Today, I take a look at the state of venture capital and early-stage funding for October 2023 in New York. Analyzing some publicly available data from our friends at CrunchBase, we break down the aggregate statistics for all funding deals by stage of funding (Early-stage [Pre-Seed, Seed], Series A, Series B, and Late Stage [Series C+]) including mention of notable rounds. In order to maintain a focus on tech-enabled startups, this analysis does not include rounds for biotech, real estate, lending startups as well as debt financings.

The AlleyWatch audience is driving progress and innovation on a global scale. With its regional media properties, AlleyWatch serves as the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement in front of, lead generation from, and developing thought leadership within our audience of key decision-makers in the New York business community and beyond. Find out more here.

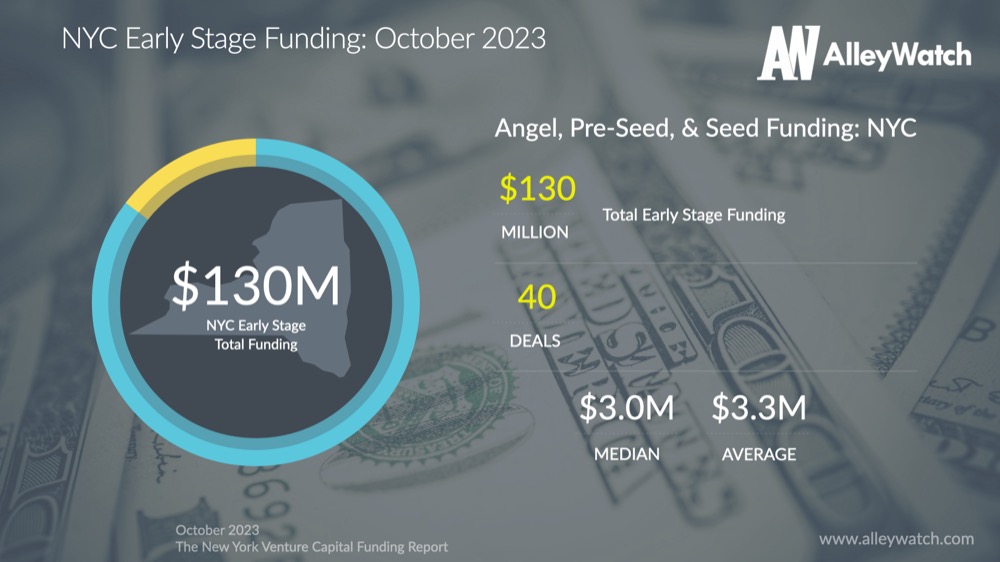

The average Seed round in NYC for October was $3.3M Tweet This

The median Seed round in NYC for October was $3.0M Tweet This

$130.1M was invested across early stages rounds in NYC in October Tweet This

15.32% of early-stage funding nationally went to startups in NYC in October Tweet This

Harvard data scientist upends finance community with returns in this market

The AI revolution has already begun to rewire Wall St, and its impact has been strongly felt in one growing market in particular. Because, thanks to a Harvard data scientist and his crack team, everyday people can now benefit from a previously “off-limits” investment.

The company that makes it all possible is called Masterworks, whose unique investment platform enables savvy investors to invest in blue-chip art for a fraction of the cost. Their proprietary database of art market returns provides an unrivaled quantitative edge in analyzing the art market.

With all 16 of its exits, Masterworks has achieved a profit, with recent exits delivering +17.8%, +21.5%, and +35.0% annualized net returns.

Intrigued? Alleywatch readers can skip the waitlist with this referral link.

LEARN MORE

Investing involves risk and past performance is not indicative of future returns. See important Reg A disclosures and aggregate advisory performance at masterworks.com/cd

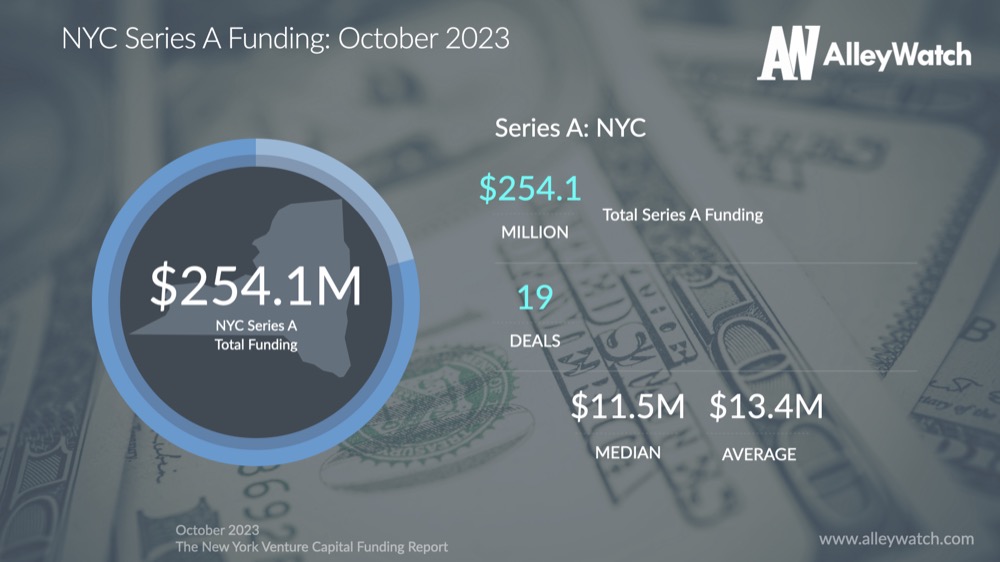

The average Series A round in NYC for October was $13.4M Tweet This

The median Series A round in NYC for October was $11.5M Tweet This

$254.1M was invested across Series A rounds in NYC in October Tweet This

12.02% of Series A funding nationally went to startups in NYC in October Tweet This

The AlleyWatch audience is driving progress and innovation on a global scale. With its regional media properties, AlleyWatch serves as the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement in front of, lead generation from, and developing thought leadership within our audience of key decision-makers in the New York business community and beyond. Find out more here.

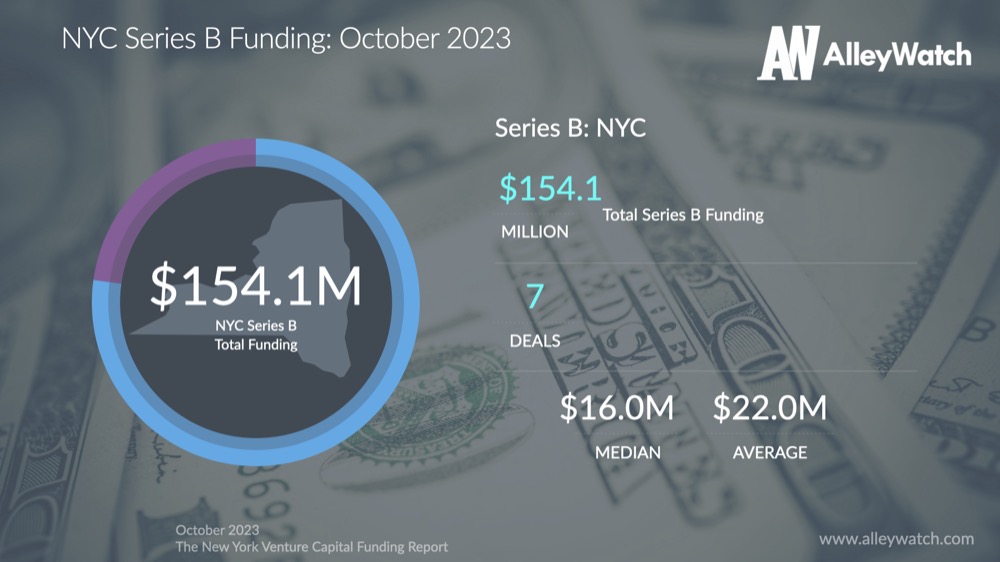

The average Series B round in NYC for October was $22.0M Tweet This

The median Series B round in NYC for October was $16.0M Tweet This

$154.1M was invested across Series B rounds in NYC in October Tweet This

8.2% of Series B funding nationally went to startups in NYC in October Tweet This

Harvard data scientist upends finance community with returns in this market

The AI revolution has already begun to rewire Wall St, and its impact has been strongly felt in one growing market in particular. Because, thanks to a Harvard data scientist and his crack team, everyday people can now benefit from a previously “off-limits” investment.

The company that makes it all possible is called Masterworks, whose unique investment platform enables savvy investors to invest in blue-chip art for a fraction of the cost. Their proprietary database of art market returns provides an unrivaled quantitative edge in analyzing the art market.

With all 16 of its exits, Masterworks has achieved a profit, with recent exits delivering +17.8%, +21.5%, and +35.0% annualized net returns.

Intrigued? Alleywatch readers can skip the waitlist with this referral link.

LEARN MORE

Investing involves risk and past performance is not indicative of future returns. See important Reg A disclosures and aggregate advisory performance at masterworks.com/cd

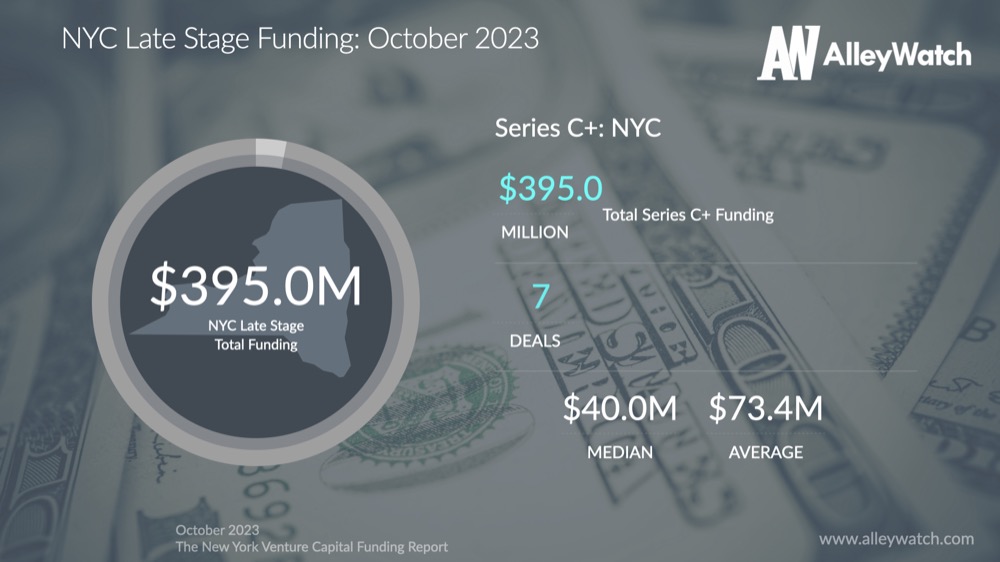

The average late-stage round in NYC for October was $56.4M Tweet This

The median late-stage round in NYC for October was $40.0M Tweet This

$395.0M was invested across late-stage rounds in NYC in October Tweet This

16.82% of late-stage funding nationally went to startups in NYC in October Tweet This

The AlleyWatch audience is driving progress and innovation on a global scale. With its regional media properties, AlleyWatch serves as the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement in front of, lead generation from, and developing thought leadership within our audience of key decision-makers in the New York business community and beyond. Find out more here.

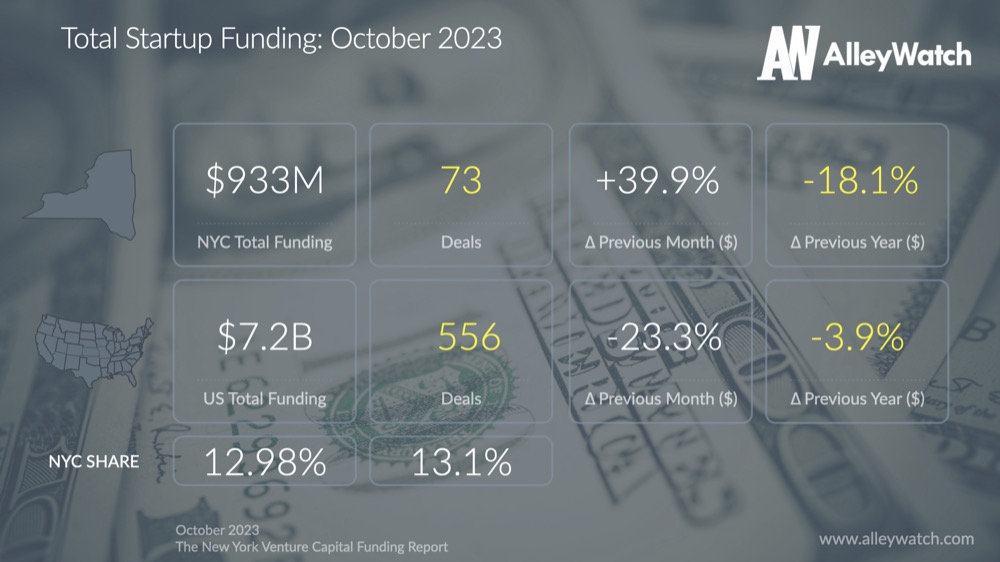

$933.4M was invested in NYC #startups in October in NYC across 73 deals Tweet This

12.98% of startup funding nationally went to startups in NYC in October Tweet This

NYC VC funding in October was +39.9% from last month and -18.1% from the same period last year Tweet This

Harvard data scientist upends finance community with returns in this market

The AI revolution has already begun to rewire Wall St, and its impact has been strongly felt in one growing market in particular. Because, thanks to a Harvard data scientist and his crack team, everyday people can now benefit from a previously “off-limits” investment.

The company that makes it all possible is called Masterworks, whose unique investment platform enables savvy investors to invest in blue-chip art for a fraction of the cost. Their proprietary database of art market returns provides an unrivaled quantitative edge in analyzing the art market.

With all 16 of its exits, Masterworks has achieved a profit, with recent exits delivering +17.8%, +21.5%, and +35.0% annualized net returns.

Intrigued? Alleywatch readers can skip the waitlist with this referral link.