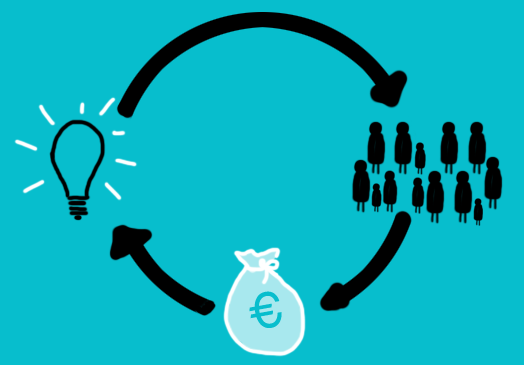

Here at ValueStream Labs, we’ve spent a lot of time thinking about crowdfunding and online lending businesses, which have been making headlines for the past two years. Though revenue crowdfunding sites like Kickstarter have garnered much of this publicity, we’re more interested in the equity investment platforms like AngelList and Funders Club, and lending platforms like Lending Club and Prosper.

Others often ask us if we think the space has become too crowded. The short answer is yes—after all, there are now hundreds of crowdfunding sites. But more sites will survive than you might think. The Internet Startup game has trained us to believe binary outcomes are the norm—if a company can’t hit critical mass, their value will evaporate and a competitor will win the day (and the billions).

Investing has always been a different animal – elements like trust, fear of loss, euphoria of gain, and regulatory complexity have conspired to make a class of companies that play by a different set of Internet Startup rules.

Whenever we look at an online lending or equity crowdfunding site, regardless of the asset class it invests in, we focus on just one number – something we call the Investment Efficiency Ratio:

We use “invested dollar” rather than “interest” when calculating IER because, as anyone who has raised capital will tell you, the chasm between “interest” and “invested” is wide.

In the equity space, the costs to underwrite the investment (such as a Reg D transaction) are plummeting as companies like SecondMarket streamline the regulatory compliance process. Likewise, in the lending space, streamlined digital credit underwriting processes are driving down operational costs as compared to traditional banks. The competitive differentiator of a site lies in how efficiently it crosses transactions – by building trust in deal quality with investors and trust in liquidity and value-add services with companies (not too dissimilar to how a venture capital fund operates).

The IER gives us a sense of whether or not a site has built a proprietary ability to attract both investment dollars and opportunities and to execute on them cheaply. As long as a site has an IER under 1, it will continue to bleed capital.

As an example, generation of online lenders before P2P lending consisted of mostly payday, short-term consumer, and express business credit lenders. Many of these businesses fell victim to IERs lower than 1, as the cost of digital marketing drove customer acquisition costs through the roof (check out the Google AdWords cost for “short term loan”).

In the more traditional Boutique Investment Banking world, the IER multiplied by the volume of business essentially equates to Partner compensation – “revenues” are fees the banker charges, and the “costs” are travel and fixed costs related to pitching companies and investors.

Although there are clear market leaders by volume in Banking and Investing, there is a long tail of participants, each surviving by creating an IER greater than 1. We expect the crowdfunding/online lending ecosystem to evolve in a similar way: a few clear winners and lots of sites that can stay afloat as long as they can beat the magic formula.

What do you think the future of crowdfunding looks like?