Nearly two-thirds of Americans live paycheck-to-paycheck according to CNBC’s Your Money Financial Confidence Survey. Nearly half will not be able to handle an unexpected $400 expense. With workers and their families operating on such tight margins, improving the timing of cash flows can be the difference between retaining an employee or having them quit. Clair is a free, on-demand pay platform that allows front-line workers to take wage advances without the onerous fees charged by conventional payday lenders. The recently-launched startup works with Pathward, a national FDIC-insured back, to offer the lending program in addition to a suite of other digital banking services including a Spending and high-yield Savings accounts as well as a branded, rewards-earning Debit Mastercard. Clair is integrated with popular workforce platforms like Gusto, TCP, 7shifts, and When I Work to offer seamless access for workers to receive payment immediately at the end of their shifts versus waiting weeks for a check that will take another few days to cash. The company has also launched Clair for Employers to allow employers that are not using one of the integrated platforms to offer on-demand pay as a benefit without investing significant time and resources to get up and running. The banking-as-a-service provider is already trusted by organizations like Viking, Everview, and SanStone Health & Rehabilitation as well as franchisees of Sheraton, DoubleTree by Hilton, and GNC.

AlleyWatch caught up with Clair CEO and Cofounder Nico Simko to learn more about the business, the company’s strategic plans, latest round of funding, and much, much more…

Who were your investors and how much did you raise?

We raised $175M, including $25M in VC equity funding and a consumer lending program with a $150M maximum participation amount from our national banking partner Pathward®, N.A. (“Pathward, N.A.”). Thrive Capital was the lead investor, with Upfront Ventures, and Kairos participating. This Series A extension round brings our total equity funding to $45M.

Tell us about the product or service that Clair offers.

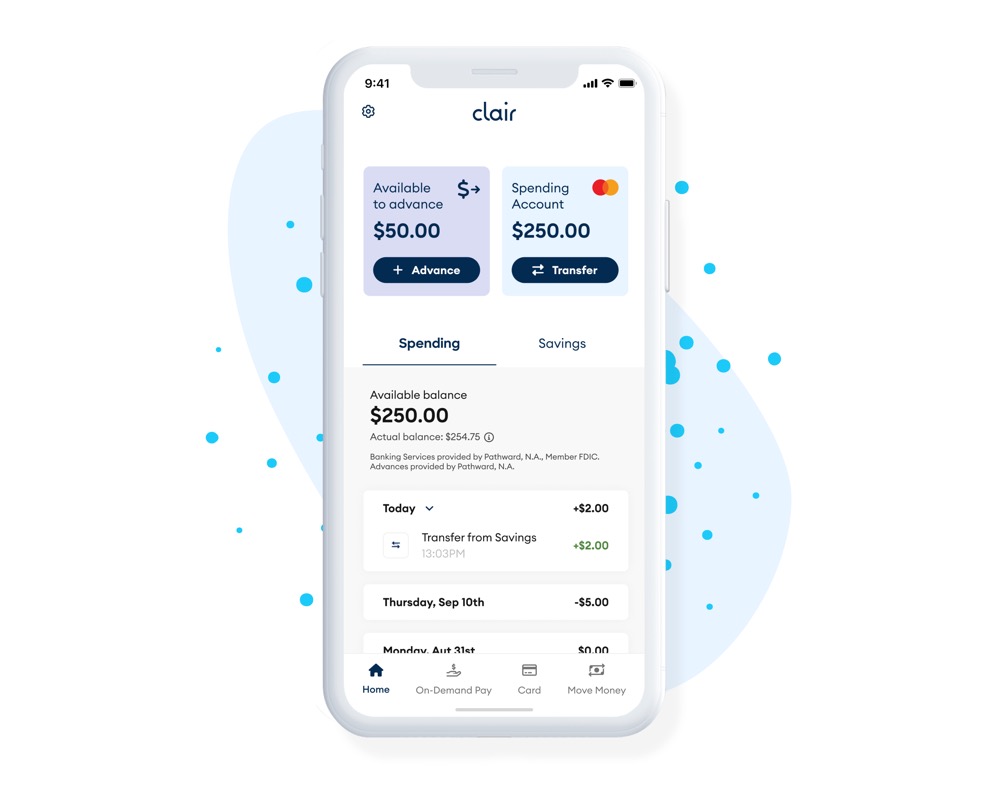

If you can send your friends money in seconds, why does it still take two weeks to get your paycheck? At Clair, we’ve created the first and only digital banking app with free on-demand pay. This means that they not only get a high-yield Savings Account*, no high or hidden fees, and 40,000 fee-free in-network ATMs**, but they can also get free access to money they’ve already worked for but hasn’t been paid out yet.

Through integrations with platforms like TCP Software’s Humanity Scheduling, When I Work, Gusto Embedded, and 7shifts, we’ve helped more than 50,000 front-line workers get paid as soon as they finish their shifts, instead of waiting weeks for a paycheck – with zero fees for advances.

As part of this news, we also announced Clair for Employers, a set of free, holistic financial wellness benefits for employees of businesses that don’t use our partner HR platforms. Offering an on-demand pay benefit usually means human resources teams must commit significant time and resources to implement and manage it, but Clair for Employers integrates seamlessly with companies’ payroll providers for free and with no ongoing maintenance. Moreover, employees of companies using Clair for Employers get additional features like 3% cash back*** on gas and groceries purchased on their Clair Debit Mastercard®.

What inspired the start of Clair?

When I was in college, I worked an hourly job and it would take me weeks to get my paycheck in the mail. And sometimes, there were mistakes that made it take even longer to get the money I earned. After college, I worked at J.P. Morgan and got deep into the fintech space. That’s where I learned that it is possible to offer free advances to consumers if you provide them with a banking app to monetize from.

When I was in college, I worked an hourly job and it would take me weeks to get my paycheck in the mail. And sometimes, there were mistakes that made it take even longer to get the money I earned. After college, I worked at J.P. Morgan and got deep into the fintech space. That’s where I learned that it is possible to offer free advances to consumers if you provide them with a banking app to monetize from.

How is Clair different?

All companies in our space make most of their money on fees that they charge to consumers for taking advances. We’re the only company that actually loses money on providing advances, and earns most of our revenue from the banking services that Pathward, N.A. provides. As a result, we spend most of our time building a banking app that our customers love and want to keep using as their main banking app, even after they leave their jobs. Additionally, we’re the only company that has a national bank providing the advances, through our partnership with Pathward N.A. That’s better for consumers because it means that the institution advancing their money is properly regulated.

What market does Clair target and how big is it?

Our target is front-line workers and the companies that employ them. There is a huge market opportunity with 76 million hourly workers in the U.S. representing 56% of the workforce. Clair is popular across industries from healthcare, to dining and hospitality, to retail and more. As the labor shortage continues with 4 million more job openings than people to fill them, I expect that we’ll see slower economic growth, increased inflation, and supply chain disruptions. Solving for this shortage would have an immeasurable market impact.

We’ve found that workers are starting to demand financial wellness benefits, so companies that provide these benefits are better able to attract and retain employees. Access to on-demand pay is a top priority benefit, as it allows front-line workers to quickly and easily access their funds to keep up with unexpected expenses, especially when they don’t have much in savings. Our employer partners have seen improved morale and increased retention, productivity, and filled shifts among their workforces – our internal research shows employees who use Clair pick up 15% more shifts and stay employed for 25% longer. That can have a big impact on a company’s bottom line.

What’s your business model?

We provide customers with a banking app and make wage advances free by default, for both employers to offer and workers to access. Instead of charging fees for advances to employees who are already struggling to make ends meet, Clair earns revenue from merchant fees every time a customer uses their Clair Debit Mastercard.

Companies like payday lenders or earned wage access companies that charge fees for advances are incentivized by the wrong things – they make money when their customers aren’t doing well financially. With our unique model, our goals are aligned with our customers’ goals. We make money when they have money to spend.

What was the funding process like?

The hardest part of the funding process was finding a national bank with expertise in consumer lending that was willing to work with us on building a first-of-its-kind approach to earned wage access. Luckily, Pathward, N.A. was excited to partner with Clair to offer a new on-demand pay solution to help front-line workers access their wages between pay cycles.

With the equity funding, we were lucky that our lead investors from our Series A were willing to lead again, so it was mostly about selecting other investors to add to the round. Luckily, we met Kairos Ventures, which had developed another fintech app called Bilt, and the Kairos team has been great partners for us on this journey.

What are the biggest challenges that you faced while raising capital?

The hardest part was selecting the right investors to partner with. Even as we saw 10x revenue growth last year, we did not want to over-raise, as that could be tricky in this market.

What factors about your business led your investors to write the check?

Our investors believe in our mission of giving front-line workers access to financial services that help them build wealth and support their families. We’re grateful to work with investors who are excited by the progress that we’ve made thus far. They know it takes time to build a category-defining business and they wanted to continue adding capital to allow us to continue building on our success and providing this service to even more companies and workers.

Our investors believe in our mission of giving front-line workers access to financial services that help them build wealth and support their families. We’re grateful to work with investors who are excited by the progress that we’ve made thus far. They know it takes time to build a category-defining business and they wanted to continue adding capital to allow us to continue building on our success and providing this service to even more companies and workers.

What are the milestones you plan to achieve in the next six months?

We’re really focused on growing our business over the next few months and expanding the customer base that we’ve worked so hard to build and retain. We want employees to continue choosing Clair not only for the advances but also for the awesome features that our partner bank offers. We also want employers to trust Clair to be the best financial wellness option available for their employees.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on the fundamentals of the business and on hiring a high-performing team. The capital will follow.

Where do you see the company going now over the near term?

We’re using our funding to expand our team to support more growth. We’re also focusing on onboarding companies to Clair for Employers, which we’re really excited about. Now that companies can partner with Clair directly versus going through one of our partner HR platforms, we can support many more businesses and their employees.

What’s your favorite summer destination in and around the city?

My favorite restaurant is Café Paulette in Brooklyn, which is a quaint, neighborhood spot with great negronis. I also spend a lot of time running around Prospect Park.