Today we take a look at the state of venture capital and angel funding during 2013, both in New York and nationally. Analyzing some publicly available data from our friends at CrunchBase, we break down the national aggregate statistics for all funding deals by stage of funding (Angel, Series A, Series B, and Series C+).

Key Takeaways:

Angel funding in 2013 was relatively flat across the board both locally and nationally.

Could this slow growth be setting the groundwork for an “angel crunch” as more and more startups are launched?

For your tweeting convenience:

Average Angel round in NYC for 2013 was $484k Tweet this

Average Angel round in the US for 2013 was $466k Tweet this

$108M was invested in Angel rounds for startups in 2013 in NYC, up 5% Tweet this

$688M was invested in Angel rounds for startups in 2013 in the US, up 6% Tweet this

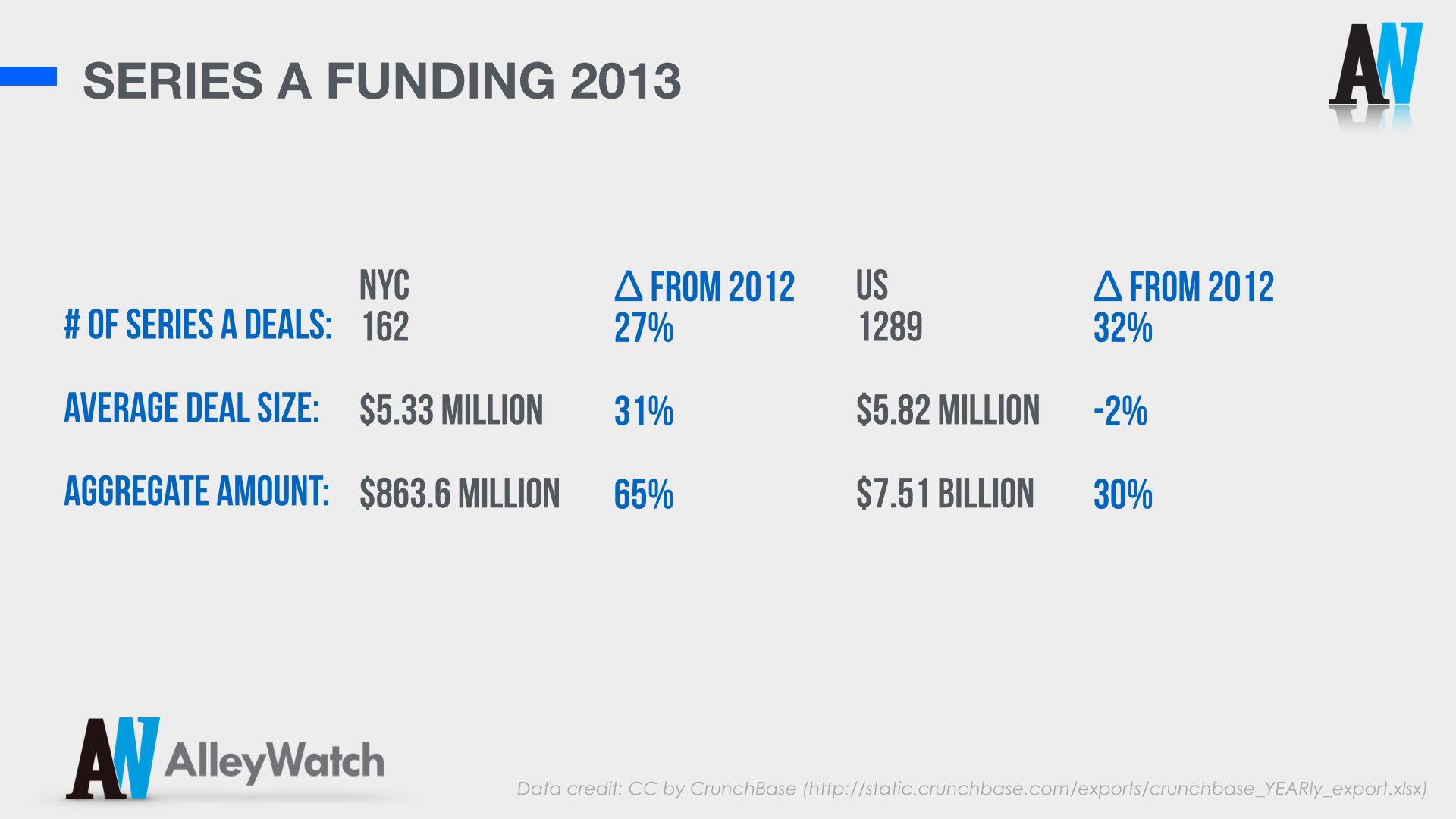

Key Takeaways:

What ‘Series A crunch’? In NYC and across the country, there were impressive growth figures in terms of the number of Series A deals but also in aggregate total Series A capital invested.

NYC exhibited a robust 65% increase in aggregate amount of Series A fundings.

For your tweeting convenience:

Average Series A round in NYC for 2013 was $5.33M, up 31% Tweet this

Average Series A round in the US for 2013 was $5.82M Tweet this

$863.6M was invested in Series A rounds for startups in 2013 in NYC, up 65% Tweet this

$7.51B was invested in Series A rounds for startups in 2013 in the US, up 30% Tweet this

The number of series A deals in NYC increased 27% in 2013 Tweet this

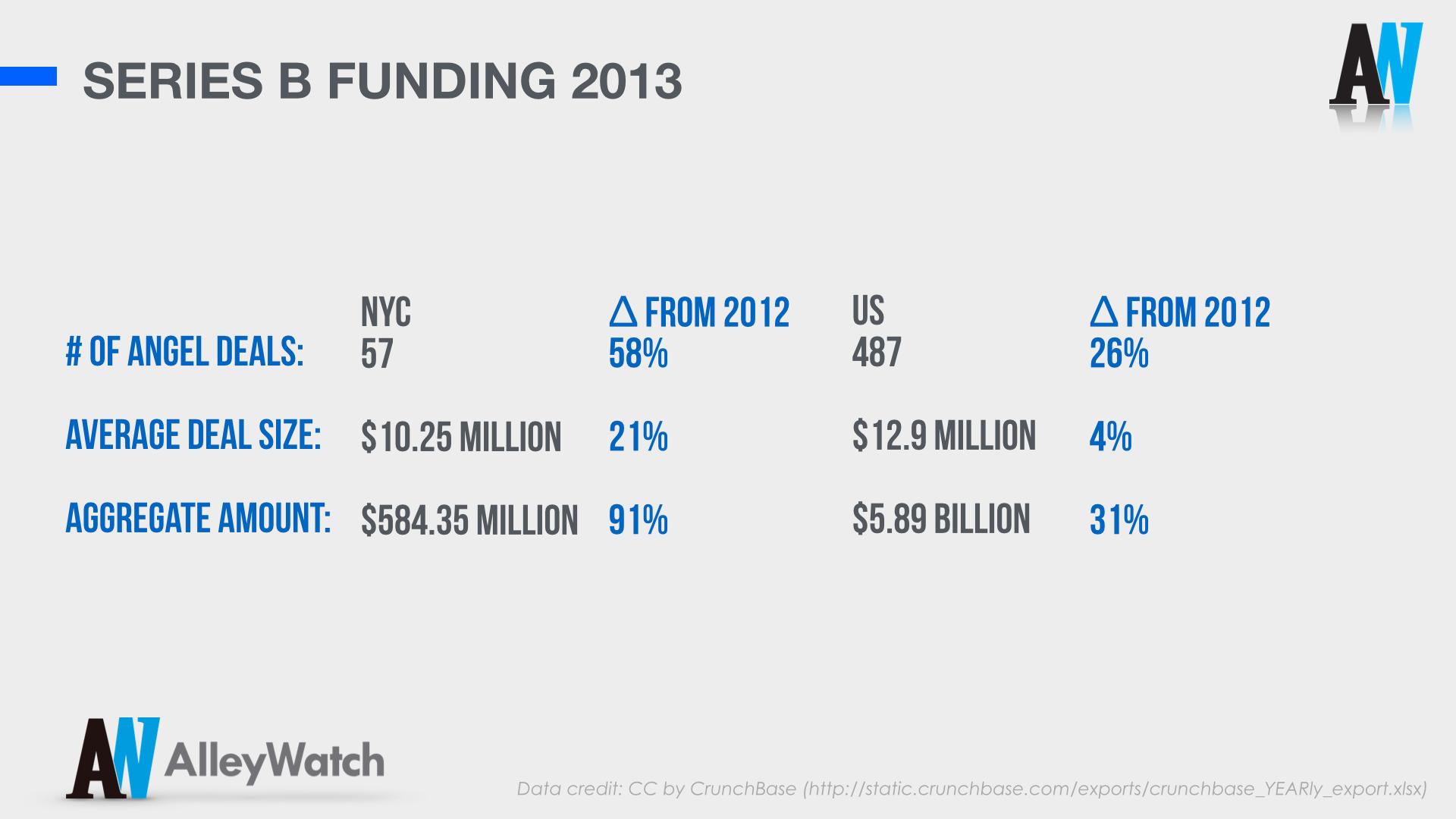

Key Takeaways:

As of recent, NYC has seen a 58% and 91% increase in number of Series B deals and aggregate amount of Series B deals, respectively. Such a whopping increase indicates that there are a number of New York businesses that are really beginning to scale.

For your tweeting convenience:

Average Series B round in NYC for 2013 was $10.25M, up 21% Tweet this

Average Series B round in the US for 2013 was $12.9M Tweet this

$584M was invested in Series B rounds for startups in 2013 in NYC, up 91% Tweet this

$5.89B was invested in Series B rounds for startups in 2013 in the US, up 31% Tweet this

The number of series B deals in NYC increased 58% in 2013 Tweet this

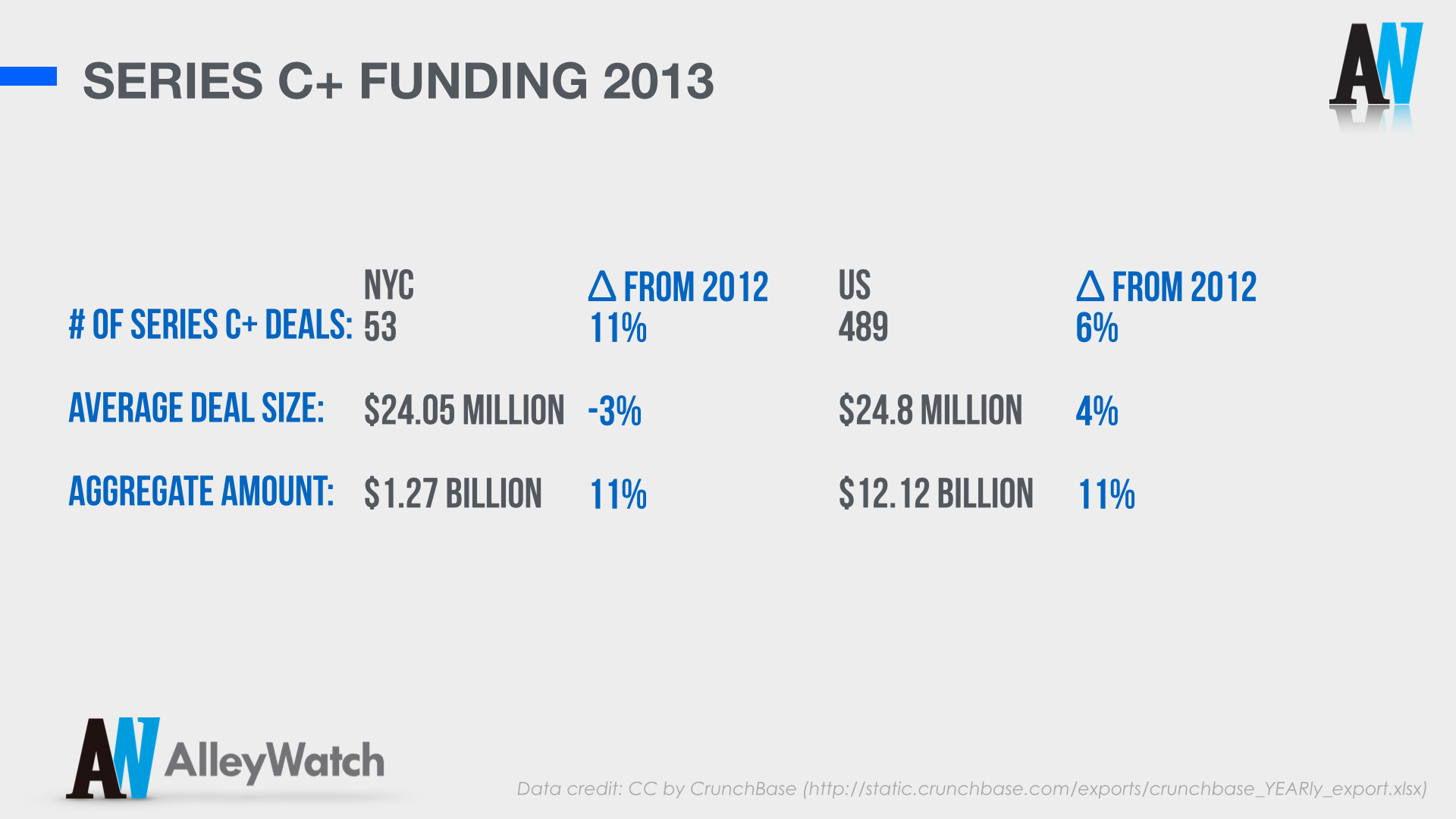

Key Takeaways:

As compared to some other funding rounds, Series C+ deals demonstrated some conservative growth increases in 2013. The pipeline for exits and acquisitions remains robust.

For your tweeting convenience:

Average Series C+ round in NYC for 2013 was $24.05M Tweet this

Average Series C+ round in the US for 2013 was $24.8M Tweet this

$1.27B was invested in Series C+ rounds for #startups in 2013 in #NYC, up 11% Tweet this

$12.12B was invested in Series C+ rounds for #startups in 2013 in the US, up 11% Tweet this

Key Takeaways:

NYC’s massive 82% increase in aggregate funding is a testament to the fertile environment and thriving ecosystem that has been built in this city. Since the bulk of this increase is driven by Series A and B companies, there is a reasonable expectation that as these companies mature, there will be additional growth that will continue to filter through and up the system.

For your tweeting convenience:

$26.2B was invested in angel and venture financing for #startups in 2013 in the US Tweet this

$2.83B was invested in angel and venture financing for #startups in 2013 in NYC, up 82% Tweet this

[ninja-inline id=19544]