The vast majority of individuals make their livings from wages, salaries, or other forms of labor compensation. However, this has changed as our perspective on work and how to earn income evolves. Harness Wealth is an accessible digital wealth management solution and tax planning platform launched for the needs of builders. The digital platform is a hub that focuses on financial, tax, and estate planning and connects clients with a growing roster of vetted professionals and advisory firms. Advisors on Harness are offered software to streamline practice management, an in-house concierge team, and community in addition to lead generation while clients receive specialized advisory and tax planning services that have previously been reserved for the ultra-wealthy.

AlleyWatch caught up with Harness Wealth Founder and CEO David Snider to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding raised to $36M, and much, much more…

Who were your investors and how much did you raise?

We have raised $17M in an oversubscribed round. The round was led by Three Fish Capital, the venture arm of the Galvin Family (founders of Motorola), with participation from Jackson Square Ventures (which led our Series A), Northwestern Mutual Ventures, and Paul Edgerley (former co-head of Bain Capital private equity) among others.

Tell us about the product or service that Harness Wealth offers.

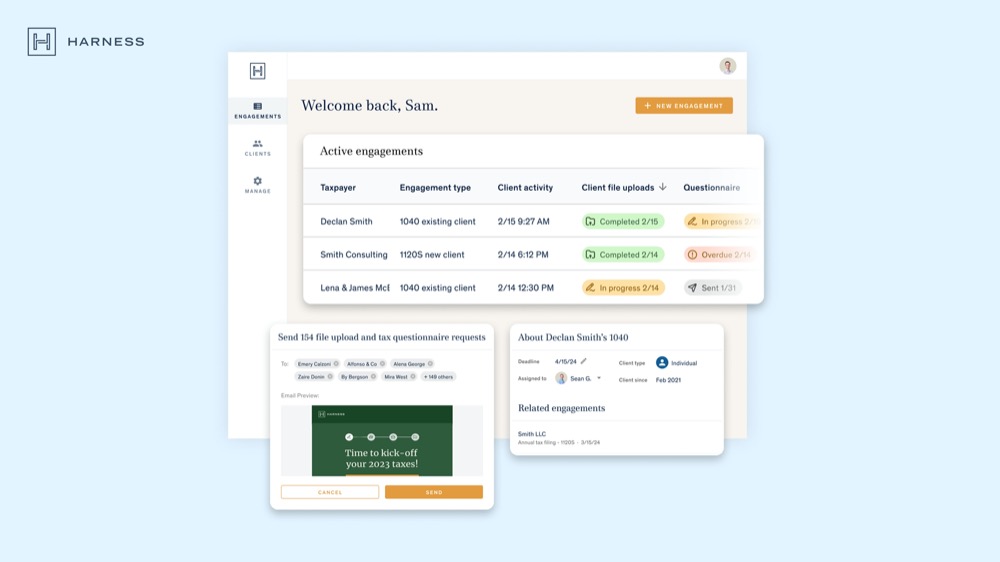

Our newest product is Harness for Advisors, a comprehensive tax advisory solutions platform for tax advisors that seamlessly brings together advanced software, an in-house Concierge team, and a professional community, all in one place. Harness for Advisors sets a new standard for efficient practice management that fuels revenue growth and increased profitability. Whether you’re trying to create capacity for your firm or starting your own practice after years in the industry, Harness can power you to new heights. Optimize your tax practice with advanced software, in-house client concierge and support, curated high-value client introductions, and a professional community of peer tax practice leaders and experts. All in one place.

For clients, Harness offers personalized tax and financial advice through specialized, vetted advisors and our user-friendly client portal. Our advisors cover a range of specialties and offer flexible services tailored to a client’s needs. Working with Harness gives you access to specialized knowledge and expertise on the nuances of your complex tax situation to ensure you leverage every available deduction and credit, leading to potential short-and long-term savings. If you have upcoming life milestones or financial planning needs, you can find additional financial and estate services in our pre-vetted advisor marketplace. Our mission is to help our clients build confidence in the path to their best financial future.

What inspired the start of Harness Wealth?

Harness was founded on a belief that the complexity of the financial decisions of builders was increasing and there wasn’t a great solution for individuals looking to comprehensively solve their financial, tax and estate planning needs.

Harness was founded on a belief that the complexity of the financial decisions of builders was increasing and there wasn’t a great solution for individuals looking to comprehensively solve their financial, tax and estate planning needs.

From my experience helping to build Compass, I felt that the ideal solution required building a platform where technology could help power both discovery and the experience of clients working with exceptional advisors.

The most acute needs in our marketplace are related to tax planning and preparation, so that is where we have differentially focused on building the most comprehensive solution for both advisors and clients.

How is Harness Wealth different?

Harness offers a unique solution that improves both the client and advisor experience, enabling a more comprehensive offering than what exists elsewhere in the market.

Harness is designed to deliver an exceptional client experience while providing increased efficiency and impact for advisors. With an intuitive and collaborative interface, the Harness platform allows tax clients and advisors to easily share documents and questionnaires, handle payments, dynamically track the filing process, and ensure important filing and other tax deadlines are met. And with Harness Concierge, tax advisors are equipped with an industry-first in-house client success team to match them with potential new clients and handle onboarding, billing, invoicing, e-filing needs, and more.

What market does Harness Wealth target and how big is it?

Harness operates in the $10B+ tax advisory market and the $50B+ financial advisor segments.

What’s your business model?

Harness’s business model relies on both advisors and clients paying for access to our software and/or services.

How are you preparing for a potential economic slowdown?

We’re fortunate to be well-capitalized after this round, and do not anticipate a near-term economic downturn significantly impacting our operations. That said, the need for tax services are evergreen. In times of economic growth or recession, we expect the demand for our services to remain strong.

What was the funding process like?

Investors remain reticent to deploy capital unless businesses are demonstrating performance well beyond the typical benchmarks for each stage. It is not an easy time to be raising capital whether you are a VC or a founder so we made the path to a strong return on capital very obvious and clear for our investors.

What factors about your business led your investors to write the check?

Harness is innovating in a large, non-discretionary market where both providers and clients believe that significant improvement is both possible and necessary.

What are the milestones you plan to achieve in the next six months?

We have onboarded thousands of clients onto our new portal and expect that to triple this year.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Developing clients that are advocates of your offering and are willing to go out of their way to support your success can be your greatest asset.

Where do you see the company going now over the near term?

We are continuing to deliver on our mission of making the tax process seamless and insightful to become a key financial resource for our clients. We are excited about the enhancements to that experience and the insights we are building around tax data.

Where’s the best place to hold a team offsite in the city?

New York is an extraordinary place to be headquartered since remote employees are excited to travel here to visit. Since a significant portion of our team is remote, we have hosted our past several offsites in New York City. Industrious was a great host for our last event and we have held dinners in team members’ homes, Niche Niche, Le District, and several other downtown spots. Amsterdam Billiards, Chelsea Piers, and City scavenger hunts have all been fun activities.