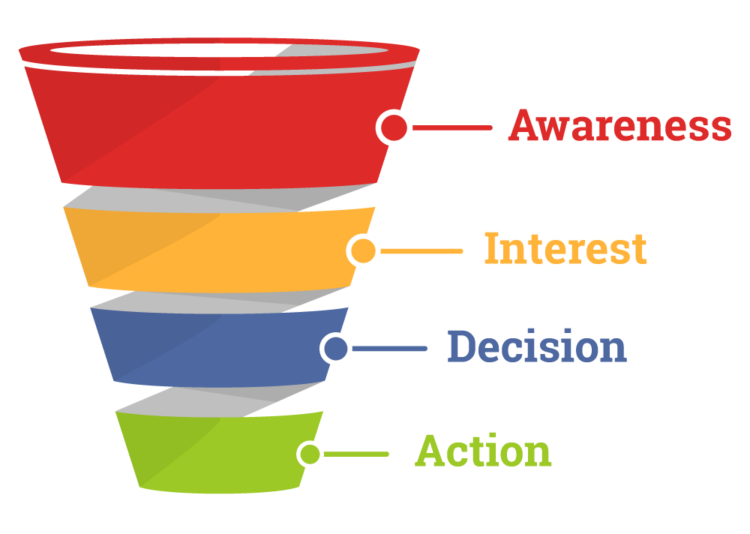

The purpose of the pitch is to communicate in a simple, clear, and concise manner to develop interest in your product and brand. The perfect pitch is effective if it elevates the encounter to the next level; usually a meeting. The perfect pitch funnel leads both the entrepreneur and the investor through the communication journey of awareness, interest, decisioning, and action.

Bring Awareness

- Be driven, authentic, open, and confident. Bring your passion, ability, and thoughtful reality.

- Introduce yourself. It is helpful to research your audience in advance.

- Start with what you do. Categorize your company.

- Be clear about who you do it for. Pick a segment or a demographic. Show that you know your customers.

Develop Interest; tell a story

- Explain why does the product exist. Be specific about the problem that you solve.

- Cover how the product is positioned against current or potential competitors. Call out the differentiators.

- Note the market opportunity and business model. Use statistics.

Highlight Decision Points; don’t get into minutiae

- Explain how you will go to market. Explore traditional and alternate approaches.

- Communicate your growth plan and how it can be sustained.

- Be clear about your exit strategy. Consider alternate avenues such as royalty and dividends, in addition to traditional buyouts.

Prompt Action

- Be specific with your ask.

- Re-introduce yourself so they will remember. Ask for feedback, if given the opportunity.