Fintech innovation driven by non-traditional finance companies, namely fintech startups, is slowly broaching the moats that have long-protected legacy banking and financial service providers. In particular, innovative payment technologies are transforming the way businesses meet market and customer demand. Main street banks have lagged behind because their innovative capabilities are often hampered by legacy systems. Extend is a financial infrastructure platform that helps banks innovate financial product development with capabilities while working with their existing systems, starting with virtual cards. The company offers three distinct solutions that help banks create new products for their customers, establish partnerships and integrations without heavy technical implementations, and increase the services available to their customers. Currently, Extend is focused on B2B payment solutions but has plans to expand to the consumer arena in the future.

AlleyWatch caught up with Extend CEO and Cofounder Andrew Jamison to learn more about how the team’s experience at leading financial institutions led to the genesis for the business, the company’s strategic plans, latest round of funding, which brings the total funding raised to $54M, and much, much more.

Who were your investors and how much did you raise?

Our Series B round was led by led by March Capital and backed by B Capital, Point72 Ventures, Fintech Collective, Reciprocal Ventures, Wells Fargo, and Pacific Western Bank.

Tell us about the product or service that Extend offers.

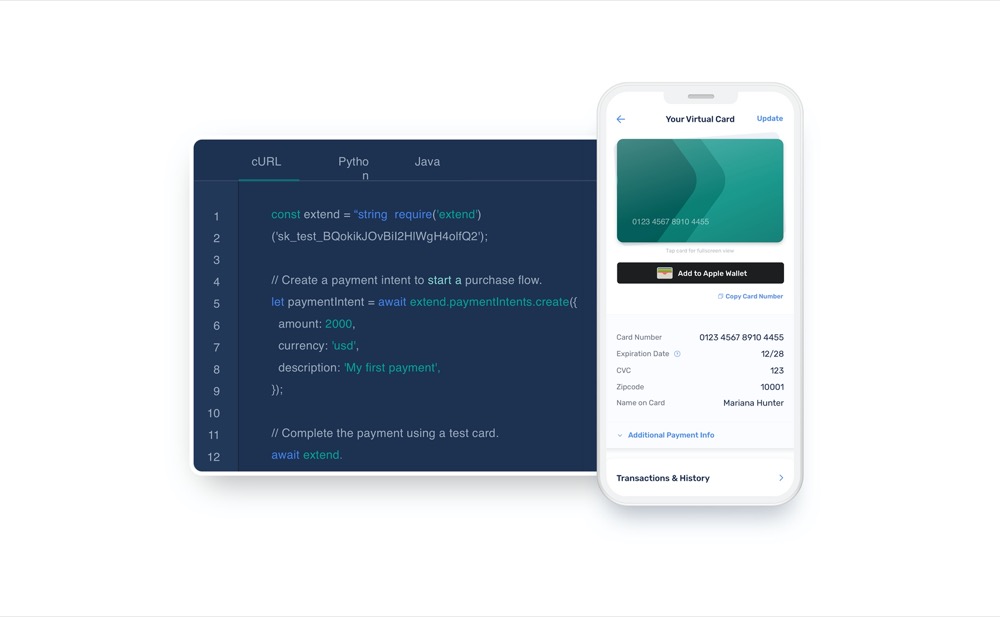

Extend is modernizing banking infrastructure from the inside out. We build our products to fit directly into the framework that supports existing processors and issuers. Our focus is currently on designing virtual card offerings on credit rails. We offer three primary products:

- Virtual card app-as-a-service: Banks can offer business customers a ready-to-use virtual card app alongside their commercial card program—a competitive offering to Brex, Ramp, and Divvy.

- Virtual card issuing APIs: Banks can support custom product development with partners and clients to compete directly with alternative processors like Marqeta and Stripe

- 3rd-party connectivity: Banks can expose key payment services through Extend to support 3rd-party embedded payment integrations. By doing this, Banks can grow the number of partner solutions in which their own payment services (eg, virtual cards) are natively offered to their customers using these platforms (e.g. AP solutions, procurement software, recruiting platforms, etc.).

What inspired the start of Extend?

What inspired the start of Extend?

Guillaume, my cofounder, and I spent more than 15 years working in payment solutions at American Express and other Financial Institutions. With the rise of fintechs and competitive neo-banks, it became clear that existing issuers could not keep up with the pace of innovation and were struggling to meet the evolving expectations of their customers. Building these solutions in-house at a large financial institution has proven to be an insurmountable challenge across the industry. We along with Danny Morrow, our other cofounder and Extend’s CTO, saw an opportunity to build an issuer-agnostic solution to serve established banks and their millions of loyal customers.

How is Extend different?

Extend is one of the few fintechs focused on serving the needs of established banks. We integrate directly with processors and networks to create technology services that can be leveraged by banks with zero technical development or integrations needed. And for customers of these banks, onboarding is instant: sign up with the card in your pocket in minutes—no new bank or account required.

What market does Extend target and how big is it?

Extend caters to a variety of market segments with our different product offerings. While our primary customer is the bank, our products are designed to serve SMBs, fintechs, software providers, and anyone looking for modern payment solutions.

What’s your business model?

Our business model primarily takes an “as-a-service” approach. We design our solutions to be implemented by banks looking to offer their customers competitive payment products.

What are your post-COVID office plans??

We are eager to get back to an office here in NYC. Most of our team now is remote, spread across the 50 states and Canada, but nearly 50% of us are still based in New York. We are actively looking for a new office space as our team has more than doubled since we closed our doors at the start of the pandemic. We are looking forward to getting face-to-face time with the team again.

What are the biggest challenges that you faced while raising capital?

Like all infrastructure projects, building Extend did not happen overnight. In our space, it’s important to work with investors who understand the challenges and timeline of such undertakings. Once built, they then benefit from a very scalable business.

What factors about your business led your investors to write the check?

Several factors contributed to the support we’ve garnered. The uniqueness of our business model and the large gap in the market for issuer-ready solutions certainly speaks to our potential market share. Another key selling point is our instant onboarding model. Businesses signing up for Extend can self-register with the credit cards in their pocket. This completely eliminates the barrier to entry when you consider competitive offerings require a customer to switch banks completely and open a new account.

What are the milestones you plan to achieve in the next six months?

As we expand our network of bank partners, we aim to bring instant onboarding to all of our issuers.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Understand the need you are trying to fill and focus on how you can do it better than anyone else. Understanding the unique pain points of your audiences and how you can fit into their existing world will set you up to be an indispensable player.

Where do you see the company going now over the near term?

We are growing in several directions. We are driving more bank partnerships, growing our user base of business customers using our virtual card app, and are connecting with tech-savvy companies that are embedding automated card issuance with our APIs into their business workflows. We will continue to evolve and refine our products and experiences, but aim to broaden our services beyond credit and beyond B2B.

What’s your favorite outdoor dining restaurant in NYC

We’re personally big fans of picnics in the park, gathering in team members’ backyards, and hanging out on rooftops.