Traditionally, building owners have relied on a combination of surveyors, architects, and engineers to develop blueprints and detailed plans to understand their buildings and their usable space, integrating very little technology into the process. Integrated Projects Exchange (IPX) combines 3D scans with software-enhanced insights to enable real estate owners to develop accurate digital depictions of buildings that provide an unprecedented level of detail at a fraction of the cost and time. This spatial intelligence is valuable not only for building owners and design professionals to do things like develop renovation plans, materials provisioning and planning, and use space efficiently but it’s increasingly becoming more critical for understanding environmental footprint. The company has partnered with leading 3D scanning companies like Matterport and Sitescape FARO to offer international coverage for building owners; presently IPX can serve 6 buildings per day. With this additional funding, the company plans to expand capacity to 60 buildings per day.

AlleyWatch caught up with Integrated Projects Founder and CEO Jose Cruz Jr to learn more about the business, the company’s strategic plans, recent round of funding, and much, much more…

Who were your investors and how much did you raise?

This was a $3M round in seed funding. The seed round is led by 186 Ventures with participation from Founder Collective, Connexa Capital, and Four Acres Capital, along with investments from leading real estate executives and institutional landlords including The Fallon Company, Atlantic Management, JLL, and Newmark.

Tell us about the product or service that Integrated Projects offers.

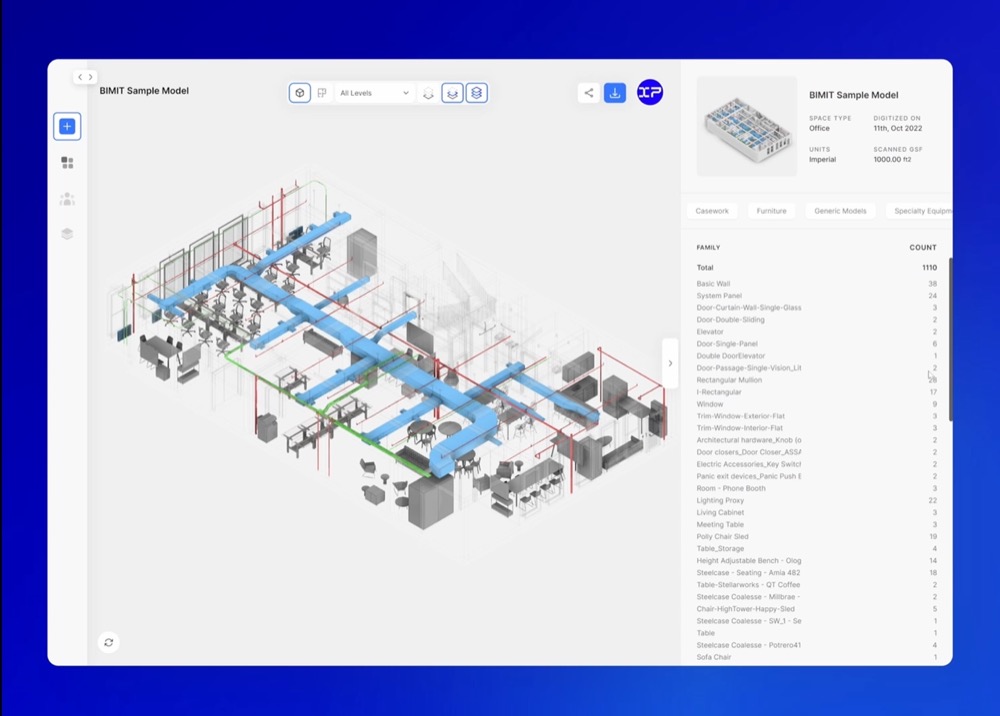

Integrated Projects Exchange (IPX) is a digitization platform for building owners and design professionals. Through IPX, customers can bring their building online—with unprecedented accuracy—by requesting a 3D capture of their building.

This on-demand digitization service offers users various benefits that span across a building’s lifecycle from acquisitions, to design, to procurement, to facilities, and marketing. On IPX, users can instantly view, share, download, report, and quantify their space from any browser.

What inspired the start of Integrated Projects?

Throughout my career, I’ve had the chance to sit across different sides of the real estate table:

Throughout my career, I’ve had the chance to sit across different sides of the real estate table:

First, as an architect, then as a construction manager, and later as an Owner’s Representative. While working on different sides of the table, it became painfully clear that we were building with bad building information. This caused expensive mistakes in the spaces that we built: from the budgets we did not hit, to the renovation timelines.

Tangentially, there’s been a wave of proptech built over the last decade focused on software—but no innovation on the hands-on services that it takes to capture good information on buildings.

IPX sits at the intersection of software and innovative services.

How is Integrated Projects different?

We’re in the business of converting atoms to bits—accurately. This means IPX is a digital proxy for dirt, brick, and mortar. By definition, software alone can’t solve the challenge of accurately measuring a physical space. We need a combination of services and software. In the same way Amazon has an interface from which you can order your shampoo and, in the background, there’s an entire fulfillment process dedicated to moving that shampoo from point A to point B. In the same way, IPX serves as an interface from which owners can digitize their building by mobilizing an entire fulfillment process to ultimately bring their buildings online.

What market does Integrated Projects target and how big is it?

Our market: existing buildings. It turns out there are about 1.6 billion unique buildings across the world. For context, there are almost as many buildings as there are total websites (as of 2022).

Existing buildings are public enemy number one, contributing more than 40 percent of global CO2 emissions—and they also represent the largest asset class in the world. In cities like New York, buildings represent an even higher CO2 ratio, upwards of 70 percent.

To curb this, building owners have the most direct agency to improve their own physical assets—while also eliminating CO2 from the environment. But they can’t do it alone. They need the help of others.

So while building owners represent our core customer segment, we’re building services for architects, engineers, product companies, and public agencies also working to facilitate the improvement of buildings.

What’s your business model?

Our business model is on-demand. It’s centered around price transparency, timeliness, and standardization.

As building owners need to 3D scan their buildings—we’re a 10X more affordable alternative versus them having to pay a combination of surveyors, architects, and engineers to simply document their building.

How are you preparing for a potential economic slowdown?

If COVID taught us anything as a business, it taught us not to underestimate how quickly things can change. In those moments of uncertainty, cash is oxygen.

Every CEO must be taking a multi-faceted approach to the looming economic slowdown:

- Create a cash runway for several months of uncertainty. Even if you’re growing and profitable now, assume the volume of work may decrease due to an impact on your customers.

- Talk to your customers. It’s likely they’re feeling pains in the economic slowdown and may need you to adjust to their needs.

- Remain lean. For a historically bootstrapped company like us, doing a lot with a little is part of our DNA. That being said, for companies used to lavish perks and simply throwing bodies at a problem—there’ll likely be a rude awakening.

What was the funding process like?

Before going through the fundraising process, I promised myself that before raising a single penny from investors, we, the Integrated Projects team, would first prove to ourselves some of the business basics:

- That people really need our services

- That people would really pay us

- That people have a recurring need

- That the problem is big enough to go global

That we can operate with high enough margins to sustainable scale without much capital.

In our case, it took about five years to find the right combinations of levers. It turns out, when you figure those levers out before raising—the fundraising process takes care of itself. Our seed round took about three months from start to finish. In this economic environment, I’d say that is a huge success.

What are the biggest challenges that you faced while raising capital?

As a founder, you want to develop relationships with investors early.

Don’t wait to get intros to investors and lenders until the moment you need it. Looking back, this is something I could have done much better. You never want to meet someone for the first time and ask them for money, it is not a good look. Perhaps we could have closed even faster had I developed relationships ahead of our raise.

Thankfully, we were generating profitable revenue ahead of our seed raise. This meant, even if we failed to raise capital, we were already creating our own cash runway. This important fact allowed me to sleep at night during the fundraising process.

What factors about your business led your investors to write the check?

Bottom line: we’ve built a profitable, scalable business in a large, new market with repeat customers.

Our bootstrapped team has paid close attention to the unit economics of our operations, finding ways to systemize at every turn, and adding value to our customers—out of necessity.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

A cash injection will simply highlight the good and bad about a business. Raising money won’t solve any of your core challenges.

From my experience, it’s better to celebrate a customer paying you $1, and reinvesting 70 percent of that dollar, than celebrating a cash injection from investors.

Where do you see the company going now over the near term?

Our entire focus is expanding IPX’s existing digitization capacity from 6 to 60 buildings a day.

With a plethora of commuting options in the city, how do you typically get to work each day?

Our operation is completely remote given our services are round-the-clock. We’ve built a decentralized workforce spanning eight time zones.

Personally, it really depends on the day. I’m an introvert living in New York City. Naturally, I prefer an isolated environment to perform my best work, but I like to be within the action to experience our landlord customers’ pain points.

For the sake of the team, specific projects, and clients, nothing beats in-person work sessions. I find myself taking the subway to the Chelsea neighborhood in Manhattan. It tends to be a central spot to meet clients and team members.