The economy is fueled by global trade and the logistics industry which supports the movement of goods through the supply chain, across multiple modes of transport. The freight forwarding industry alone exceeds $130B per year and is expected to continue growing rapidly through the end of the decade. Despite the critical supply chain implications and high stakes, the industry has largely been reliant on disparate legacy systems and paper and pencil processes. Denim is a financial enablement platform for the freight forward industry that handles working capital financing options as well as operational management through technology, coordinating the activity of freight forwards, shippers, and carriers alike. The platform is versatile enough to be used by freight brokers – large and small – to automate invoices, collections, and payments as well as handle financing needs with approvals in hours. The company has over 400 clients, processed $300M+ in payments, and quadrupled revenue last on the back of strong interest in optimizing all aspects of the supply chain. In conjunction with this funding, the company announced a rebrand; it was previously known as Axle Payments.

AlleyWatch caught up with Denim Cofounder and CEO Bharath Krishnamoorthy to learn more about the business, the company’s strategic plans, latest round of funding, which brings the total equity funding raised to $55.6M, and much, much more…

Who were your investors and how much did you raise?

The $126M Series B consists of $26M in equity financing and $100M in debt financing to provide our customers (freight brokers) with the working capital they need to scale their own operations. The round was led by Pelion Venture Partners and included participation from additional investors Crosslink Capital, Anthemis, Trucks VC, FJ Labs, Tribeca Early-Stage Partners, and Refashiond Ventures. Founders of Project44, Easybib, Kodiak Cakes, PluralSight, Walker Edison, Novo, Fundopolis, Cantaloupe Systems, Deserve and Bounce also contributed to the round.

Tell us about the product or service that Axle Payments offers.

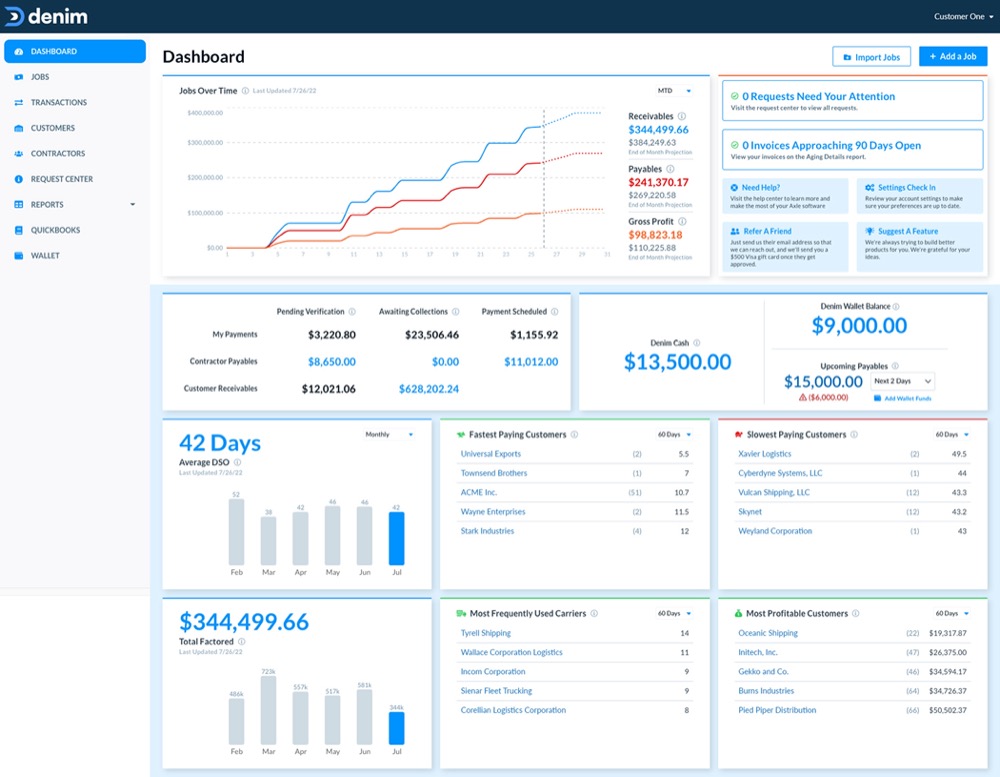

Denim is a financial enablement platform for the logistics industry that offers an ecosystem of intelligent financial products, operations tools, and time-saving automation. Its proprietary technology enables freight brokers to simplify their financing operations and easily access the working capital they need to grow. Denim automates invoicing, collections, and payments — ultimately reducing time spent on daily payments and collections tasks by 75%.

What inspired the start of Axle Payments?

What inspired the start of Axle Payments?

Cofounder and CTO Shawn Vo and I had been friends for ~15 years before we founded Denim (previously Axle Payments). We used to travel up and down the east coast on intercity buses to visit each other all the time and became fascinated with how the economy moves people and goods. While passenger transportation saw a lot of innovation, we quickly learned that few people were talking about freight transportation. We witnessed a significant gap in the freight broker market, where legacy systems (i.e., paper checks, physical filing, et.) were still in place, and we developed an intuitive payments technology to help streamline broker operations and attract the best carrier relationships through the platform.

How is Axle Payments different?

Freight intermediaries are at the center of the U.S. supply chain serving as matchmakers between shippers like Target and Walmart and trucking companies to ensure goods are smoothly moved across the country.

Denim pioneered a flexible and seamless financial enablement platform specific to freight brokers that saves significant time in brokers’ operations. Denim’s platform is a multi-party payment system that both streamlines the factoring process and maintains an industry-leading risk posture.

Unlike vendors who offer a “one-size-fits-all” product, Denim’s platform can be customized to integrate into existing processes for everyone, from startups to enterprise-level freight brokers. Freight brokerages can leverage Denim’s open API to build a personalized tech stack with transportation management systems (TMS) and accounting system integrations.

Factoring has traditionally been an invasive and painful process for brokers and carriers. Denim has disrupted the status quo by building a sleek and modern platform, creating delightful client experiences, and building strong relationships with all members of the ecosystem. Denim’s unique ability to deliver on rapid funding turnaround times and a premier customer service team have resulted in a 4.7-star rating on TrustPilot.

No two loads are the same, and the Denim’s platform reflects that. Through Denim’s unmatched flexibility, clients are able to personalize their experience across collections, carrier payments, and working capital, spending less time on operations and more time on growing the business.

What market does Axle Payments target and how big is it?

Today, Denim is delivering solutions to meet the growing needs of the $134B freight broker market. But our vision is to build a single freight payments network to serve as a common thread for the movement of all goods. That represents nearly $10T globally and nearly $2T in the US.

What’s your business model?

We charge freight brokers a single flat fee on each load, in exchange for automating their core financial operations, financing their carrier payments, and helping them better leverage their data.

How are you preparing for a potential economic slowdown?

Despite the slowdown, Denim is uniquely positioned to continue scaling its platform and workforce. We’ve established a financial model based on healthy unit economics. We’re continuing to bring innovative solutions to the industry and give freight brokers what they need to adapt to changes in the supply chain.

What was the funding process like?

We were fortunate to connect with Pelion nearly a year before we raised the Series B, so we had plenty of time to build a good relationship with them, which allowed them to move quickly when they found out we were raising. They also connected us with a bunch of successful entrepreneurs in their network who co-invested with them. Most of the rest of the money came from our existing investors – our Series A lead invested almost as much in this round as the last. It’s a great sign that the investors who know our business best have the confidence to double down on us.

What are the biggest challenges that you faced while raising capital?

Due to the economic climate, the process of raising funding this time was definitely more difficult. Some investors completely shut down investing for the quarter, so we actually saw some investors pull out after committing to the round. But luckily, we were coming off a very strong year, so we were still able to generate significant VC demand and interest.

What factors about your business led your investors to write the check?

We’re growing fast, and we’re hyper-focused on our unit economics. Last year we grew revenue 4.6x. And unlike many other companies who can show similar growth, we were able to do so while keeping our spending under control. Particularly in this market, investors are keen to find businesses that have strong fundamentals in addition to an exceptional growth rate.

We’re growing fast, and we’re hyper-focused on our unit economics. Last year we grew revenue 4.6x. And unlike many other companies who can show similar growth, we were able to do so while keeping our spending under control. Particularly in this market, investors are keen to find businesses that have strong fundamentals in addition to an exceptional growth rate.

What are the milestones you plan to achieve in the next six months?

In 2022, we’ve more than tripled our headcount and have recruited talent from top employers like Salesforce, BlockFi, and TQL. We’re still actively recruiting for roles and plan to reach 150 employees by the end of the year.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Now is the time to buckle down and focus on execution. Even with this fresh capital in the bank, I’d say we’re in the same boat. No one knows when the capital markets will return to normal, so we’ve all got to squeeze all the value we can out of every dollar.

Where do you see the company going now over the near term?

We’re going to be really focused on product expansion over the next 12 months, and to that end, we will be hiring many people across product, engineering, and data. Additionally, we’ll be building out our partnerships network and scaling our sales team with an eye towards maintaining our historical growth rate.

What’s your favorite restaurant in the city?

Semma in the West Village is the best Indian food. Joe and Pats in the East Village is a family favorite.