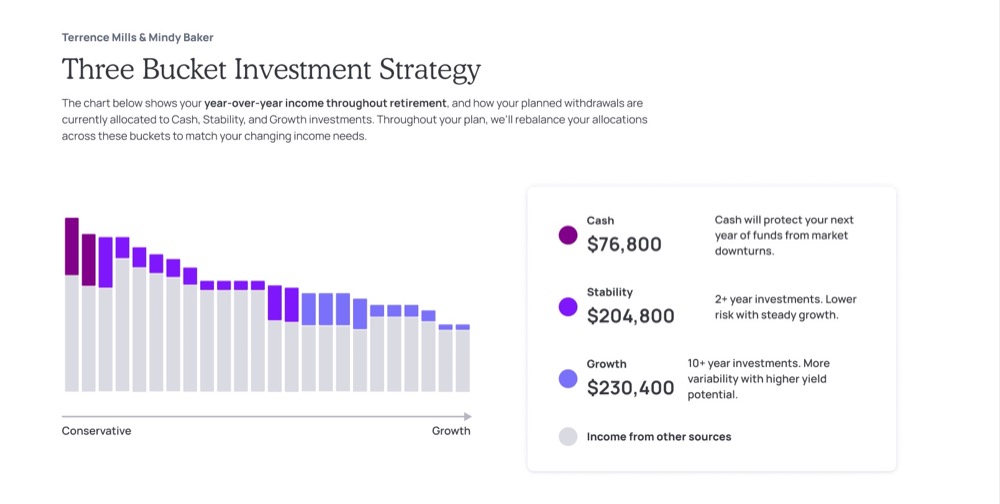

Experts suggest that retirees have $514,800 saved for retirement but the average retirement savings is $191,659, far short of the recommended retirement savings amount. 75% of retirees carry debt into retirement. Retirable is a financial planning platform created specifically for those in retirement or near retirement. While the affluent have long had access to personalized wealth management advisory services, the majority of retirees do not meet the minimum investable asset tiers to receive this type of advice from conventional firms. Retirable seeks to address this gap by offering tailored, tech-enabled advisory services along with access to managed investments through an accessible fee structure – .75% on the first $500K assets under management on the platform. The company builds a three-pronged approach to portfolio construction for retirees by focusing on growth, cash, and stability. Retirable has built 50,000 retirement plans over the last two years and has not had a single client leave the platform.

AlleyWatch caught up with Retirable CEO and Cofounder Tyler End to learn more about the business, the company’s strategic plans, latest round of funding, which brings the total funding raised to $10.7M, and much, much more…

Who were your investors and how much did you raise?

$6M was raised in an additional Seed funding led by Primary, with additional investments from Vestigo Ventures, Diagram, Portage, and Primetime.

Tell us about the product or service that Retirable offers.

Retirable is the first-of-its kind holistic retirement solution for adults in or near retirement. We offer products and services across the retirement investing, planning and spending spectrum — all with the ongoing care of an advisor.

What inspired the start of Retirable?

What inspired the start of Retirable?

I witnessed firsthand how most adults weren’t receiving the advice they needed to thrive in retirement during my time as a retirement advisor at prominent financial services firms. From these experiences, I was inspired to create a service that could fully support soon-to-retirees to feel confident about their retirement, regardless of their net worth.

How is Retirable different?

Retirable supports the majority of middle-class Americans who haven’t had the opportunity to receive personalized, professional advice for their retirement planning journey. Traditional retirement advisors overlook millions of people that don’t meet asset minimums but still need clear and confident retirement solutions. Retirable is filling this gap in the market by specializing in the retirement planning, investing and spending needs of mass-market retirees.

What market does Retirable target and how big is it?

Retirable primarily targets the 50 million Americans approaching retirement in the next decade who lack a formal retirement plan. This segment of soon-to-be retirees has typically not had access to a financial advisor long-term. These individuals are constantly navigating the process alone and are in severe need of retirement planning services.

What’s your business model?

Retirable is a wealth management fintech and retirement advisory platform that charges .75% of managed assets on the first $500K that a client invests. Retirable’s capped-fee structure provides greater access to a broader group of retirees and pre-retirees that otherwise could not have afforded such a service.

How are you preparing for a potential economic slowdown?

Retirable is preparing for any potential economic downturn by remaining focused on providing clear and confident retirement plans for every American. Economic downturns tend to create a surge in demand for financial advisory like ours—particularly among those who are about to retire or already retired.

As pre-retirees and retirees are faced with market uncertainty and rising inflation, hard decisions around Social Security, Medicare and taxes are more important than ever. Retirable’s mission-driven work revolves around empowering our clients to rise above potential economic slowdowns with education, guidance and holistic strategies that help them reach their retirement potential.

What was the funding process like?

The funding process has been incredible as we have been fortunate to work with some of the most involved Venture Capitalists in the industry. This most recent addition in seed funding was particularly successful in furthering our mission of empowering everyone through a confident, worry-free retirement.

What are the biggest challenges that you faced while raising capital?

Our biggest challenges were skepticism around 1: If we could reach older adults remotely, and 2: was it too late to help people who didn’t have any retirement savings so close to retirement?

Both of these issues, and the fact that they came up so often, only reinforce the need for our product. More adults aged 50+ are online than people think, and Retirable believes that it is never too late for an individual to take steps toward a relaxing and happy retirement. We’re seeing these assumptions prove out in daily interactions with our clients as we support their retirement journey.

What factors about your business led your investors to write the check?

Investors have shared that our team’s solid and diverse experience is their main driver for their investments. Our business addresses a large market and a clear societal need. Our team’s passion for helping individuals through a holistic lens also inspired investors who share those values and strategic approach. Our clients’ success and overall satisfaction helps to make our case as well.

What are the milestones you plan to achieve in the next six months?

In the coming months, Retirable plans to focus on growing its advisor team, strengthening its partnerships, distribution channels, and building out more features for clients — including the upcoming launch of its beta debit card.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank? T

The business cycle ebbs and flows, but in an environment like this—when fundraising is harder—it’s time to hunker down and focus on the steak more than the sizzle. Winning companies can be borne out of the resilience it takes to persevere through downturns, so make sure you have the runway to weather the storm and focus on strong unit economics.

“Growth at all costs” is resonating less in 2022, so it’s best to focus on profitable growth and prioritize what you know works. Focus on finding clarity around your best-performing channels and customer profiles while making tradeoffs/prioritizations where needed. Don’t be afraid to be opportunistic in increasing resources towards CAC-efficient channels and tactics.

“Growth at all costs” is resonating less in 2022, so it’s best to focus on profitable growth and prioritize what you know works. Focus on finding clarity around your best-performing channels and customer profiles while making tradeoffs/prioritizations where needed. Don’t be afraid to be opportunistic in increasing resources towards CAC-efficient channels and tactics.

Where do you see the company going now over the near term?

We are increasing the scope of Retirable’s reach and focusing on providing the most effective active asset management for current Retirable customers.

What’s your favorite restaurant in the city?

Last time we chatted, I mentioned Pierozek in Greenpoint. I stand by that but must add Ginjan Cafe in Harlem! The two brothers that started it have an incredibly inspiring story, the flagship ginger juice is a life changer, and the food is uniquely delicious!