As the self-storage industry navigates a technology inflection point, operators face mounting pressure to modernize operations while managing tighter margins in an increasingly competitive landscape. The sector’s race toward digital transformation has exposed a critical gap: while public storage operators like Public Storage report 85% of customer interactions are now digital and have reduced labor hours by over 30% through automation, thousands of independent operators still rely on legacy systems that can’t deliver these efficiencies. Cubby addresses this divide by providing an AI-native platform built specifically for self-storage operators, integrating facility management, revenue optimization, intelligent call handling, and Voice AI into a unified system. The platform serves as the operational backbone for over 400 operators managing 450,000 units across North America, helping them compete with institutional players through tools that continuously optimize pricing as market conditions change, convert leads more effectively through AI-powered call grading, and automate routine customer interactions while maintaining brand consistency. The company now offers autonomous AI agents that handle customer inquiries, process rentals, and manage move-ins, while their open API approach partners with vendors rather than creating walled gardens, positioning Cubby as the foundational system of record for the next generation of the industry.

AlleyWatch sat down with Cubby CEO and Cofounder Matt Engfer to learn more about the business, its future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

We closed our $63M Series A led by Goldman Sachs Alternatives.

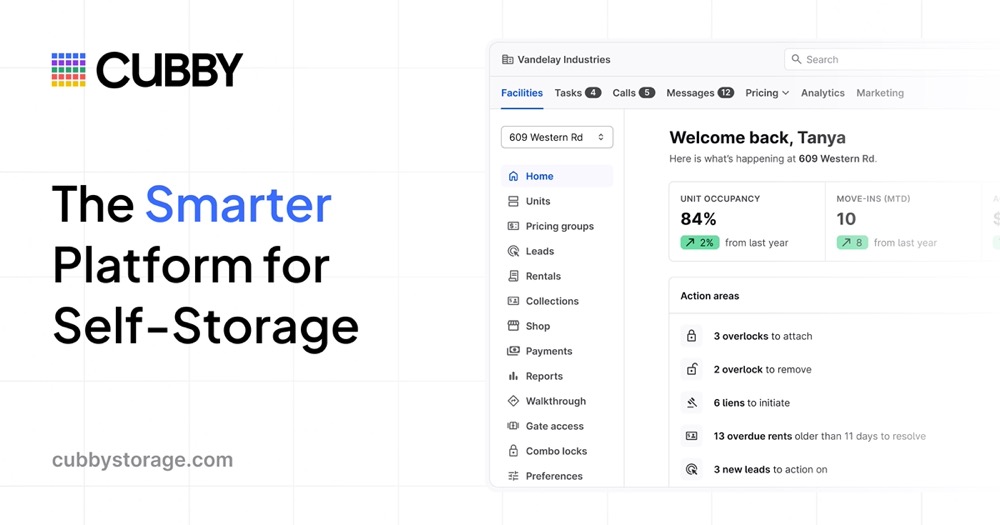

Tell us about the product or service that Cubby Storage offers.

Cubby is an AI-native platform built specifically for self-storage. We provide an integrated suite of tools that includes facility management, e-commerce, revenue management, calls, and Voice AI – all in one platform. We’re helping operators replace outdated legacy systems with modern technology that lets them run more profitable, efficient businesses while delivering better experiences to their customers.

What inspired the start of Cubby Storage?

I come from a commercial real estate background. I started a side hustle selling art where I had to book storage units. I was blown away by the technology. The self-storage industry – worth $50B with over 52,000 locations across the U.S. – was being underserved.

I come from a commercial real estate background. I started a side hustle selling art where I had to book storage units. I was blown away by the technology. The self-storage industry – worth $50B with over 52,000 locations across the U.S. – was being underserved.

Adam Fleming and I founded Cubby in 2022 because we saw a massive opportunity to bring modern, AI-powered software to an industry that had been left behind. We started by working at storage facilities ourselves – doing overlocks, walkthroughs, even shoveling snow – to truly understand the problems operators face every day.

How is Cubby Storage different?

We’re building the first truly AI-native platform for self-storage from the ground up. Cubby unifies the entire operator experience – from marketing and lead management to revenue optimization and facility operations. Our AI learns and adapts continuously, whether it’s optimizing pricing based on market conditions or handling customer calls intelligently. We also take a fundamentally different approach to partnerships – we provide open API access to vendors who serve our mutual customers rather than creating walled gardens.

What market does Cubby Storage target and how big is it?

We serve the self-storage industry across North America – a $50B market with over 52,000 facilities. That’s more locations than Burger King, Chick-fil-A, Starbucks, and McDonald’s combined. With 30-40% profit margins and consistent demand, it’s a robust, recession-resistant market with massive room for technological transformation.

What’s your business model?

We operate on a SaaS subscription model, charging operators based on the size and scope of their operations. Our platform delivers clear ROI through increased operational efficiency, optimized revenue through AI-powered pricing, improved lead conversion, and reduced labor costs – making the investment case compelling for operators of all sizes.

How are you preparing for a potential economic slowdown?

Self-storage is inherently recession-resistant. During economic downturns, people downsize homes, start businesses, go through life transitions – all of which drive storage demand. We’re focused on helping our operators become even more efficient and profitable, which positions both them and us well in any economic environment. We’re also maintaining disciplined growth and a strong balance sheet while investing strategically in our product and team.

What was the funding process like?

Once inbound investor interest surged, we started the process to engage investors. We were looking for someone who thinks big and brings helpful expertise – particularly in commercial real estate – but would let us continue to run the company the way we know how. Goldman Sachs Alternatives was the perfect fit: they bring healthy pressure and expertise in real-estate and technology.

What are the biggest challenges that you faced while raising capital?

Early on, there was skepticism about whether the self-storage industry was ready for modern technology. Some industry folks were not overly enthusiastic – they’d seen promises before. It was clear it would be hard, but that’s exactly why the opportunity was so significant. We had to prove not just that better software was possible, but that operators would actually embrace it and that we could execute on the vision.

What factors about your business led your investors to write the check?

Several key factors: First, our proven product-market fit with over 400 operators across 2,000+ facilities, including major names like Atomic Storage Group and American Self-Storage. Second, our AI-native approach to a massive, underserved market. Third, our team’s deep domain expertise and customer-centric approach. Fourth, our strong unit economics and explosive growth trajectory. And finally, they recognized we’re not just building better software – we’re building the foundational system of record for the next generation of the self-storage industry.

What are the milestones you plan to achieve in the next six months?

We’re focused on several key areas: significantly expanding our customer base and facility count, accelerating product development with new AI capabilities across our platform, recruiting top talent across engineering, sales, and customer success, and deepening our position as the industry’s leading technology platform. We’re also investing heavily in customer success initiatives to ensure our operators are getting maximum value from our platform.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus obsessively on solving real problems for customers who will pay for solutions. Build something valuable before you raise – the best time to raise capital is when you don’t desperately need it. Be disciplined about burn rate and make every dollar count. And don’t be afraid to get your hands dirty early on. We started in a basement in Brooklyn, went months without taking paychecks, and worked as site managers to understand our customers’ problems firsthand. That foundation of understanding and fiscal discipline has been invaluable.

Where do you see the company going now over the near term?

We’re positioned to become the standard operating platform for self-storage. With this capital, we’re accelerating everything – product innovation, market expansion, and team growth. But fundamentally, we’re staying focused on what got us here: obsessive attention to our customers’ success, relentless innovation, and building technology that makes operators’ lives genuinely better. The industry is at an inflection point in its technology transformation, and we intend to lead that change.

What’s your favorite winter destination in and around the city?

I just bought the team gift cards to Aire in Tribeca for our holiday party. It’s a spa that is super relaxing in the NYC winters when everyone is so busy running around closing out the year and dealing with the holidays or when you’re trying to get through the dog days of February and March.