In the wealth management industry, financial advisors face a critical challenge: spending excessive time on administrative tasks instead of focusing on client relationships and strategic advice. The statistics paint a clear picture – while 60% of client data gathering happens during meetings, less than 25% of these interactions are properly documented due to the time-consuming nature of manual note-taking and follow-up work. Zeplyn, founded by former Google engineers with expertise in AI and speech recognition, has emerged to tackle this industry-wide problem. Its AI-powered Meeting Assistant transforms unstructured client conversations into highly accurate notes, capturing financial details, goals, and action items while streamlining the entire meeting process from prep to follow-up. By automating these administrative burdens while maintaining compliance requirements, Zeplyn saves financial advisors an estimated 10-12 hours per week – time that can be better used on servicing client relationships and business growth.

AlleyWatch caught up with Zeplyn CEO and Cofounder Era Jain to learn more about the business, the company’s strategic plans, recent round of funding, and much, much more…

Who were your investors and how much did you raise?

We raised $3M in seed funding, led by Leo Capital. Our investors were Leo Capital, Converge and various angel investors.

Tell us about the product or service that Zeplyn offers.

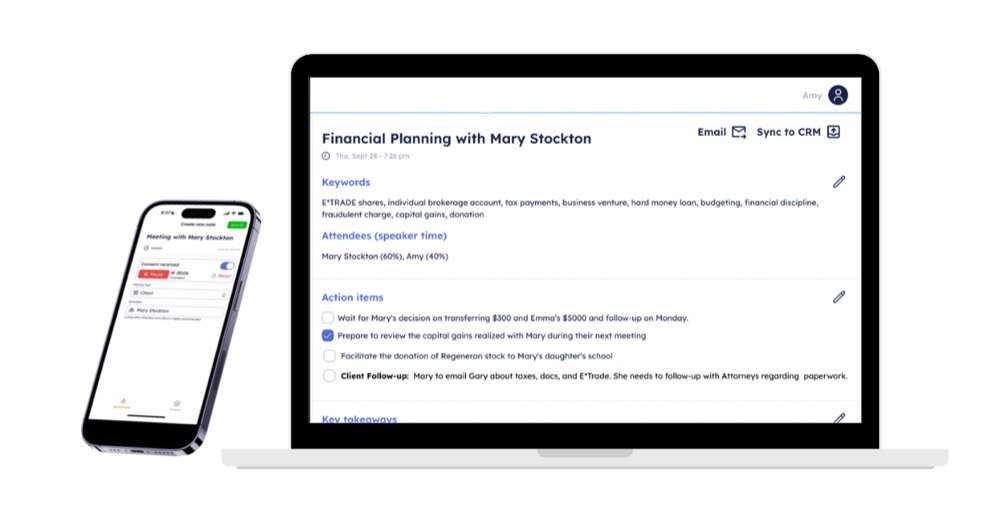

Zeplyn Meeting Assistant, our flagship product, is designed specifically for financial advisors and wealth management firms. It takes unstructured client conversations and turns them into highly accurate notes, capturing client financial details, goals and objectives, key discussion points, and action items. This is one area where our AI really shines.

In fact, one of our customers, who spent a significant amount of time testing and training other AI solutions, told us that no other tool understood her firm’s acronyms and could summarize the complexities of their financial planning conversations. She told us, “I didn’t think AI was anywhere close to being able to do it, until we found Zeplyn.”

Zepkyn Meeting Assistant also streamlines meeting prep, note-taking, and post-meeting workflows while fulfilling compliance requirements, saving financial advisors an average of 10-12 hours per week.

What inspired the start of Zeplyn?

My cofounder Divam Jain and I met at Google, where we spent years building AI for Search, Voice Assistant, and speech recognition products. Excited about the possibility of using our expertise to reimagine how financial advisors work, we started Zeplyn.

My cofounder Divam Jain and I met at Google, where we spent years building AI for Search, Voice Assistant, and speech recognition products. Excited about the possibility of using our expertise to reimagine how financial advisors work, we started Zeplyn.

My introduction to the wealth management industry came through my classmates at Harvard Business School, who have worked at firms such as Morgan Stanley, and the school’s alumni network, many of whom were running their own RIA practices. In digging deeper into the space, I learned that the client meeting process is one of the most expensive activities for a wealth management firm. Advisors spend hours per day documenting client meetings and executing post-meeting follow-up tasks. We also found that 60% of client data gathering happens over meetings, yet less than 25% of client meetings are properly documented because of the time-consuming nature of this process. The antiquated manual processes were a big problem, one we could solve by introducing AI.

Passionate about the potential of AI to transform workflows for financial advisors, my cofounder and I set out to develop a meeting assistant that would help automate the tedious but necessary sections of the process: meeting admin tasks and fulfilling regulatory reporting requirements. In doing so, we freed up wealth management professionals to focus on the human element and deliver better results for their clients.

How is Zeplyn different?

Zeplyn is a highly accurate end-to-end AI solution that streamlines the entire meeting process: meeting prep, note-taking, task management, and follow-ups. Built for financial advisors and trained to understand the wealth management context, Zeplyn Meeting Assistant delivers highly accurate, post-meeting structured summaries, making it a reliable tool for documenting client interactions. It also meets the unique workflow requirements and security and compliance standards of the industry, and it can be used across video meeting platforms, in-person meetings, and dictations. Zeplyn integrates with existing infrastructure and the advisor technology stack with ease.

What market does Zeplyn target and how big is it?

Zeplyn serves the wealth management market, including RIAs, brokerages, and family offices. The market is experiencing significant growth and transformation, and we’re proud to be supporting it.

What’s your business model?

Zeplyn is available for any sized RIA and brokerage, with pricing plans for the individual advisor, multi-advisor teams, and enterprise deployments. Advisor Assistant licenses are also available. Zeplyn offers seat-based pricing, with the flexibility to choose between monthly and annual subscriptions.

What are the biggest challenges that you faced while raising capital?

We had a great experience, honestly. When we were meeting with Leo Capital and Converge, we did our research and prepared a detailed pitch deck that spoke to our offerings, the product-market fit, and how it aligned with their respective portfolios. I know it’s been a tough year for funding in tech, but we believe in our mission, and it was great to find VCs that believe in it as well.

There are a few key things to keep in mind when trying to secure funding, regardless of external economic conditions:

- Know your market. What are the pain points? What are the gaps? How will your company fit in?

- Gather as much validation and as many proof points as you can at your current stage. Rapid customer acquisition? Major industry players vouching for the impact of your product? Statistics that back up your product thesis? Make sure you’re presenting those points succinctly and communicating your value.

- Know your audience. If you are doing VC outreach, make sure you understand their existing portfolio, their investment thesis, and where you fit in. If you’re planning to pitch a VC that exclusively invests in one industry, for instance, make sure you have a relevant product that is sufficiently differentiated from their existing investments.

What factors about your business led your investors to write the check?

Early-stage investors care a lot about the strength of the founding team. At Zeplyn, we’ve built a strong foundation. Our product and go-to-market teams bring a blend of expertise across AI, wealth management, and enterprise SaaS. Our founding team includes engineers who bring more than a decade of foundational AI, machine learning, and software engineering experience from leading tech giants such as Google, and seasoned wealth management professionals with more than 20 years of experience building advisory platforms at top brokerage firms such as Merrill Lynch and LPL Financial.

This unique combination of technical excellence and industry expertise equips us with a profound understanding of the wealth management sector’s complexities and the challenges our users face. Our team’s capabilities allow us to design and deliver robust, high-performing, and user-centric solutions that directly address these pain points, inspiring investor confidence in our vision and execution.

What are the milestones you plan to achieve in the next six months?

Over the next several months, we are going to be focused on a few initiatives:

- User acquisition: Zeplyn has received a warm response and has grown three-fold in the last three months. We are onboarding new advisors every week, mostly through organic channels. We are investing in sales and marketing, and we are planning to grow our customer base while continuing to deliver reliable and time-saving AI.

- Technological advancement: Our goal is to bring an AI-native perspective to wealth management, rebuilding the industry and addressing critical needs. Zeplyn is committed to reimagining the financial advisor experience, top to bottom. We have already introduced new levels of efficiency and client intelligence with Zeplyn Meeting Assistant, and we have no plans of stopping there. Our vision is to build a full stack workflow automation solution for financial advisors that also handles sophisticated and complex wealth management workflows, serving as a single source of truth.

- Team expansion: We will expand our product, engineering, sales, and marketing teams.

Where do you see the company going in the near term?

Zeplyn Meeting Assistant is our first product, and we are building towards a full-stack workflow automation solution that will deeply integrate with advisor technology and tools to streamline other complex wealth management workflows— beyond client meetings.

With Meeting Assistant, we’ve solved for a huge gap in client data gathering in meetings. Now that advisors can capture complete and accurate client data, they can leverage it to enhance not just their downstream workflows but also the overall client experience. We’re really excited about the opportunities the data will unlock for advisors.

What’s your favorite fall destination in and around the city?

It’s touristy, but in the city, Central Park is breathtaking all year round. It hosts all sorts of wonders, from art vendors to concerts and performances to hidden gardens. There’s always something new to do and discover, or if you just want to sit and relax, you can do that too.

Farther afield, Beacon is worth a trip. It’s a great little city with art galleries, nature, and history. In particular, the Storm King Art Center hosts artworks that push the boundaries of their medium. It’s a huge outdoor art museum, and it’s especially stunning in fall.

In the Catskills, Woodstock is a great retreat in fall. There are hiking trails that will take you into nature, and it’s a fun town to explore, with art galleries, retreats, and quirky shops that keep the spirit of the 1960s Woodstock and “Peace, Love and Music” alive.