Enterprise Resource Planning (ERP) systems are crucial for many companies, centralizing core business processes across various functions such as finance, HR, supply chain, inventory, service, and procurement. However, legacy ERPs, primarily designed in the early 2000s, are struggling to meet the complex demands of modern businesses. Rillet is a cutting-edge ERP solution, leveraging automation to streamline accounting workflows and eliminate the need for manual data entry and spreadsheets. Remarkably, 93% of journal entries in Rillet have been processed without human intervention, freeing finance teams to focus on strategic, high-value work. The platform seamlessly integrates with existing systems, efficiently processing both unstructured and structured data while considering qualitative factors. This capability is particularly valuable given the current shortage of 340,000 accountants in the US and the fact that 75% of accountants are nearing retirement age. Rillet helps alleviate the growing burden on finance and accounting teams, who are facing increasingly heavy workloads.

AlleyWatch caught up with Rillet Founder and CEO Nicolas Kopp to learn more about the business, the company’s strategic plans, recent round of funding, and much, much more…

Who were your investors and how much did you raise? $13.5M Seed from First Round Capital, Creandum, Susa Ventures, Box Group with participation from incredible individual investors including Kevin Hartz (founder of Eventbrite and Xoom), the former Chief Accounting Officer of Facebook and Stripe, and the Controller at Ramp.

Tell us about the product.

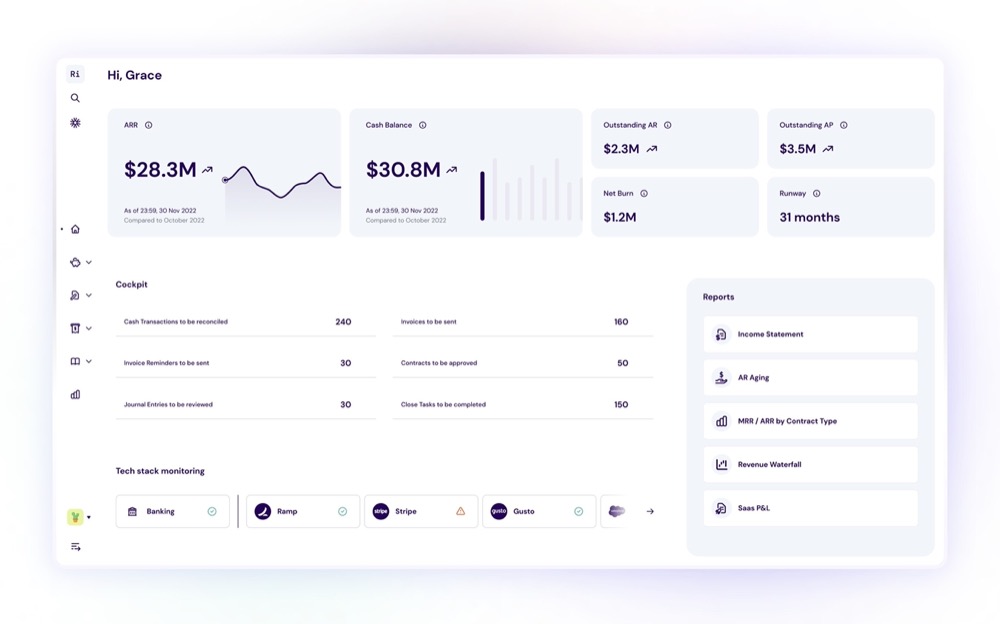

Rillet is the first modern ERP that automates accounting for high-growth companies. We pull in metadata from your CRM, billing, AP, and payroll and automatically create invoices, bills, journal entries, deferred revenue schedules, prepaid schedules, billing forecasts, and many more.

What inspired the start of Rillet?

Personal pain points around reconciliation and how long it took every month to get financials in prior roles. At N26, our accounting and finance teams were always struggling to keep up with their financials and reports. It was really not a human problem… it was really a software problem.

Personal pain points around reconciliation and how long it took every month to get financials in prior roles. At N26, our accounting and finance teams were always struggling to keep up with their financials and reports. It was really not a human problem… it was really a software problem.

How is Rillet different?

Built on modern infrastructure and AI-native vs. incumbents that are 25+ years old. We allow teams to close their books in close to real-time with our automations and give access to powerful investor reporting.

What market does Rillet target and how big is it?

We focus on high-growth tech companies to start with. The immediate addressable market is $10B, and the wider ERP market is one of the largest software categories in the world with $100B+.

What’s your business model?

SaaS software license.

How are you preparing for a potential economic slowdown?

We’re working to support new industry verticals and geographies on our platform.

What was the funding process like?

All up 3 weeks, we were lucky to have a round that was multiple times over-subscribed.

What factors about your business led your investors to write the check?

Very strong customer love (G2 reviews of straight 5 stars and >75 NPS) and a large market.

What are the milestones you plan to achieve in the next six months?

Build out more product functionality, especially on international support and embedding AI across more places in the platform.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Keep making your customers happy, focus on efficient distribution, and good things will follow.

Where do you see the company going now over the near term?

We’re continuing to invest in our product to support our customers and are building out our sales and partnership teams over the near term.

What’s your favorite summer destination in and around the city?

Battery Park City.