In this series, we dive into technologies and industries we’re excited about, going deep into their change drivers and stakeholders while exploring investment trends and opportunities through an early-stage lens.

In a sentence: Proptech refers to technology and innovation in the real estate industry.

Size and scope: Real estate is the world’s largest asset class, so the market opportunity for proptech is immense; the global real estate tech market is estimated at $521.7B with a projected 8.6% CAGR between 2020 and 2025. Key sectors include commercial real estate, residential real estate, and construction.

Stakeholders: Stakeholders in the proptech ecosystem are diverse and numerous — in commercial real estate, they include developers, owners, investors, tenants, and those who facilitate transactions. In the residential sector, stakeholders include homeowners, landlords, tenants, property managers, mortgage lenders, brokers, and real estate agents.

Change drivers:

While the real estate industry has long resisted technological innovation, with challenges to scale including capital and operational efficiency, the current environment has accelerated tech adoption. COVID-19 made in-person transactions difficult and market dynamics made efficiency more important than ever — these factors have proven strong tailwinds for proptech. Further, several relevant trends are driving the industry:

Housing market dynamics: The United States is currently experiencing a unique housing market. Low- interest rates have been driving record transaction volume, with 6.46 million homes sold in 2020. Millennials, initially having waited longer than previous generations to buy, are finally entering and dominating the housing market as the largest growing segment of homebuyers. This influx, in combination with stagnation in construction productivity and longstanding underinvestment, has resulted in an inventory shortage. Further, the pandemic changed where consumers are looking to live, as remote work and social distancing have driven an exodus from major cities to more affordable and spacious suburban areas.

Future of work: Another driver of proptech innovation and adoption is the future of work. Many major employers are announcing permanent remote work options, and time spent in offices is expected to decrease. This shift will have ramifications not only for where people choose to live, but how commercial office space is managed. According to a McKinsey survey, executives plan to reduce office spaces by 30%.

Flexible and distributed workspaces will be top of mind, as will technologies that keep employees/consumers safe when we do return to work (such as contactless tech, autonomous cleaning, and improved ventilation, among others.) This adjustment will also prompt commercial owners to think more critically about the value proposition their offices provide beyond physical space in terms of their amenities and lease structures.

Climate and sustainability: Heatwaves, wildfires, floods, droughts, and hurricanes are proving devastating to human lives and infrastructure. Extreme weather events from this summer alone included: deadly flooding in central China and Europe; 120+ degree temperatures in Canada; tropical heat in Finland and Ireland, and wildfires across the United States. Further, this summer’s report from the Intergovernmental Panel on Climate Change underscores the threat of climate change; the U.N. secretary general called the report a “code red for humanity.”

Accordingly, several factors are catalyzing action on climate change. U.S. policies are seeking to address the climate crisis. The Biden Administration’s proposals on infrastructure spending and aggressive sustainability targets are likely to inject more public capital into these areas. Advances in sustainability technology and consumer consciousness of the environment are clearing the way for the adoption of cleantech solutions in energy efficiency.

Where our portfolio fits: Lerer Hippeau portfolio companies are innovating across the real estate value chain, from property search and evaluation to home services and energy management, streamlining processes and providing analytical insights. Crexi and Reonomy are streamlining real estate data for commercial real estate brokers. Morty is driving efficiency in the homebuying process with an online mortgage platform. Realm gives homeowners insights into how to increase their property values, while Havenly, an online interior design consultancy, and Block, an end-to-end renovation platform, provide solutions for executing such projects. And Palmetto helps homeowners implement cost-efficient, clean energy solutions.

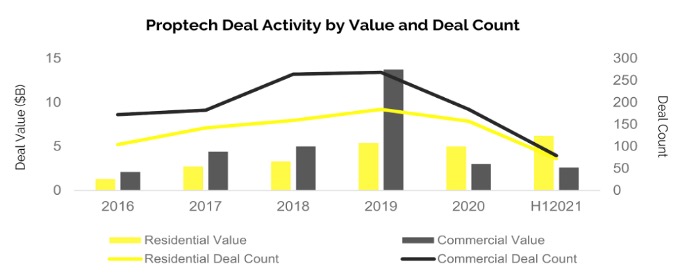

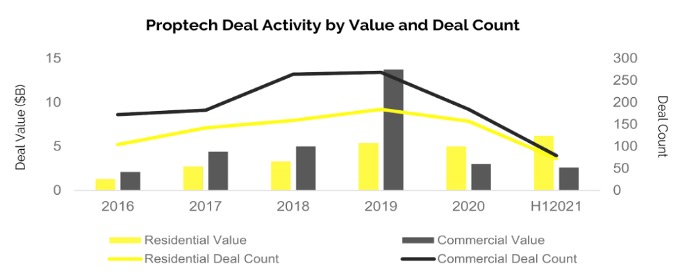

Investment trends: The proptech landscape is poised to see record VC investment this year, after a decline in 2020 related to the pandemic. With $6.2B invested in residential proptech and $2.6B invested in commercial proptech as of June 2021 could be a record year for venture activity. Notable deals include a $371M Series B raise for Homeward, a company that helps homebuyers make cash offers (especially relevant in today’s competitive market); home services platform Thumbtack’s $275M funding round; and digital brokerage Compass’s IPO.

Where to look: Given current industry tailwinds, the single-family residence market is particularly exciting right now. Of 140 million housing units in the US, 80 million are single-family homes, and 15 million are rental properties. Despite single-family rental construction being up 66% during the pandemic, the US housing market still has a deficit of 3.8M single-family homes.

Single-family residences are also a growing institutional investor market — while only 2% of SFRs are currently owned by institutional investors, institutional investors put $77B into the rental home market in H12021. Investors purchased 1 in 7 US single-family homes in Q1 2021. As sale and rent prices rise and small landlords struggle due to unpaid rents and eviction moratoria, this trend is expected to continue.

Accordingly, interesting opportunities abound in this market, with proptech companies looking to solve the pain points of homeowners, landlords, tenants, property managers, and investors in this market. Addressing the issue of limited supply are companies offering prefabrication, modular construction, and 3D printing solutions to home construction. Companies at the intersection of fintech and proptech look to streamline and accelerate the traditionally fragmented and long process of purchasing a home with digital mortgage brokerages that minimize the need for intermediaries; others are enabling transactions that simply could not occur before with new financing products (e.g., rent to own programs), securities (e.g, fractional real estate investing), and models of ownership (e.g., co-ownership of rental or residential properties). Further, several proptech solutions are aimed at simplifying the costly and complicated process of managing a home — either as a primary residence or a rental property.

How to evaluate opportunities: Several factors can be considered in evaluating proptech ventures:

Strong value proposition around cost savings and efficiency: In an industry where tech adoption has traditionally lagged, it is important to consider the value proposition of the solution. Proptech innovations should provide a clear opportunity to save money or time, not just introduce technology for the sake of technology.

Business model and capital intensity: Real estate can be a capital and operationally-intensive industry. Investors should consider how capital-intensive the business is and whether it is truly a tech solution or is it overly reliant on physical real estate assets (e.g., WeWork).

Integrated solution: A major pain point in real estate is the fragmentation of the value chain. Successful ventures will piece together and simplify transactions in this traditionally fragmented process with a single platform or solution.

Seed considerations: At the early stage, it’s also important to consider the founding team. As sales motions, especially in commercial real estate and construction, can be very relationship-driven, ventures well-positioned for success are led by teams with deep industry insight and expertise. Additionally, it is important to look for a scalable approach to growth. Can the business scale quickly and sustainably in a local, physical asset-driven industry? Questions like these are key when considering an investment.