The financial sector is seeing a rise in challenger providers targeting the unique needs of its 47M+ immigrant population in the United States. These innovators are addressing key challenges immigrants face in banking, such as building credit, overcoming language barriers, and accessing suitable payment services. Comun, a digital banking platform, stands out in this space by offering immigrant-focused financial services. Their offerings include no-fee accounts with no minimum balance requirements, access to a vast cash deposit network, and remittance services to seventeen Latin American countries. This approach has resonated strongly, resulting in an impressive 52% month-over-month growth in active customers since launching. By tailoring their services to the specific needs of immigrant communities, Comun is not only tapping into a significant market opportunity but also promoting greater financial inclusion in the United States.

AlleyWatch caught up with Comun Cofounder and CEO Andres Santos to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding raised to $26M, and much, much more…

Who were your investors and how much did you raise?

Our investors were Redpoint Ventures, ANIMO Ventures, Costanoa Ventures, FJ Labs, RTP Global, and South Park Commons. Redpoint Ventures led our Series A funding round of $21.5M.

Tell us about the product or service that Comun offers.

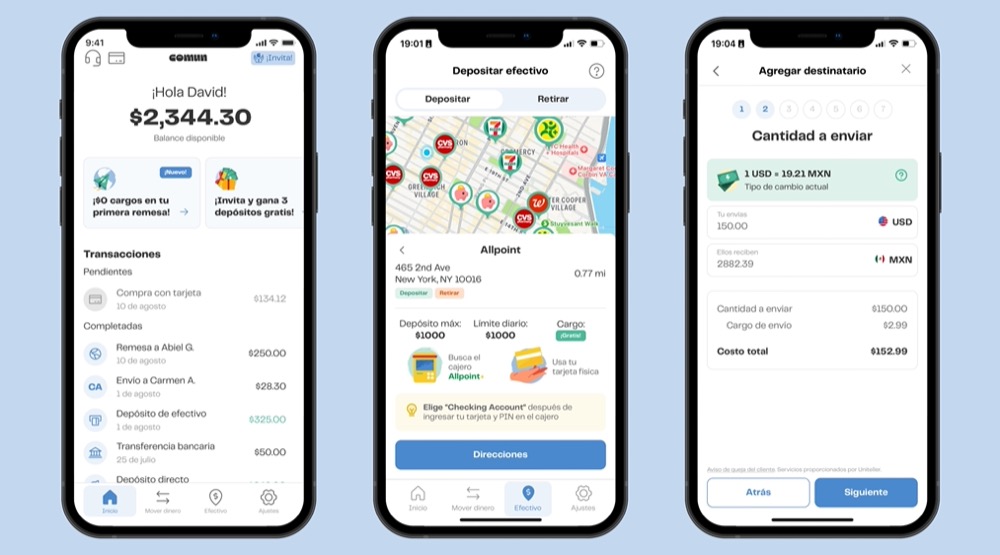

At Comun, we offer an inclusive, low-fee, digital financial solution that includes an FDIC-insured US checking account, VISA debit card, instant remittance service, access to Zelle, and access to the largest cash deposit network in the U.S., all accessible via a user-friendly, Spanish-first mobile app.

What inspired the start of Comun?

My cofounder, Abiel Gutierrez, and I were inspired to start Comun after facing financial exclusion in the U.S. when we migrated from Mexico. When we both came to the US to study, we faced several challenges opening a bank account, from a language barrier to ID requirements.

My cofounder, Abiel Gutierrez, and I were inspired to start Comun after facing financial exclusion in the U.S. when we migrated from Mexico. When we both came to the US to study, we faced several challenges opening a bank account, from a language barrier to ID requirements.

As we looked into this matter, we found the Latino community has been underserved in accessing financial products and services that fit their unique needs. Many don’t have social security numbers or credit scores in the US, so the more traditional ways banks assess and understand potential customers don’t work for this community. In addition to these obstacles, access to financial services in the US can be extremely costly. Latinos are 3x more likely to go unbanked and pay an average of 5x higher fees for basic services. All these factors, including our own experiences, inspired us to start Comun. We want to provide all Latinos in the US with easy-to-access and affordable banking solutions and help them achieve upward mobility.

How is Comun different?

Customers can open an account with over 100 IDs from Latin America – we have a very comprehensive KYC system that has allowed us to remove many of the friction points immigrants typically face while also blocking fraudulent actors.

Our accounts do not include fees – There is a $0 opening fee, $0 minimum balance, $0 monthly fee, and $0 membership fee.

One of the largest and affordable cash networks – our users can deposit and withdraw cash at ~100k locations around the US for free or at industry-leading prices.

International transfers (remittances) to 17 countries in Latin America – family members in LATAM can receive funds at a bank account or through a cash network of over 300k merchants across the region at industry-leading prices compared to incumbents like Western Union.

Spanish-first customer support – customers can contact Comun 24/7 by phone, email, chat, and WhatsApp with native speakers.

Peer-to-peer instant payment network – customers of Comun can send money easily to friends and family who also have Comun accounts for no cost.

What market does Comun target and how big is it?

At Comun, our mission is to empower immigrants and their families to turn their hard work into upward mobility. Today, the Hispanic population in the U.S. is more than 63M and is expected to reach 111M by 2060.

What’s your business model?

Similar to other fintech services like Chime, our revenue comes from interchange fees and other product offerings like our remittance program and cash deposit network.

How are you preparing for a potential economic slowdown?

We are fortunate that our remittance service and expanded cash deposit network have diversified our revenue streams, reducing our reliance on interchange fees and demonstrating resilience against 2025’s uncertain macroeconomic headwinds. Our focus this year is to continue offering the best product experience and expanding our remittance program into other countries in Latin America. We have also been very thoughtful in expanding our team and have remained lean despite our growth.

What was the funding process like?

To be frank, we were not looking to raise our next round. We started receiving preemptive offers from investors, which led us to launch a full process. We received significantly more interest than we could accept, and every previous investor decided to double down.

What are the biggest challenges that you faced while raising capital?

We feel very fortunate that our investors believe in our mission, which sparked this funding round.

What factors about your business led your investors to write the check?

We received positive feedback from our investors. A common theme among investors was our growth. Many VCs told us that we were one of the fastest-growing consumer fintech companies they had seen recently. We were also told we had superior unit economics than most other companies they evaluated.

What are the milestones you plan to achieve in the next six months?

We have aggressive goals set for this year that will help deepen our relationship with our customers. That includes providing customers with additional alternatives on how they fund their accounts, enhancing our fraud detection capabilities, making sure every customer has a great product experience, and including more countries in Latin America where customers can send money.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Be laser-focused on what truly matters. At Comun, we stripped away anything non-essential and zeroed in on our core mission. We stayed close to our customers and ruthlessly prioritized only what would significantly move the needle. In tough times, the ability to prioritize ruthlessly can make all the difference.

Where do you see the company going now over the near term?

We envision Comun as the one-stop trusted financial partner for immigrants in the US. However, to get there, we recognize that immigrants need access to credit solutions, the knowledge on how to build a great credit score and ongoing financial advice, whether it’s around saving for retirement, buying a house, or building an emergency fund. We believe we are well-positioned to become that trusted partner for our customers.

What’s your favorite summer destination in and around the city?

I love going on road trips with my wife and daughter and discovering new places around New York. There’s always something new to explore just a short drive from the city.