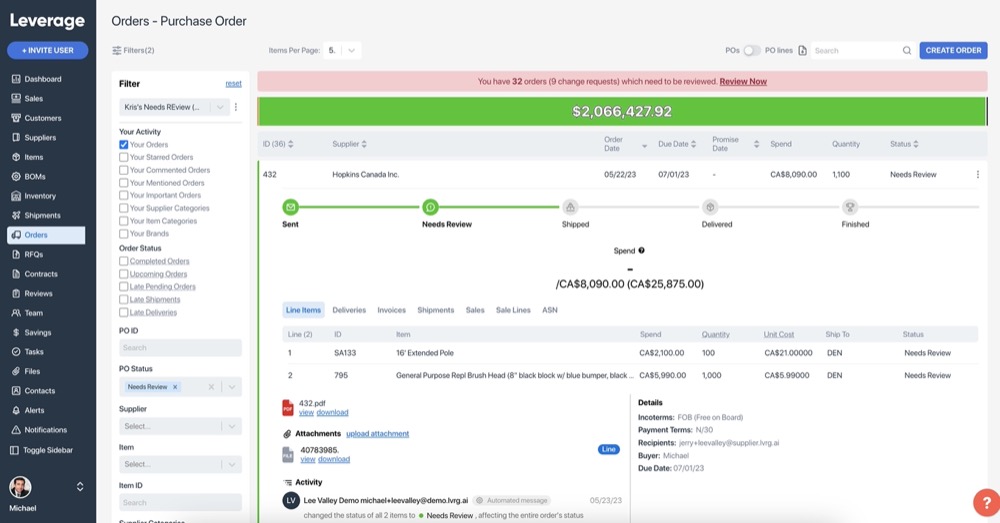

Supply chain disruptions were up 67% in 2020 and 83% percent of these disruptions were caused by humans somewhere in the many moving parts that need to work in unison, whether at the supplier, trader, bank, or manufacturer end. The pandemic exposed shortcomings that were decades in the making. The importance of how technologies can bring supply chain transparency and flexibility is now at the forefront with unprecedented attention given to visibility and decision-making tools to ensure that our global, interconnected supply chain remains as resilient as it can be. Leverage is an end-to-end supply chain visibility platform. Built with versatility in mind, the platform integrated with existing systems to provide real-time visibility and automated purchase order and exception visibility leveraging AI. Leverage also uses AI to anticipate potential inventory risks by tracking SKUs across distribution centers. Last year, the platform handled over $500M in purchase order spend, working with some of the world’s largest manufacturers.

AlleyWatch caught up with Leverage Cofounder Nadav Ullman to learn more about the business, the company’s strategic plans, latest round of funding, which brings the company’s total funding to $13.9M, and much, much more…

Who were your investors and how much did you raise?

The $7M round was led by Chicago Ventures, with participation from Las Olas Ventures, Tensility Venture Partners, Remarkable Ventures, and Florida Funders.

Tell us about the product or service that Leverage offers.

Leverage automates the previously highly manual process of processing purchase order statuses from suppliers, while providing unprecedented visibility into both real-time and historical lead times and costs for the products they order. Supply chain teams can now finally answer the fundamental question, “Where’s my stuff?”

What inspired the start of Leverage?

In March 2020, my cofounder Andrew Stroup and I started a nonprofit called Project N95.

In March 2020, my cofounder Andrew Stroup and I started a nonprofit called Project N95.

What started out as a few Google forms to help connect PPE suppliers to frontline workers, the non-profit became the national clearinghouse for vetted PPE during the height of the PPE crises. The organization grew to over 250 people in the first 3 months, hiring folks focused on vetting and distributing millions of units of PPE to frontline workers from global suppliers

Project N95 became the primary organization in the country vetting PPE from around the world, as well as the go-to sourcing arm for the White House.

The reason we had to build such a large team there is because there was no good technology where our orders were.

As the PPE crises normalized, and PPE vetted went from a shortage to an oversupply, we then set out to build Leverage, to help the broader supply chain space modernize these space processes.

How is Leverage different?

Today, manufacturers who don’t use Leverage must collect status updates from a global supplier base by manually making phone calls and sending emails. Then, they take that data and update a spreadsheet or internal system of record. It’s incredibly costly, unreliable, and the lack of consistent order visibility ultimately leads to unhappy customers and lost revenue.

Leverage fully automates this workflow for them, which provides day-one ROI by automating manual workflows, as well as company-wide visibility on how their customers and sales may be impacted by their supply chain operations.

What market does Leverage target and how big is it?

Leverage targets companies with material supply chain organizations. Our customer verticals today range from apparel to furniture to industrial electronics. It’s roughly a $75B industry that’s growing quickly. So, it’s quite big- a lot of opportunities for Leverage to make an impact on a global scale.

What’s your business model?

We’re a classic subscription SaaS, with a pre-built platform that’s all based on the cloud and ready to use. Our customers pay an ongoing license fee to use that platform, which keeps us all aligned.

How are you preparing for a potential economic slowdown?

The macro situation is definitely impacting a lot of startups, depending on their industry and business model.

For instance, I think if I were running a crypto or VR company or a consumer product that was hoping to figure out revenue later, I’d be thinking really hard about the shifting appetites of capital allocators.

We’ve been revenue generating since month one and are in an industry that will be around forever. And the problem we’re solving isn’t speculative – we’re providing the technology to better move things around the world. The current volatility is in fact increasing manufacturers’ interest in finding solutions to find efficiencies and cost savings with technology.

We’ll of course practice prudent financial management, but being lean is in our DNA anyway. If we stay laser-focused on solving our customers’ needs then I think we’ll continue to build a great business over the long term.

What was the funding process like?

Chicago Ventures led this round and they are absolute pros. When they have conviction in a team and company, they move super quickly. The rest of the round was then oversubscribed from participation from many of our prior investors. We increased the size by about $1M along the way in roughly five weeks, including paperwork. Shout-out to Peter Christman at Chicago Ventures.

What are the biggest challenges that you faced while raising capital?

Since there’s a lot of uncertainty in the startup and venture community, we weren’t sure what was going to happen going in. There are fewer rounds closing partially because no one knows how to price deals right now. We ultimately decided to come out with a fair price on day one.

What factors about your business led your investors to write the check?

I think primarily, it’s the value that we’re bringing our customers every day – how much we’re truly able to help them out. You speak to a few of our customers who all tell you “I’m getting 15x ROI on this platform, and before this, we had no visibility on our purchase order statuses, lead times, costs etc.”

Then you realize the entire global supply chain has been operating this same exact way. The size of the problem we’re solving starts to become pretty clear, and it’s easy to get excited about being a part of the journey.

Supply chain is an inherently messy space, so kudos to our investors who picked up on this all pretty quickly.

What are the milestones you plan to achieve in the next six months?

There’s a ton to do. We have a huge product roadmap that includes a lot of novel applications of AI to space, which we’ll be excited to announce when we get there. We have a lot of key hires to make across engineering, support, and sales. Based on the demand and our sales pipeline, we’ll be investing first and foremost in ensuring our incoming customers are successful.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Just don’t get distracted by the latest zeitgeist or hype. Solve your customers’ actual problems.

Where do you see the company going now over the near term?

We’re going deep, not wide, so to speak. The problem we’re solving—to automate supplier visibility—is huge. The challenge will be to focus. If you look across the supply chain operations, there’s a sea of inefficiencies that our customers are always asking our help to solve, so it would be easy to get distracted. Our job is to make sure we’re building what is truly most impactful for them, and to be the best at what we do

To do it right, it’ll be critical to continue to hire, retain, and empower a champion team. Easier said than done!

What’s your favorite summer destination in and around the city?

Going for runs down the Hudson River Park is pretty hard to beat.