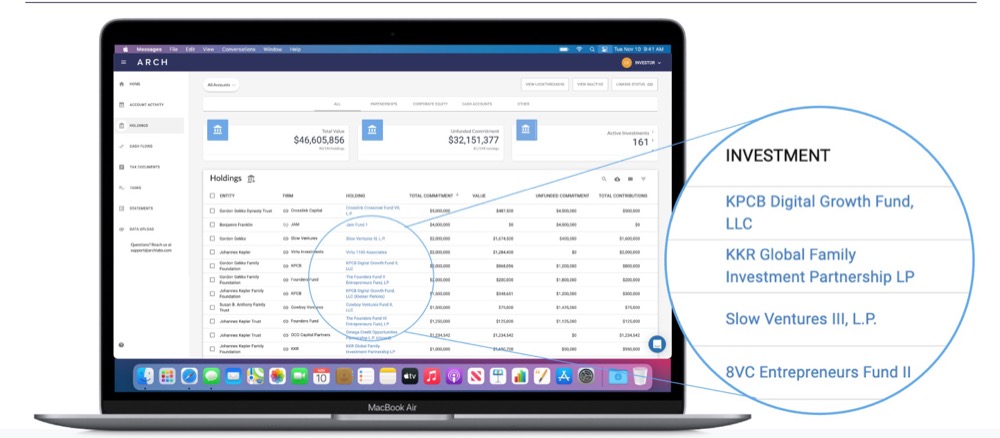

Managing the lifecycle of a private investment fund is a process that’s rife with inefficiency. For advisors and investors in these funds, aggregating information across all their alternative investments becomes an equally arduous task. Arch is a digital-first private investment management platform that allows stakeholders to access relevant details across their portfolio of alternative investments. The platform handles new investment opportunities, portfolio management, capital calls, distributions, reporting, and investor updates through automation. Advisors and accountants no longer need to access fund admin portals but instead will receive polished reporting-ready data straight from the platform which connects directly with the back office of each private investment. Arch is currently being used by over 200 family offices, investment firms, and institutions, tracking over $60B in total alternative investments.

AlleyWatch caught up with Arch CEO and Cofounder Ryan Eisenman to learn more about the business, the company’s strategic plans, latest round of funding, which brings the total funding raised to $25.5M, and much, much more…

Who were your investors and how much did you raise?

Our $20M Series A funding round was led by Menlo Ventures, with participation from existing investors Craft Ventures and Quiet Capital, as well as new investors Carta, Citi Ventures, GPS Investment Partners, and Focus Financial Partners.

Tell us about the product or service that Arch offers.

Arch is a private investment management platform modernizing K-1 collection, automating operations, and simplifying reporting for financial professionals. Our platform is client- and advisor-facing, aggregating data and documents across every investment. This eliminates the need for users to access fund admin portals, and delivers reporting-ready data directly to investors, accountants and advisors. We provide intuitive tools for users to review and efficiently manage updates within their portfolios, including new investment opportunities, capital calls, distributions and more. Additionally, our platform collects and aggregates tax documents (such as K-1s) as they are distributed, allowing users to locate these items from a centralized source when tax season arrives.

What inspired the start of Arch?

Arch was founded in 2018 after a pre-seed-stage investor connected me with two computer scientists from MIT, Joel Stein and Jason Trigg. The investor had a private investment portfolio that was difficult to manage, so he connected the three of us to work on a solution. When presented with this opportunity, I remembered seeing my father, a financial advisor, struggle with similar issues around his clients’ private investments and decided to take on the challenge.

Arch was founded in 2018 after a pre-seed-stage investor connected me with two computer scientists from MIT, Joel Stein and Jason Trigg. The investor had a private investment portfolio that was difficult to manage, so he connected the three of us to work on a solution. When presented with this opportunity, I remembered seeing my father, a financial advisor, struggle with similar issues around his clients’ private investments and decided to take on the challenge.

How is Arch different?

Arch meets the complex needs of private investors, financial advisors, banks, and institutions, equipping them with a platform to efficiently manage and understand their private investments. There are alternative platforms already out there doing some of this administrative work on behalf of advisors, however, those platforms automate those tasks only for the asset managers on their platforms. We have designed Arch to capture anything with a general partner or limited partner structure, as well as private companies, directly held real estate, and directly held startup investments.

What market does Arch target and how big is it?

Arch targets advisors, accountants, and individuals who are managing private market investments. With tens of trillions of dollars currently invested in alternative assets, our platform can benefit a large network of advisors and investors.

What’s your business model?

Arch is a B2B SaaS technology company that aggregates unstructured investment data from diverse alternative investments into a single digital platform, empowering investors to understand, analyze, and manage their alternative investment portfolio at scale.

How are you preparing for a potential economic slowdown?

We’re operating Arch conservatively, maintaining a long runway, so that we can thrive in any economic condition. That being said, we’re bullish on the overall market (and especially bullish on New York). Arch has both a cost savings aspect to it (helpful in a recessionary environment) as well as an “allocate capital more effectively” aspect to it, which is especially helpful when LPs are actively investing.

What was the funding process like?

We were lucky to receive a pre-emptive offer for this round when we weren’t fundraising, which made our process faster than expected. We then had a couple weeks of conversations with potential investors, many of which we knew coming into the process. We’re excited to partner with Menlo Ventures, who understood the Arch value proposition quickly, and also included several clients and strategics to round out our investor base.

What are the biggest challenges that you faced while raising capital?

When we were preempted, we didn’t have a deck or other key funding materials ready to share (as we weren’t yet planning to fundraise), so that was a bit of a scramble. People talk about building the plane as you’re flying. In this case, we were building the deck as we were pitching (which made for an exhausting but action-packed few weeks).

What factors about your business led your investors to write the check?

Investors were eager to support Arch because of the enormous problem it solves for private market investing, a growing sector of the industry. Our solution brings much-needed efficiency, speed and convenience to investment managers, high net-worth families, institutional investors and tax advisors. Without Arch, wealth managers must log-in to tens, if not hundreds, of third-party portals to pull down K-1s and financial statements, manually track capital calls and distributions, and craft their own reports on each client’s private investments portfolio.

What are the milestones you plan to achieve in the next six months?

Over the next six months, we will hire more engineers and developers to facilitate the expansion of our product roadmap. Additionally, we will aim to build a more open architecture for integrations with other advisor tech companies and custodians. The goal is to release an API to allow anyone to integrate with Arch in the near future.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

It’s always easiest to raise when you don’t need to, so the more you can operate leanly and let product/sales progress lead hiring (instead of the other way around), the more you can control your own destiny.

Three years in, we were 5 people, and have grown to 61 since then as the business took off.

Where do you see the company going now over the near term?

In the near term, we will further the development of our product roadmap, which includes automating more workflows for advisors, accountants and their clients; delivering increased insights around an investor’s private markets portfolio; and building additional tools to reduce the risk of fraud against investors.

What’s your favorite fall destination in and around the city?

Mah Ze Dahr in Greenwich Village – sitting outside on a sunny fall day with a coffee and pastry.