The security of digital assets is absolutely critical in ensuring widespread adoption and this has led to the emergence of countless digital-asset-as-security-service offerings. In just two years Fireblocks has emerged as a leader in digital asset security, with a growing number of companies relying on Fireblock’s platform to securely store, transfer, and issue digital assets. The company has facilitated the transfer of over $150B+ in digital assets for local and international companies since its launch, $23B+ worth of digital assets transferred in Q3 alone, and the company has tripled its customer base already in Q4. Fireblocks’ proprietary network and MPC-based wallet infrastructure provide the company with a distinct competitive advantage since its wallet infrastructure enables enterprises to easily transition from existing storage solutions.

AlleyWatch caught up with Cofounder and CEO Michael Shaulov to learn more about how Fireblocks provides the critical infrastructure needed for enterprises to scale digital asset exposure, the company’s growth, and recent funding round, which brings the total funding raised to $46M. In conjunction with this funding announcement, Fireblocks has added Fred Ehrsam, the cofounder of Coinbase, to its Board of Directors.

Who were your investors and how much did you raise?

Fireblocks has raised $30M in Series B funding. This round was led by Paradigm with participation from existing investors, Cyberstarts, Tenaya Capital, Swisscom, Galaxy Digital, Digital Currency Group (DCG), and Cedar Hill Capital.

Tell us about the product or service that Fireblocks offers.

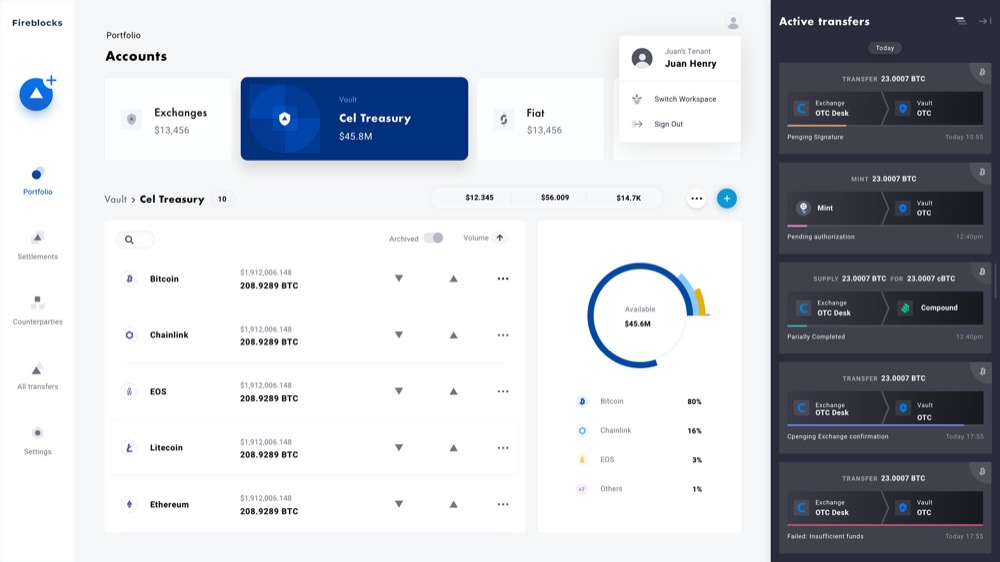

Fireblocks provides a digital asset security platform for financial institutions. Fireblocks enables direct and secure access into every cryptocurrency trading venue, liquidity provider, lending desk, counterparty, and app in the global ecosystem. With Fireblocks, financial institutions and retail-focused businesses can build digital asset products and services, and leverage Fireblocks’ encrypted highways to safely transfer digital assets and cryptocurrencies in real-time.

What inspired the start of Fireblocks?

What inspired the start of Fireblocks?

In 2017, the infamous Lazarus Group hacked into four South Korean exchanges and stole $200M of Bitcoin. Working for the cybersecurity leader Check Point at the time, we (the would-be founding team of Fireblocks) were part of the task force that investigated the massive cyber breach. From our investigation, we concluded the shift and motivation of cybercriminals from hacking traditional finance to digital assets, and the complexity and the lack of solutions for securing digital assets in an enterprise environment. My cofounders and I each spent the last twenty years transforming how cybersecurity is being applied to mobility, cloud, and critical infrastructure so the next obvious challenge was clear, to secure the blockchain. We teamed up to create Fireblocks.

How is Fireblocks different?

The difference between Fireblocks and other competitors is the combination of its next-generation MPC-based wallet infrastructure and Fireblocks Network. There are many hot wallet and cold storage custody options, even warm ones, but what Fireblocks provides is secure rails for funds to be easily transitioned from cold storage or any other storage solution and settled on the largest institutional digital asset transfer network. The network provides secure access to exchanges, liquidity providers, lending desks, and counterparties.

From a customer standpoint, assets are more secure, and treasury and operations teams get even more capital efficiency from accessing funds or transferring funds through the Fireblocks Network.

In addition to this innovation, Fireblocks also provides crypto and fintech apps with a bespoke, flexible, and scalable wallet infrastructure that strikes the right balance of security and operational utility.

What market does Fireblocks target and how big is it?

$20B for Institutional Crypto Market + $6B Online Banking.

What’s your business model?

SaaS.

How has COVID-19 impacted the business?

COVID-19 created a macroeconomic climate that is favorable for cryptocurrencies (with bitcoin leading the pack). It has increased the activity of existing institutional players and brings new players into the space. The influx of new financial institutions created a huge tailwind for Fireblocks, and we’ve increased the number of customers from 40 at the beginning of the pandemic to over 120 in Q4.

Our platform is fully optimized for Work From Home scenarios that are really challenging for digital asset businesses. We’ve released a blog post that helps our customers to understand how to leverage the system for the current work setup.

What was the funding process like?

We’ve found great investors that understand the space and bring a lot of value to Fireblocks. The process itself was reasonably streamlined.

What factors about your business led your investors to write the check?

Fireblocks’ Trusted Infrastructure: Fireblocks has become one of the most trusted platforms to utilize when businesses are looking to build new digital asset operations or scale existing ones because of its superior security infrastructure. Fireblocks has not only won the confidence of leading brands in fintech, such as Signature Bank, Galaxy, and Revolut, but has prevented the loss of more than $150B cryptocurrency transfers that could have fallen victim to any number of exchange hacks, thefts, or scams that took place this year. Its unique technology prevents private key theft, deposit addresses spoofing, and compromised credentials while upping efficiency, creating a path for institutions to scale their operations.

Fireblocks has not only won the confidence of leading brands in fintech, such as Signature Bank, Galaxy, and Revolut, but has prevented the loss of more than $150B cryptocurrency transfers that could have fallen victim to any number of exchange hacks, thefts, or scams that took place this year. Its unique technology prevents private key theft, deposit addresses spoofing, and compromised credentials while upping efficiency, creating a path for institutions to scale their operations.

Being a key innovator in the space: With the adoption of digitized dollars across more than a handful of the leading economies in the world, businesses will need a better and more secure way to enable and add support for these new methods of value transfers across a globally connected ecosystem. Fireblocks has built the most trusted and easiest to deploy infrastructure for securing the transfer of digital assets such as stablecoins, cryptocurrencies, and more across a host of venues. As fintech continues to adapt and evolve, Fireblocks’ platform will become a core building block for constructing the cross-asset transfer highways that powers the next generation of financial products.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today