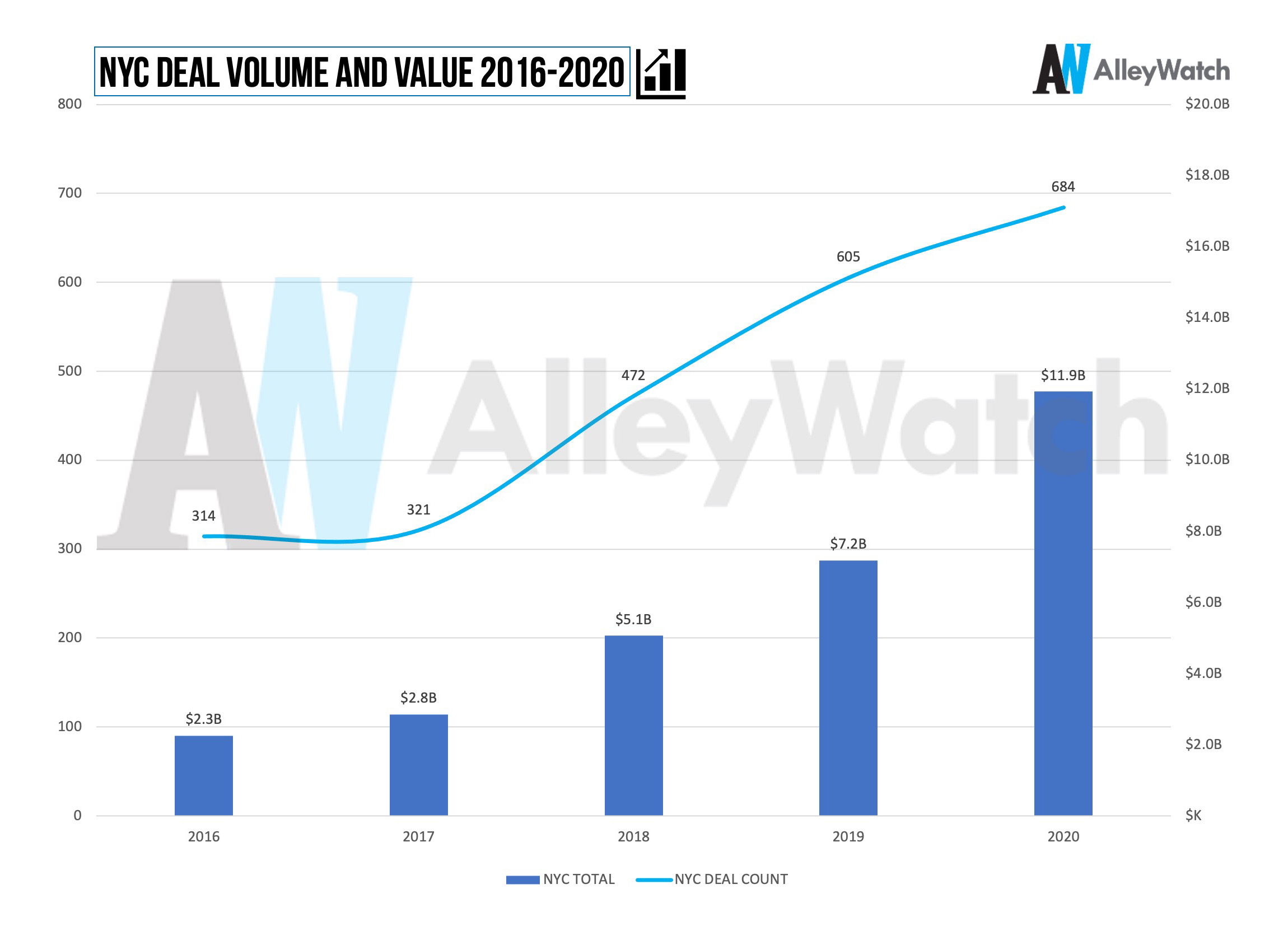

Both NYC VC deal count and value have moved into record territory in 2020 with increases in deal size.

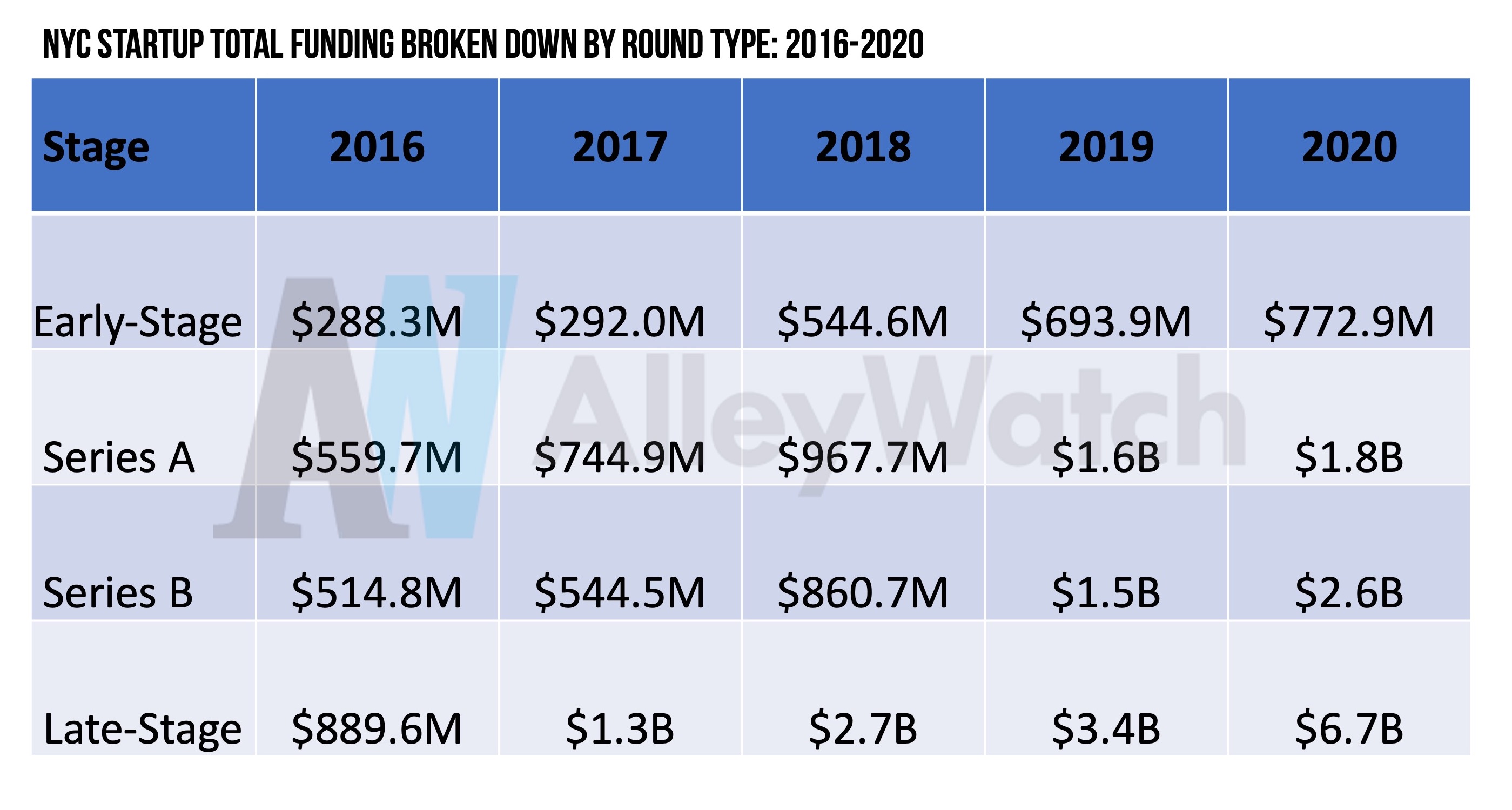

Despite the challenges faced as a result of the pandemic, NYC startup activity was remarkably resilient. By the end of 2020, the venture capital industry deployed $12B in NYC-based startups, the highest total on record, driven by strong Series B and Late Stage (Series C+) activity. 2020 funding figures surpassed the $7.2B mark set in 2019, representing a 67% growth year-over-year. Quarterly funding levels each quarter exceed those of 2019 and funding each quarterly steadily rose in 2020. An unprecedented $4B was raised in Q4.

The New York Tech ecosystem matured with a number of successful recent venture-backed IPOs that have performed well (Lemonade 2020, fuboTV 2020, Vroom 2020, Peloton 2019, Datadog 2019) and a robust IPO and pipeline (UiPath, Oscar Health). Adding to the excitement and potential exit paths for NYC startups is the meteoric rise in SPACs with Bark’s announcing its intention to merge in December. Firstmark became the first New York venture firm to set up its own SPAC, a $360M instrument in October. Given the strength in the equities market, a number of companies that were previous candidates for IPO may file in 2021 (ZocDoc, Harry’s, Warby Parker)

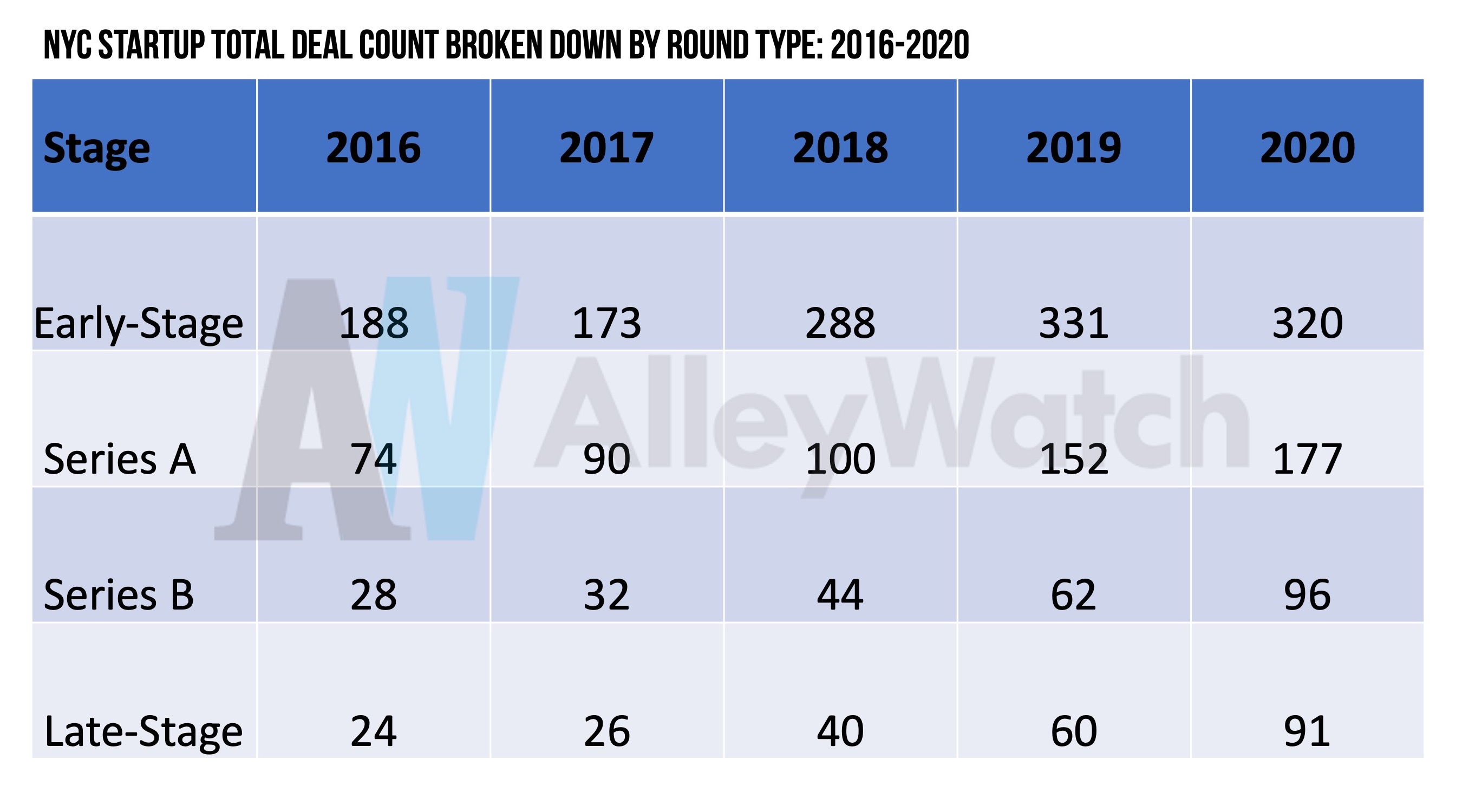

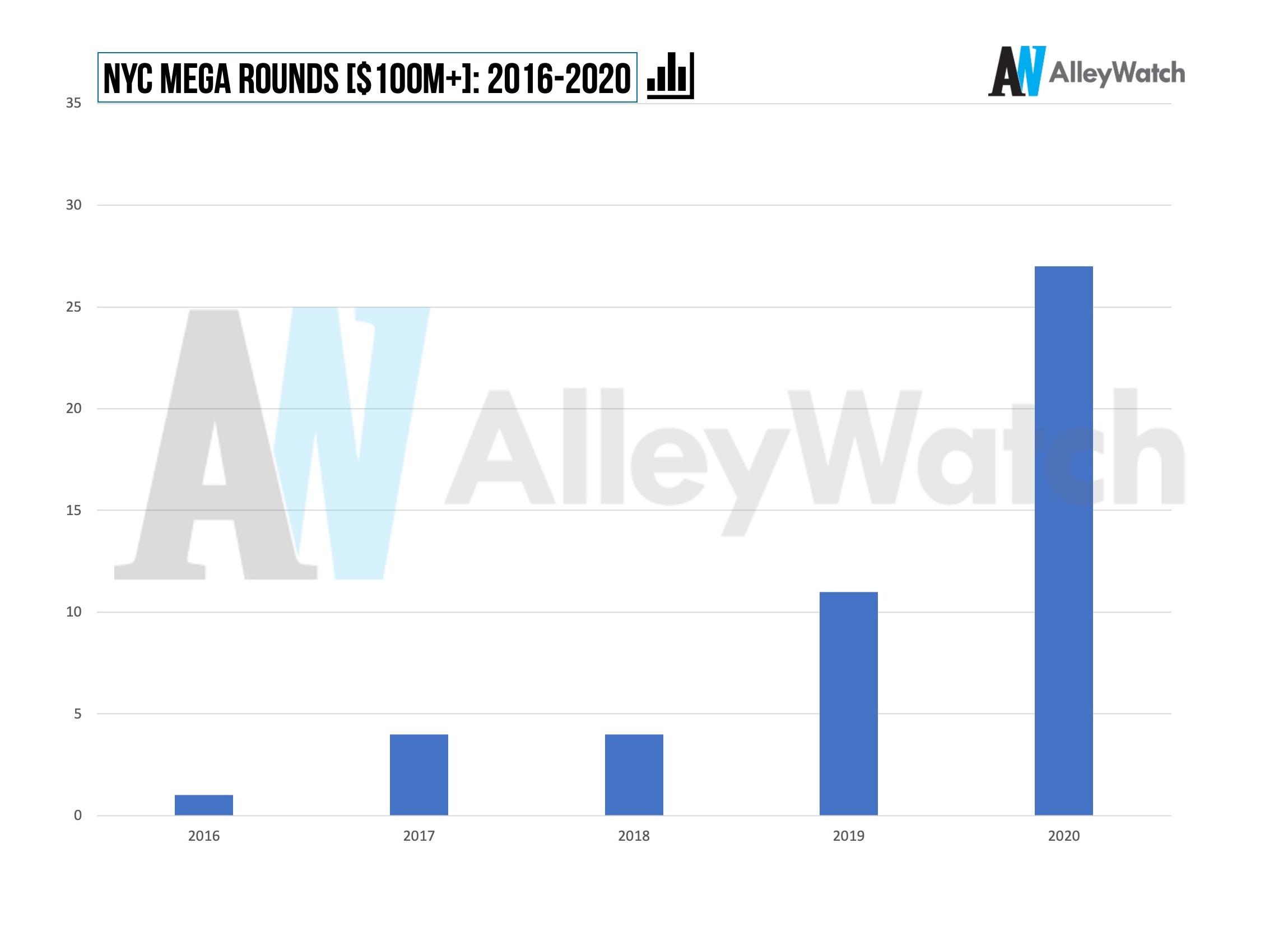

684 companies were able to raise funding in NYC in 2020, an increase of 13% from 2019. This growth came largely from Series B and Late-Stage companies, where there was a 50+% increase in the number of companies funded (Series B – 60 to 91, Late Stage – 62-96). There were 27 mega ($100M) funding rounds in the city, an increase of 145% from 2019. These mega deals represent $4.1B or 34% of all capital raised.

Aggregate early-stage funding was up with the number of companies raising slightly down as the world moved remote, making funding more difficult for founders that may not have established networks in place. At the initial onset of the pandemic, investors honed in on their portfolio companies and a number of early-stage companies that were not well-positioned (eg significant in-person reliance) for an uncertain future faced difficultly raising additional and initial funding. Many of these companies would have likely raised rounds if not for COVID. This trend was mitigated by a number of companies that were able to successfully pivot or adjust their focus to address a COVID-centric world (eg online restaurant tech, work from home, mental health, etc).

2020 was a breakout year with resilient strength in the venture market serving as a foundation. Let’s take a deeper dive:

New York City Venture Capital activity in 2020 hit a record level in terms of both investment amount and number of deals.

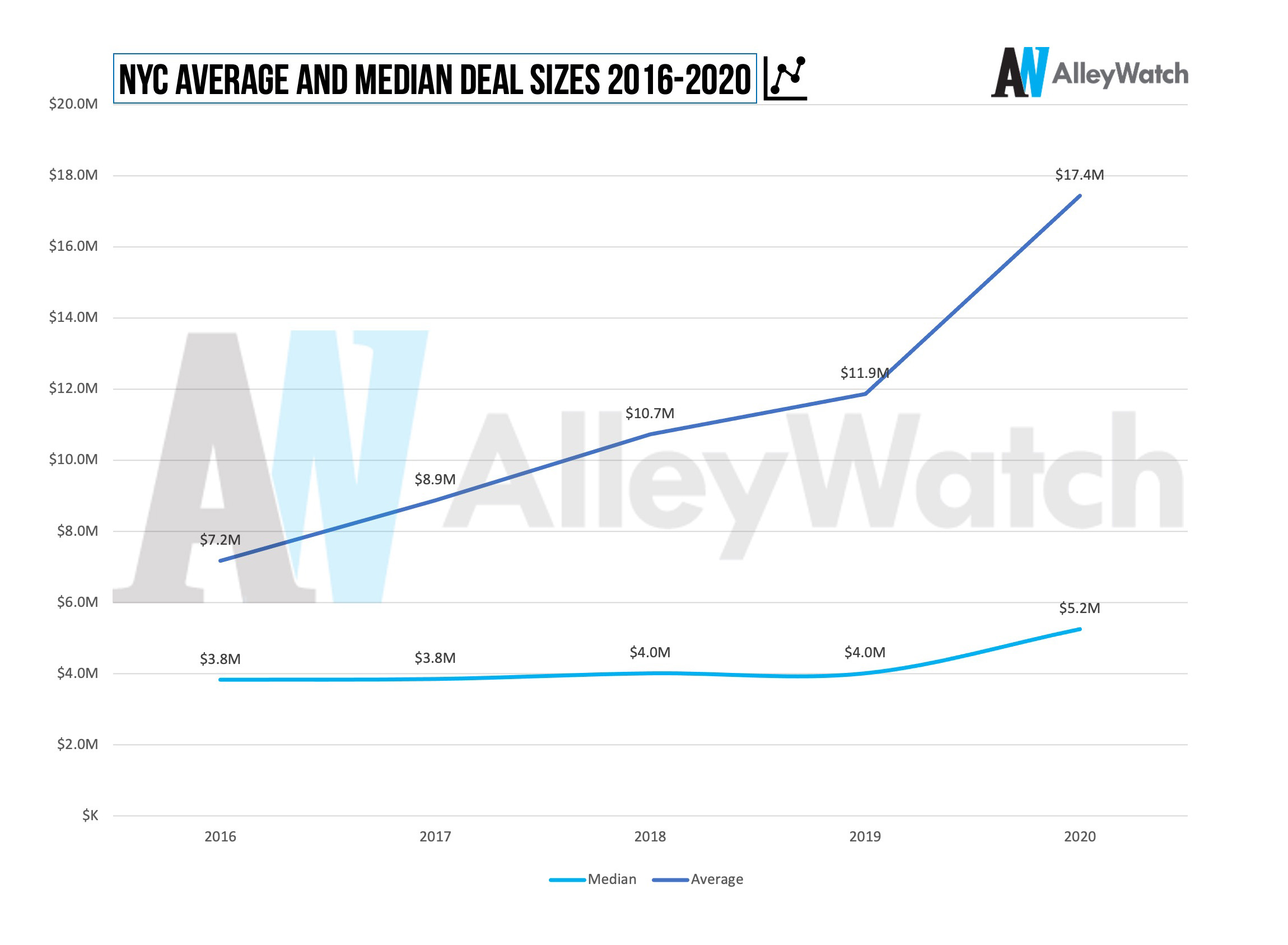

Average and median deal sizes for NYC startups continue to increase with profound growth in 2020 as investors doubled down on portfolio companies and proven opportunities.

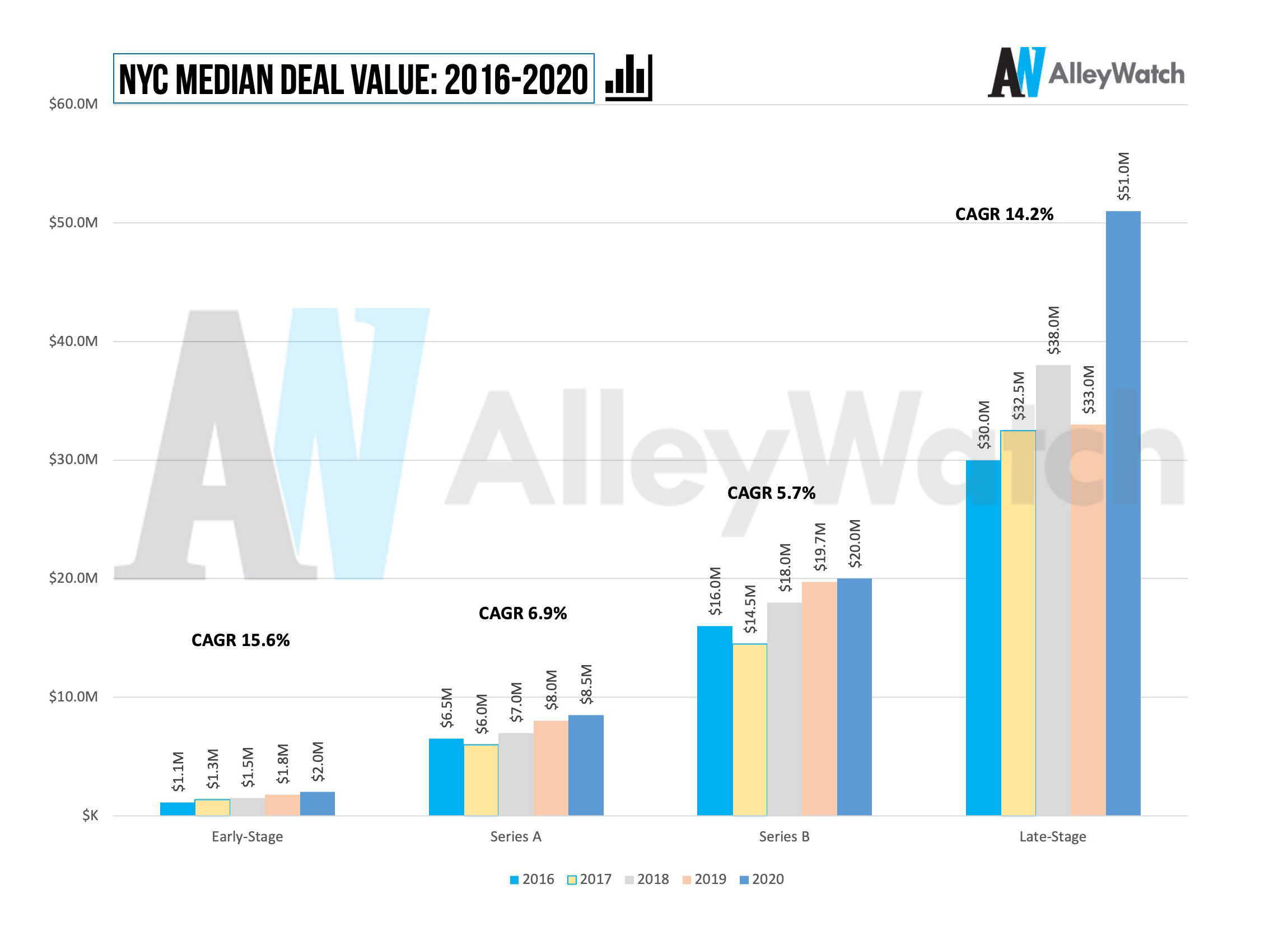

Median deal sizes across all rounds continue to increase with rapid growth at the earliest and latest stages. The number of companies that are able to successfully scale to subsequent founding rounds continues to increase in NYC, signifying a maturation in the ecosystem.

Median deal sizes across all rounds continue to increase with rapid growth at the earliest and latest stages. The number of companies that are able to successfully scale to subsequent founding rounds continues to increase in NYC, signifying a maturation in the ecosystem.

The number of mega-rounds ($100M+) doubled in 2020, representing 34% of all NYC startup funding for the year.

The number of mega-rounds ($100M+) doubled in 2020, representing 34% of all NYC startup funding for the year.

A look at all the numbers year-over-year.

Notes:

- Only equity financings were included.

- This analysis, unlike others, in order to maintain a focus on tech-enabled startups does not include biotech startups, lending institutions, and real-estate transactions where capital requirements are significantly different.

- Early-stage rounds consist of rounds classified as pre-seed, seed, angel, and convertible note fundings <$10M.

- Late-stage rounds consist of rounds classified as Series C and any subsequent rounds. Unclassified venture rounds over $25M are included in late-stage.

Make an impact on your bottom line and drive leads in 2021!

The AlleyWatch audience is driving progress and innovation on a global scale. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement, lead generation, and thought leadership in front of an audience that comprises the vast majority of key decision-makers in the NYC business community and beyond. Learn more about advertising to NYC Tech, at scale.