Managing medical claims presents significant challenges for self-insured employers. While self-insurance offers greater control over healthcare costs, it demands sophisticated oversight of the claims process. With medical overbilling accounting for $300B annually, employers face substantial financial exposure from inaccurate claims. Bluespine addresses this challenge through its innovative AI-powered claims cost optimization platform. The platform is focused on self-insured employers and delivers comprehensive claims auditing to combat widespread medical overbilling. Unlike traditional approaches that focus solely on high-cost claims, Bluespine’s technology examines every claim submission using LLMs to integrate and analyze health plan contracts, Summary Plan Documents, Machine-Readable Files, and billing guidelines to ensure accuracy. Built by a team of cybersecurity veterans, Bluespine takes an advanced fraud detection approach to identify billing anomalies. With an estimated 80% of medical bills containing errors, there’s a significant opportunity for cost recovery. The company’s business model aligns with client interests through a contingency-based fee structure, where compensation is tied directly to successfully recovered overbilled amounts.

AlleyWatch caught up with Bluespine CEO and Cofounder David Talinovsky to learn more about the inspiration for the business, the company’s strategic plans, recent round of funding, and much, much more…

Who were your investors and how much did you raise?

$7.2M seed funding led by Team8 and strategic partners.

Tell us about the product or service that Bluespine offers.

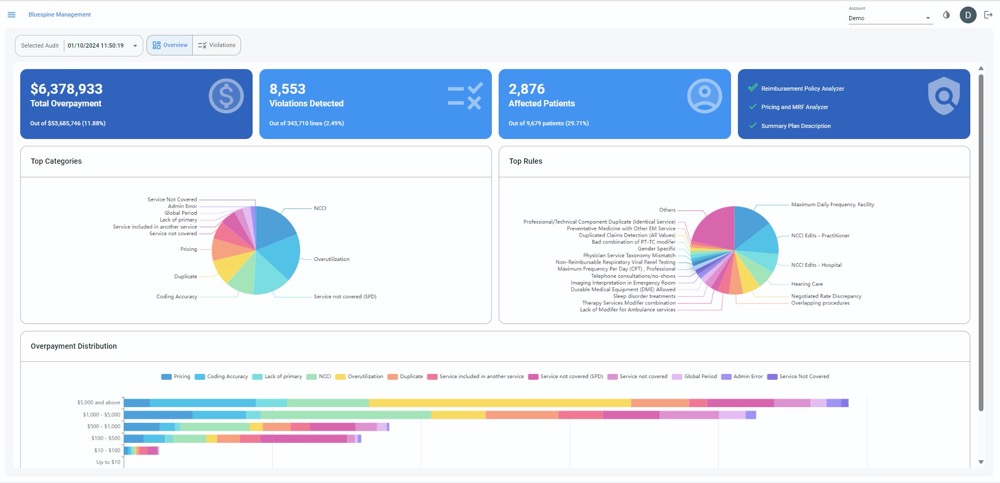

Bluespine is an AI-driven claims cost reduction solution that helps self-insured employers discover, recover, and prevent medical overbilling. Our platform enables businesses to reduce annual healthcare spending by up to 10% while mitigating financial and legal risks associated with plan sponsorship.

In addition to attracting several large employers, such as the leading toy company Mattel and the DavidShield insurance company, Bluespine is partnering with leading brokers, including Alliant Insurance Services, to enhance their capabilities and service offerings.

What inspired the start of Bluespine?

Our team has a strong background in cybersecurity and preventing financial fraud. Looking for our next venture, we got excited about opportunities at the intersection of FinTech and healthcare. American healthcare is a $4T market, with close to 10% going to fraud, waste, and abuse. We saw an opportunity to apply our expertise in fraud detection to help solve this growing problem.

Our team has a strong background in cybersecurity and preventing financial fraud. Looking for our next venture, we got excited about opportunities at the intersection of FinTech and healthcare. American healthcare is a $4T market, with close to 10% going to fraud, waste, and abuse. We saw an opportunity to apply our expertise in fraud detection to help solve this growing problem.

How is Bluespine different?

Unlike traditional sample auditing methods, which typically review only 1% of high-value claims, Bluespine’s evidence-based approach leverages proprietary AI to analyze 100% of claims with pinpoint accuracy. Our platform is the first of its kind to combine data from health plan contracts, Summary Plan Documents, Machine-Readable Files, and plan billing guidelines to conduct comprehensive audits that are uniquely tailored to the specific coverage terms of each employer.

What market does Bluespine target and how big is it?

We target self-insured employers, who represent 91% of companies with more than 5,000 employees. The problem of medical overbilling – a symptom of fraud, waste, and abuse, costs self-insured employers an estimated $300B annually.

What’s your business model?

Our business model is fully aligned with the financial interests of our clients. We charge a contingency fee based on recovery results.

How are you preparing for a potential economic slowdown?

A potential slowdown would incentivize employers to be innovative with their cost savings strategies, and we can play an important role in helping them reduce their second-largest expense. At the same time, we’re always tracking our operational costs and are committed to building a resilient business.

What was the funding process like?

We are a bit unique in that we were established within Team8’s fintech venture creation fund, which partners with entrepreneurs to build category-leading startups. The fund is led by Managing Partners Rakefet Russak Aminoach (former CEO of Bank Leumi), Ronen Assia (co-founder of eToro), Alon Huri (co-founder of Next Insurance and Check), and Team8 Partner Galia Beer (former executive at PayPal).

What are the biggest challenges that you faced while raising capital?

Team8 actively helped us validate our thesis and solution early on. This gave them a lot of confidence in our market potential during the early stages of ideation. By the time we were ready to move forward, their commitment to backing us felt like a natural next step in realizing a shared vision.

What factors about your business led your investors to write the check?

Team8 saw that we (the founders) had deep technical knowledge with expertise in building and scaling tech companies. We are serial entrepreneurs who understand that the opportunity we are tackling extends beyond self-insured employers. It is also highly relevant to the broader healthcare payment integrity space. Our investors are well aware of the high costs in healthcare and were happy to support our mission – by leveraging AI to reduce administrative burdens, we’re ultimately working toward better healthcare outcomes for Americans.

What are the milestones you plan to achieve in the next six months?

In the next six months, we are looking to expand our team to meet the demand that we’re seeing in the market. We also want to extend our AI capabilities to analyze an even broader range of healthcare data sources.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Being a founder and raising capital these days isn’t easy. You need strong conviction in what you’re building and a clear focus on delivering real value to your customers. I also believe in maintaining a bootstrapped mindset—even with investors on board. This approach helps you run your business in a highly efficient way.

Where do you see the company going now over the near term?

While we’re starting with self-insured employers, we see demand from brokers, consultant firms, and carriers. We also have requests from government agencies who are looking to embrace innovative technology that can help them reduce healthcare costs for US citizens.

What’s your favorite fall destination in and around the city?

I’m a fan of Central Park, especially this time of year.