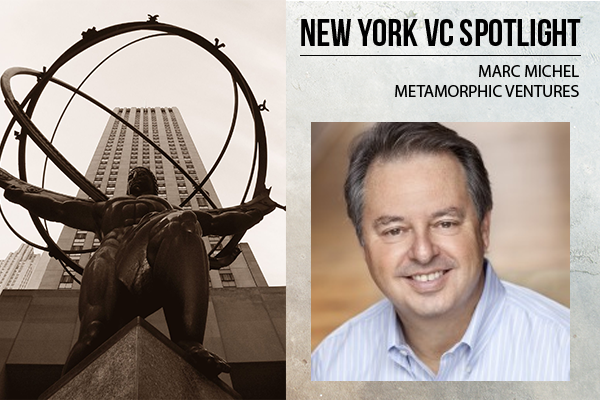

Marc Michel, a Managing Partner at Metamorphic Ventures, has more than 20 years experience as an investor, having been involved in both both private equity and venture capital.

Metamorphic Ventures is a seed-stage VC focused on the intersection of digital media, digital commerce and transaction processing. Michel has helped many entrepreneurs over the years go from startup to ramp to exit,helping them build executive teams, develop operational and corporate strategies, and assist with executing financings. For Michel, helping entrepreneurs survive the rollercoaster ride of building a start-up is why he goes to work every day.

Michel began his career at Merrill Lynch Interfunding Inc., a past investment arm of Merrill Lynch and $1.3-billion middle-market buyout fund. Michel spent 10 years at Merrill, leaving in 1994 to pursue his passion for start ups and founded EOS Partners SBIC, a $60-million venture capital fund. He was then recruited to lead and build TD Capital’s nascent private equity fund focused on media and communications and built this into a $500 million fund.

While at TD, leveraging the internet, voice recognition technology and his knowledge of the healthcare industry, he co-founded Precyse Solutions, a healthcare IT and data analytics company in 1999. Now known as Precyse, the company is still operating – and growing – to this day with revenues well north of $100 million.

Michel worked as President of Michel Capital, LLC from 2003 to 2008, until the founding of Metamorphic Ventures in January 2009.

In his spare time, the investor enjoys playing tennis, golf,, skiing, coaching soccer, watching the Yankees and Rangers, reading, listening to music and keeping up with politics. He is also a part of the National Kidney Registry.

Michel holds a B.A. from Emory University and an M.B.A. from The Wharton School of Business of the University of Pennsylvania.

Sector Focus:

Digital media, technology, media, communications, software, telecommunications, marketing

Selected Investments:

Tapad

Indiegogo

SailThru

Fuze Network

Precyse Solutions

Exits:

Tynt (merged with 33 across.com)

Nearbuy

Thinknear

Aditive

Stamped

FetchBack

OfferIQ (merged with Transactis)

IndustryBrains (sold to Marchex)

Boards:

Michel has served on numerous boards of directors in partnership with management and co-investors.

Expertise:

Venture capital, private equity, digital media, startups, mergers

Social Media Links:

On what investors look for in a startup: “A great team. Not one jockey – a team of people. You’re racing in a big race. The Kentucky Derby, not Yonkers. It’s easier to make money in a bigger market. What’s important? The quality of the service or product: You need all three: the jockey, the race, and the horse.”

On best practices for sharing bad news about a startup with board members or ventures capitalists: “Deliver bad news or personal concerns about issues expeditiously to your backers. We can take bad news a lot better than surprises. The earlier the better so that we can help you strategize through the issues and be your partner.”

On whether or not VCs kill innovation: “VCs are in the business of funding innovation and turning that innovation into a valuable business. We are not in the business of pure R & D for the intellectual curiosity of it. That is a non-profit exercise that is well served by universities or some very large companies who can afford such departments. That said, we often fund a company with one idea in mind and then new ideas emerge and as long as they make business sense, we are more than happy to fund them. I don’t recall saying “no” very often to entrepreneurs with well thought out ideas for a new product.”

On ‘first mover advantage’: First mover advantage implies that one is creating a new category with few other barriers to entry, in that the product isn’t hard to copy on a feature or price basis and so the race is on to gain significant market share traction so that barriers to entry can be created by a) establishing a brand and b) establishing economies of scale that make the first mover much more profitable per dollar invested and allow the first mover to leverage those profits and brand to be the first to iterate and introduce new products. Apple is a classic example of this with their iPod and iTunes product lines, which let them introduce the iPhone and then the iPad.