Life is not always cut and dry and individual needs have to be taken into consideration in order for justice to be in place. At Crediyo, this is precisely what they strive to do by understanding exactly the financial and emotional needs, as well as offer incentives to individuals for being a good patient.

CEO Leonard Hinton and Director Alana Levy, tell us about the startup ahead of BluePrint Health’s upcoming Demo day.

Tell us about the product or service.

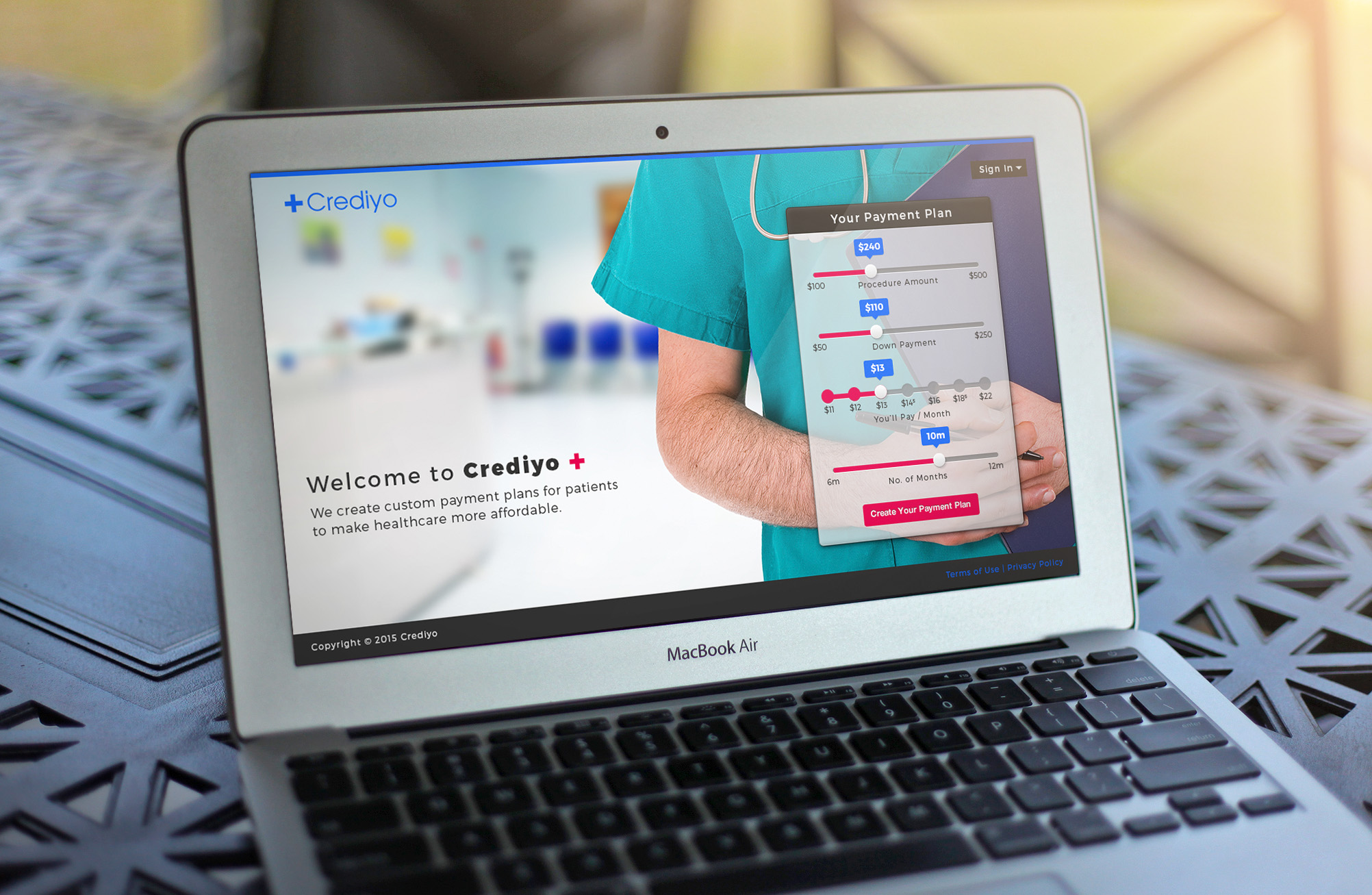

Crediyo helps patients pay for their out of pocket medical expenses (e.g. their deductible) by giving them access to completely customized, low interest credit products at the point of service. Additionally, Crediyo pre-funds healthcare providers on behalf of their patients, giving medical practices immediate access to cash flow. Overall, we create a retail-like pricing, billing, and credit experience at the point of service, where prices are transparent, patients are rewarded with discounts for positive repayment behavior, and providers collect more.

How is it different?

Crediyo helps providers collect more, removing the need to send unpaid patient medical bills to collections. Our proprietary underwriting model and analytics platform scores each patient individually, not only improving our ability to score each patient’s propensity to pay but also allowing us to approve more patients- even those with poor credit or limited credit histories.

What market are you attacking and how big is it?

We are attacking the growing market for patient out-of-pocket medical expenses. Patient balances will account for $180B by 2018. Nearly half of Americans cannot afford a $1,500 emergency expense. We believe there’s a huge need for our product to help those with higher deductibles, which can now top $5,000, pay for their medical expenses.

What is the business model?

Similar to other marketplace platforms, Crediyo charges an origination fee for loans created on its platform. The origination fee is incurred at the time the loan product is created/funded. In addition to the origination fee, Crediyo charges a small servicing fee for consumer payment collection. These fees will be incurred as patients make payments on their outstanding balance.

Tell us about the experience participating in Blueprint Health…

Blueprint Health has been tremendously valuable. Their mentor network is thoughtful and engaged and has helped us think through and solve many very difficult questions. While at Blueprint, we’ve refined our product, ramped up our sales, and gotten a lot of investor attention. We’re also really lucky to be working alongside Blueprint’s incredible portfolio of digital health companies and founders.

What are the milestones that you plan to achieve within six months?

Within 6 months, we hope to sign a major hospital system in NYC as well as a major outpatient/ urgent care chain. We also plan on closing our seed round.

If you could be put in touch with one investor in the New York community who would it be and why?

Josh Kopelman from First Round Capital. First Round is one of the best east coast venture investors we’ve spoken with. They know the space well and have invested in similar companies like Clover Health, Mango Health, CareDox, OnDeck, and Flatiron Health.

Why did you launch in New York?

New York is one of the biggest startup hubs in the world and we’re excited about the number of innovative healthcare companies based here. Alana is a NY native and Leonard is a NY transplant, originally from New Orleans.

Where is your favorite place to visit in the area in the fall?

Storm King in Orange County, NY is absolutely beautiful in the fall. It’s a massive open-air sculpture park that you can wander around for hours.