As my colleague Steve Crowe reported last October, one of the biggest automation stories of the year was the stalling of Cruise after California’s Department of Motor Vehicles suspended its driverless testing license. While Cruise has had many mishaps since the launch of its robotaxi service on the streets of San Francisco in June 2022, including blocking emergency vehicles, parking on construction sites, and holding up traffic unnecessarily, the breaking point came after it dragged a fallen pedestrian (hit by a human driver) 20 feet under its chassis. As Crowe stated, “According to the DMV, Cruise withheld footage of the incident in which its robotaxi attempted to pull over while the pedestrian was under the vehicle, dragging her for around 20 feet at a speed of 7 MPH before stopping. ‘Footage of the subsequent movement of the AV to perform a pullover maneuver was not shown to the [DMV] and Cruise did not disclose that any additional movement of the vehicle had occurred after the initial stop,’ the DMV wrote.” The implications could even threaten the job of GM’s CEO, Mary Barra, who recently boasted to Wall Street analysts that “Cruise has a tremendous opportunity to grow and expand and that the company could generate $50B a year in annual revenue by 2030.” Last October, GM disclosed its billion-dollar purchase of the startup lost over $730M during Q3 2023.

In 2016, John Zimmer the President/co-founder of Lyft wrote a 16-page whitepaper predicting that the majority of rides on his network would be autonomous by 2021, and, by 2025, car ownership would join buggy whips as a symbol of transportation lore. Zimmer was not alone in this belief, Uber’s former CEO, Travis Kalanick also exclaimed to Business Insider that same year, “I think it starts with understanding that the world is going to go self-driving and autonomous.” Of course, Elon Musk promoted this dogma by declaring all of his cars would be “full self-driving” in 2016 enabling drivers to nap on the way to work (note that just this month Tesla recalled 2 million vehicles because of its autopilot technology). Reflecting on missing these milestones could be depressing for investors as we find ourselves in a trough of disillusionment. Still, could the coming year be a breakout point for Autotech enabling not just new advanced driver-assistance systems (ADAS), but even empowering disabled people to be more independent behind the wheel?

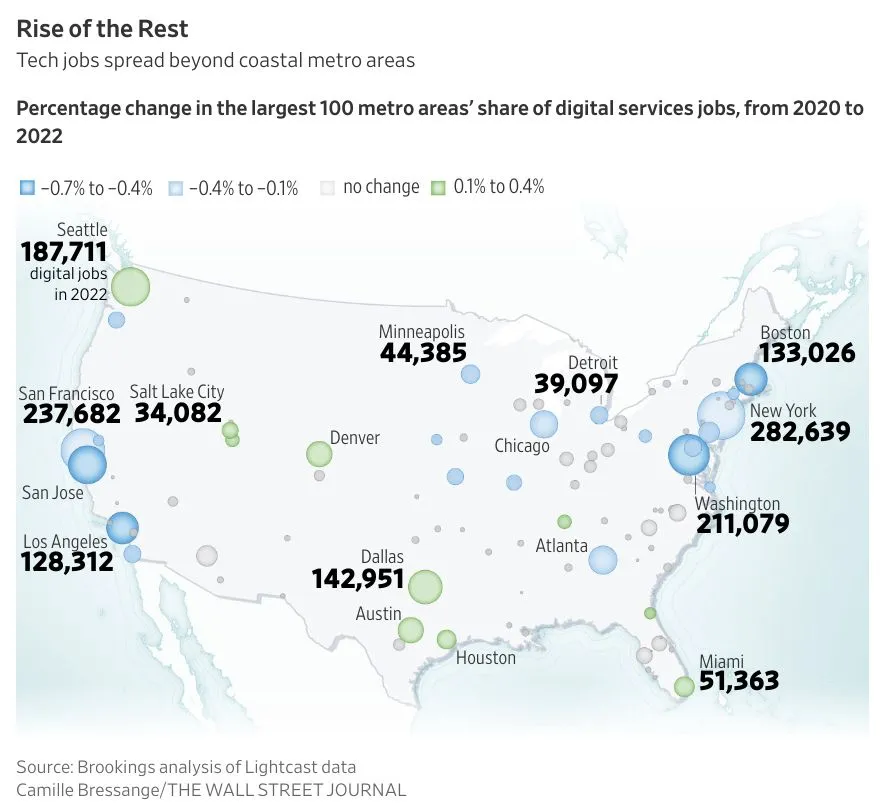

At the same time in 2022, Christopher Mims of the Wall Street Journal reported a huge shift in the growth of tech jobs from San Francisco to across the East Coast with the hubris of the Valley (stated above) being outmaneuvered by the revenue-centric pragmatism of New York entrepreneurs. As an example of the ingenuity of these new Mid-Atlantic innovators, I interviewed Samatha Lee of Meili Technologies, a driver-assist health monitoring platform for trucking fleets and other commercial vehicles. Lee grew up in rural Florida about 45 minutes from Cape Canaveral where her father worked on the launch codes for the space shuttle program. This upbringing, and specifically witnessing how her father’s epilepsy made him dependent on others for transportation, shaped her product vision. As she describes, “My dad lost his license. Probably around the time I was 15, because of his epilepsy, his seizures started to become more frequent. And so the rule is that if you have a seizure, you aren’t allowed to drive for 6 months, and he started having seizures once a week. And so we used to talk a lot about technology and just what it could do to help him regain his freedom or in the future what things like autonomous vehicles could do for society.” After a series of academic pursuits, Lee ended up in Wendy Ju’s lab at Cornell Tech in New York City pursuing her Ph.D. research in studying the interactions between humans and computers in uncrewed systems.

Lee originally set out to create in-cabin monitoring systems for fully autonomous cars but had to pivot when the market came to a halt after a lot of false starts. “And it’s funny, ’cause we started with fully autonomous vehicles. And we’ve changed a lot, like a lot of pivots in that regard. And that we’ve also worked with automakers for cars being sold on the road today with level 2 autonomy, features like adaptive cruise control and lateral steering,” shares the inventor. She continues, “Things very much slowed down. So we began working actually in the commercial vehicle space quite aggressively, probably about half a year back and so we’ve seen a lot of traction there.” Rather than investing huge sums of money in Level 5 autonomy, Lee iterated to find a product market fit with today’s trucking fleets by meeting with everyone in the industry and listening to their needs. “So we’ve moved into the commercial space, also providing safety systems there, where we’ve also found about 70% of commercial drivers have pre-existing [health] conditions, too. So for the health emergency side of things, there’s a huge benefit there for not only saving lives, because when those trucks crash they cause a lot of damage, but also helping the businesses in that space,” explains Lee. Her optimism for an after-market solution that protects drivers is refreshing after so many high-profile autonomous trucking startups shuttering, including Embark ($300M+ loss), Uber Freight ($680M+ loss), TuSimple ($775M+ loss), and, even, Alaphabet’s Waymo Via (losses undisclosed). These closures come at a time when the National Safety Council reports that large truck fatalities have increased close to 50% in the last 10 years, a promise that autonomy aimed to solve.

The key for Lee right now is acquiring the training data to detect people with medical conditions and episodic events while driving, such as erratic breathing, collapsed states, and/or disorientation. “We’re actually doing sponsored research with leading hospitals in New York for heart attack seizures and diabetic emergencies,” comments Lee. She then continued to outline her proprietary data collection, “We have about 20 TB of normal driving data already. And we’re collecting more all the time with our test vehicle, but we’re also in the hospital space and actually collecting driving behavior, as well as health events that occur while they’re using our vehicle simulator. It’s a very niche space where that data doesn’t really exist. At this point, we’re really the first to collect in mass. You kind of have to go through the hospital in order to do it in a safe way.” Lee is not waiting for her training data to be complete before going to market with a smaller version of the platform. “We’ve done many pilots both in automotive, as well as, the commercial space. The one we can talk about, as most of them are under NDAs, was our pilot with Stellantis. That was the demonstration you saw last year at CES where we built our system with the ‘collapsed state’ understanding of incapacitated drivers in one of their Chrysler Pacificas. And so we were showing the kind of responses we trigger like turning on hazard lights, having the vehicle come to a stop, and calling first responders. And what kind of data we would send to first responders,” remarks Lee. She will be returning to CES this month at the COVESA showcase at the Bellagio on January 9th demonstrating Meili’s new commercial fleet solution and expanded passenger vehicle product.

In explaining Meili’s current sales strategy, Lee clarifies how she is focused on driving revenues in the near term, “We actually are selling off-the-shelf hardware components. We would like to eventually be software only, but for now, we’re doing this for go-to-market. And it includes things like understanding if somebody’s having a collapse state, we have that today, as well as, an understanding of those more broad safety systems like limbs outside of the vehicle and backing up incidents [for forklifts].” She presents the initial markets for these solutions, “So we began working actually in the commercial vehicle space quite aggressively, probably about half a year back, and we’ve seen a lot of traction there. We’re now a general operator focused on safety computer vision systems. We’ve also recently moved into the factory manufacturing distribution space.” Lee’s early traction in enabling uncrewed vehicles, like forklifts and scissor lifts, with vision safety systems is an example of the growing autonomy industry outside of the car and Valley startup ecosystem.

The tenacity of roboticists outside the Valley is not limited to New Yorkers. This past September in Pittsburgh Çetin Meriçli founded autonomous forklift startup Atlas Robotics after years of running Locomation an autonomous trucking business. Similar to Lee, Meriçli is capitalizing on the huge opportunity driven by the explosion of e-commerce fulfillment and logistics. According to Markets&Markets uncrewed forklift technology could grow to more than $8 billion worldwide by 2028. There are already two dozen companies vying for market share in this space, many led by engineers formerly designing autonomous driving systems. While the trolley problem is still being debated on the streets of San Francisco, these companies (many located outside of the Bay area) are driven by the promise of real profit. This has even attracted the interest of Sandhill Road with the $20mm investment of Austin-birthed Fox Robotics by BMW i Ventures, Zebra Technologies, and Autotech Ventures (backer of Lyft). This trend is spilling over into more hardware exits (via M&A activity) outside of Northern California, as the audacious concepts founded pre-2021 are closing up shop in the offices of Palo Alto and Menlo Park. Forward-thinking Westcoast funds are now expanding East, most notably Eclipse VC hired a New York-based partner, Kaitlyn Glancy, this past June.

The buzz in the Big Apple has made Lee optimistic for 2024 as she predicts sensor-based technology will become ubiquitous across the industry: “Technologies that enable driving could make us safer today, and even in a Level 5 world.” She further predicts, “If you have an autonomous taxi one day, you need to know if people are actually in it, or you could have a big safety issue with other people getting in the vehicle if somebody else is there and they shouldn’t be. Comfort is a big focus right now in passenger vehicles already on the road. But that’s gonna be, of course, even more important down the road with autonomous vehicles, making sure people have more relaxing environments.” She reckons that this will lead the way for a more widespread autonomous vehicle market over the next 10-15 years, “I’d love it to be on the road like tomorrow, and I’m optimistic. I just think public adoption takes a long time, and that’s going to be decades.”