Ever wonder how a global pandemic would affect NYC startup funding and venture capital activity? Look no further. Here are the numbers you need to know and predictions to get you through…

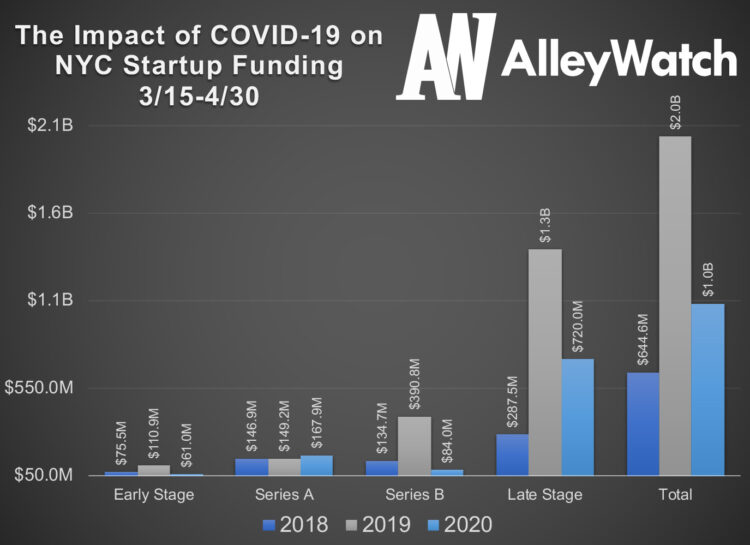

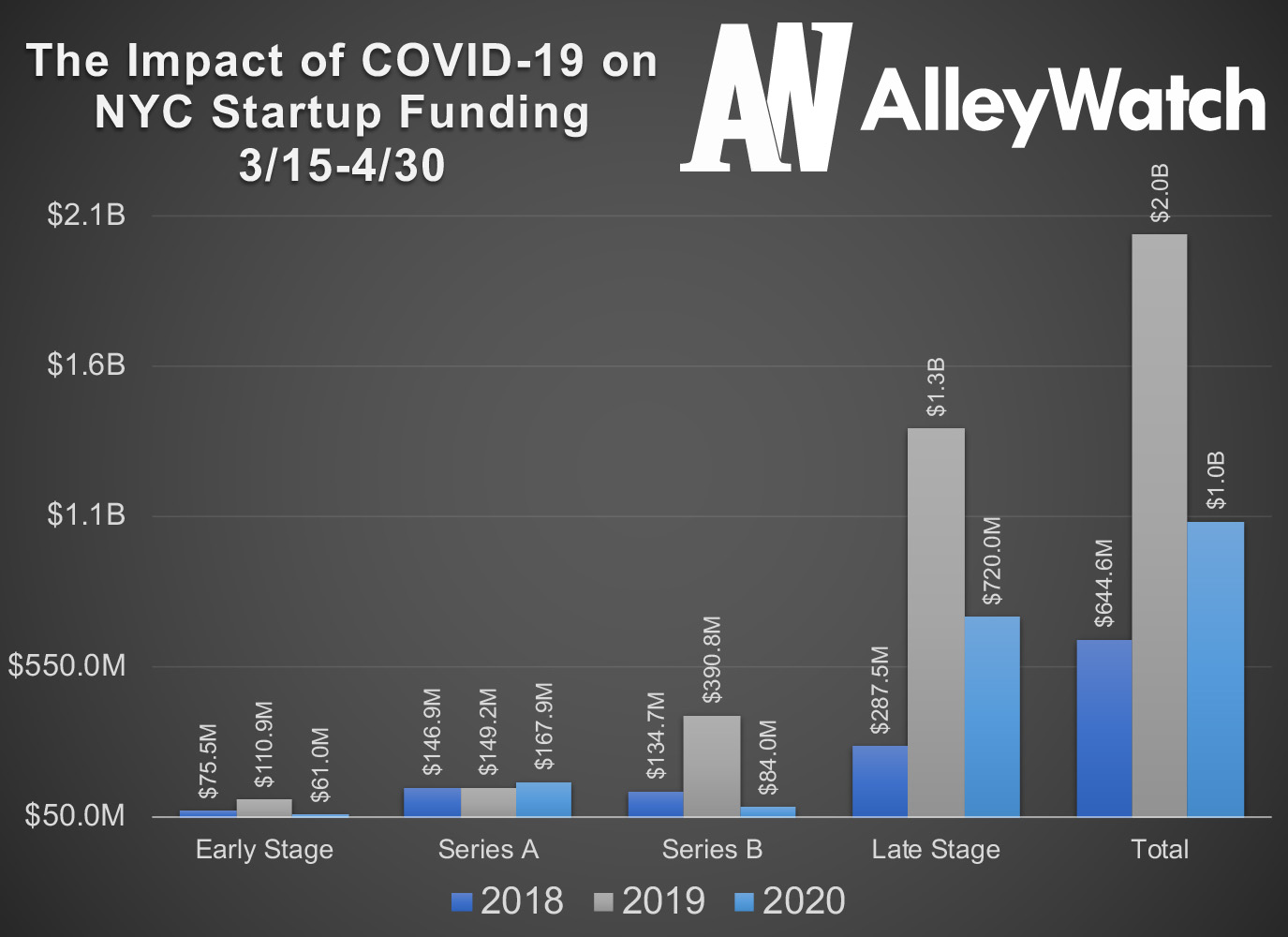

Today, I quickly examine total NYC startup funding from March 15th to April 30th year-over-year to quantify the impact that COVID-19 has had one the funding landscape in New York since the lockdown started.

Facts:

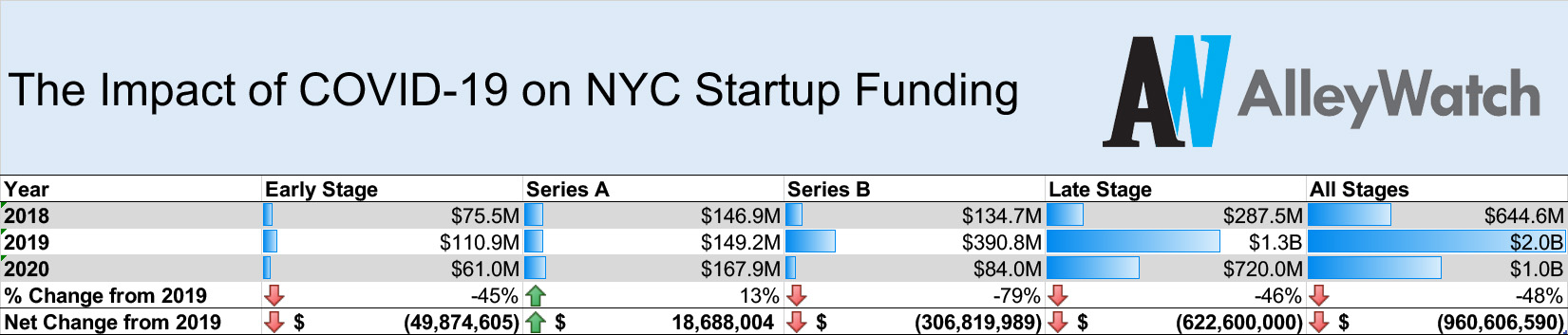

Early-stage startup funding in NYC is -45% from year-ago levels since the lockdown started on March 15th Tweet This

Series A startup funding in NYC is +13% from year-ago levels since the lockdown started on March 15th Tweet This

Series B startup funding in NYC is -79% from year-ago levels since the lockdown started on March 15th Tweet This

Late-stage startup funding in NYC is -46% from year-ago levels since the lockdown started on March 15th Tweet This

Total startup funding in NYC is -48% from year-ago levels since the lockdown started on March 15th Tweet This

Early-stage startup funding in NYC is down $49.8M from year-ago levels since the lockdown started on March 15th Tweet This

Series A startup funding in NYC is up $18.7M from year-ago levels since the lockdown started on March 15th Tweet This

Series B startup funding in NYC is down $306.8M from year-ago levels since the lockdown started on March 15th Tweet This

Late-stage startup funding in NYC is down $622.6M from year-ago levels since the lockdown started on March 15th Tweet This

Total startup funding in NYC is down $960.6M from year-ago levels since the lockdown started on March 15th Tweet This

Opinions:

The effects of the pandemic will shape the venture capital industry for some time to come and it is not prudent to expect a quick V-shaped recovery. Consumer sentiment about the future of the economy and the time to recovery will affect spending both at the business and consumer levels and we can expect a retraction. Every market downtown over 20% in history has taken at least 18 months to recover.

While Series A may seem like a bright spot in this year’s numbers, it’s important to note that these figures were skewed by an aberrant, large $70M Series A round. When accounting for this, Series A funding would be down 40% from historic levels as well. Early-stage companies, especially on the consumer-side, will face tremendous difficulty in raising funding unless they are able to show defensible unit economics when it comes to acquisition costs. This focus is not only due to coronavirus but also thanks to the collapse of several well-known companies that had raised too much funding at unsustainable levels. The “scale or die” model will be replaced with a renewed focus on profitability.

Most VCs are working closely with their portfolio companies and their accountants through the pandemic to help them survive, hire, fire, scale, etc. Do expect that some VCs will have to make the tough decision to not invest in the next round when gaining a full picture of where a startup is today during the pandemic. There will be a number of bridge financings in between the Series A and B levels for companies that warrant a flyer on a “wait-and-see” basis. Some startups will be nimble and be able to adjust to what the market brings in a post-pandemic world; however many will not be able to.

Acquisition activity will increase in the next six months; most being acquihires; but larger public companies will dip their toes into the water looking to buy instead of building, especially when it comes to digital services like personal finance and banking.

You are seconds away from signing up for the hottest list in New York Tech! Join the millions and keep up with the stories shaping entrepreneurship. Sign up today