Where have all the investors gone edition…

Today we take a look at the state of venture capital and angel funding during the all of July, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel/Seed, Series A, Series B, and Series C+).

CLICK HERE TO SEE ALL THE JULY FUNDING DATA

Key Takeaways:

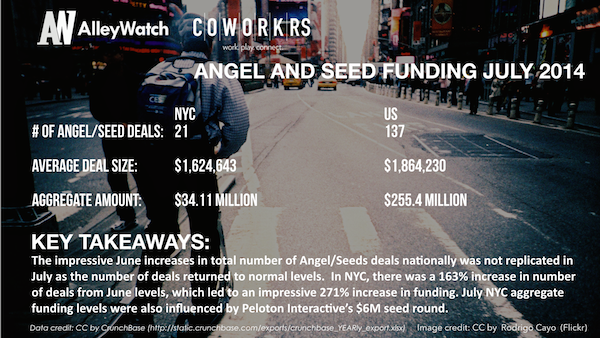

The impressive June increases in total number of Angel/Seeds deals nationally was not replicated in July as the number of deals returned to normal levels. In NYC, there was a 163% increase in number of deals from June levels, which led to an impressive 271% increase in funding. July NYC aggregate funding levels were also influenced by Peloton Interactive’s $6M seed round.

For your tweeting convenience (anyone who tweets from here will receive good funding karma):

Average Angel/Seed round in NYC for July was $1.62M Tweet this

The number of Angel/Seed deals in NYC increased 163% in July Tweet this

Angel and seed funding in NYC was up 271% in July Tweet this

Average Angel round in the US for July was $1.86M Tweet this

Key Takeaways:

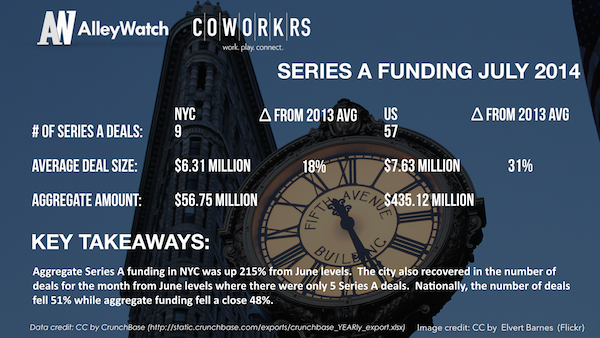

Aggregate Series A funding in NYC was up 215% from June levels. The city also recovered in the number of deals for the month from June levels where there were only 5 Series A deals. Nationally, the number of deals fell 51% while aggregate funding fell a close 48%.

For your tweeting convenience (anyone who tweets from here will receive good funding karma):

Average Series A round in NYC for July was $6.3M Tweet this

The average Series A round in NYC was up 75% in July Tweet this

Series A funding was up 215% in July in NYC Tweet this

Average Series A round in the US for July was $7.6M Tweet this

Key Takeaways:

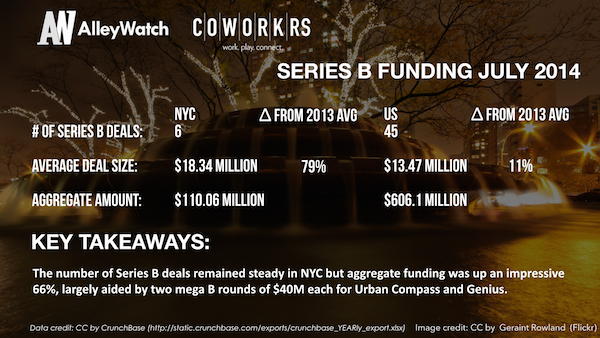

The number of Series B deals remained steady in NYC but aggregate funding was up an impressive 66%, largely aided by two mega B rounds of $40M each for Urban Compass and Genius.

For your tweeting convenience (anyone who tweets from here will receive good funding karma):

Average Series B round in NYC for July was $18.34M Tweet this

The average Series B funding round in NYC in July was up 38% Tweet this

Series B funding was up 66% in NYC in July Tweet this

Average Series B round in the US for July was $13.47M Tweet this

Key Takeaways:

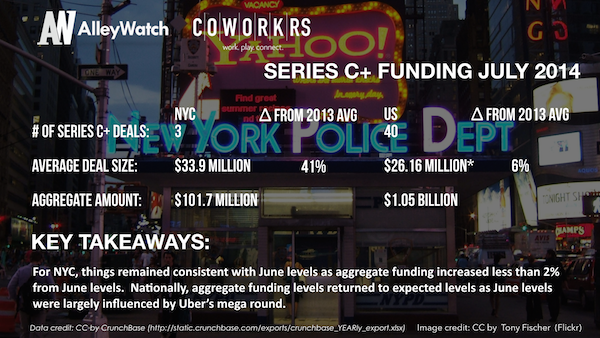

For NYC, things remained consistent with June levels as aggregate funding increased less than 2% from June levels. Nationally, aggregate funding levels returned to expected levels as June levels were largely influenced by Uber’s mega round.

For your tweeting convenience (anyone who tweets from here will receive good funding karma):

Average Series C+ round in NYC for July was $33.9M Tweet this

Average Series C+ round in the US for July was $26.16M Tweet this

Key Takeaways:

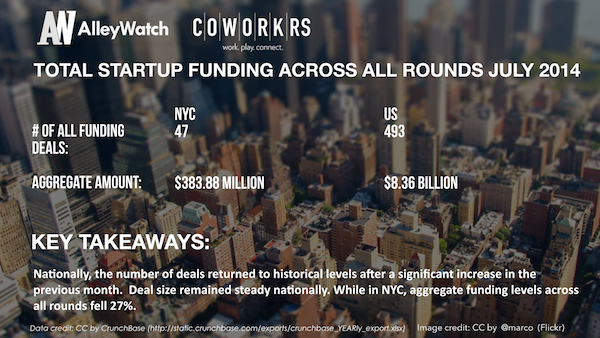

Nationally, the number of deals returned to historical levels after a significant increase in the previous month. Deal size remained steady nationally. While in NYC, aggregate funding levels across all rounds fell 27%.

For your tweeting convenience (anyone who tweets from here will receive good funding karma):

$384M was invested in angel and venture financing for startups in July in NYC across 47 deals Tweet this

$3.6B was invested in angel and venture financing for startups in July in the US across 493 deals Tweet this