History Doesn’t repeat itself, but it rhymes — Mark Twain

A Brief History Of The Internet

The first wide-area packet-switching network with distributed control, the ARPANET (the precursor to the internet), was started in 1966. The 1st message was sent over ARPANET when it had four nodes (Stanford, U.C.S.B, U.C.L.A., and the University of Utah) in 1969. The first specs for TCP/IP were written in 1974. In 1983, DNS was introduced, including 7 top-level domains (.edu,.gov, .com, .mil, .org, .net, and .int), replacing the prior designations such as 123.456.789.10. Symbolics.com, the website for Symbolics Computer Corp., registered the first domain name in 1985. English computer scientist Tim Berners-Lee invented the World Wide Web in 1989 and developed the first web browser in 1990, releasing it to the public in August 1991.

In December 1991, the Gore Bill provided the funding for Marc Andreesen’s Mosaic browser project. The Mosaic beta was released in September 1993. By the end of 1993, there were 600 websites. In January 1994, The Today show was trying to figure out what the internet was.

On April 4, 1994, Marc Andreesen’s Netscape was founded. The company’s first web browser was released in October 1994. In four months, Netscape’s browser captured 75% of the browser market as the number of websites exploded to more than 10,000.

And the internet was on its way to mass adoption. An overnight sensation, 28 years in the making. Enabled by an easy to use browser.

On August 9, 1995, with the NASDAQ at 1,004, Netscape IPO’d at $28 per share. The stock soared, finishing its first day at $58.25, nearly a record first-day gain. Just 16 months after it was founded, Netscape was worth $2.9 billion, kicking off a massive five-year bull run. On March 10, 2000, the NASDAQ peaked at 5,048, a stunning 42.5% annualized return from the day Netscape IPO’d.

2019 Set The Stage For DeFi To Go Mainstream

I wrote an article for CoinDesk’s 2019 Year in Review forecasting mainstream adoption of DeFi’s in 2020, for two reasons:

1. Composability Enables Rapid Innovation — A key aspect of DeFi is its composability, which is the ability to combine two distinct services to get a novel third service. A great example of is InstaDapp, which created a link between Maker and Compound, increasing the efficiency of the entire lending market by enabling borrowers or savers to easily find and engage with the providers offering the best rates on lending, borrowing and margin trading.

2. DeFi Products Don’t Ask For Approval From Regulators — DeFi has a major advantage over incumbent financial and tech companies because they can introduce products without asking any regulators for permission. If Uber had asked taxi regulators for permission, there’d be no Uber. There’s no Libra because Facebook had to ask for permission. Maker didn’t ask for permission to introduce Dai. Uniswap didn’t ask for permission. Compound didn’t ask.

DeFi Is Crypto’s Netscape

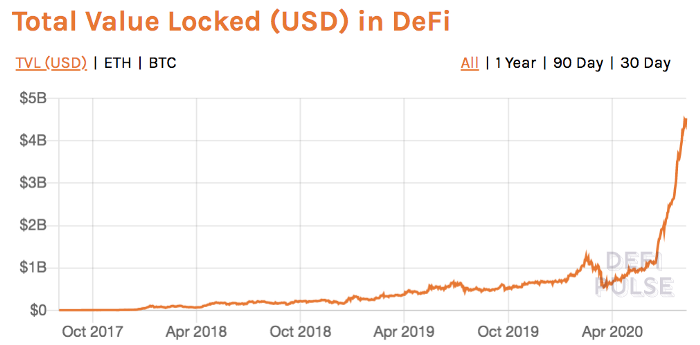

I know DeFi is our Netscape moment because it’s scaling, rapidly. Just like Netscape’s browser did. The market is screaming that DeFi has found product-market fit. Total value locked in DeFi is up more than 4X in two months:

Netscape’s value of $2.9 billion in 1995, is equal to $4.9 billion in 2020 dollars. Almost the same amount that DeFi has locked up today.

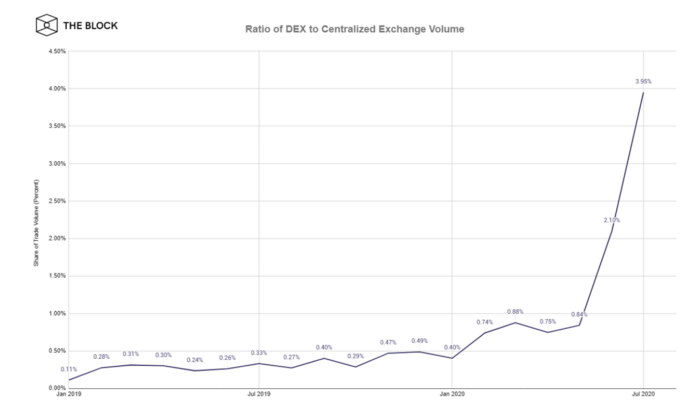

Decentralized exchanges (DEXs) have also grown their share of trading volume 4X+ over the last two months:

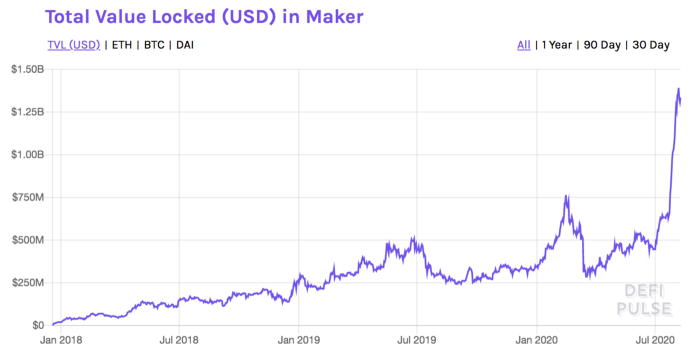

I first started diving into DeFi in November last year writing “ 6 Thoughts Following Our Conf. Call On The Massive Potential of Multi-Collateral Dai “. It’s potential is now being realized:

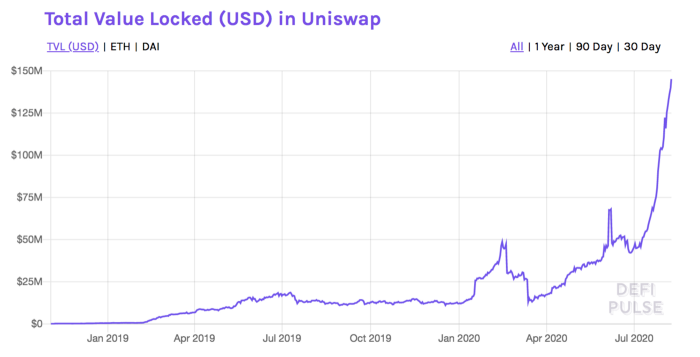

I was blown away by Bancor’s automated market-making concept in early 2018, before the space was even called DeFi. Then Uniswap swapped Ether as the collateral, instead of Bancor’s BNT token, and now Uniswap is doing this:

In another sign of DeFi’s potential, on August 6th, Uniswap T raised $11M in Series A funding led by Andreessen Horowitz, with from USV, Paradigm, Variant, Parafi Capital, and SV Angel also participating. The VC sentiment has shifted dramatically, and rounds are increasingly competitive and

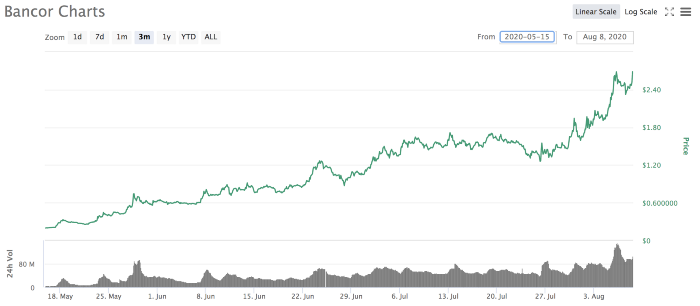

Bancor announced V2 on April 29th, and BNT is up 12X:

DeFi is clearly the thing we’ll look back on, like we look back on Netscape, as the technology that started crypto on the path to mainstream adoption.

The emergence of DeFi is clearly the thing we’ll look back on, like we look back on the Netscape’s IPO, as the event that started a massive bull market that created unimaginable wealth.

So buckle your seat belts. The next bull crypto market is upon us and it will dwarf the last crypto bull market. And DeFi is leading the way.