Having worked in the finance industry and spent hours researching financial statements, copying and pasting documents and text, and repeating loads of manual tasks, Kumesh Aroomoogan knew there had to be a more efficient to free-up human capital and optimize productivity. Aroomoogan cofounded , the workflow automation and risk management solution. This no-code platform allows enterprises in the financial service industry to build and deploy AI solutions within minutes. With a few clicks, developers, data scientists, and business analysts can create insightful models from large volumes of unstructured data, which allows teams to implement solutions 24x faster due to the elimination of repetitious work and manual tasks. Accern’s solution is presently being used in investment research, credit lending, financial crimes (KYC), and reputational risk management by Accern’s 50+ enterprise clients that include Google’s finance team, Jefferies, Allianz, and IBM.

AlleyWatch caught up with Aroomoogan to learn more about the company and Accern’s latest funding round. Since its founding in 2014, Accern has raised a total of $15M across three rounds.

Who were your investors and how much did you raise?

Accern raised $13M in our Series A round. Fusion Fund was the lead investor. Mighty Capital, Allianz Life Ventures, Vectr Fintech Partners, and Viaduct Ventures also participated, along with angel investors from a previous round.

Tell us about the product or service Accern offers.

Accern’s AI Platform contains ready-made solutions for the financial service industry across asset management, banking, and insurance. Powered by adaptive learning, Accern allows enterprises to build powerful workflow automation and risk management solutions for investment research, credit lending, financial crimes (KYC), and reputational risks, among others.

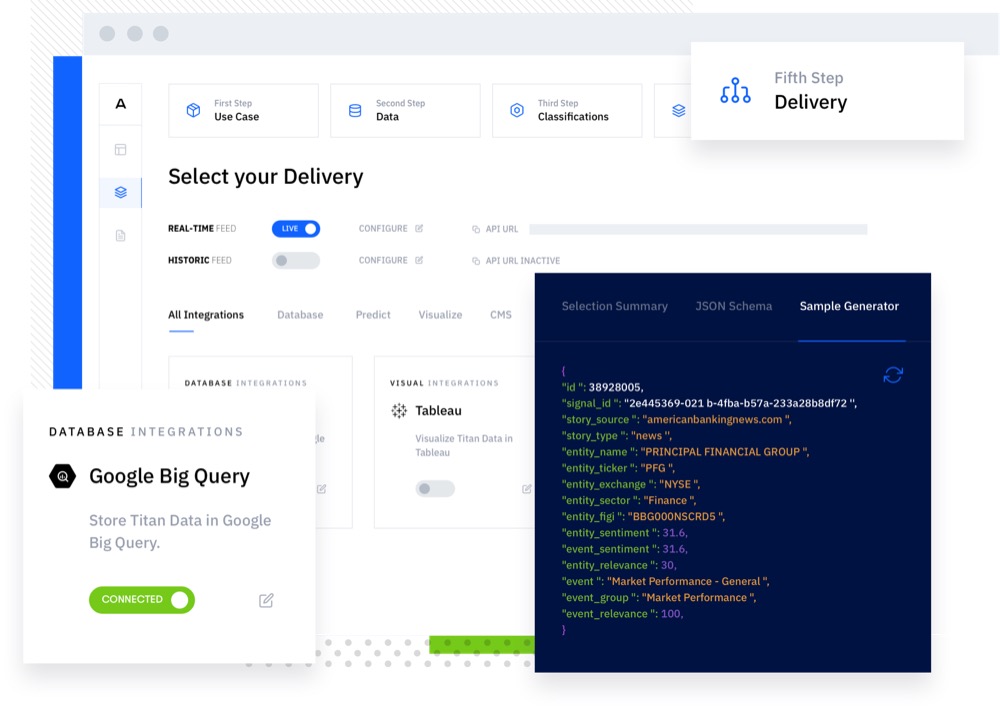

Created for developers, data scientists and business analysts, Accern’s no-code platform allows users to build and deploy AI solutions in minutes. The seamless, data-driven platform brings together an integrated data store, AutoML taxonomy capabilities, adaptive NLP and forecasting models, and multiple integrations to import and export solutions. Our adaptive NLP and forecasting models are able to learn from past actions and provide intelligent recommendations going forward, which is very useful for credit and insurance underwriting, portfolio risk, fraud detection, and more. Now teams are able to share their works, integrations, models, taxonomies, and more across the enterprise to be leveraged in other use cases, significantly reducing the amount of re-work, and therefore time, that goes into every solution.

What inspired the start of Accern?

I was working in finance and we were spending hours looking at financial statements, copying and pasting documents and text, and repeating loads of manual tasks. As data grew, we had to hire more and more people – we could only scale with people, not technology. I figured if we could automate this it would save a lot of time and allow our team to focus on higher value. I had an idea for a product that would do these manual tasks automatically, and I met my cofounder Anshul Pandey, who was a data visualization expert and he was doing his Ph.D. at NYU, and here we are – we provide an AI platform to the financial services industry.

How is Accern different?

Accern provides all the power of advanced NLP and forecasting in a no-code platform so that companies can build and deploy AI enterprise solutions in minutes. In fact, our solution allows R&D teams to implement solutions 24x faster because we eliminate rework and manual tasks. In addition, most of our models are pre-trained for financial services so customers don’t need to spend months training general models before they can use it in production. This saves months of man-time and significantly reduces costs for Accern’s clients.

What market does Accern target and how big is it?

We are targeting R&D teams within the $47B financial services market.

What’s your business model?

We have an enterprise Software-as-a-Service business model based on usage. We charge customers based on the number of documents analyzed and delivered. In this way, customers can start off with minimum commitment and scale up as needed.

How has COVID-19 impacted your business?

With the pandemic, every business has been forced to be more nimble and think of new ways to work. We are fortunate that our technology enables companies to work quickly and more efficiently, which is a message that resonates right now. In addition, many of our financial service customers are coming to Accern to build risk management AI solutions.

What was the funding process like?

Speaking of COVID-19 it was certainly interesting to close a funding round in this environment and we are so thankful we were able to. As our Series A began, we had significant interest from many investors, but as our deal moved to close COVID-19 was becoming a bigger issue in the US. A major Silicon Valley law firm we were working with ultimately went out of business leaving us with a single attorney to work at the end of our close. We were able to close one day before the WHO declared COVID-19 a pandemic.

What are the biggest challenges that you faced while raising capital?

The biggest challenge was definitely dealing with the uncertainty we faced because of the pandemic and our law firm closing.

What factors about your business led your investors to write the check?

We had a history of financial success and customer growth. Our clients include some of the biggest financial and technology companies in the world, and their trust in our product certainly helps validate our position. We think our investors saw Accern as a great opportunity because of the value we provide customers, the significant ROI our customers achieve, the massive innovation, and the size of our market.

What are the milestones you plan to achieve in the next six months?

We plan to invest in our product and grow our team with a focus on sales expansion. We will make our platform even easier to use so companies can adopt AI across their organizations even faster. Lastly, we’re also focusing on building distribution channels and strategic relationships with firms that can help us scale exponentially.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Right now, we all have to be most focused on delivering value to our clients. The best way to grow our business is to become an integral part of our customer’s way of doing business.

The best way to grow our business is to become an integral part of our customer’s way of doing business.

If we provide considerable ROI and help them do their jobs better and more effectively we are well-positioned.

Where do you see the company going now over the near term?

Our plan is to continue to innovate our product and to provide the best no-code AI platform to asset management, insurance, and banking sectors. We will also be expanding into other sectors like healthcare and technology later.

What’s your favorite restaurant in the city?

Buddakan Restaurant.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today