The United States is home to roughly one million businesses that operate vehicle fleets, with an average of 40 vehicles per fleet. Managing a commercial fleet involves numerous considerations, including financing, maintenance, route optimization, insurance, and fueling. Coast offers a comprehensive fleet management platform and integrated charge card system specifically designed for fleet vehicle expenses. This solution provides real-time visibility for fuel purchases, seamless employee spend monitoring, and integration with existing fleet management tools. Coast focuses on businesses with field service fleets like HVAC, plumbing, and construction businesses. The charge cards are accepted anywhere Visa is accepted. On the revenue side, Coast earns an interchange fee along with a $4 per month fee per issued card. Fleet operators earn a $.02 rebate per gallon of gas purchased while ensuring that employee vehicle and fuel spend are both aligned with expense policies with increased oversight.

AlleyWatch caught up with Coast Founder and CEO Daniel Simon to learn more about the business, the company’s strategic plans, latest round of funding, and much, much more…

Who were your investors and how much did you raise?

We raised a $40M Series B equity financing, led by ICONIQ Growth. They were joined in the round by existing investors Accel, Insight Partners, Vesey Ventures, and Avid Ventures, as well as new investors Thomvest. This brings Coast’s total equity funding to about $100M.

Tell us about the product or service that Coast offers.

Coast provides a modern, tech-forward expense management software platform with a commercial charge card – analogous to solutions from companies like Ramp or Brex – but specifically designed for the vast and underserved sector of businesses that operate vehicle fleets.

Fleets like these have data needs that regular corporate cards don’t provide. They need detailed visibility at the line-item level into their employees’ spending. For example, they want to know how many gallons of which fuel grade are being bought for which vehicle, and to make sure that their employees’ spending complies with company policies when those workers are in the field.

Coast provides a simple way for the employees of these businesses to pay for gas and other vehicle expenses when they’re on the job, wherever Visa is accepted. Coast gives finance and fleet management teams powerful tools to control expense policies and have insights into employee spending, so they can spend their time growing their businesses faster.

What inspired the start of Coast?

We started this business at the height of the COVID-19 pandemic, when logistics and mobile workforces, essential workers at the front lines keeping the economy functioning, were under massive strain. These “real world” business employees — delivery people, plumbers, HVAC installers, taxi and limo drivers — are sometimes overlooked by the technology industry. But they are the hidden force that powers the digital age, making possible every Amazon shipment or Shopify purchase, every DoorDash delivery or Uber ride. As our society demanded more and more of these workers during the pandemic, their community’s needs and pain points became even more apparent to us. We set out to build a business that would improve the working lives of mobile workforces while helping their employers’ businesses thrive.

We started this business at the height of the COVID-19 pandemic, when logistics and mobile workforces, essential workers at the front lines keeping the economy functioning, were under massive strain. These “real world” business employees — delivery people, plumbers, HVAC installers, taxi and limo drivers — are sometimes overlooked by the technology industry. But they are the hidden force that powers the digital age, making possible every Amazon shipment or Shopify purchase, every DoorDash delivery or Uber ride. As our society demanded more and more of these workers during the pandemic, their community’s needs and pain points became even more apparent to us. We set out to build a business that would improve the working lives of mobile workforces while helping their employers’ businesses thrive.

How is Coast different?

Coast reimagines the product category with best-in-class security and spend controls, real-time transaction data and reporting, and integrations with fleet management and telematics software. Coast’s software gives fleet managers powerful policies and controls that they can tailor to the on-the-job needs of different employees and vehicles in their fleets.

What market does Coast target and how big is it?

The fleet fuel payments on these specialized cards add up to a staggering estimated $120B transacted annually in the US.

Coast focuses on field services fleets, e.g. HVAC, plumbing, construction businesses, as well as passenger transport and local delivery fleets.

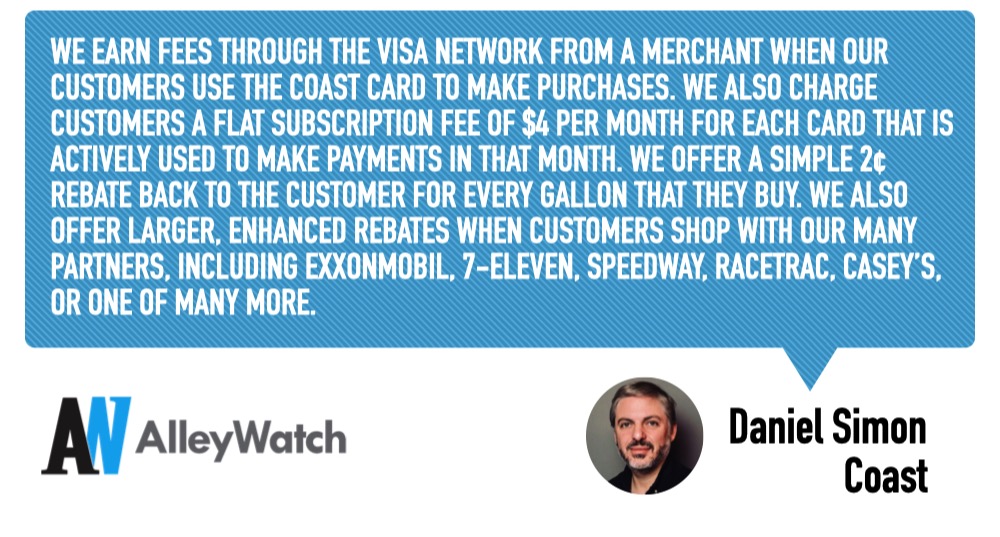

What’s your business model?

We earn fees through the Visa network from a merchant when our customers use the Coast card to make purchases. We also charge customers a flat subscription fee of $4 per month for each card that is actively used to make payments in that month. We offer a simple 2¢ rebate back to the customer for every gallon that they buy. We also offer larger, enhanced rebates when customers shop with our many partners, including ExxonMobil, 7-Eleven, Speedway, RaceTrac, Casey’s, or one of many more.

How are you preparing for a potential economic slowdown?

First of all, this fundraise ensures the company has the resources to weather any storm that may be coming, as long as Coast responsibly stewards its capital. More fundamentally, Coast avoids concentration in its customer portfolio and serves thousands of businesses across industry categories. While Coast shares in the growth of companies that benefit from boom times, like construction, we also serve companies that have less exposure to economic cycles, like those in residential services for plumbing or electrical. This broad customer base ensures the company can maintain revenue even in a downturn.

What was the funding process like?

As we started to build a relationship with ICONIQ Growth over some months, both teams grew increasingly excited about the potential to work together. ICONIQ understood and believed in our vision, and knew we had the tenacity to make it happen, and we were equally impressed with the resources and commitment with which ICONIQ helps its portfolio companies to grow. With our ambitious growth goals and an uncertain capital markets environment, it made sense to arm the company with additional capital, and ICONIQ seemed to us to be perfect partners in that role.

What are the biggest challenges that you faced while raising capital?

The venture capital markets have shown significantly reduced activity after 2021 and capital isn’t as easily available to startups as it was in prior years. That said, Coast’s demonstrated growth, sustainable business model, and loyal customers inspired the continued enthusiasm of our existing investors and sparked the interest of our new lead investor, who dug deep into our product and market and became excited to get involved.

What factors about your business led your investors to write the check?

The enormous market opportunity, fast growth and commercial traction, and the development of multiple effective channels for acquiring customers across marketing, sales, and distribution partners. But most of all, hearing from our customers that they love the Coast product and that it’s categorically better than anything they’ve used before for fleet and fuel payments.

![]()

What are the milestones you plan to achieve in the next six months?

- Launching a first-of-its-kind mobile app that eases the collection and verification of transaction data for fleet payments.

- Building out specialized expense management functionality that supports our customers’ financial processes, including job codes and integrations with field services management software.

- Integrating with new platforms that our customers use, across fleet management, telematics, accounting, and ERP platforms.

- Launching additional partnerships with fuel brands, fleet management companies, field service software providers, and other critical vendors for our customers.

- Growing the team across our New York City headquarters and our expanding Utah office.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on profitable and capital-efficient customer acquisition and unit economics. but don’t neglect investing in growth. If you have a truly differentiated product and your customers are sticking with your product, the capital is out there to fuel fast-growing products that customers love.

Where do you see the company going in the near term?

We intend to use the new capital to continue to invest in building a best-in-class product for the fleets vertical, including expanding to other financial services needs of its business customers, such as accounts payable automation and bill payments. We currently have a team of around 65 employees, largely headquartered in New York City, and a growing presence at our second office in Utah, which we opened earlier this year. The company is actively hiring to grow headcount across its functions. We’ll focus on product development, adding new integration partners as well as supporting business expenses beyond fuel. Over time, with developments in alternative vehicle energy and facilitating the purchase of gas that fuels an internal combustion engine, we will also be powering the transaction that charges an electric vehicle battery that gets the HVAC installer to his job or the package delivery driver to her destination.

What’s your favorite summer destination in and around the city?

The pond in Prospect Park in Brooklyn!